The Digital Generation (Gen-D) is comprised of technologically savvy consumers comfortable using all types of devices and apps. While Millennials, born between 1980 and 1994, represent the largest segment of this audience, Gen-D is more of a mindset.

FICO recently completed an extensive consumer research study that looked at Gen-D and how they are consuming financial products. The research found that the Digital Generation is growing in economic strength, social influence and banking potential, and are having some very expected and unexpected impacts on our economy. Because they have grown up with mobile devices that can simplify life and keep them connected to people and businesses, they differ from the general population in the way they bank and the channels they prefer.

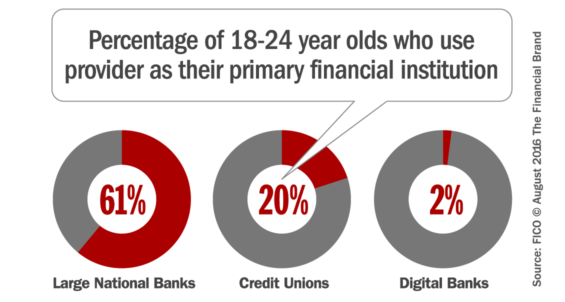

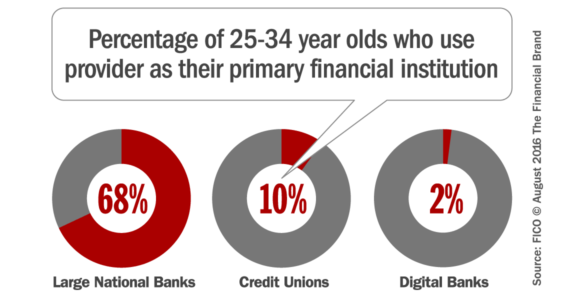

Recent research indicates that large national banks continue to dominate market share in the US, with these largest banking organizations growing from a 50% share to a 57% share – mostly at the expense of smaller community banks and credit unions. Much of this shift in market share has been attributed to the advanced mobile capabilities of the largest financial institutions.

This trend becomes even more significant since Millennials, ages 18–24 and 25-34, prefer large national banks at a rate of 61% and 68% respectively. Mostly due to the perceived lower cost value proposition, 20% of 18–24 year-old consumers use credit unions as their primary financial institution, the highest of any age category.

While digital banks have yet to make much headway with the Digital Generation, it will be interesting to see if younger Millennials move their banking relationships to larger national banks as they mature.

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

1. The Digital Generation is Open to Alternative Providers

According to the latest consumer research on the Digital Generation done by FICO, while only 2% of Millennials currently have a relationship with a “Digital Bank,” the older sub-segment of Millennials (25-34 years-old), are 2 to 3 times more likely to close all accounts with their primary financial institution than people in other age groups. This propensity is twice as high as only a year ago.

“The 25-34 age category holds 6.27 financial products on average, compared to 5.79 for the entire US adult population.”

According to the survey, 16% of 25-34 year-olds are considering opening an everyday banking product with an online-only bank in the next year. If this prediction becomes reality, this could have a significant impact on organizations, since this age group holds 6.27 financial products on average, compared to 5.79 for the entire US adult population.

“The increased volatility in this 25-34 year-old age group can be a costly exercise for incumbent banks, due to the increased marketing and operational costs required to win new customers, especially if they are only replacing the ones that have left,” states Joshua Schnoll, senior director for FICO. “Banks will need to address Millennials’ sensitivities to bank fees and a desire for convenience in order to arrest churn and build loyalty.”

When it came to reasons for switching, 45% of Millennials aged 25-34 cited high fees as a key reason for leaving their bank. For younger Millennials aged 18-24, the number was also high at 36%. A negative experience when they missed a payment was the second biggest reason for 25-34 year-olds to switch banks. Inconvenient branch locations and too few ATMs were tied for third.

”Smart institutions are using transaction and customer-level data to build models that look at profitability, attrition risk and historical fee waiver requests.”

According to the FICO research, a key to managing attrition is leveraging existing transaction and customer-level data models to anticipate lifecycle changes or possible switching, and make correct decisions related to pricing, cross-sell offers or fee waivers. “Today, smart institutions are already building models that look at the long-term profitability, attrition risk and historical fee waiver requests on an account, and then make an analytics-driven decision to proactively waive a fee, provide reactive fee refund offers or not refund fees at all,” said Schnoll.

2. The Digital Generation is a Very Active Mobile Banking User

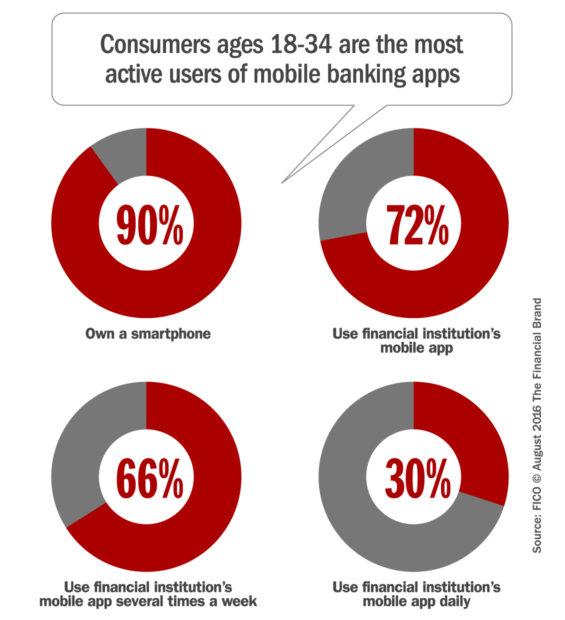

As would be expected, Millennials are very high users of their financial institution’s mobile banking app. Over 90% of consumers aged 18-34 have a smartphone, with close to 72% using their financial institution’s mobile app. Further, 66% use the app several times a week, and 30% use the app once or more per day.

Interacting with their mobile phone continuously as part of their daily life, Millennials are 2–3 times more likely than the general population to want mobile app notifications for credit limit warnings, suspicious charge alerts and payment reminders. For fraud notifications, the Digital Generation also wants to be notified by phone, opening the opportunity for a multi-channel communications plan. Not surprisingly, a poor experience with a mobile banking app increases the likelihood of the Digital Generation switching institutions at twice the rate as the population as a whole.

3. The Digital Generation is Concerned About Debt

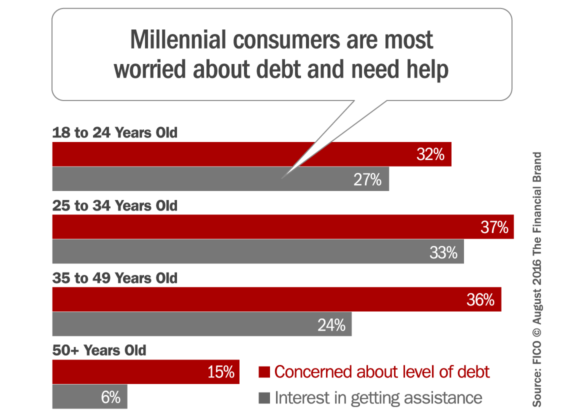

According to FICO, 37% of Millennials aged 25-34 are concerned about their level of debt, while 33% of them are interested in getting assistance to help manage their debts. The level of concern and desire for assistance is not significantly lower for the younger sub-segment of Millennials (age 18-24).

The most significant debt burden for the 25-34 age group is residential mortgages followed by student loans. 32 percent of Millennials say they owe $20,000 or more in student debt. In addition to mortgages and student loans, the next highest category of debt is auto loans, with 45% of Millennials reporting they owe $7,000 or more.

Tim Van Tassel, vice president of FICO’s credit lifecycle business line, said, “Our research shows that delinquency risk is highest among 25-34 year-olds, who are still developing their financial literacy skills and learning to manage their loans and lifestyle costs. The silver lining for lenders is that Millennials aged 24-35 are keenly aware they may need some help. For financial institutions, there’s a great opportunity to minimize the risk of delinquency by alerting customers when payments are due.”

Alternative lending options are becoming more attractive to high-delinquency-risk consumers such as Millennials. While they are still only a small factor in overall lending market share, they’re growing considerably due to the ease of application and speed of decisioning. Because of the overall value of the Digital Generation from an overall relationship basis, it’s important to keep an eye on these fintech competitors.

According to FICO, organizations that evolve beyond traditional debt collection strategies, by adding advanced analytics, optimization, multi-channel communication and payment options, will have greater success with Millennial consumers. Collectors can become financial partners by using online channels, which are preferred by Millennials.

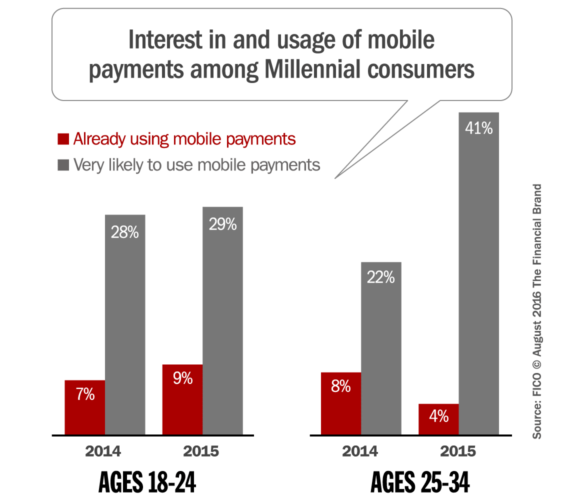

4. The Digital Generation Doesn’t Use Mobile Payments … Yet

Mobile payment usage among Gen-D remains very low, as is true across the marketplace in the US. Indications, however, point to increased use of mobile payment services in the next year, consistent with the Digital Generation’s use of lifestyle enhancing mobile apps across industries. In fact, usage could increase by 300% if those surveyed follow through on their expected acceptance of mobile payment options. One of the major hurdles (as referenced in several studies) is the ease and acceptance of current payment options.

The FICO research shows that Gen-D is using their primary bank’s mobile app quite frequently, and they trust their banks to make payments. As a result, it becomes a prioritization and investment decision to determine if, and when, individual banks and credit unions should move forward on the opportunity to push mobile payments directly or via a partner like Apple Pay.

5. The Digital Generation Trusts Traditional Providers

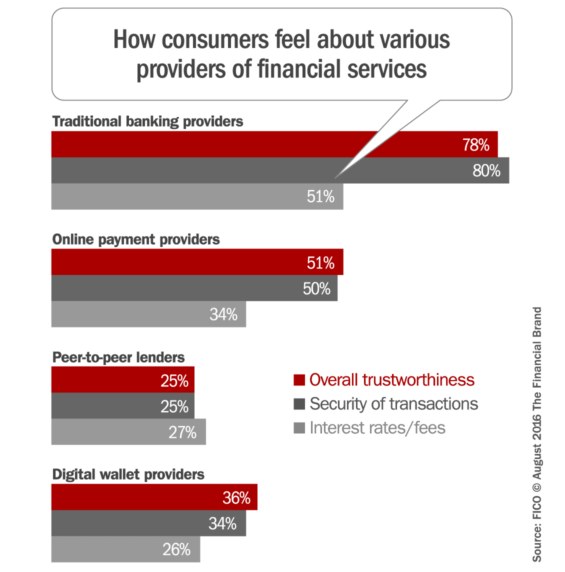

When FICO compared non-traditional financial services providers to banks in a number of categories like “security of transactions,” “overall trustworthiness,” and “low interest rates,” banks and credit unions score on average 30-50 points higher than non-traditional options. The highest scoring non-traditional providers were well-known online payment firms like PayPal, which also have highest usage.

While the growth rate of alternative providers may seem impressive, the P2P lending industry is still an insignificant part of the total number of consumer loans. According to FICO, “As a result of this slow growth in market share, many of the P2P lenders are now focused on partnering with traditional financial institutions, such as Lending Club’s partnership with Citibank or Prosper’s partnership with the Western Independent Bankers (community banks) to grow the scale and expose more customers to the services they offer.”

6. The Digital Generation Wants Credit Cards

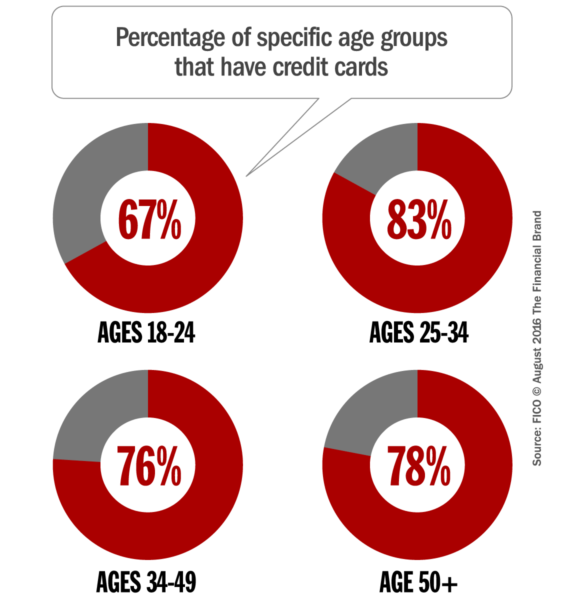

While many bankers believe Millennials are debt-averse and use debit cards or checking accounts as opposed to credit cards, FICO found that Millennials actually want credit cards. While only 67% of those 18-24 own a credit card, the percentages (and sue) skyrocket for 25-34 year-old consumers.

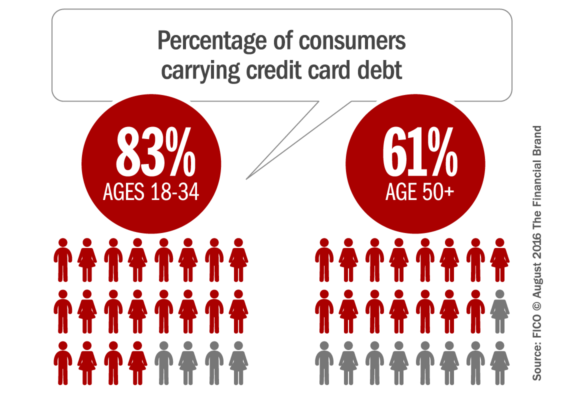

In fact, FICO found that 83% of Millennials aged 25-34 use credit cards and that 31% of consumers 25-34 years old carry a balance of $1,000-$4,999 on their credit card. This was significantly more than all the other age groups. The 25-34 year-old consumer also had more balances in the $5,000-$9,999 range, but were the second most likely age segment to have over $10,000 in credit card debt.

“Millennials are very interested in obtaining and using credit cards as they remain a convenient mode of payment and source of credit,” stated Schnoll from FICO. “They are still maximizing their earning potential but also juggling numerous lifestyle costs, such as college loans, car and home ownership, as well as supporting young families.”

With 49% of Millennials holding between three and five credit cards, lenders are competing for share of wallet with by offering no annual fees, low interest rates and cash back rewards. “Credit cards that offer low cost-of-use are favored by this demographic,” said Schnoll. “Segmentation here is very important, so the right product at the right risk level is marketed to the right customer. Banks need to make sure that Millennials want their card and choose it at the point-of-purchase.”

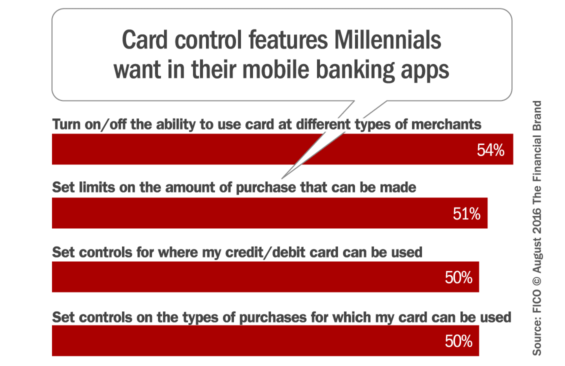

The survey also showed that Millennials want credit cards that offer the following:

- Account notifications

- Enhanced security

- “Self-managing” card controls

- Automated notifications about late payments

7. The Digital Generation Expects Personalized Communication

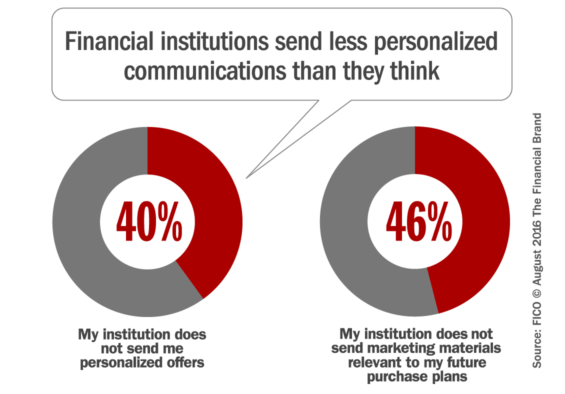

One of the biggest frustrations Millennials have with their bank or credit unions is that they don’t feel like their bank’s or credit union’s messaging is catered to them or relevant to their needs. FICO research found that 40% of those surveyed said banks don’t send personalized offers and 46% said banks aren’t sending information that’s relevant to future purchase plans.

“Based on the survey results, banking organizations should take advantage of the rich transaction and life stage information they possess to make the right offers to their customers and members, said the FICO report. “Connecting data from product silos and managing the individual as opposed to the account represent a large opportunity for better engagement.”

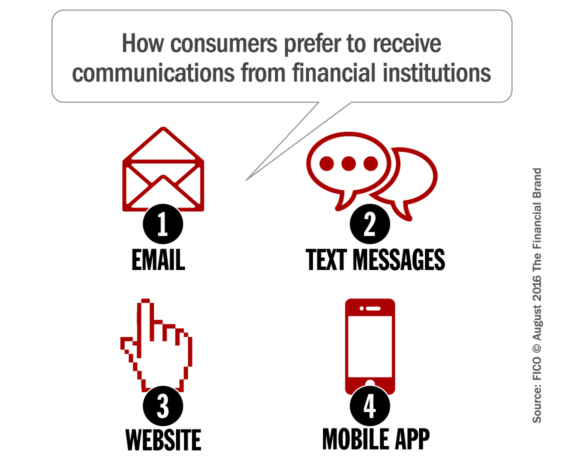

Millennials not only want to receive personalized and pertinent communication, but they are very particular in terms of how they want to be reached. With smartphone saturation among the group, it makes sense for banks to pay attention to preferred communication preferences and use them.

Smartphones mean banks can be constantly connected to their customers. The key to mobile banking is to approach them the way they want to, be it through email, text messaging, or app notifications. The key to a differentiated experience is understanding the preferences of each individual Digital Generation consumer and matching this with the way an institution interacts. The analytics and automated communication tools are available to deliver those experiences at scale today, and organizations need to leverage these tools.

Today’s tech-savvy, mobile-first Digital Generation consumer wants choice, convenience and personalization. The Digital Generation wants customized offers and communication and an experience that is easy and intuitive while also being contextual based on their real-time activities. Banks and credit unions that understand the differences of the Digital Generation and take the steps needed to provide what they want will be at a competitive advantage in a rapidly evolving marketplace.

About the FICO Research

The Digital Generation insights discussed in this article were consolidated from a series of comprehensive eBooks developed by FICO. Each eBook on the Digital Generation can be downloaded at no cost here.