Open banking is a much talked about topic that thus far has not realized its full potential. A Morning Consult 2021 study found that just 45% of U.S. adults have heard of open banking, compared with 56% of adults in the U.K., where open banking is required by regulation.

Given that, it’s understandable that many banks and credit unions may not be in a big rush to embrace something ill-defined, little known, and potentially threatening to the status quo. Most have not yet begun to craft a plan around how their business model might change in an open banking environment.

But while consumers may not know what open banking is, they increasingly expect data portability among different institutions including between traditional institutions and the proliferation of fintech apps. They are also concerned about fraud as a result of this data sharing.

In July 2021, the Biden Administration issued an executive order urging the Consumer Financial Protection Bureau to issue regulations implementing the data sharing provisions of Section 1033 of the Dodd Frank Act. Some observers believe that these rules, once issued, will be the first step along the path to open banking in the U.S.

Meanwhile data aggregator firms Plaid, Envestnet Yodlee, MX and Akoya, and U.S. industry associations like the Financial Data Exchange (FDX) have significantly advanced the industry down the data sharing path already. All of which means open banking can’t be ignored any longer.

“In a fast-changing world, it is crucial for us to adapt and open up our economic model … forming close ties with external players, harnessing their value proposition to offer it to our customers.”

— Philippe Aymerich, Societe Generale

Financial institutions that want to be at the forefront of open banking in the future need to start developing a strategy around it now.

Read More: Data Sharing Partnerships Give a Big Boost to Open Banking

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Steps to Prepare for an ‘Open’ Future

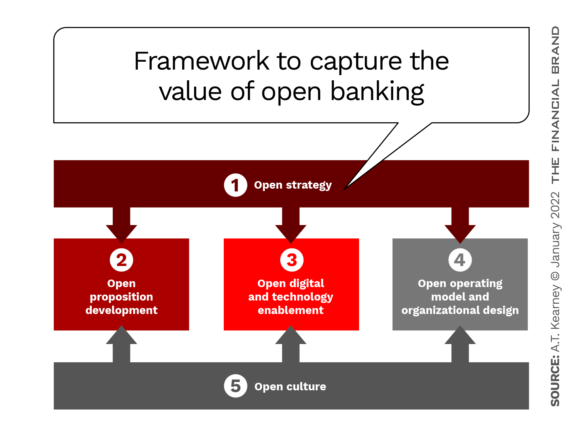

That starts with walking first before running. Financial institutions need to establish a concrete strategy around open banking, one that includes stakeholders from across the enterprise. There will always be a measure of uncertainty when it comes to new ground such as open banking, and with a strategy in place institutions will be able to navigate the natural growing pains that come with such a new endeavor. In a paper on open banking, A.T. Kearney diagrammed what it sees as a five-part framework for capturing the value in open banking.

That strategy should start with a “test-and-learn” approach, the consulting firm writes. “This will determine which ideas will have the biggest potential impact for their customer base and which will be most aligned with their open banking strategies.”

For example, “many organizations try to develop some sort of account aggregator play,” writes Kearney. “However, we recommend thinking about what other pain points could be addressed using open banking — areas that could have a more significant impact on the customer base. One example is direct bank account integration during the mortgage origination process for affordability checking. Although it’s not a transformational proposition, it could affect a large number of customers and bring an uptick in conversion rates.”

There is no one way to do open banking, and financial institutions have several options in how they can embrace this trend. One is following a marketplace model wherein they would integrate third-party products — such as those from fintechs — into their platform, acting in a similar way to Amazon.

A perhaps even bolder option is to start a separate, digital-only bank from scratch incorporating open banking principles from the outset.

“This is a pragmatic way for established banks to escape the burden of their existing infrastructure and processes,” says Visa in a whitepaper. “Many existing banks may be eager to participate in the upside [of open banking]. Yet they are conscious that building best- in-class UX and data analytics on top of their existing infrastructure is a huge challenge.”

Following this path means that “they can be as nimble as any start-up, yet still pull on the resources and expertise of a large parent organization. It also enables them to target those consumer segments who are most likely to be attracted to a neobank (such as Millennials or small businesses),” Visa notes.

Read More: Why Open Banking Is a Must-Have for U.S. Banks

Putting the Customer at the Center

However banks and credit unions approach open banking, it is imperative they adopt a mindset that puts the customer at the center of a particular financial process and allows them the ability to share data as needed and make complicated processes simple. An institution that can provide such an environment can deepen customer relationships and improve customer stickiness.

“Sharing access to your bank account information can also allow you to access new, tailored and more relevant financial services that improve your control over your data,” writes Mastercard in a blog about open banking, as an example of how customers can benefit. “For example, many of us hold accounts at different banks or brokerages. Open banking allows you to aggregate the information for all those accounts into one real-time dashboard of your choosing, so you can see all your money in one place.” Banks and credit unions have the inherent customer trust to be the preferred ones to do that.

Enabling such an environment for customers will give banks and credit unions a competitive edge. In fact, open banking is not an end in itself; it’s a tool to enhance customer satisfaction, said Societe Generale Deputy CEO Philippe Aymerich in an interview on the French bank’s website.

What It Means:

Open Banking should be seen not as a new type of product offering, but rather a way to enhance and strengthen customer relationships.

“In a fast-changing world with the emergence of new entrants and constantly changing technologies and practices, it is crucial for us to adapt and open up our economic model,” said Aymerich. “This includes forming close ties with external players, harnessing their value proposition in order to offer it to our customers.”

Aymerich added that the future of open banking also means connecting customers with products and services “that complement traditional banking in an appealing and relevant manner.” For example, this could mean connecting customers who have taken out a home loan with contractors or helping them find accommodations until their new home purchase is complete.

Another example is tailored product offerings based on transaction history, such as customized holiday loans based on flight and hotel bookings and anticipated spend, according to PwC.

The Future of Open Everything

Along these lines, open banking could merely become one facet of a so-called “open everything” environment, where data from across industries is continually shared. In open banking the sharing of data can allow for things like faster and more accurate credit decisioning or enabling customers to budget better by giving them a holistic view of their overall finances.

“But add in alternative sources of data — for example, data from mobile phones — and this sort of solution is able not just to improve lending, but to bring the unbanked and underbanked into the financial system,” writes Marie Walker, Co-Founder of open banking and open finance community Open Future World. “That can be a life-changing transformation for the individual.”

“Go a step further and start combining other types of data — for example, the carbon emissions associated with different products,” she adds. “Then you’re looking at solutions that don’t just empower the consumer but could make a meaningful contribution to global sustainability.”

Future Gazing:

One possible scenario in the future is data aggregation and sharing at cross-industry, global levels.

However, to take part in and enable such an ecosystem, banks and credit unions will need to move beyond the legacy IT systems they currently operate with. They will need to embrace an end-to-end digital architecture that embraces open APIs, is driven by AI-powered analytics, is elastically scalable and is highly secure, advises the World Economic Forum.

“The complex, legacy IT systems that many banks are still using cannot deliver this confidence,” the group states. “They have high operational risk, meaning new services cannot be delivered seamlessly. They don’t have the capabilities to create and launch products quickly, and they can’t innovate and create tailored, hyper-personalized experiences.”