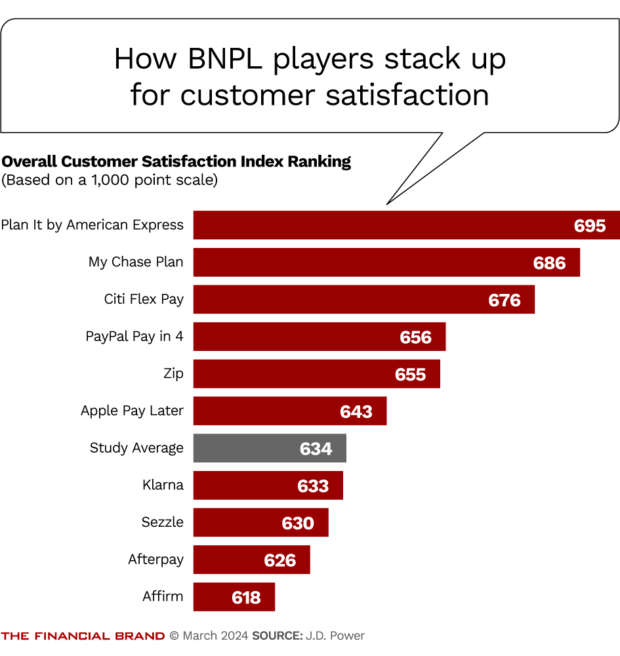

American consumers have high levels of satisfaction with buy now, pay later options, according to the inaugural edition of a J.D. Power study examining this trend. But what’s most surprising is that the top three providers in the study don’t include any of the firms that specialize in BNPL financing.

The leading offering at 695 on a 1,000-point scale is Plan It from American Express, which permits consumers to turn Amex credit card charges into fee-based installment plans. Plan It started in 2017. The average for all programs rated in the J.D. Power study was 634.

My Chase Plan, from JPMorgan Chase, also begins with a card transaction, as does Citi Flex Pay. The Chase program received a 686 rating, while Citi’s offering received a 676. Behind those offerings from traditional players came PayPal Pay in 4, earning a 656, and finally, specialist Zip at 655.

Apple Pay Later, part of the Apple financial “walled garden” centered around its iPhone, scored 643, 52 points below American Express. The tech giant’s BNPL offering debuted in March 2023 and became generally available to Apple Pay customers later in the year.

Apple’s offering came in above the study average, but Klarna, Sezzle, Afterpay and Affirm scored below that mark. Affirm, which has spoken of ambitions for becoming a major factor in consumer payments beyond BNPL, came in last, at 618 points — 77 points behind Amex. The range between the study’s high and lower scorer reflects the typical pattern in J.D. Power satisfaction studies. (An initial round of the study done in 2023 was performed for development but not published.)

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

How Did Amex and Two Banks Lead the Field?

In a recent Forbes blog Ron Shevlin, chief research officer at Cornerstone Advisors, urged banks to “get on the buy now, pay later bandwagon.”

“It’s time for banks — and all BNPL detractors — to get with the program,” said Shevlin, noting how usage of BNPL has skyrocketed, especially at holiday times.

A key reason for the appeal of BNPL programs to consumers, especially the younger demographic groups that favor it, is the contained, structured nature of the plans, versus the revolving debt structure of credit cards, according to Erin McCune, expert partner in payments at Bain & Co.

How, then, did three traditional providers beat out specialized BNPL providers on the customer service front? The answer points suggests that more traditional institutions could make further inroads on BNPL volume.

Bottom line: There’s more to BNPL success than product innovation and buzz — something the study seems designed to draw out.

J.D. Power researchers asked consumers who have used buy now, pay later in some form to rank the offerings on six criteria, according to Miles Tullo, managing director of banking and payments. The six metrics have differing weightings, which the firm treats as proprietary. The metrics included:

- Quality of customer support if the consumer has an issue.

- Acceptance — being able to make purchases where and when the consumer wants or needs to do so.

- Perks for making purchases — rewards points, cashback and other incentives.

- Reasonableness of terms — how consumers feel about repayment plan structure and details such as fees and interest.

- Ability and convenience to review and manage the buy now, pay later relationship digitally.

- Security of the consumer’s account information.

Given this mix of criteria, Tullo says it shouldn’t be surprising that American Express came out on top. “American Express has had a long head start on customer service,” for example, he says. This includes deep expertise through both digital and staffed customer service channels.

All three leaders have massive technology budgets overlaying extensive infrastructure originally built to support their card programs, which have been around for decades, Tullo adds in an interview with The Financial Brand.

Read more: Buy Now, Pay Later Needs to Pay Off in 2024

Glitz, Innovation and Acceptance Don’t Do It All

One surprise for Tullo was Apple coming in towards the middle of the ranking.

“Apple tends not to be in the middle on anything,” says Tullo. “But Apple is missing on some of the study dimensions and they need to do a better job in some areas.” (The Apple Card topped the rankings for no-fee cobranded cards in the firm’s 2023 U.S. Credit Card Satisfaction Study.)

One key driver in the current study is breadth of acceptance.

Apple Pay Later enjoys ubiquity via its role as an integral part of the Apple ecosystem. “Apple Pay is accepted everywhere they can put it and they have a huge customer base,” says Tullo. Affirm, for its part, has negotiated various mega-deals, he says, such as with Walmart stores and with Booking.com, a leading travel platform that includes Priceline, Kayak and others. These build acceptance and volume.

Yet volume advantages can erode, Tullo suggests.

“As this market matures, BNPL brands that aren’t doing as well with customer satisfaction are going to need to resolve that rather quickly, because the card brands at the top of the list can be used everywhere.”

— Miles Tullo, J.D. Power

Read more from our Payments Trends coverage:

- Lifetime Value vs. Share of Wallet: Which is the Right Metric for Customer Retention?

- BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

- Credit Card Watch: Balancing ‘Growth Math’ and Lending Risk

Another Advantage for Traditionalists on BNPL’s Ground

Tullo says there’s another advantage of American Express, Chase and Citi are their card programs and card customer bases. As he explains it, consumers who are financially healthier tend to express higher levels of satisfaction than do those who are not.

A good many consumers who use nonbank BNPL programs tend to not have credit cards or prefer not to use them because they are less financially stable.

The customers of the bank card-issuing players “start with being accepted for a credit card,” says Tullo. “So they are self-selecting for a financially healthier consumer base.”

Tullo says this is why PayPal, which came in fourth place, did so well.

“PayPal tends to attract an older, financially healthier customer,” says Tullo. “They have a lot of Boomers and Gen Xers. So that’s helping them.”

Tullo explains that financially healthy consumers surveyed have the highest overall satisfaction levels with BNPL services, at 731 points. Financially vulnerable consumers average only 593 on the satisfaction scale.

In a recent interview, Dan Schulman, retired president and CEO at PayPal, and speaker at the upcoming 2024 Financial Brand Forum, explained how the company has made its foray into BNPL.

“We have 400 million consumers and for most of those applying for our buy now, pay later product, we know them and we know their payment history,” says Schulman. “Even if they don’t have a credit score, we can infer one based on their payment history and decide whether or not to accept them for buy now, pay later payments.”

Read more: Why Consumers Don’t Think BNPL Is ‘Debt’ (and Why It Matters)

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Financial Confidence Creates Split in Reasons for BNPL Usage

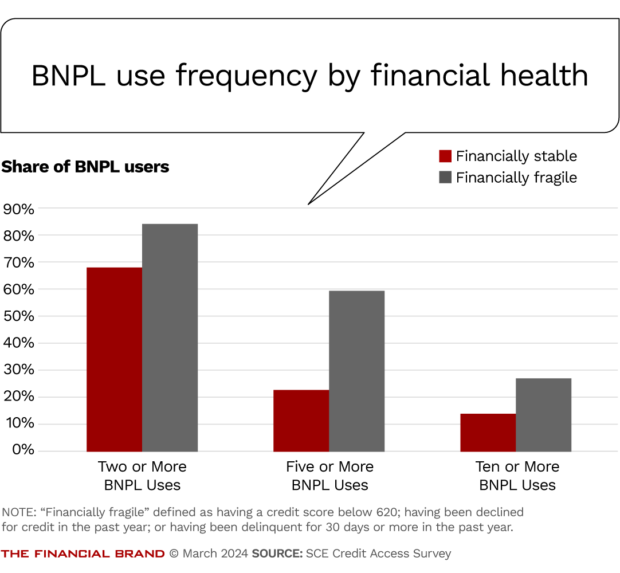

People don’t all choose to use buy now, pay later services for the same reasons. In February economists for the Federal Reserve Bank of New York published a blog analyzing key differences. It was based on a sampling taken from the Fed’s Survey of Consumer Expectations Credit Access Survey.

The N.Y. Fed found that “financially stable” consumers use BNPL differently than do the “financially fragile.” The study defines the latter as one or more of these characteristics: a credit score below 620; having been declined for credit in the past year; or having been delinquent for 30 days or more in the past year.

The study found that financially fragile consumers tend to use BNPL to make smaller purchases that they would find unaffordable without the financing. Financially stable people, in contrast, tend to use BNPL less frequently, and when they do, they are usually avoiding interest charges.

Read more: Why Offering BNPL Makes Sense for Banks and Credit Unions

Apple Begins Reporting BNPL Debt to Experian

To this day, most of the nonbank buy now, pay later providers do only soft credit checks and generally don’t report BNPL debt to the credit bureaus. For the most part, when asked for progress reports, the bureaus typically refer to “ongoing negotiations.”

Apple Pay Later has broken through. On March 1 Apple began reporting BNPL debt to Experian. The stream will cover new BNPL usage going forward. Initially, consumers who pull their credit reports will see the debt identified as “BNPL.” At present creditors will not be able to see the data and it won’t be incorporated into Experian credit scores.

“When BNPL account information becomes more widely reported to Experian by additional BNPL providers, a consumer’s BNPL history will be visible to lenders who request a credit report,” the company said.