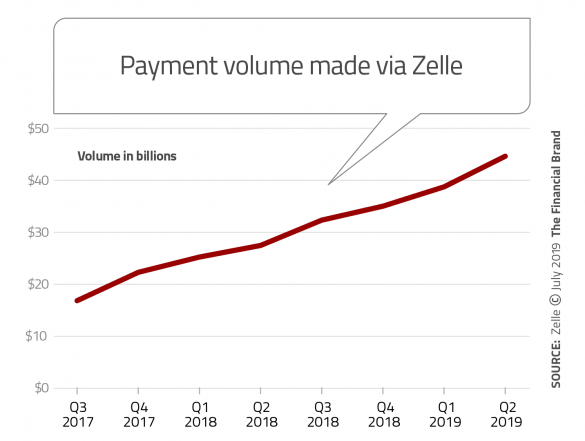

Zelle, the bank-owned response to PayPal’s Venmo person-to-person mobile payment service, Square Cash, and others, continues to grow by long strides since its launch in 2017.

Early Warning Services, the network that operates Zelle, announced that in the second quarter 2019 it hit total payment value of $44 billion, spread over 171 million transactions. The payments dollar value represents an increase of almost 13% over the first quarter 2019 and an increase of 56% over the year-earlier quarter. For the second quarter 2019 Venmo reported total payment volume of $24 billion, representing growth of 70% over the second quarter of 2018.

Year-over-year the transaction volume rose by 71%. This means that the average transaction on Zelle fell in the second quarter to about $257, about 8% lower than the $281 of second quarter 2018. And that is seen positively. Payments experts take the decline as a sign that Zelle is steadily being used for smaller and smaller payments, rather than just larger P2P transactions like rent payments.

In 2018 Zelle processed payments of $119 billion and Venmo processed $62 billion.

In the second quarter almost 500 banks and credit unions were contracted to join Zelle, and 179 were online and processing transactions. Significant growth has been seen in the system’s second year. At the end of the first year, 29 institutions were live on the system and 119 were under contract to begin operations. Aite estimates that one in four Zelle users are Bank of America account holders. While a small group of very large banks founded Zelle, the majority of the network’s members are regional and community banks or credit unions. (Consumers who bank with thousands of other banks and credit unions that are not currently hooked into Zelle directly can also use the service by enrolling their debit card in the Zelle mobile app.)

At the time these figures were announced 480 institutions were contracted to join Zelle and when they are up and running the network estimates that Zelle will be available to 64% of U.S. demand deposit accounts.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Zelle’s Base Grows Beyond Original Millennial Fans

While P2P service first gained a toehold among younger consumers, the face of Zelle members is changing.

In early 2019 Early Warning Services released its Digital Payments Adoption Study. The research, based on a poll of over 1,500 U.S. consumers in late 2018, found that 50% of first-time Zelle users were 45 or older.

“Consumers above the age of 45 are overcoming their skepticism of P2P and are beginning to trial digital payments as part of their changing mobile and online banking behavior,” Early Warning states. Generation X and Boomers have a high degree of trust in their financial institutions. The increase in trial can be attributed to solutions, such as Zelle, being included within the banking apps these consumers are comfortable using.”

Read More:

- The Mobile Experience Now More Important Than In-Person Banking

- 14 Great Ideas For Marketing Zelle P2P Payments

Privacy Wrinkle May Also Exert Some Influence

While it’s hard to demonstrate a definite correlation, a year ago Wired published a very direct blog on P2P, “It’s Time to Stop Sending Money on Venmo.”

The blog, by a writer who had dropped her own Venmo account, attacked the nonbank P2P service operated by PayPal on privacy grounds. Venmo users automatically take part in a social media-style network that indicates what they are spending money on with the app and with whom — but not how much. Users can opt out of the network, but the blog indicated that this step can be complicated to carry out.

“Creepy, right?” commented Louise Matsakis in her blog. “Venmo does give users the ability to limit who can see transactions both before and after they’re sent, but many people don’t choose to adjust their privacy settings. When I opened Venmo recently, the first payment on my news feed was from a friend whose concerns about privacy have led him to delete both his Instagram and Facebook accounts. Despite taking drastic steps to limit his digital footprint, I know who he ate sushi with last night, thanks to Venmo.”

Around the same time, a software designer and privacy advocate demonstrated how Venmo’s API enabled reverse engineering that could enable information about users to be gathered into profiles from public activity on the payment service. Currently the advocate’s site indicates that Venmo has taken steps to curb this ability. It’s likely both this and the social media issue generally have been a turnoff.