Banks, credit unions and fintech lenders are heading into the unknown. They and their consumer borrowers face the highest level of inflation in three decades.

As lenders head into 2022, some areas of credit have grown hotter again, including bank card lending and unsecured personal lines of credit, while mortgages have slowed down and auto loans are stymied by ongoing supply issues.

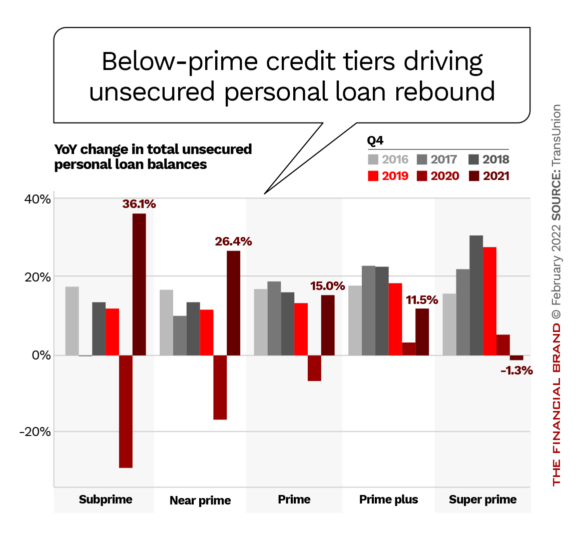

In the face of uncertainty and the continuing need to find growth, lenders are going further out on the credit limb to find more borrowers and to increase the potential revenue from their portfolios, according to TransUnion. In the third and fourth quarters of 2021 loans to non-prime borrowers increased significantly in year-over-year comparisons.

Non-Prime* Account Originations Show Growth Across Credit Products in Q3 2021

| Credit Product | Non-Prime Originations | QoQ Growth | YoY Growth |

|---|---|---|---|

| Credit Card | 9.0 million | 3.8% | 75.0% |

| Personal Loans | 3.5 million | 18.7% | 46.9% |

| Mortgage | 303,000 | 8.4% | 17.6% |

| Auto | 2.4 million | -10.5% | 5.6% |

*Note: Non-Prime: VantageScore 4.0 Risk Range of 300-660. Originations are viewed one quarter in arrears to account for reporting lag for the Q4 2021 TransUnion Credit Industry Insights Report.

Source: TransUnion

“We have seen a really strong rebound in demand for and access to unsecured credit particularly,” says Charlie Wise, SVP of Research and Consulting at TransUnion. “Credit cards and personal loans were areas hit very hard in 2020. Lenders pulled back over credit quality concerns and consumers didn’t need credit because the market was flooded with government stimulus and enhanced unemployment.”

“Consumers are burning through their accumulated savings. I’m not saying that they’re strapped, but they have come back for credit in a huge way.”

— Charlie Wise, TransUnion

Demand began picking up for unsecured credit in latter 2021, according to TransUnion records, and Wise believes the pace will continue through 2022, though growth might not be quite as rapid.

Looking forward, Wise says, inflation is the biggest variable.

“Consider those consumers who don’t have a lot of cushion, people who are living paycheck-to-paycheck,” Wise says. “A rise in the price of essentials like gas, food, housing costs means there’s a chance that there will be less money for them to meet their financial obligations. Some will have to make choices about what bills to pay and sometimes credit cards or personal loan payments are the ones they will deprioritize when there’s only so much to go around.”

This has not yet come to pass in a notable way, cautions Wise. TransUnion’s latest Credit Industry Insights Report concerning consumer credit indicates that recent borrowers are still maintaining decent credit performance, overall. In some areas delinquencies have increased but they are still at comparatively low levels relative to historical trends.

Year-over-year, balances grew in unsecured personal loans (15.1%), mortgage (8.6%), auto (6.9%) and bankcard (6.1%), according to TransUnion. In the fourth quarter of 2021, average balances per consumer also increased, year-over-year, in most consumer credit areas, including unsecured personal loans (9.4%, $9,600 average); auto (7.2%, $21,200 average); mortgage (6.9%, $237,400 average); home equity loans (2.7%, $47,700); and bankcard (0.5%, $5,100). (TransUnion is working on adding national figures on buy now, pay later trends to its database and hopes to begin regular reporting on BNPL in mid-2022.)

In terms of originations — new accounts opened — the leading categories were bankcard (63.5% year-over-year); unsecured personal loans (46.8% YoY); and home equity lines of credit (21.6%).

Further insights into credit card and personal loan trends come from TransUnion’s report and a related webinar.

Read More: Why Consumers Don’t Think BNPL Is ‘Debt’ (and Why That Matters)

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Credit Card Issuers Open the Doors Wider

While overall credit card originations grew 63.5%, non-prime card originations grew by 75% year-over-year in the third quarter of 2021. By share, 45% of the originations in the period came among non-prime segments. TransUnion reports that this is the highest proportion of non-prime originations since 2010. These trends occurred during two record quarters, the second quarter of 2021 (19.3 million) and the third quarter of 2021 (20.1 million).

“Lenders are looking for balanced growth,” explained Chris Huszar, Senior Manager, Financial Services Consulting, during a webinar. “They know that subprime and near-prime consumers have higher utilization rates and that there’s a better chance that that consumer is going to be revolving versus transacting.”

Huszar said that usually super prime consumers lead an increase in volume of originations, historically, but that the situation has flipped. In the third quarter of 2021, subprime originations were up 27% over the third quarter of 2019 and near-prime originations were up 16% compared to the same period. By contrast, prime borrowers were up 11%, prime-plus were about even, and super prime originations were down by 15%. The comparison to 2019 is meaningful here given the tremendous drop in originations seen in 2020 due to the pandemic and the related factors, such as federal stimulus, mentioned earlier.

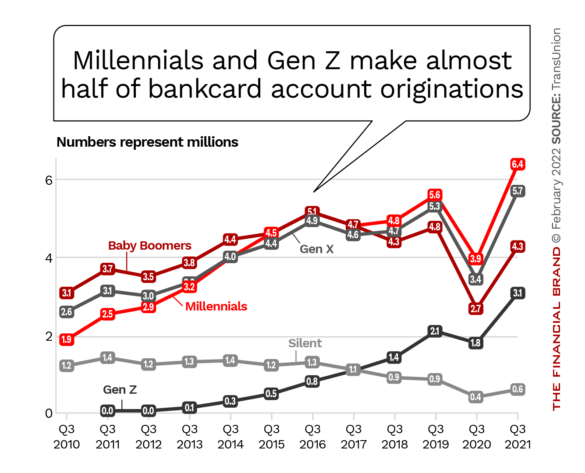

Millennials Discover Plastic:

The generation that supposedly doesn't like credit cards — Millennials — is now the leading source of new card originations, TransUnion reports

Taken with Gen Z, parts of which are coming into financial maturity, the two generations are generating almost half of originations seen now, and this will increase in coming years.

While originations are rising, and are increasing balance growth overall, average new account credit lines remain below pre-pandemic levels, according to TransUnion. The average in the fourth quarter of 2021 was $4,468 versus $5,221 in the final quarter of 2019. The company has found that most credit line increases have come in the super prime category.

Read More: How Banks & Credit Unions Should Prepare for Rising Interest Rates

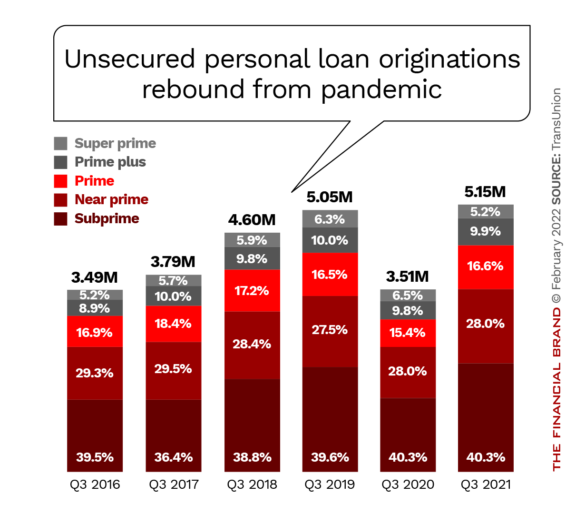

Personal Loans Hit All-Time High As Fintechs Rev Up

Total balances in unsecured personal loans shot up to $167 billion in the fourth quarter of 2021 and the resurgence in this category appears to be continuing strong into 2022. (Balances stood at $145 billion in the fourth quarter of 2020 and at $157 billion in the last quarter of 2019.)

Balances have already passed levels seen in the fourth quarter of 2019, indicating that this category has moved past the impact of the pandemic. Originations in this category grew in the third quarter of 2021, with substantial activity seen in the subprime (over 2 million originations) and near-prime (over 1.4 million originations) credit segments.

Average balances per new borrower are also up, hitting $7,104 in the final quarter of 2021 versus $5,739 a year earlier and $6,211 in the fourth quarter of 2019. The averages smooth out the magnitude of the balance levels seen by credit tier in the fourth quarter of 2021:

- Super prime: $16,600

- Prime plus: $15,200

- Prime: $10,400

- Near-prime: $5,700

- Subprime: $2,800

However, the increase in balances comes substantially from the subprime and near-prime tiers.

While delinquencies are up, they remain below pre-pandemic levels, said Dan Simmons, Director of Financial Institutions Consulting, during the webinar.

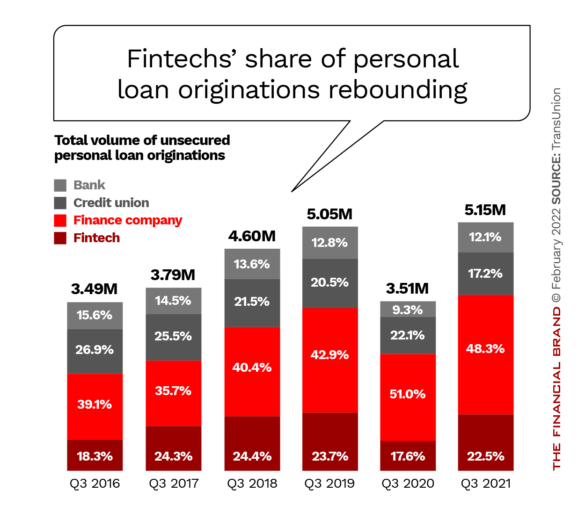

During the 2020 pandemic period capital for many fintechs ebbed and often fintech consumer lenders had to pull back on their lending substantially. TransUnion found that those firms are now having a comeback in originations, beginning in the third quarter of 2021, past the 2020 dip, as their funding returns.

Among the four types of lenders tracked by TransUnion in this research, the highest average balance as of the fourth quarter 2021 was among banks, at $9,200, followed by fintechs, $9,000; credit unions, $6,200; and finance companies, $5,800.

Wise notes that in some ways the fintech unsecured personal lenders are no longer the new disruptive kids on the block, having relinquished that distinction to buy now, pay later lenders.

Read More: BNPL and Crypto Trends Influencing Consumer’s Banking Preferences

Tips for Lenders Moving Deeper into Fresh Risk Tiers

TransUnion’s Wise suggests some steps that lenders can take to address the competitive and credit impact of these trends.

1. Nail your risk management strategy. Understand precisely what your organization’s risk strategy and risk appetite is as below-prime opportunities rise. Be sure you understand the tools being used to evaluate those segments.

“I’m not saying there’s any concern with that lending, just that they should make sure they are keeping an eye on those loans,” says Wise.

2. Don’t become complacent, and keep alert for an increase in delinquencies. “Lenders have to keep an eye on their portfolios,” says Wise, “to make sure that there’s not an unexpected bounceback in delinquencies that could catch them unprepared.”

3. Pay attention to the inflation situation. While the Federal Reserve no longer speaks of inflation being “transitory,” some private economists still predict that inflation will turn out to be a temporary phenomenon. But what if something of a worst-case scenario becomes reality? Wise says the possibility of inflation 9% or higher — it was 7.5% in January 2022 — should have lenders watching for its impact on below-prime borrowers and other consumers.