The intersection of data, analytics, new technologies, and the impact of the pandemic have changed and disrupted the experience consumers expect when engaging with their financial institution on a digital device. They want more than speed and simplicity. They expect more than being able to do basic transactions of their phone.

Increasingly, consumers are making decisions about their banking partner based on mobile and online banking capabilities. In fact, according to research done by Citizens Bank, 40% of consumers say it is the most important factor, while only 27% cited the convenience of a physical branch as the most important factor. This has positioned many fintech providers in an advantageous position, while challenging many legacy financial institutions.

For most traditional financial institutions, creating a digital banking experience consumers want requires a complete rethinking of back office processes and leveraging data in new ways. According to Insider Intelligence, 87% of adult U.S. mobile banking users said that mobile is the primary way they access their checking accounts. As an increasing number of consumers and businesses use their mobile device to do banking, the user experience becomes more important, and the competition between different types of financial institutions becomes increasingly intense.

Read More:

- Mobile Banking Apps Failing in Key Areas of CX

- Now is the Time for Intelligent Digital Banking Experiences

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

What Emerging Features Do Consumers Expect from Mobile Banking?

To win the battle for the mobile banking customer, organizations must focus on delivering those features that are considered the most important. In addition, it is more important than ever to improve the mobile banking experience as soon as possible – because the customer of the future isn’t waiting.

Action Item #1:

Prioritize support for the most in-demand features mentioned by consumers in the research.

To determine the most important differentiating components of a mobile banking experience, Insider Intelligence identified 42 features whose novelty, utility, or rarity distinguish a mobile banking app from the norm. A survey was then conducted among adult US mobile banking users to determine the value of each of the features from the consumer’s perspective.

Three of the study’s five most valued features fell into the Security and Control category, with Social Security number monitoring being the only feature to receive an “extremely valuable” rating from more than half of respondents. The second most in-demand mobile banking feature was the ability to set up direct deposit electronically (44%), with the third most popular feature being the ability to receive overdraft alerts (42%).

The six major categories reviewed and the top 3 features by category were:

- Security and Control (Social Security number monitoring, debit card replacement, unfamiliar device login notification)

- Transfers (electronic direct deposit sign-up, transfer money to other bank, stop payment on a check)

- Alerts (set alert for overdraft, set alert for purchase over set limit, set alert for balance lower than set amount)

- Account Management (change debit card pin, view copies of documents, activate new debit card)

- Digital Money Management (see list of recurring charges, see credit score, cancel subscription)

- Customer Service (converse with human agent via chat, authenticate via app when calling customer service, search bar)

With security being the top factor that determines how confident digital banking users feel about their financial institution’s digital channels, it should not be a surprise that the category of “security and control” was the highest rated overall. With basic security functionality being table stakes, organizations will increasingly find new ways to build trust. Interestingly, all security and control features were more highly valued by respondents ages 18 to 24 than by older cohorts.

Mobile alerts and account management categories had the second and third most desired set of features, with transfers, digital money management and customer service being ranked slightly lower. There were significant differences in how various demographic groups rated each category and how well financial institutions were able to deliver on these experiences.

Which Financial Institutions Deliver the Most Emerging Features?

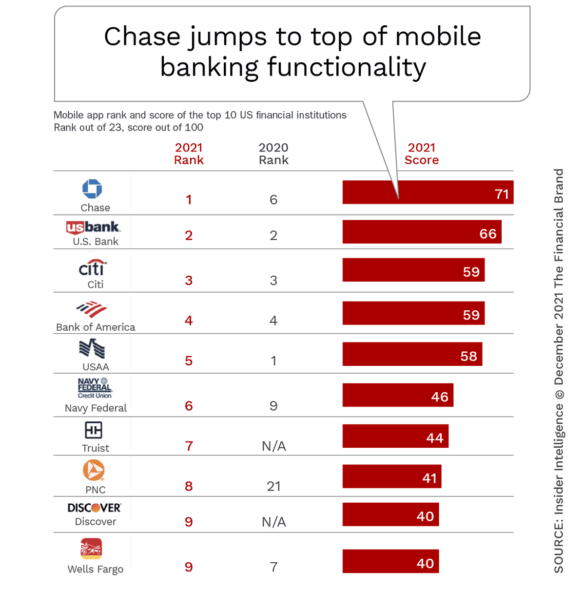

No single financial institution delivers on the all of the mobile banking features desired by consumers, and some organizations do better than others in different categories. Bottom line, there is a lot of room for improvement by even the highest rated financial institution’s mobile app. But for 2021, Insider Intelligence rated Chase the best mobile banking app overall due to its delivery of many of the most important mobile features.

Illustrating the intense ongoing focus on improving mobile banking app experiences, Chase rose from sixth place in 2020 to be the best this year. There were 23 US financial institutions evaluated across the six categories, with each organizations getting a score on the delivery of desired experiences.

“Chase annihilated competition in the top-valued Security and Control category, while also leading Transfers and Digital Money Management,” stated the report from Insider Intelligence. “But it [Chase] still has room to grow, ranking 10th in Alerts and 11th in Customer Service. Runner-up U.S. Bank topped two categories, which were the second- and third-most valued: Alerts and Account Management.”

Action Item #2:

Secure an advantage by developing features not supported by key competitors in your market footprint.

Of concern, and potentially illustrating a tremendous opportunity, only four of the 23 financial institutions that were evaluated scored more than half the points possible (compared to 11 financial institutions in 2020). On a more micro level, only two financial institutions (Chase and USAA) provided notification that a social security number had been breached (the top rated feature in the study).

Of all the categories measured, the top 10 financial institutions did the best in the category of “alerts” and worst in the categories of “security and control” and “digital money management”.

In a separate study conducted by Insider Intelligence that rated US neobanks, neobanks also performed relatively poorly, with the winner Current scoring less than half of all possible points. Rising from second place in 2020, Current topped five of seven categories. The next highest scoring US neobanks were Chime, Aspiration and Varo. (Note: Insider Intelligence also conducted similar research studies for traditional UK banks and UK neobank organizations).

The lower than expected performance by neobanks should not provide a sense of comfort to the vast majority of traditional banks and credit unions. This is because the neobanks often provide the ‘basics’ of mobile banking (simplicity, speed and personalization) much better than most legacy banking organizations.

Read More:

- Mobile Banking: Financial Institutions Must Clean Up Their Apps

- How to Build the Best Mobile Banking App [Podcast]

Why Should I Care About ‘Emerging’ Features?

Most financial institutions have not yet responded adequately to the ‘basics’ of mobile banking customer experience, including the improvement of the speed and simplification of everyday transactions and activities. While many organizations have provided features in areas of lower importance, such as rudimentary alerts and customer service access, these features have quickly become table stakes in the battle for the mobile banking customer.

Action Item #3:

Evaluate the demand for features by customer segments that are the most important for your organization, prioritizing these features to acquire (and retain) targeted demographic groups.

As an increasing number of traditional financial institutions have prioritized the development of an expanded array of mobile banking features, the bar is being set higher and higher for organizations of all sizes. Just as importantly, digital-only bank account holders are expected to exceed 53 million users in 2025, up from 29.8 million this year, per Insider Intelligence forecasts.

With adoption of digital channels continuing to increase at a rapid pace over the past 2 years, it’s increasingly important for banks to make these channels more user-friendly to achieve customer satisfaction. This requires an ongoing focus on mobile application development and enhancement. As opposed to being a limited-term project, this has evolved into an ongoing process of innovation and digital banking transformation.