One of the biggest benefits of open banking is the collaboration potential between banks and fintech firms. As opposed to being in direct competition for a consumer’s business, the collaboration can result in an almost seamless integration that benefits the consumer. There is also the benefit of innovation speed, which is more important now than ever.

According to McKinsey, the general benefits of open banking are efficiency, fraud protection, improved workforce allocation and reduced friction in data intermediation. These benefits apply to both traditional financial institutions as well as fintech organizations.

Open Banking Benefits:

Banks will leverage open banking to generate new customers and grow existing relationships through improved customer experiences.

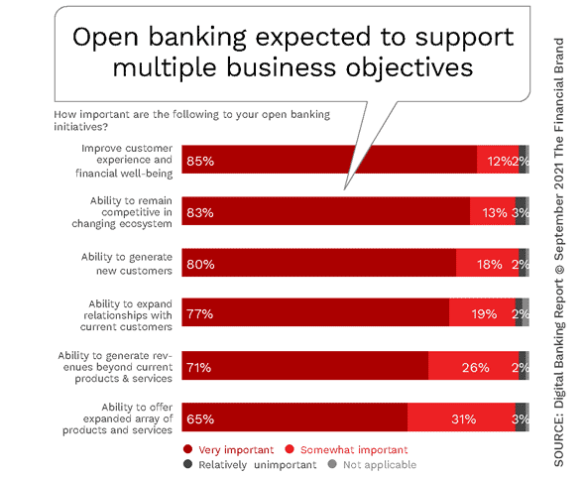

When the Digital Banking Report asked financial institutions globally about the benefits they expected from open banking, the biggest benefit expected was in support of a stronger customer experience and an improvement in financial well-being. Aligned with this benefit was the belief that open banking would allow their organization to remain relevant in an increasingly competitive marketplace.

As the chart below illustrates, open banking is also anticipated to support acquisition, cross-sell and revenue objectives.

To achieve the benefits that are mentioned, traditional financial institutions will need to change existing business models, leverage new technologies and embrace completely new business models. In the future, technologies such as voice assistants and elements of augmented reality will be incorporated into the interfaces of banking institutions.

Legacy banks and credit unions will need to determine whether to embark on this journey independently or to use fintech providers to enrich the customer journey. In this new model, there will definitely be a reduced need for physical locations since most of the open banking innovations will be delivered in an entirely digital world.

Read More:

- Open Banking Provides Potential For Revenue Goldmine

- Open Banking Fintech Partnerships Required For Better CX

- Platforms for Retail Banking Could Turn Rivals into Allies

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Need for a Long-Term Perspective

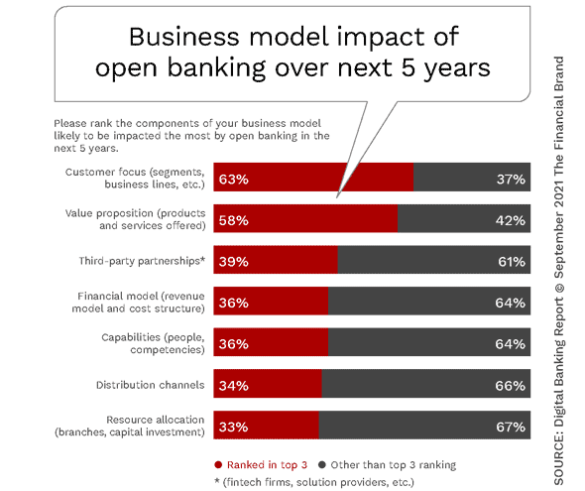

Open banking offers both short- and long-term opportunities for financial institutions. Beyond the short-term benefits of an improved customer experience, there are significant business model benefits that financial institutions mentioned as part of our research.

In the next five years, not only do financial institutions expect long-term consumer benefits, but they believe their business models will be enhanced by improved value propositions, a broader array of third-party integrations, enhanced revenues and expanded capabilities.

Future-Ready Positioning:

Open banking requires a rethinking of existing business models, leveraging third-party collaborations to innovate at speed.

For most organizations, it will be a case of ‘walking before you run’, with use cases being created and more sophisticated open banking business models being supported. The objective in the longer term is to be future-ready, creating the foundation with business model and infrastructure modernization to expand both banking capabilities and services for a marketplace that expects more. This will require a much more seamless flow of digital capabilities in both the back-office and front facing areas of the bank.

Open Banking Requires More Than Core Providers

Successful adoption of open banking will usually require significant re-engineering of existing core banking infrastructure. It will also require an enterprise-wide embracing of new back-office processes and business strategies that will be able to support API-based business models.

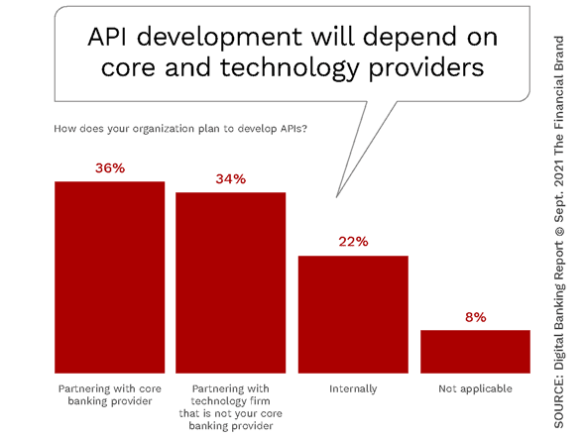

While this transformation can occur in a somewhat phased manner based on both short-term and longer-term objectives, the transformation is not optional to support open banking. Interestingly, when we asked financial institutions how they would support API development, an almost equal number of organizations indicated a reliance on existing core banking providers compared to the option of using a technology firm that was not their core provider.

Exploring New Partner Options:

More than 50% of banking organizations will not use core providers for open banking solutions.

This diversion of option is most likely a reflection on the confidence in existing core providers to be able to support open banking objectives at the speed of change. This is also consistent with other research conducted by the Digital Banking Report regarding the desire to increase partnerships with multiple third-party providers that have illustrated unique skills to meet future-ready objectives.

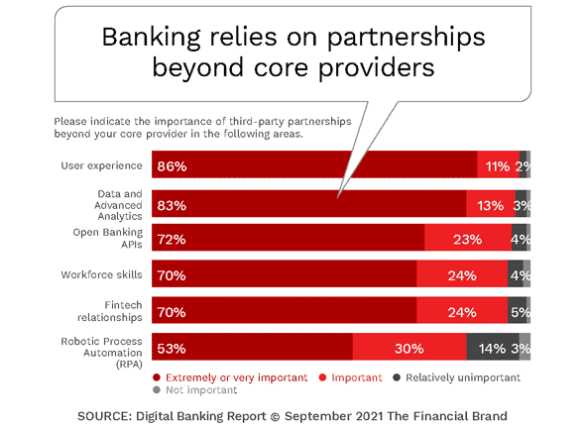

When we inquired about the importance of third-party partnerships beyond core providers, they aligned with many of the key gaps in digital transformation in general. From improving the user experience, improving the use of data and advanced analytics and building and deploying open banking APIs, most financial institutions did not have confidence that their current core provider could deliver on these needs.

When asked how open banking would be delivered, more than half (51%) of the financial institutions responded that they would integrate their solutions as part of their existing digital banking platform as opposed to a separate, freestanding application. Interestingly, 35% of the organizations anticipated that open banking would be deployed on both an existing platform and a new, freestanding application.

Challenges to Open Banking Deployment

Open banking enables financial institutions to connect existing services as well as external solutions between third-party providers and customers through digital channels including online, mobile, voice and chat. It also will open opportunities for workforce automation across internal and external systems. This provides extensive opportunities and new banking models.

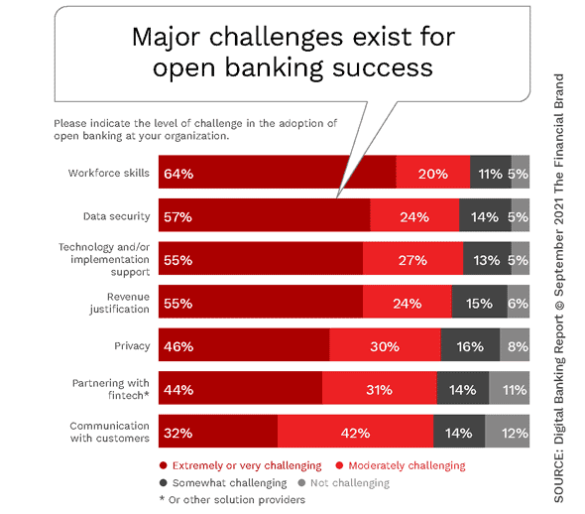

However, traditional financial institutions and fintech firms face several challenges in their effort to support open banking initiatives. Interestingly, the highest rated challenge found in our research was around workforce skills. This may relate to technical skills, but there is also the possibility that a deep understanding of open banking is lacking in many organizations.

Not surprisingly, data security and privacy issues also ranked very high in the challenges mentioned. And consumers are aware of this risk. In fact, research shows that 48% of consumers had negative opinions about open banking because of data and cybersecurity concerns. The good news is that cybersecurity is constantly getting better, looking for vulnerabilities and usually identifying issues before they happen.

Finally, of the major challenges identified, putting the necessary technology and support infrastructure in place was the third most mentioned challenge. In many organizations, this challenge is being addressed through third-party partnerships.

When we dug deeper to determine where investments would be required to support open banking, the vast majority of organizations stated they needed support to fill in significant gaps around technology, data/analytics, and partnership integration. There was far less concern around investments in skillsets, core infrastructure and other components of deploying open banking.

Open Banking Product Innovation Support

Open banking provides a significant opportunity for traditional financial institutions to broaden the products and services they offer customers. To do so, banks usually look outside their organization to diversify their offerings quickly.

According to Accenture, 29% of banking’s traditional retail-based revenue streams are at risk, so organizations feel the necessity to partner with outside partners. But the only way these partnerships will prevail is if they can offer more value than could be offered by either party individually in a seamless manner for the consumer.

In our research, the vast majority (76%) of financial institutions believed that fintech organizations would be the primary source of new product and service offerings as part of an open banking solution. Roughly half of the financial institutions surveyed believed that their current core provider or an open market solution would be the source of solutions. Interestingly, more innovative options (accelerators and incubators) were not seen as a major source of products and services in the near term.