For decades, America’s economy has been built on consumer spending. Historically credit powered much of that spending. So much so that it’s fair to say that if none of that credit existed, Americans would live much different lives.

Now the economy labors in the midst of an extended reboot from the COVID crisis. As Americans reenter some version of normality their views about borrowing will vary, based on their employment status, where they live, the options available to them now, and in some cases their age. In some ways their thinking about credit is changing.

Lenders and financial marketers face a steep challenge trying to figure out where the immediate future is for the types of credit they sell. Given the highly unusual nature of the COVID-19 slowdown, past patterns only go so far. Even the economic developments right in front of them can be misleading.

“We’re seeing the macroeconomics change on us weekly, if not daily,” said Jennifer LaClair, CFO at Ally Financial, during a Morgan Stanley virtual investor conference in early June.

The recession we’re now officially in is not an ordinary one, according to Jim Houston, Managing Director Of Consumer Lending And Automotive Finance Intelligence at J.D. Power. The Great Recession, he continues, was driven by lack of liquidity, an over-extended subprime sector in multiple types of credit, and enthusiastic lender risk tolerances that enabled many consumers to borrow more than they could afford.

By contrast, today’s economy was still booming when COVID-19 shutdowns pulled the rug out from under. Many have lost their jobs or substantial parts of their incomes and with that their ability to make payments on borrowings, says Houston. The J.D. Power COVID-19 Pulse Survey for May 29-31 indicates that two out of five Americans have seen their income drop by 25% or more. Just over 52% of the U.S. still pay all of its bills on time. But a good third of the country believes worse impact from COVID-19 on their finances is coming.

Today, “most lenders are pretty liquid, and they have the ability to lend,” says Houston, and many reached out to offer forbearance, deferrals and other relief to borrowers back at the beginning of the COVID-19 period. This, coupled with federal stimulus payments seems to have tided over many Americans thus far.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

COVID Consumers: Making Less, Spending Less, Saving More

But there has also been a major change in American spending habits, in part by choice and in part because there was little opportunity given social separation policies.

“Consumers have been staying home and they are not spending money,” said economist Amy Crews Cutts of A.C. Cutts & Associates during an Equifax webinar in late May. “What are they going to do with that money? They are putting it in banks.” She noted that bank deposits have risen by $2 trillion — an increase of 15% — since February 2020, through early May.

Concurrent with that, credit card debt has declined by $80 billion, according to Jennifer Cox, Risk Solutions and Consulting Leader at Equifax, during the same webinar. Beyond the drop in retail sales, consumers have been paying down their existing card debt with stimulus checks or what they saved through, say, mortgage forbearance.

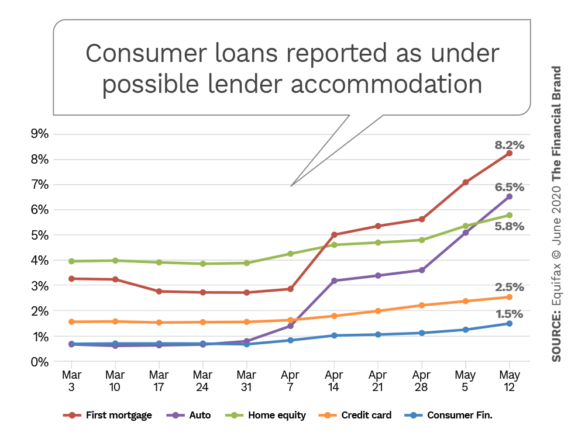

How much consumers appear to have requested relief from lenders varies among credit types. Equifax figures, in the chart below, projects that through mid-May 8.2% of consumers with first mortgages may have requested relief, the highest category, presently, among those in the chart. Student lending (not shown in the chart) is in a league of its own: 77% of student loan borrowers were projected to be in some form of credit accommodation in mid-May, according to Equifax data. (The CARES Act applies special conditions to student loans, halting payments automatically through Sept. 30, 2020.)

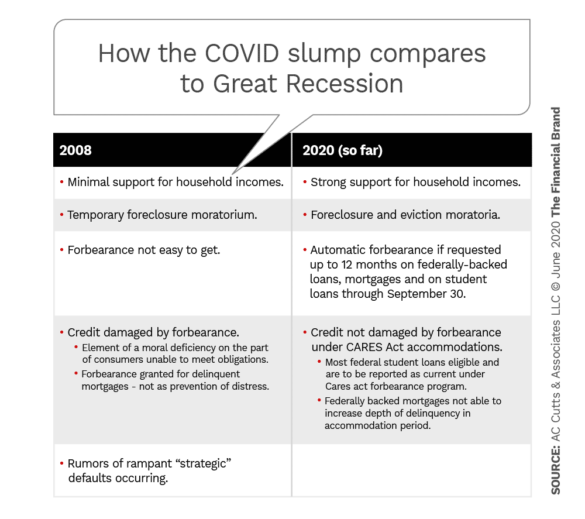

Cutts says mortgage defaults necessitated by long-term job loss are much more likely in the current recession than the “strategic” defaults of the Great Recession, in which borrowers simply walked away because their homes had negative equity. Cutts compares the Great Recession and the COVID-19 slowdown in the chart below.

Changes In Attitude Towards Debt and Financial Health

In the period ahead, banks and credit unions will need to assess the potential for growth going forward.

“Lenders are going to have to see who can resume payments, who needs refinancing or modifications, and who can’t pay.”

— Liz Pagel, TransUnion

In late May and early June lenders have simply been “coming up for air,” says Liz Pagel, SVP and Consumer Lending Business Leader at TransUnion. They have been handling requests for relief and dealing with the internal issues facing all banking organizations. Now, she continues, as some of the aid to consumers will be tailing off under current programs, “lenders are going to have to see who can resume payments, who needs refinancing or modifications, and who can’t pay.”

One major shift that Pagel says TransUnion sees ahead is much more attention to financial health on consumers’ part. “They will be working to protect their credit standing going forward,” she says, which may influence how they use credit.” As lenders also tighten up in certain areas, she says, an interesting alignment is being created: “There’s a decrease in demand and a decrease in supply at the same time.”

Here’s a look at several major lending areas banks and credit unions must be watching.

Auto Lending Coming Back, But Watch Supply Issues and Changing Preferences

Millennials have been an ongoing quandary for the auto business and for lenders. They have tended to be the generation that doesn’t feel the need to own a car — prior to the arrival of COVID-19.

Ally’s LaClair says her organization has noted a change. Millennials, still frugal regarding transportation, have started to favor buying used vehicles. Even with many of them working from home through the pandemic, they are worried about exposure to the disease via mass transit.

“Millennials, still frugal regarding transportation, have started to favor buying used vehicles. They are worried about exposure to the disease via mass transit.”

One bit of fortune for them is that recessions, historically, pull down used vehicle prices, according to Edmunds.com. The flip side of that, the site’s blog continues, is that consumers looking to trade in will get less for their vehicles, as will people selling their cars to raise cash.

J.D. Power’s Houston says that during the height of the lockdown period, with dealerships closed and car factories temporarily shut down for social separation as well, dealers increased their efforts to sell vehicles over the internet, concluding the process with “touchless” delivery service. (As of early June, about 21 states still limited dealers’ physical operations.)

Much of the financing provided during this period was by manufacturers’ captive finance companies. This is a model that companies like Carvana and Vroom pioneered with used vehicles and the dealers followed suit. One advantage the dealers had were apps, quickly developed, that seamlessly combined the browsing, buying and financing process, tying in the captives to the dealers’ sales. Houston says this came at a time when consumers had more time to research car buying online, but he thinks this model will continue to appeal to consumers even as dealer lots reopen.

“Consumers under 40 are interested in the ease of doing business on the smartphone,” says Houston. Shifting to more “virtual car lots” will be among the changes this part of the industry sees, he says.

New car inventories are down because factories haven’t been producing new vehicles for some time. As a result, there will be more emphasis on selling and financing used vehicles, experts say.

Additional opportunity for banks and credit unions will arise because the captives are reducing the extremely attractive terms that they were offering during the height of the pandemic. From early March to early June, according to J.D. Power figures, captives’ share of market of new vehicle loans and leases rose from 63.8% to 76%, banks’ share fell from 24.5% to 15.9%, and credit unions’ share went from 8.5% to 6.7%.

Notably, in late March, 22% of new vehicle sales were for loan terms of 84 months or more, a huge increase in such long-term credit. J.D. Power figures indicate that this percentage is quickly falling as America reopens, with only 12% of borrowers going so long in early June. Power says that’s more than halfway back to pre-virus levels. To a great degree this has happened because dealer inventories have been reduced, lessening the need for such liberal terms. Power also suggests that captives are conserving incentive budgets.

On the other hand, leasing has fallen off tremendously, in part because many people who favor leasing extended their leases during the pandemic lockdowns.

LaClair noted that Ally early on saw a drop in applications and originations of over 50%. She says the company expects that the second quarter will end with originations off by 25%-30% from pre-COVID expectations. Floor planning, the financing of dealer inventory, fell off a cliff for Ally and other lenders as production ceased — she gave a rate of $1 billion a week in decreases. Now that production is up, this will improve in the second half.

Ally has taken the unusual step of providing its dealers with help for re-opening marketing, including social media posts and email marketing campaign templates, training — and even decals to encourage social distancing at the dealership.

As the digital showroom and finance department come to the fore, Houston suggests that dealerships, once a mainstay of local business banking, will consolidate in a big way. There just won’t be the need for as many of them. He points out that Tesla doesn’t rely on local franchised dealers.

Looking at Home Equity Credit

Home equity loans and home equity lines of credit have not been as popular as they once were, though that may shift again in the future. One reason is that online lenders’ unsecured personal loans, even though with higher rates, are much easier and faster to obtain than a loan secured by real estate. Another is that some consumers have instead chosen “cash out” refis, which refinance the original mortgage at today’s ultra-low rates but drawing out additional cash based on equity at the same time.

Joe Mellman, SVP and Mortgage Business Leader at TransUnion, says that originations of home equity lines of credit are currently off by about 7%. Credit performance on equity lines has been good, he says. In addition, he says that at present home prices have been staying very high, so thus far there hasn’t been a falloff in security for the loans.

At present, Mellman says, there is $19 trillion in home equity available to secure loans and lines. In spite of the strong performance of home equity credit, he says, several large lenders, including Chase and Wells Fargo, have stopped doing new equity lending due to coronavirus-related uncertainties. (Existing lines have not been affected.)

“I don’t think either bank’s suspension is permanent,” says J.D. Power’s Martin, in regard to home equity lines. “But it is a riskier position to be in.”

During the COVID period HELOCs have been pretty much flat in origination volume, and some other forms of credit may be more desirable for lenders themselves. Houston points out that as credit lines HELOCs require a degree of reserving, for capital calculation purposes, even for the unused portion of the lines, and institutions are keeping their eyes on capital.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Credit Needn’t Look Like Traditional Loans or Lines

There’s been pullback on both sides of unsecured personal loans, especially those provided by fintech lenders, Pagel notes. While some lenders have tightened standards or decreased activity, she says, borrowers have also pulled back as the COVID period continued.

Among prime borrowers these loans were used for vacations and home improvement, in addition to credit card consolidation, “but those things just aren’t happening at all,” says Pagel. She adds that deep subprime borrowers typically tapped these lenders for emergency funds, but explains that stimulus checks and other temporary measures have replaced that, for a bit. This comes at the same time that credit card balances have been falling. It’s likely this will continue until circumstances improve and the economy truly reopens.

In the absence of the COVID recession, says Pagel, fintech personal loans would have remained a growing part of the credit industry. “Prior to the impacts of COVID-19, the personal loan market was well-positioned for another strong quarter,” Pagel says.

Early on in the COVID crisis federal financial regulators encouraged banks and credit unions to offer “responsible small-dollar loans” to customers affected by the pandemic. Later they issued principles for such program. This was a continuation of efforts by regulators, notably the Comptroller’s Office and FDIC, to encourage lenders to devise such programs a few years earlier. Historically the point has been to give consumers who need short-term credit but who can’t afford to run credit card balances an alternative to less-palatable choices like payday lenders. (The same two agencies had earlier gone after institutions offering a selection of short-term credit products that were considered very expensive and unfair alternatives.)

Pagel says she has seen little uptake on the request. One new glimmer may be a blueprint that the Bank Policy Institute trade group filed with the Consumer Financial Protection Bureau. In late May this template received a bureau “no-action letter.” No-action letters provide some regulatory protection for fledgling financial experiments. The idea is that the template can be used as the basis of individual banks’ own requests to set up small-dollar credit programs.

In early June the Wall Street Journal published an investigative story indicating that many payday lenders, some in partnership with banks, have been targeting borrowers slammed by the coronavirus with loans with triple-digit interest rates.

‘Point-of-Sale Finance Will Keep Me on My Budget’

In the meantime, the unsecured personal credit market has continued to see growth in a newer take on borrowing that is a tech-enabled variation on the old concept of layaway purchases. This is point-of-sale financing. Some POS lenders specialize in ecommerce only, some do both ecommerce and in-store financing.

“The shift to online retail spending has been a great opportunity for these companies,” says Pagel. “It’s the one bright spot in the market.”

Both specialists as well as mainstream financial firms have entered the POS finance field. (Marcus is a recent entrant, for example.) Essentially it permits shoppers to buy what they want and to break up the cost into installments.

“It’s a substitute for putting something on your credit card,” says Pagel. Even before the COVID period, according to McKinsey, POS financing was growing faster than traditional unsecured lending.

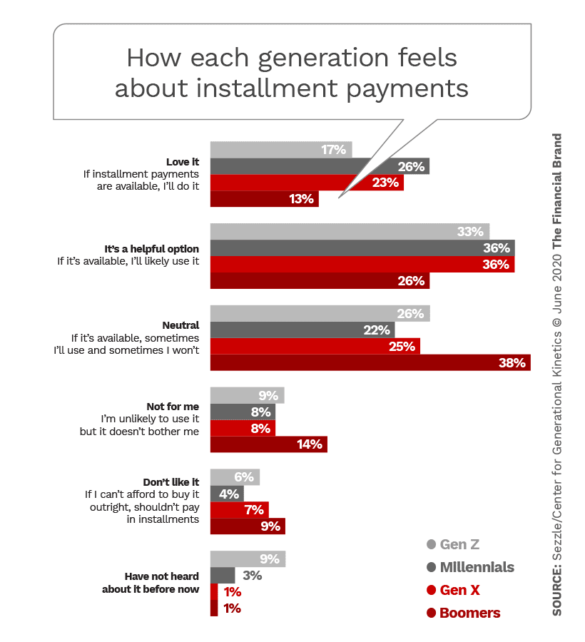

A post-COVID study for Sezzle, a POS lender, by the Center for Generational Kinetics, finds that credit cards are losing their appeal in certain consumer segments. The study found, for example, that 72% of Millennial consumers feel credit card rates are too high. Gen Z and Millennials both worry about credit, and cards exacerbate that worry.

The study found strong interest in POS financing among Gen X and Millennials, with Gen Z also interested.

The study asked consumers how their behavior would be changed by using a POS installment payment product. The top five points:

- It would help me better budget my finances 36%

- I would pay closer attention to my finances 35%

- I would feel more in control of my financial situation 33%

- I would have more financial freedom 31%

- I would feel less stressed by my finances 30%

This synchs with the COVID-caused stress on financial wellness. Houston believes that while rate is always important, consumers will be digging further than ever into the rates, terms and fees lenders charge and where they come out in the end.

The COVID period gave many a gift of time and they have gotten into the habit of using it.

“In the go-forward environment,” says Houston, “when it comes to credit, consumers will shop and shop and shop.”