The Millennial generation is the largest and potentially most influential generation in history. The size and long-term spending power of this segment of the population will create huge opportunities over the next decade for banks and credit unions who are prepared for the shift in emphasis from post-World War II baby boomers to the very unique Gen Y segment.

A survey from the Millennial Disruption Index found that 71% of millennials “would rather go to the dentist than listen to what banks are saying,” and 33% “believe that [in five years] they won’t need a bank.” To succeed, financial institutions must leverage digital and mobile technologies and use advanced analytics to build an effective long-term engagement strategy.

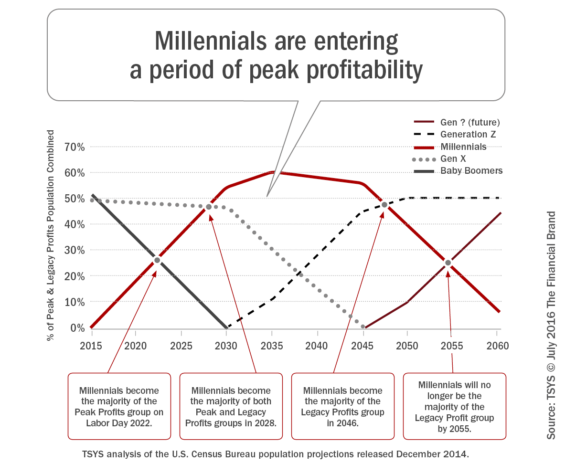

According to a TSYS white paper, “Addressing the Generational Shift Among Cardholders: Strategies for FIs to Successfully Engage Millennials,” the Millennial generation is approaching a sustained period of peak profits, replacing the Gen X segment, that has held that position for more than a decade. While the paper emphasizes that banks and credit unions should not ignore either the Gen X segment or Baby Boomers, the growth potential of profits in these segments will not be as significant in the future.

Despite the fact that today’s peak profit category consists wholly of Gen X, Millennials will represent a majority of the peak profit category by 2022, and by 2030, this category will be entirely compromised of Millennials, says the report. In addition, the report projects that FIs will heavily depend on Millennials as a main revenue source for more than a 32-year period.

Read More: Preparing for the Generational Shift in Banking

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Millennials at a Glance

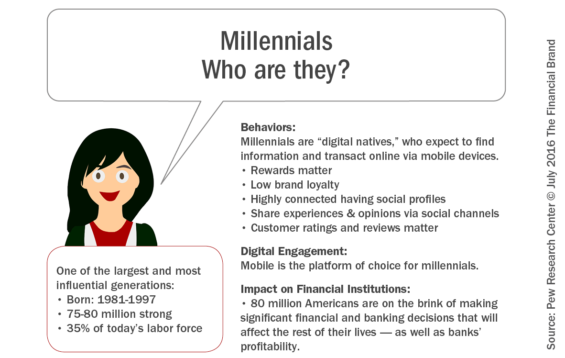

According to the Pew Research Center, the Millennial generation surpassed the Baby Boom generation as the nation’s largest living generation in 2015. According to Sarbjit Nahal, Head of Thematic Investing Strategy at Bank of America Merrill Lynch, Millennials “are the most important group in terms of the workforce, and by 2018 they’re going to overtake the boomers. By 2025, we’re looking at over $8 trillion worth of annual net income.” Bottom line, they are a force to be prepared for in the banking industry.

3 Ways Millennials are Different than Previous Generations

There are three ways that the Millennial generation is significantly different than generations from the past (Gen X and Baby Boomers). Understanding these differences is key to being able to build strategies for future profitability in financial services.

1. Millennials Easily Adopt New Technology: “Millennials are digital natives — the first generation to have grown up with Internet-enabled devices and digital technologies — and thus expect on-demand engagement with brands,” states the TSYS report. “They have a low tolerance for poorly designed user experiences, and marketers must be ready to provide an intuitive experience, regardless of whether a consumer engages with them via laptop or mobile device.”

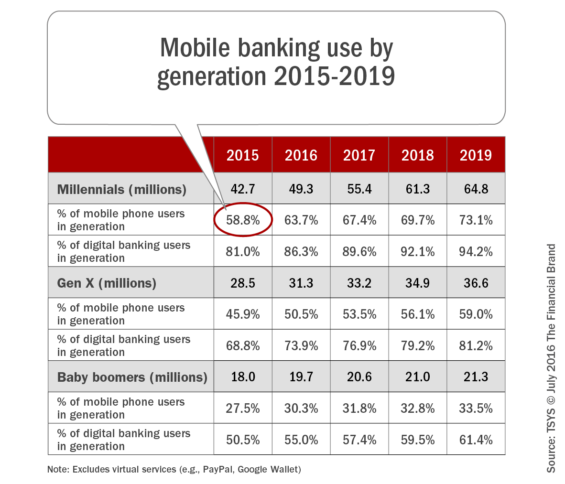

According to eMarketer, about 59% of 18-34 year-old mobile phone users accessed their bank, credit union, credit card or brokerage account via mobile browser, app or text messaging on their phones at least monthly in 2015. By comparison, fewer than 28% of baby boomer mobile phone users used mobile banking in 2015.

TSYS suggests that, while mobile is the Millennial segment’s preferred platform today, banks and credit unions must invest in the newest technologies that can create a seamless experience they receive from non-financial brands that this segment already uses (Apple, Amazon, Venmo, Google, etc.). Financial firms also need to support social platforms for sharing and delivering financial experiences.

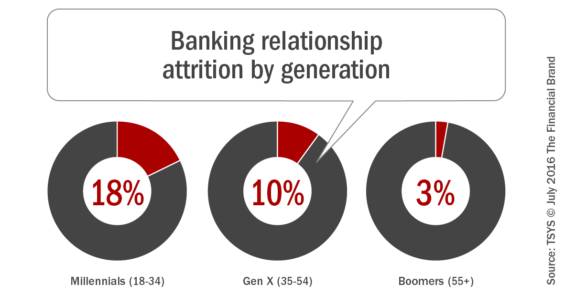

2. Millennials Have Less Brand Loyalty: According to a survey from Accenture, 18% of millennials switched primary banks within the previous 12 months, compared with just 10% of customers aged 35-54 and 3% of those aged 55 and older. Part of this is due to mobility of Millennials, but some is also attributable to higher expectations of the brands they use most frequently.

This generation also researches products and services more thoroughly before making a purchase or becoming affiliated with a brand. As a result, financial organizations who want to appeal to Millennials need to make it easy for them to navigate a banking website and mobile app, providing clarity around product specifications and enabling easy account opening and use.

While Millennials may not be as brand-loyal as older generations, a Boston Consulting Group study found that U.S. millennials engage with brands much more extensively and personally when they do engage. To take advantage of this opportunity, TSYS suggests that, “FIs that want to build brand loyalty among Millennials must shift away from transactional interactions and move toward creating experiences that will develop lasting customer relationships.” This will require the application of stronger analytics capabilities by banks and credit unions.

3. Millennials Use Alternative Payments: The TSYS report references a FICO study that found that Millennials have a gravitation toward alternative payment solutions. FICO found that, “twice as many millennial respondents (32%) report that they are likely to use mobile wallet services like Apple Pay® or Google Wallet™ in the next 12 months as those who are 35 and older (16 percent).” Additionally, the survey found that “56% of the younger millennial segment (18-24) report that they are already using or very likely to use alternative payment services like Venmo and PayPal.” Finally, the FICO survey noted that one area of expected payment growth driven by millennials is the use of peer-to-peer lending services, with 23% saying they will consider such services — more than 10 times the level of boomers and twice that of Gen X.

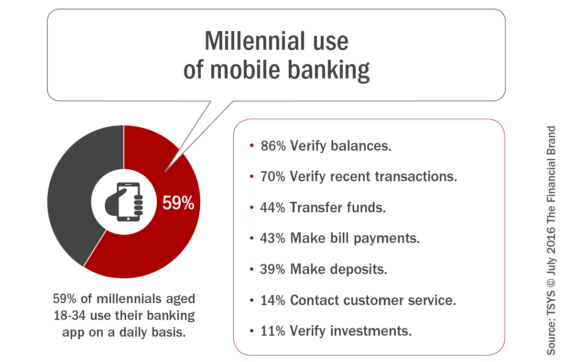

The fact that Millennials use digital apps more than any other generation is reinforced by their engagement with their mobile banking application. The 2015 U.S. TSYS Consumer Payment Choice Study found that of the respondents who reported using their mobile banking app on a daily basis, 59% were millennials (aged 18-34).

According to TSYS, financial institutions must offer millennials digital tools to support their always-connected lifestyles. They recommend offerings such as online tools and mobile apps for accessing accounts, managing money, or making payments on time.

3 Millennial Marketing Strategies

TSYS recommends three strategies to respond to the differences that Millennials present financial institution marketers. By embracing these strategies, bank and credit union marketers will be in a better position to capture a larger share of the increasingly important Millennial segment.

”Those FIs that better understand how millennials approach financial decisions and transactions and use this insight to deepen relationships will be in an enviable position. To achieve such a position, issuers must recognize that millennials truly represent the lion’s share of future revenue.”

1. Leverage Data and Advanced Analytics: While customer data has been used for decades, much of the use has been for reporting purposes. Advanced analytics tools are more accessible than ever and must be used to apply data for improved product development, targeting, communication and building enhanced contextual experiences.

The ability to engage Millennials will be driven by the power of personalization. TSYS provides four examples of where advanced analytics will prove useful:

- Acquisition

- Deepen relationships

- Product development and reward offerings

- Improved messaging and communication

2. Develop Digital Engagement Strategy: Digital engagement requires high-touch, personalized and contextual online experiences across devices and channels. This helps to provide important insight to the Millennial consumer at the point and time of interaction, increasing engagement as well as potential solutions to current or future financial needs.

A study by The Economist’s Intelligence Unit and SAP Software Solutions found that 82% of retail bankers agree or agree strongly that in the next five years mobile will become the number one channel for millennials and younger consumers. According to the TSYS report, “FIs can create an advanced digital engagement strategy by assessing their current product portfolio and building solutions that integrate the various digital tools millennials want to help them make better financial decisions. That could entail integrating features such as PFM software, customized alerts for low balances, withdrawals or payment due dates and statement notifications.”

3. Building a Strong Rewards Strategy: The 2015 U.S. TSYS Consumer Payment Choice Study revealed that loyalty and reward offerings remain the biggest influencers in driving consumer payment behavior among all ages of consumers, including millennials. According to research from Jason Dorsey, a researcher on millennials at the Center for Generational Kinetics, “To millennials, loyalty programs are not just about freebies, but being part of a special club or experience. Members are willing to pay to get the extra benefits and feeling of being special.”

Those financial institutions that best understand the Millennial consumer and use data-driven technology, insights, communication and rewards to acquire, engage and retain Millennials will be in the best position to differentiate their offerings (and generate revenues). Those firms that act quickest and best understand the generational shifts will be the winners.