Americans’ thirst for consumer credit, having had a hiatus in 2020, is continuing to grow again. This is driving demand for unsecured personal loans. Depending on the category of borrower and the market niche of the lender, these may range from hundreds of dollars up to as much as $100,000 — all on a signature.

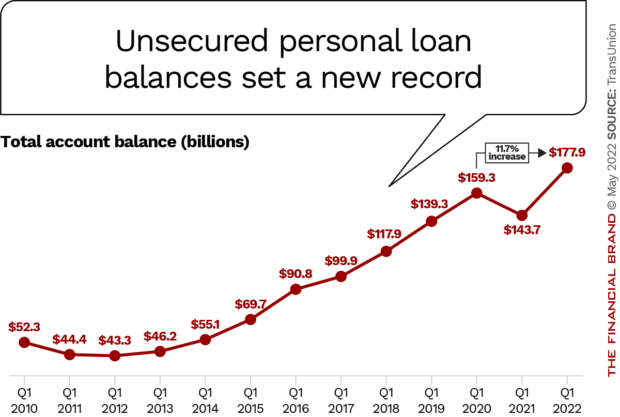

Even as volume hits record levels, unsecured personal loans outstanding represent a tiny fraction of outstanding consumer debt, making it even more likely to be a potential growth area in the period ahead.

The demand arises in two ways. Some consumers want loans for large credit needs such as major home improvements, payment of uncovered medical expenses, building out home offices, and weddings. Others seek them as a means of debt consolidation to bring down interest costs and to adjust monthly payments.

The average debt among unsecured personal loan borrowers stood at $9,896 in the first quarter of 2022, up 18% from the first quarter of 2019, and up 12.2% from first quarter 2021, according to TransUnion. The year-over-year growth rate was the highest among eight consumer credit categories tracked by TransUnion.

The overall trend represents an opportunity for institutions that haven’t done much unsecured consumer lending, other than credit cards.

Lenders seeking growth will see fresh territory, especially as longstanding growth sources such as purchase and refi mortgages begin to dry up as interest rates continue to rise.

However, increasing loan market share must be balanced against risks of further inflation as well as predictions from some quarters of a recession in 2023. In addition, the cushion of the excess savings created by stimulus payments is gone.

Personal Loan Rivals:

Fintechs, including SoFi and LendingClub Bank, represent a major factor in unsecured personal loans. Marketplace lenders like Prosper and their investors are another factor.

Some major banks as well as credit unions have made unsecured personal loans for some time, and some finance companies and diversified financial services companies like Discover and American Express are also active.

This article will examine the overall trend, the competition would-be lenders will face, and a look at marketing trends and practices among companies offering unsecured personal loans.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Makings of an Unsecured Loan Boom

Even before the current rise, more banking institutions were increasing their unsecured personal lending efforts.

“Many had very small portfolios that were used for offers to existing customers who asked about getting one,” says Liz Pagel, SVP and Consumer Lending Business Leader at TransUnion. “In the past few years some of these banks have decided this is a product that can grow in its own right.”

Multiple analyses indicate that many consumers’ incomes aren’t keeping up with inflation’s impact on their spending. Many people will need more credit, or need to restructure the debt they’ve already incurred. A May 2022 study by Morning Consult, for example, found that more adults — typically single parents, Millennials and high earners — are carrying unpaid credit card balances.

Home equity lines of credit and loans are becoming popular again in response both to the need for credit and the rising levels of home equity available as prices shoot up. But even for the approximately 65% of Americans who own homes, unsecured personal loans have appeal.

A key reason may be urgency, according to Craig Martin, Managing Director and Global head of Wealth and Lending Intelligence at J.D. Power. While home equity credit would generally be cheaper than unsecured personal credit for a given borrower, “the speed of the process of each is materially different,” Martin explains. “People may not want to wait for as long as 45 days for home equity credit to be approved.”

By contrast, personal loans, which are evaluated by artificial intelligence among the fintechs, can be approved quickly. Two out of five respondents to the research firm’s “U.S. Consumer Lending Satisfaction Study” said lenders acted on their requests within an hour.

Pagel suggests that the growth in buy now, pay later credit may be playing a part too. “People pay for their BNPL purchases in installments and when they are done that feels good. They think, ‘That was a pretty easy experience’,” says Pagel. “And then when they are making a big purchase, they think ‘Wouldn’t it be nice to finance this as an unsecured loan too’.”

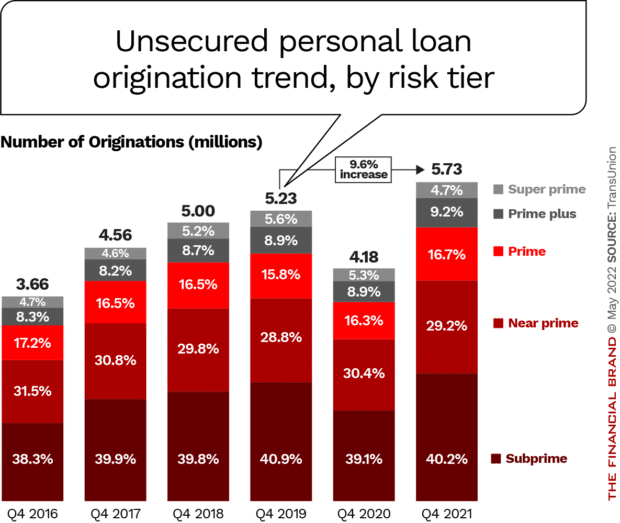

TransUnion figures indicate that part of the growth being seen comes from lenders liberalizing their standards. The firm says lenders have been cautiously moving back into the nonprime market, with the mix of credit risks in the fourth quarter of 2021 resembling that of the pre-pandemic period, superimposed on higher overall volume.

In the first quarter 2022 20.4 million consumers had 23.9 million unsecured consumer loans. The higher second number reflects that it’s not unusual for borrowers to go back for additional personal loans. In fact, many firms making unsecured personal loans refer to their customers as “members” in recognition of this pattern.

The J.D. Power report suggests that almost two in five personal loan borrowers use them as a “lifeline” because they are financially vulnerable. “And some brands that cater to higher-risk customers have nearly double the average number of financially vulnerable customers,” the firm notes.

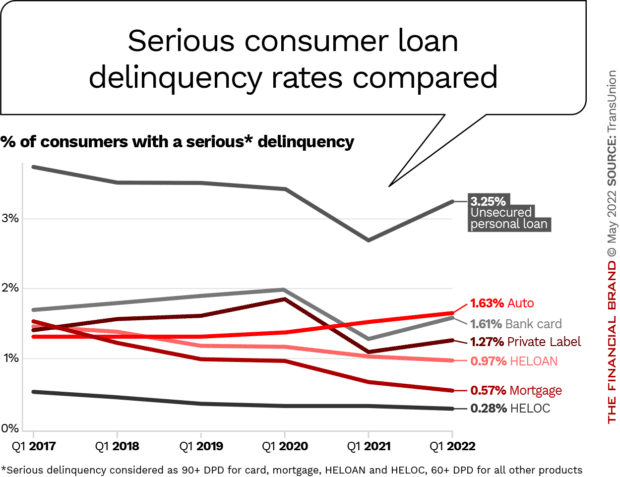

Serious delinquency levels, as defined in the chart above, typically run higher for unsecured personal loans. J.D. Power says this is in keeping with the rising level of below-prime borrowers. “Delinquency rates remain at healthy levels and are below pre-pandemic highs,” the firm states.

Read More about Loan Growth:

- Innovation and Inflation: Two Trends Changing Credit Card Marketing

- Where Banks Can Find Consumer Loan Growth in Inflationary Times

- Electric Vehicle Lending: How Green Credit Can Feed Loan Growth

- Lender Alert: Struggling Consumers Using BNPL Almost 4x More Than Others

How Competition Shakes Out in Unsecured Personal Loans

To get an appreciation of the scale of some of the largest unsecured personal lenders, consider that in the first quarter of 2022 alone, SoFi originated over $2 billion in personal loans. This was up about 25% from the fourth quarter 2021 and up nearly 54% over the first quarter 2021. By one estimate, unsecured personal loans are now a $1 trillion market.

The average SoFi personal loan customer has income of $160,000 per year and it will lend up to $100,000 in unsecured personal loans, depending on credit and income level. By contrast, LendingClub Bank’s average borrower income for this product is $100,000 and it will lend up to $40,000. Both organizations’ current model is a blend of lending from their own insured deposits and selling loans to investors. Each has noted in investor presentations that deposit-funded loans are more profitable. (LendingClub bought Radius Bank in early 2021 and SoFi bought Golden Pacific Bancorp in early 2022.)

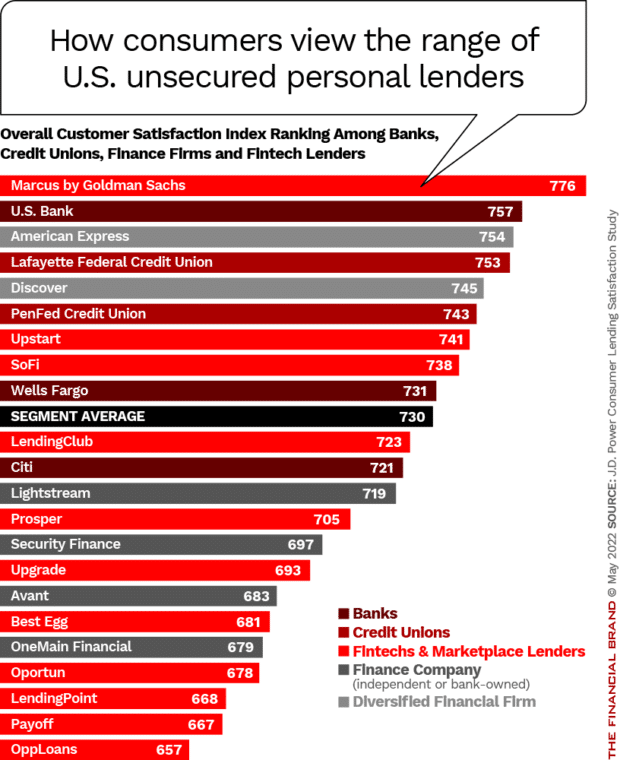

The J.D. Power study ranked companies offering unsecured personal loans as shown in the chart below, for overall customer satisfaction levels.

As the chart demonstrates, parts of both the bank and credit union fraternity have been making unsecured personal loans for some time.

The roster in the chart includes companies that tend to lend to higher-earners borrowing four or more figures all the way down to those who serve consumers who periodically need smaller credit. Security Finance, for example, markets itself as a lender that offers loans “from $428 – $2,230.” (The loan ranges vary by state.)

J.D. Power’s Craig Martin says many factors go into satisfaction levels with unsecured personal loan lenders. A prime one is customer service, especially providing ease of access when there is a problem and being able to solve the issues. Another key issue is fees — these borrowers are especially sensitive about surprise charges. Some brands visibly promote that they charge no fees.

Take Sofi: “Low rates. No fees. Personal loans made easy. … Compared with high-interest credit cards, a SoFi personal loan is simply better debt.”

Many of the providers in the lower portion of the chart generally work with consumers with credit challenges. Martin says this impacts the rankings. “Financial stress does impact those consumers’ experiences,” he explains. Martin adds that the most successful providers understand the needs and expectations of their target clients, and adapt to meet them.

Read More: Why SoFi’s Tech + Bank Deals Could Disrupt Traditional Banking

Marketing Unsecured Personal Loans Via Paid Search

Martin says that the study indicates that digital media is the best way to promote unsecured personal loans. Specifically this means websites, social media and email. He says this reflects that these loans tend to skew younger. The study found that 60% of users are Gen Y and Gen Z, 20% are Gen X and 10% are Baby Boomers.

Getting consumers to a lender’s website takes more than careful search engine optimization. It takes money, specifically search engine marketing, the purchase of keywords. Most of this takes place on Google. Search for a term like “unsecured personal loan” or “personal loan” and you will see a bunch of ad listings before any organic search results appear.

In fact, notes analyst Lierin Ehmke, the organic results may initially be dominated by links to affiliate marketing sites like NerdWallet and Credit Karma because of their strong content marketing strategies. Both of those sites have increased their spending on paid search as well, she’s found, to show up high in search results for terms they aren’t as associated with, such as “personal loans.”

Ehmke, Research Manager at Comperemedia, has in her work found that personal loan companies are increasing their spending to build market share. She found that SoFi led the field both in total spending and for growth from year to year.

“90% of people’s online journeys start with search, so having a paid search presence is a strong strategy for personal loan brands.”

— Lierin Ehmke, Comperemedia

While SEM implies bidding, the lenders aren’t all going for the same terms necessarily. In part this is because, as noted earlier, they often target a particular type of borrower.

“So, for example, if a company were to target nonprime or subprime customers, they might buy words that would go with people who are searching who have bad credit,” says Ehmke. Key words might also be bought based on the purpose the lender is marketing loans for, such as home improvement, debt consolidation or wedding costs.

Other terms that might be purchased would include “credit score calculator” or “free credit report.” In the latter case, fintech platform Best Egg, owned by Marlette Funding LLC, invested in free reports to back up the purchase of that term to attract potential borrowers.

Ehmke points out that one advantage of paid search is that the advertiser only pays when the prospect clicks on the link. In the meantime, if someone is doing a lot of searches, they may see a lender’s name multiple times. This exposure can add up and only costs when they finally click.

“There’s constant monitoring in paid search, and a lot of malleability in terms of the kind of keywords for a firm to bid on,” adds Ehmke.

Website structure is also important in ranking in Google. Ehmke points out that having a folder labeled “loan product,” with robust content, can help boost the visibility of paid search. Lenders who study the sites of personal loan specialists will note that they tend to have multiple folders and landing pages, not only for types of loans, but for specific purposes, like debt consolidation or weddings.

What about the smaller lender who may be thinking regionally or even locally? One point from Ehmke is to think in terms of long-tail keywords. These are long phrases, such as “best personal loans for those with good credit standing.” Longer and more detailed, they are less likely to be sought after, and therefore cheaper to bid for.