Interest begins accruing again on federal student loans on Sept. 1 and repayments start up again in October.

But even with the three-year pandemic moratorium ending, “normality” may be elusive for the student lending market for a while.

The Supreme Court struck down President Biden’s forgiveness program for federal student loans in a June 30 ruling, and the administration has a new plan afoot to achieve its goal.

The Court’s ruling coincides with a restart of what has been a giant pause on the entire student loan market. The federal government declared a moratorium on both loan payments and interest in March 2020, as part of numerous Covid-era relief efforts. The controversial moratorium concludes at the end of August as a result of the federal budget agreement reached earlier this year.

Still, there’s an “on-ramp” period during which missed payments will not be reported to credit bureaus.

What does it all mean for the banks and fintechs offering private student loans?

Here’s an overview, with key questions answered.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

What are the key details about the Court’s ruling against student loan forgiveness?

The Supreme Court held in a 6-3 decision that the Heroes Act permitted modification of student loan programs but not their wholesale rewrite.

The decision derailed a Biden administration plan that would have allowed many borrowers to get as much as $10,000 of their debt erased. Some would have been eligible for as much as $20,000 in permanent relief.

Forgiveness of federal student loan debt remains a major goal of the administration, though.

The Federal Reserve estimates that Americans have roughly $1.75 trillion in student debt, of which $120 billion consists of private sector educational loans.

Keefe, Bruyette & Woods analysts said in a report after the Court’s decision that they expect any impact on consumer spending to be muted. “Broadly speaking the decision could put pressure on spending given consumers will have to start making payments again,” they wrote. “But we think payments are manageable, and that it could take some time for payments to recommence as the Biden administration is working on plans to allow for grace periods.”

Will federal student loan debt still be forgiven? Biden thinks so.

Having been stymied by the Court, Biden told reporters that the Education Department is devising a workaround that relies on a different law, the Higher Education Act of 1965.

“This new path is legally sound. It’s going to take longer, but, in my view, it’s the best path that remains to providing for as many borrowers as possible with debt relief.”

—President Biden

This will not affect the end of the moratorium, however. “Monthly payments will be due, bills will go out, and interest will be accruing,” Biden told reporters. “And during this period, if you can pay your monthly bills, you should.”

He also introduced several programs to help those who can’t afford the monthly payments on their federal student loans.

What if borrowers can’t afford to start repaying the debt right away?

Anticipating that some borrowers will have trouble, Biden announced a temporary 12-month “on-ramp repayment program.” Essentially, during that yearlong period the Education Department will not report missed payments to credit bureaus. Biden said the intent was to give people “a chance to get back up and running.”

At the same time, Biden and Secretary of Education Miguel Cardona announced the finalization of the “Saving on a Valuable Education” (SAVE) program. This is an expansion of an Obama-era program — Revised Pay as You Earn (REPAYE) — which enabled federal borrowers to pay no more than 10% of their disposable income toward their student loan debt. The new move cuts this to 5%.

“The typical borrower is going to save about $1,000 a year,” Biden said. “And if you keep up payments for 20 years without missing them, your total debt is forgiven after 20 years.” (The forgiveness was already provided in these instances, in the form of the reduction of the threshold to 5%.)

Cardona said monthly payments will be cut to “zero dollars” for millions. This would include borrowers making less than $15 an hour. Expressed another way, a borrower who is single making $32,805 annually wouldn’t have to make payments. A federal fact sheet on the SAVE program goes into considerable detail.

A key point: The government will stop charging any monthly interest that is not covered by the borrower’s payment under the SAVE plan. “As a result, borrowers who pay what they owe on this plan will no longer see their loans grow due to unpaid interest,” the fact sheet says.

Read more: What Bankers Need to Know About Higher Consumer Debt

What does this mean for private student loans from banks and fintechs?

There is a cadre of lenders — including banks and fintechs — that make private student loans. These were not subject to the federal moratorium nor to the forgiveness effort. However, there are ripple effects.

One category consists of new private student loans intended to close the gap between tuition and additional school expenses versus what is covered by government loans, grants, scholarships, savings and other sources of education funds. These are made during the school years.

The other category consists of refinancings of outstanding student loans. The goal for people who refinance is to bring down the rate — which is less likely for many borrowers as market rates have risen — or to extend the term of the loan in order to reduce the size of monthly payments. Some borrowers also refi to consolidate multiple student loans into one, though the federal programs also provide some consolidation options.

How much the new state of affairs at the federal level will affect these private loans remains to be seen. It will depend in part on the market segments that refi lenders serve. Some, such as LendKey, market to lower-income borrowers; some, such as SoFi, to higher-income borrowers; and some more generally. Others, such as Laurel Road and Panacea Financial, specialize in people with specific careers, such as medicine.

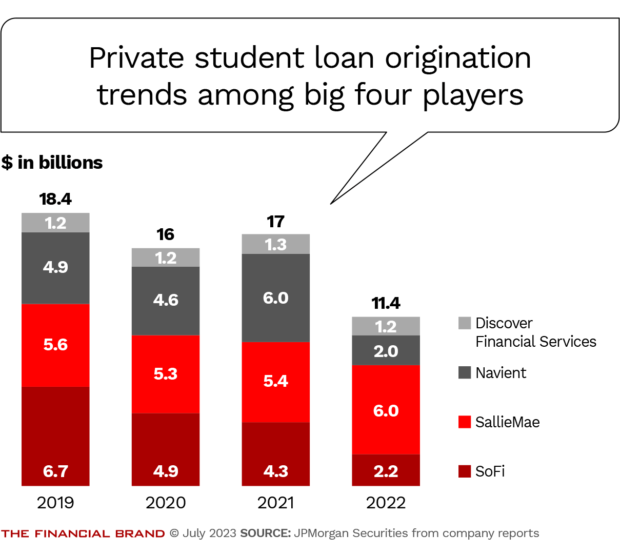

Demand for refinancing existing student loans plummeted after the federal government declared the moratorium. Some foresee a major rebound once monthly payments kick in again.

“We think there’s a lot of pent-up demand from the last three years,” Anthony Noto, the chief executive of SoFi, told analysts in June. “And there’s also a lot more awareness that you can refinance student loans. Many people don’t realize that you can do that.” SoFi officials anticipate that the company could grab up more than half of the demand that will emerge later this year.

“We’ve been supportive of forgiveness,” Noto said. “We were supportive of the moratorium for the first year. In the last year we thought it was a little exorbitant.”

SoFi originates new loans in addition to setting up refinancings. The company generally markets its private student loan programs to super-prime borrowers, with FICO scores of approximately 770, according to Reginald Smith, an analyst at J.P. Morgan Securities.

Read more:

- Inside KeyBank’s New Strategy for Its National Digital Brand

- Two Digital Banking Models for Targeting Doctors and Nurses

How much upside is SoFi estimating?

Even before the latest developments, there were questions regarding the potential volume of the student loan refi market.

In analyst meetings, SoFi’s Noto has said that the fintech-turned-bank believes the total addressable market of loans it could refinance within the credit parameters that the company favors is about $200 billion. He said that interest in stretching out loan terms had been growing even before the end of the moratorium was announced.

A Double Dip for SoFi?:

Noto has also suggested that when rates turn down in the future, there will be an opportunity to refinance refinancings.

When SoFi was a fintech, unable to raise its own deposits, it depended on securitizations and whole loan sales to fund its lending. Since SoFi became a bank, via an acquisition that gave it a national charter in early 2022, it has been funding about 40% of its lending using deposits.

Read more about SoFi:

- SoFi Has Big Plans for the $2B of Deposits It Scoops Up Every Quarter

- SoFi Intends to Become the Center of the Financial Universe (Podcast)

How big is the market for student loan refis?

This is a matter of some debate, even though the total amount of outstanding student loans is huge.

In his June 29 report, J.P. Morgan’s Smith suggested the demand for refinancing is likely to be smaller than SoFi anticipates.

“We believe refinancing with a private lender like SoFi makes economic sense for just a fraction of borrowers — those with relatively high income, credit scores, and APRs,” Smith wrote. “In most instances, borrowers are better off keeping their existing federal loan and/or applying for an income-based repayment plan.”

Rather than $200 billion, Smith thinks $90 million — less than half — is a more accurate estimate of the potential volume in refis.

Smith’s report was published prior to the announcement about the SAVE program, but that development appears to bolster his point. Smith cites College Board research indicating that more than half of outstanding federal student loans use income-driven repayment plans.

Smith also cited figures indicating that less than 2% of outstanding student loans were refinanced in 2019.

See all of our latest coverage of loan growth opportunities.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What’s the bottom line for SoFi?

SoFi, often a volatile stock, has been experiencing considerable enthusiasm, which Smith thinks could be overdone. “While there may be an initial surge in refinancing, we don’t see the tsunami the stock seems to be reflecting,” he said.

The J.P. Morgan report also examined the pros and cons of using deposits to fund student loan refinancing on balance sheet, a shift from SoFi’s past practice made possible by its bank charter.

Given the accounting treatment that SoFi uses for loans on its balance sheet, Smith believes it makes more economic sense for SoFi to sell or securitize student loans, and to hold personal loans on the books instead, as those would earn more. “We think adding student loans to the balance sheet, while profitable, is an inefficient use of capital,” he wrote.

Meanwhile, in their note issued after the student loan ruling and subsequent announcements, the KBW analysts described the Supreme Court’s decision as “a slight positive” for SoFi over the near term. “The elimination of $10,000 of debt per student loan borrower would not have had a significant impact to volume given the average refinancing amount is about $70,000,” they wrote.

The analysts said that the end of the moratorium on student loan payments was more significant, because it “could allow student loan refinancing volume to normalize up to pre-pandemic levels,” which amounted to about $1.7 billion quarterly in 2019.

Like Smith, the KBW analysts were skeptical of SoFi’s $200 billion estimate of the total addressable market size for refis. “This figure might be a little high based on our analysis,” they wrote.