The Internet of Things is defined as a way for devices that are connected to the Internet to communicate and share information with other ‘smart’ devices in real time. In context, these sensors would leverage the capabilities of big data, analytics and even artificial intelligence to anticipate needs, solve problems and improve efficiency.

Estimates of the size of the IoT market vary. Analysts and technology providers forecast added economic value of anywhere from $300 billion to $15 trillion by decade’s end. And FSIs will most likely be active participants in this transformation.

We already have products that use sensing and communication technologies in a range of consumer sectors, such as self-driving cars, ‘smart’ appliances and geolocational sensing on mobile phones. We are also seeing applications in business, with assembly line management being a focal area.

With the benefits of IoT, comes challenges such as in the area of security and privacy. With the explosion of devices and sensors, cybersecurity takes on a whole new dimension – not just for institutions but also for consumers. With more digital connections and information being transmitted, digital vulnerabilities are likely to expand exponentially.

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance. Read More about The Power of Localized Marketing in Financial Services 83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

Banking and the Internet of Things

What does the flow of IoT-generated insight mean for financial services? Many firms are already using sensor data to improve customer experience, product development and back-office performance. While contrarians may argue that the IoT may have only a minimal impact in the foreseeable future, others disagree.

“By enabling the collection and exchange of information from objects, the IoT has the potential to be as broadly transformational to the financial services industry as the Internet itself,” states Jim Eckenrode, executive director of the Deloitte Center for Financial Services and the author of the Deloitte report, How Financial Services Can Make IoT Technology Pay Off.

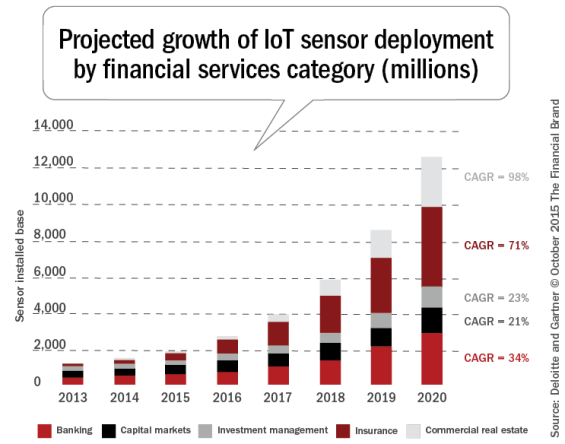

Gartner forecasts that, on a worldwide basis, “endpoints of the Internet of Things will grow at a 32.5% CAGR from 2013 to 2020, reaching an installed base of 25.0 billion units.” Covering more than 200 different categories of sensors, across consumer, business, and vertical-specific categories, the forecast suggests a broad expansion of deployments between now and the decade’s end.

Obviously, with the deployment of 25 billion new endpoints, there will be opportunities for all industries, including banking. The Deloitte analysis suggests that as many as one-quarter of sensors deployed in 2013 could be of use to FSIs, rising to one-third in 2015 and then to about 50% by 2020.

Overall, the growth in sensor deployments for financial services is expected to be very strong, ranging from just over 20% to 100% annually on a compounded basis, depending on the sector.

Some use cases have already proven themselves, such as in insurance where telematics monitor driver behavior. Other potential applications in insurance are life, health and homeowners insurance where health monitors can communicate a client’s well being or a home’s structural condition in real time.

Another example is in commercial real estate, where sensors within commercial buildings of all types can help better manage energy usage, environmental comfort, and security. This could impact properties’ attractiveness and thus drive increased rental income and investment activity.

Finally, branch-based examples of IoT applications could include video tellers and kiosks in bank branches where sensing technology can monitor and take action on the consumers’ behalf. In addition, mobile geolocation capabilities combined with beacon technology can ‘introduce’ a customer upon entering a branch with pre-queing for improved service.

IoT in Banking Perspectives

To get a further perspective on the potential of the Internet of Things and financial services, we reached out to some members of The Financial Brand Crowdsource Panel for their thoughts. The scope of their insights and variance of their perspectives illustrates why many consider IoT to be the ‘Wild West of the Web’ in the future.

Cherian Abraham

Mobile commerce and payments advisor at Experian Global Consulting

Mobile commerce and payments advisor at Experian Global Consulting

“I think 4 Billion smartphones (by 2020) – being refreshed every handful of years – has the upper hand on dumb and cheap sensors in a IoT world. The smartphone universe is global and cross-demographic. The supply chain is complex, but well oiled and scalable. The acquisition channels are all well-defined. Platforms exist and have scaled, and so have standards.

I can go on and on as to why mobile is the only mature platform that we will see for a while – irrespective of how many types of other devices that we will see in the next 10 years. There is no other use case that will warrant similar scale in IoT.

It’s not for a lack of IP connected devices. My opinion is that smartphones will continue to be the center of the connected device universe – because nothing else comes close.”

Brett King

CEO of Moven, bestselling author and Breaking Banks radio show host

CEO of Moven, bestselling author and Breaking Banks radio show host

“Within the next 10 years, we’ll launch almost 100 billion IoT devices onto the world’s stage. Whether an autonomous, self-driving car driving for Uber, a smart fridge that orders your groceries, a solar-powered car recharging station that requests a payment or your automated assistant on your smart device booking your airline or movie tickets, the vast majority of payment and financial transactions around the globe will be fully automated within a decade.

These are bank accounts you can’t KYC for, these are transactions that don’t involve a plastic card, NFC chip or checkbook, and these are accounts that you won’t find listed on the website of a retail bank. The Internet of Things means the way we think about bank products and services and how we marry an identity with an ‘account’ is going to be completely undermined over the next decade.

Regulators and bankers better get ready for a new reality.”

Chris Skinner

Chairman of the Financial Services Club and author of Digital Bank

Chairman of the Financial Services Club and author of Digital Bank

“The Internet of Things is all about machines trading with machines. However, machines cannot trade with machines if it’s expensive and slow. Unfortunately with the four-pillar card scheme model and the SWIFT counterparty bank system, that is the problem we face today.

As a result, we need an Internet of Value to work with the Internet of Things. The Internet of Value, or ValueWeb for short, allows machines to trade with machines and people with people, anywhere and in real-time for free. Using a combination of technologies from mobile devices and the bitcoin blockchain, fintech firms are building the ValueWeb.

This new infrastructure will allow machines to trade with machines in the Internet of Things in real-time for near free. The real question then is what this means for financial institutions, governments and citizens?”

David Birch

Founding director of innovation at Consult Hyperion

Founding director of innovation at Consult Hyperion

“It seems to me that there are probably three main ways that banking will intersect with the Internet of Things in the foreseeable future. The first, and to me most interesting, is the issue of identification and authentication. This is an area where banks ought to be able to deliver interesting new services to customers, building them around the idea of safekeeping and privacy.

The second, and I’m not the only person to focus on this area, is in terms of instrumentation for risk management. If a bank knows what the customers “staff” is doing all the time then all sorts of services (and not just insurers) can be optimized and given the right context.

Finally, in the limited field of payments, banks are going to have to provide services to things and this strikes me as being a fun area to explore. What’s the point of marketing a new credit card (or whatever) to me when it’s my lightbulb that makes the decision about buying electricity“

David Brear

Partner of the international Think Different Group

Partner of the international Think Different Group

“I see within 5 years new categories of IoT establishing themselves into the mainstream without customers having to do anything significant other than upgrade. I see IoT in isolation being more of a benefit to the banking ecosystem than to legacy banks individually because of 1) Data Apathy – Banks are terrible at using data to its full potential, and 2) Business Model Inertia – Most impactful IoT use cases require fundamental shifts in the business models which is difficult for most organizations. Without a significant paradigm shift, IoT will be slow to benefit this industry.

Outside of new fintech players, only a handful of legacy banks will be in a position to take advantage of the IoT opportunity … but it doesn’t have to be that way.”

Simon Taylor

VP Entrepreneurial Partnerships at Barclays

VP Entrepreneurial Partnerships at Barclays

“Financial products are all about risk management. Many will be familiar with how insurance companies are now using data to alter health or auto insurance policies. Similarly, real time data can make a difference to the risk a bank is taking when they provide a financial product.

Perhaps demographics make a consumer a risky bet for a loan, but sensor data shows the customer is a safe driver, they are thrifty with electricity or participate in regularly exercise. Perhaps this makes the customer statistically far more likely to pay back a loan on time. For the consumer, this means a more affordable loan. For the bank, a new customer who perhaps would have gone to a competitor before they had the power of IoT data.

With IoT in financial services, enhanced insights allows for better decisions by the consumer and the banking organization, allowing for a more perfect marketplace and a better consumer experience.“

Bradley Leimer

Head of innovation at Santander, N.A.

Head of innovation at Santander, N.A.

“The growing IoT opportunity manifests itself in an augmented world of sensors and connected smart devices that can have a tremendous implication for financial services. I can eventually see our personal identities and payment mechanisms become part of this broader information network, much in the same way the web and smartphone have impacted our daily lives already.

Our connected home will grow to include an expanding array of security and home monitoring devices that provide feedback and an improved quality of life, while transmitting insight to our trusted partners in real time. For banking, this insight will impact insurance, lending opportunities and even savings offers.

Our connected businesses will be impacted in areas like trade finance, a $22 trillion market where embedded sensors can determine the location and condition of goods shipped, often between previously unconnected parties. Smaller businesses will be able to ship goods more efficiently on a global basis as data is disseminated by trusted data providers.

These behavioral changes will impact the way we spend, the way we are paid, the way we run our businesses, and our interactions with banks. In addition to efficiencies, I’ve long argued that the growing IoT ecosystem should be embraced by financial players as they help us save the most valuable commodity of all … time.”

IoT Information ‘Value Loop’

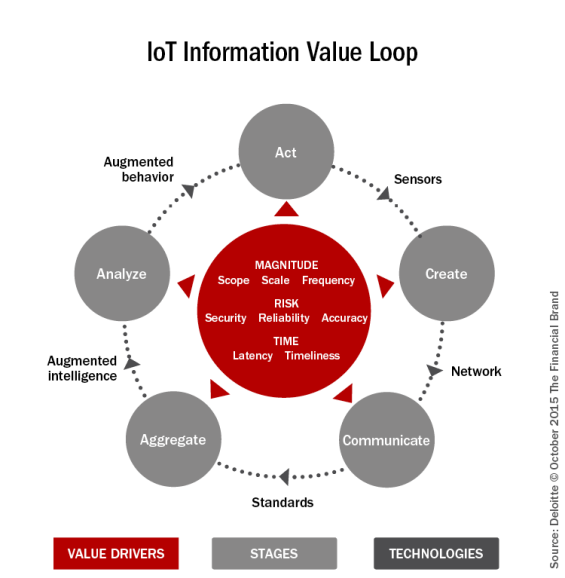

Realizing the IoT’s full potential is based on a framework that captures the series and sequence of activities by which organizations create value from information. Deloitte refers to this as the Information Value Loop.

Insight complete ‘the loop’ and create value as it passes through the loop’s stages, each enabled by specific technologies. The loop is completed by either enabling automated autonomous action or by impacting human decisions that improves the overall customer experience.

The amount of value created by the overall information loop is a function of the illustrative value drivers identified in the middle – magnitude, risk, and time.

Security and the Internet of Things

In a perfect world, the more data points the bank or credit union has to verify, the stronger the identity security and privacy protection. By definition, the Internet of Things should allow an institution more data points for purchase and identity verification.

Biometrics should also assist in the authentication process in all digital banking transactions, with wearable technology increasing this potential. Finally, the geolocational capabilities of all mobile devices helps to validate a specific person’s whereabouts as part of the verification process.

More data points can can also help the bank make better risk management decisions. In addition to tapping into social media, spending, and other credit behavior data, the ability to monitor residential and commercial premises reduces the potential for loss and can increase the ability to manage commercial operations.

On the negative side, IoT raises some questions around privacy and the security of insight that is collected. Most firms aren’t prepared for the security of such vast amounts of personal data.

The financial services sector also is at risk due to the presence of Internet of Things tools and gadgets within firewalls that are continually beaconing out to the internet, including Smart TVs, alarm systems and even smart thermostats used by banking organizations. The risk posed by the Internet of Things today may still relatively modest, but as these devices grow, the incumbent risk also increases.

The Future of IoT and Banking

The potential of Internet of Things is that the applications are limitless. There are hundreds if not thousands of ways the IoT can improve the customer experience, reduce costs and inefficiency, reduce risks and increase market share.

The key, as with much around digital banking, is how well any organization can leverage and analyze big data insights in real time. Great insight, applied at the right time for the benefit of the customer is invaluable. But, the Deloitte report warns that an avalanche of IoT-generated data will dwarf firms’ current data volumes, threatening to overwhelm already-inadequate strategies and technologies.

The challenge, again, is the legacy infrastructure that slows down the delivery and application of insights. This is where non-bank fintech firms can take advantage of their newer technologies to engage the consumer and impact the traditional business model of legacy banking organizations.

However, says Eckenrode from Deloitte, “Firms that get ahead of the IoT trend will likely be at an information advantage, where faster, better, and cheaper insight can create opportunities for improved customer experience and operational performance.”