Banks, credit unions and other home equity lenders have been expecting a lot of growth in this loan category, as rising home prices have been boosting the amount of equity homeowners can tap. However, as rates have increased, potential borrowers are crying uncle, and they have not been drawing on that equity as much as anticipated.

This conclusion comes from research that Black Knight released in early September.

The average rate on 30-year fixed-rate mortgages hit a 20-year high — 7.09% — in mid-August, according to Freddie Mac, one of the federal secondary mortgage market agencies. It rose to 7.23% a week later and fell slightly to 7.18% at the end of August, still at record levels.

Interest Rates Are at the Pain Level

Rising rates have helped propel the average monthly principal and interest payment for homebuyers using a 30-year fixed-rate loan to a record $2,306, according to Black Knight’s Mortgage Monitor Report. This amounts to an increase of 60% over the past two years and the mortgage servicing and research firm predicts that it will go higher before it recedes. More than half of purchase mortgages closed in July have principal and interest totals of over $2,000 and nearly a quarter require payments of over $3,000.

The news gets worse. When rates hit 7.23%, that pushed the monthly principal and interest payment to buy a median-priced home to $2,423, Black Knight says. That is a 91% jump from two years ago. (The calculation assumes a 20% down payment and 30-year fixed-rate mortgage.)

This is part of the drag being seen in the mortgage market, but now it is affecting the state of home equity lending.

Home equity lending, separate from cash-out refinancings, had been in something of a comeback phase after a hiatus. How far things will throttle down remains to be seen as more Americans stay put and need to borrow to make home improvements but now face discouraging prices for home equity loans and lines of credit.

Read more:

- To Capitalize on Home Equity Opportunity, Go Beyond Credit Scores

- How Citizens Bank Became the U.S. Home Equity Leader

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Home Equity Is Up, But Borrowing Against It Has Hit a Turning Point

To put all this another way, it now takes 38.3% of median household income to cover the monthly payment on an average-priced home. This is the least affordable level since 1984.

“Rates aren’t just hampering prospective homebuyers. While tappable equity levels have returned to near-record highs, rising rates are having a clear impact on how — and how much — equity mortgage holders are willing to withdraw from their homes,” says Andy Walden, vice president of enterprise research at Black Knight. “Tappable equity” is not total equity, necessarily. It is defined as the calculated equity available for securing additional credit while maintaining a loan-to-value ratio of 80% or less on the home.

Walden offers some eye-popping figures:

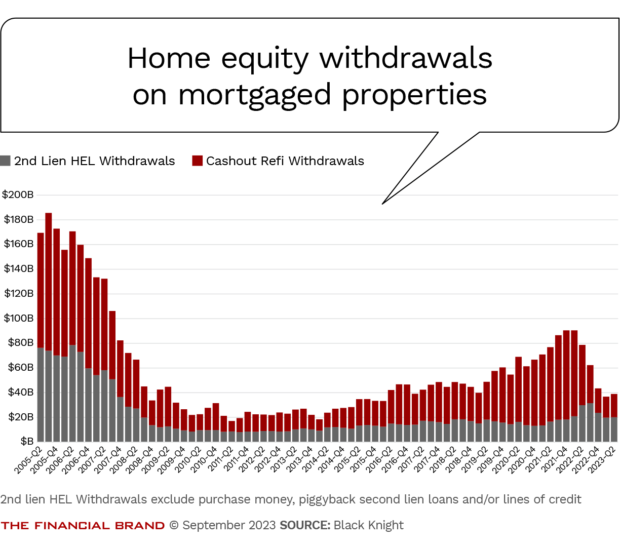

• Homeowners withdrew $39 billion in equity in the second quarter. This includes cash-out refinancing, home equity loans, and home equity lines of credit.

• While that level is up a bit from the $37 billion in equity draws seen in the first quarter, it is only about half of the volume seen in the second quarter of 2022.

• Between 2010 and 2021, homeowners drew on just shy of 1% of their home equity each quarter. But now that has fallen by over half. Black Knight indicates that in the last three quarters the rate of equity draw has dropped to 0.4%.

“Over the last 15 months, there’s been nearly $200 billion less equity withdrawn — and reinjected into the broader economy — than might otherwise have been, due in large part to elevated interest rates.”

— Andy Walden, Black Knight

Dig deeper: Direct and Indirect Loan Payments and Skips: Self Service Automation

HELOC Rates Have Caught Up to Reality

An additional drag specific to home equity lines of credit comes after a rare interlude. Black Knight noted in its report that rates on home equity lines of credit are generally pegged to the prime rate. This benchmark rate rose more slowly, initially, than did 30-year mortgage rates. This made HELOC rates cheaper than cash-out refinancing.

That lag has closed up, and now the average rate on home equity lines of credit has risen above 8.5%, making this type of borrowing less attractive. As a result, HELOC draws in the second quarter of 2023 fell about 30% from the second quarter a year earlier. While HELOCs typically carry floating rates — they function as a credit line — home equity loans tend to have fixed rates.

However, there are lots of moving parts to this. When mortgage rates were low, it could be beneficial for people wanting to tap their equity to do a cash-out refi at primary mortgage rates. Doing so now means giving up lower rates obtained even a few years ago.

“HELOCs are still more attractive than refinancing for those looking to access equity but who don’t want to give up their record-low, first-lien rates locked in during recent years,” Black Knight’s report states.