The future for banks providing embedded finance, which many see as bright, will hinge on more consumers ignoring the banks themselves and concentrating on doing business with their favorite retail brands.

Those institutions that partner with nonbank brands to become the financial engine behind their website and mobile sales — and even at the physical point of sale — will enjoy increasing success, even though anonymously.

The number of traditional institutions and fintechs that will engage in and win with this strategy will increase, but will still be a small part of the industry — possibly only around 300 companies, all told, sharing $25 billion in annual revenue. Financial institutions and the brands that they partner with could enjoy a “flywheel effect” — i.e., the momentum of their arrangements will increase business for both. That is due to the removal of friction by blending purchase and payment, letting consumers focus on what they are buying and using rather than on how to pay for or finance it.

These conclusions come from a study on embedded finance Cornerstone Advisors completed for Bond, “The Embedded Finance Flywheel.” Cornerstone’s Chief Research Officer, Ron Shevlin, notes in the report that in some ways the basic idea of embedded finance isn’t a new concept at all. Indirect auto finance has relied on a structure where the dealer is in the forefront for both sales and finance, and the bank is in the background.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Embedded finance builds on longstanding practices like that. The report defines the term this way: “The integration of financial services into nonfinancial companies’ websites, mobile apps and business processes.”

The aim of the study was to probe consumers to determine the degree of acceptance for embedded finance versus preference for keeping things separated.

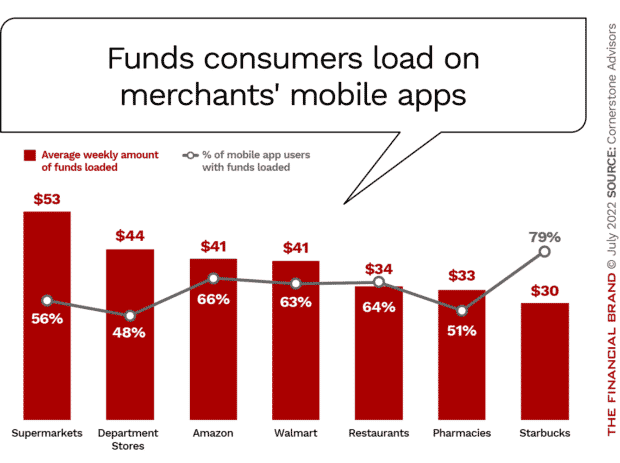

To a degree, use of merchants’ mobile apps for payment, most notably Starbucks’, demonstrates that many consumers are willing to cross the banking-commerce line.

Embedded finance has the potential to expand to many more brands, as larger retailers and other sellers try it out, according to Roy Ng, Co-Founder and CEO at Bond, a provider of embedded finance platforms. Indeed, research by Accenture found that nearly half of companies surveyed planned to launch embedded finance offerings. A key element, says Ng in an interview with The Financial Brand, is trust in the nonbank seller’s brand, since the embedded financial brand is essentially invisible.

The future of embedded finance will depend on moving beyond the basic payment transactions that have become table stakes, according to Ng.

Expanding Scope of Embedded Finance:

You can only squeeze so much out of interchange fees. Moving into embedded credit is one of the ways revenue can be increased.

Read More:

- Does Anyone Really Know What ‘BaaS’ or ‘Embedded Banking’ Is?

- The Potential Impact of Apple’s New ‘Embedded’ BNPL Product on Banks

- Banks Tap Fintech Partners to Address Embedded Banking Threat

- Why KeyBank Believes ‘Embedded Banking’ Is the Future of the Industry

The Potential for Embedded Banking in 6 Product Categories

“The potential value of embedded finance rests on a very important assumption — that consumers will obtain financial products from their favorite brands if the brands offer them,” the report states. “Curiously, despite all the hype around embedded finance, this assumption has gone largely unexamined.”

The first part of the research delved into how deeply committed consumers are with their top brands.

Cornerstone probed people’s favorite brands by company, finding that Amazon is the top retailer for 44% of consumers, with Walmart second at 21% and Target third at 12%. The study also asked about preferences in pharmacies. CVS led there, at 25%, followed by Walgreens at 23%, Walmart 12% and Amazon at 10%.

The study also asked about favorite spending categories and the brands dominating those:

- Technology/electronics: 58%, Samsung, Amazon

- Home improvement: 42%, Lowes, Home Depot, Ace Hardware

- Gaming/consoles: 39%, PlayStation, Nintendo, Xbox

- Fashion/Luxury Goods: 34%, Coach, Chanel, Gucci

- Home fitness: 25%, Fitbit, Peloton

- Automotive: 19%, Ford, Chevy

Going beyond the data, potential for embedded relationships clearly exists for a handful of competitors in each space. Ng points out that different lenders have different risk appetites and varying focuses on consumer credit strata. Over time, multiple financial institutions could become embedded in a retailer’s sales stream, he suggests, with the retailer seamlessly routing a buyer to the appropriate credit provider. This would all happen in the background of the purchase.

A startling finding of the study concerns how frequently consumers interact with brands in the six product areas outlined above.

As the table shows, in three categories, more than half of people sampled interact daily with companies in gaming/consoles, home fitness and technology/electronics. This suggests a potentially huge stream of credit and payments volume for banks and fintechs that can obtain the preferred position of being the brand’s embedded finance provider.

How often consumers engage with companies in favorite categories

Read More: The Future of Banking as a Service and Trends in Embedded Finance

Why Consumers Will Accept Financial Products from Nonbanks

The use of embedded banking is already in motion, so there is some experience to explore. 35% of consumers had already used embedded financial services with technology/electronics sellers, for instance, most typically in the form of a credit card or an extended warranty.

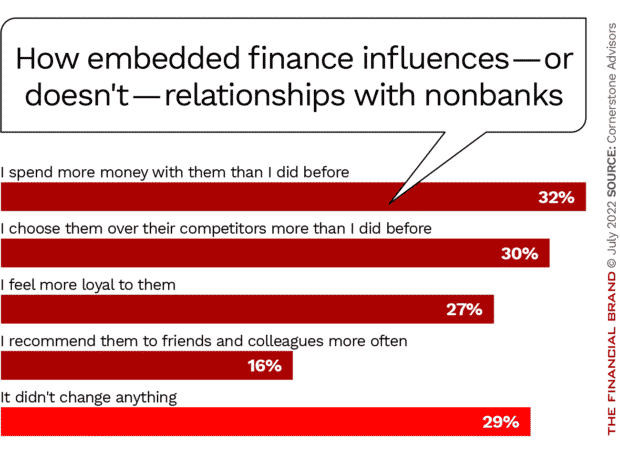

Given that an embedded relationship must pay off both for the nonbank brand and the financial provider, Cornerstone also asked consumers what impact embedded finance had on their relationship with the nonbank brands. This produced a nuanced picture. While nearly a third of people surveyed reported spending more money with sellers who offered embedded finance, for example, an almost identical number of people said that nothing had changed.

Though spending more money with sellers was cited only about a third of the time, focusing only on that ignores other important results seen in the chart. Choosing sellers over competitors also means more sales (and volume for the embedded provider) and increased loyalty and recommendations can also go to the bottom line.

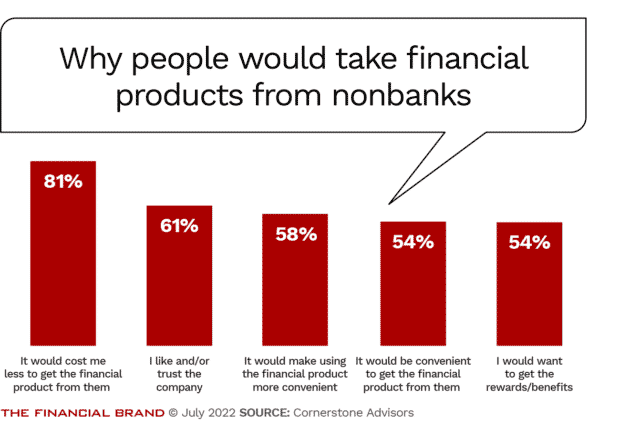

The study then looked at willingness to use financial services provided through nonbank sellers.

The strongest reasoning seen among those who would use financial products came down to price — four out of five assumed that obtaining the financial product from the seller would make it cheaper. It’s possible this is influenced by consumer observation of the way most buy now, pay later programs have worked in the past — the seller is seen as putting the BNPL offer forward on behalf of the provider and there is no interest charge.

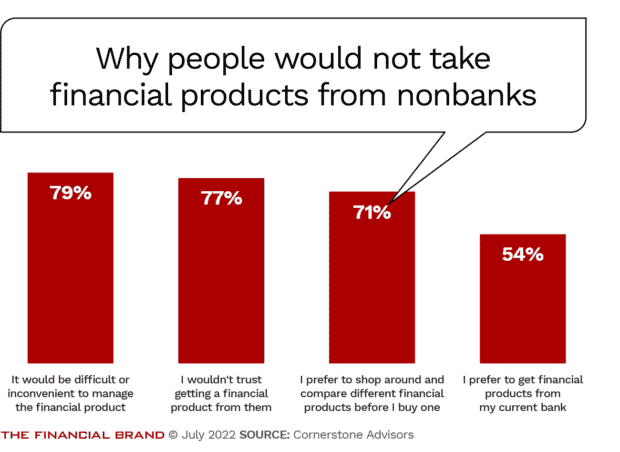

However, hurdles exist in moving forward with the embedded finance model. As seen below, 77% of consumers said they would not trust financial products obtained from a nonbank. It may be that the invisibility of the bank or fintech in the mix may be a handicap with some segments.

Incentives and innovation may help move those needles. The study provides a long list of variations on product themes. Among those that interested people, with the percentage of those indicating attraction:

- A credit card that rewarded players for the purchase of games and for in-game purchases: 75%

- An in-game deposit account (real money) used to buy and sell in-game items and to store real rewards for progress in the game: 74%

- Health insurance with rates pegged to personal fitness habits: 68%

- An investment account integrated into fashion and luxury brand apps, for investing in the brand’s stock, crypto and other assets: 65%

- A savings account that sets aside extra money towards a future auto purchase, beyond current car payments: 52%

- A home equity line of credit built into home improvement stores’ own apps to handle payments for big projects: 49%

Read More: Innovation and Inflation: Two Trends Changing Credit Card Marketing

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Adjustments Financial Institutions Must Make

Ng points out that embedded banking efforts rely on a balancing act between the seller and the financial institution. The nonbank controls the customer experience, but the banking provider controls what that service will be and how flexible it will be. Perceptions are important too. If a person thinks they are using home equity credit from their favorite home center, for example, having a bank or fintech logo suddenly pop up during the process could be a negative, jarring experience.

Making the transition to embedded finance demands some mindset changes, too, for the bank or fintech that is going to fade into the background. The question of “who owns the customer” is a factor when a provider is accustomed to a direct relationship. Ng says it is helpful for banks and credit unions to regard embedded finance as an additional channel for bringing products to prospects, something separate from their traditional channels and not a parallel track.

In addition, technology must be adapted from a direct relationship to an arms’ length approach. There needs to be a big investment to ensure that data is exchanged accurately and in compliant ways, Ng explains.