The pandemic provided a wake-up call to traditional banking organizations, and they have responded. The ongoing Covid event highlighted the inadequacy of existing lending solutions in a world that was unable to transact in a physical environment prompting many institutions to prioritize investments and decisions that had been dormant for years.

The combination of changed consumer expectations and fintech pressure has made it no longer sustainable for a bank or credit union to take days or weeks to take an application, process the application, and disburse funds. Today’s consumer expects simplicity in applying for a loan, immediacy in loan decisioning, and seamless delivery of funds.

And the loan journey doesn’t end when the money is received – a multi-touch digital engagement process is important throughout the customer journey. Across all layers of the journey, automation of back-office operations is required.

Good News:

New research by the Digital Banking Report indicates that many banking organizations are finally making major strides to improve all components of digital lending.

The research shows that more organizations are offering online and mobile lending solutions, that the speed of application has improved, that there are more organizations supporting a ‘save and resume’ functionality, and that universal loan applications are in greater use. A great deal of the rapid improvement of digital lending capabilities can be attributed to the leveraging of third-party partners that have helped provide modern platforms and solutions.

Read More:

- Banking Must Digitally Transform Consumer Lending

- How Financial Institutions Can Fire Up Their Lending Engine

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Move to Digital Lending Jumps Post-Pandemic

Most financial institutions had not changed their basic lending processes in decades. From application to close, most lending platforms had been cumbersome and time-consuming for both the consumer and the financial institution. Even if an institution had created a way for the consumer to apply online or with a digital device, our previous research indicated that most steps and requirements from the past usually still remained, making customer experiences unsatisfactory.

As the pandemic moved almost all financial interactions to digital channels, financial institutions had to expand loan application capabilities beyond branch visits. And for those institutions that allowed customers to apply online or on a mobile device, the process had to be quicker and easier. Many banks and credit unions increased investment in digital lending functionality to support the distribution of billions of dollars in Paycheck Protection Program (PPP) loans early in 2020. This investment assisted in the advancement of digital lending across all credit types.

Pandemic Effect:

The pandemic motivated all financial institutions to increase the availability of online and mobile loan application options.

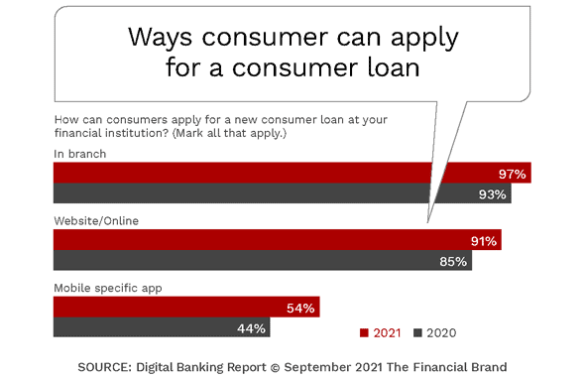

The increase in digital loan application availability over the past two years is evident as more organizations indicate that they can provide both online and mobile options. While the availability of loans through branches has remained close to 100%, online/web applications are now available at 91% of financial institutions. This is an increase from 76% in 2019 and 85% last year.

There has been an equally impressive jump in availability of mobile loan applications across the banking industry as well, with 54% of financial institutions offering mobile loan applications in 2021 compared to only 44% in 2020 and 34% in 2019. The ability to apply for a loan on a mobile phone is significantly more likely at financial institutions with assets greater than $100 billion according to the research. In fact, larger organizations appear to be moving away from online applications and focusing most of their efforts on mobile capabilities.

Of those organizations that answered yes to the ability to process online/website and mobile applications, we inquired as to their ability to support a complete end-to-end application process.

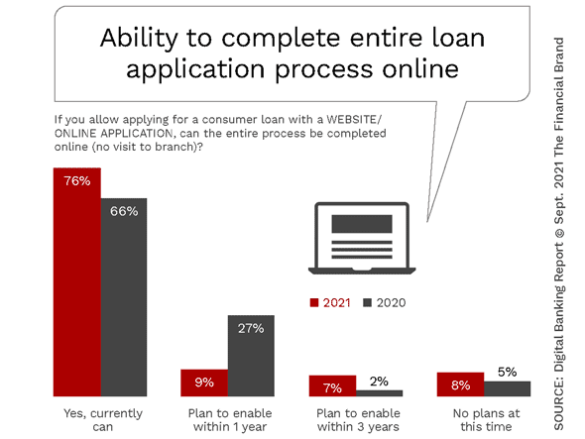

We found that significantly more financial institutions are allowing the consumer to complete their online or mobile application process without requiring a visit to a branch. In 2021, 76% of banks and credit unions that supported an online loan application process did not require a branch visit (compared to 66% in 2020 and 52% in 2019).

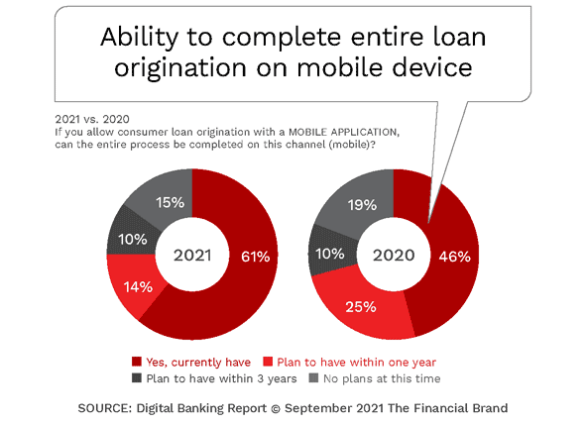

Similarly, 61% of organizations that offered a mobile loan application capability did not require a branch visit (compared to 46% in 2020, 31% in 2019, and 20% in 2018). Another 14% planned to have this capability in the next year compared to 25% last year, reflecting that more organizations are moving to where they want to be.

Financial Institutions Begin to Embrace the ‘Need for Speed’

Even though the number of financial institutions offering digital loan application capabilities had been increasing gradually for years, there never appeared to be a commitment to improving the overall digital experience. In other words, while a consumer could complete a loan application process online or on a mobile app, the experience was not usually intuitive and easy.

Simply offering the ability to apply for loans digitally is no longer enough. The underlying processes, from the data that must be supplied by the consumer, to the decision process and disbursement of funds must be completely rethought.

Consumers want an application process that can be done with a few taps on a computer or swipes on a mobile phone. Entering dozens of fields of data that can be pre-filled by a financial institution is a fast track to application abandonment. Speed and simplicity win the day.

For the first time since we have done extensive research on digital lending, it appears that many traditional financial organizations have embraced the need for digital lending transformation, supporting an application process that can be completed in a few minutes, with almost instant decisioning and availability of funds in less than 24 hours.

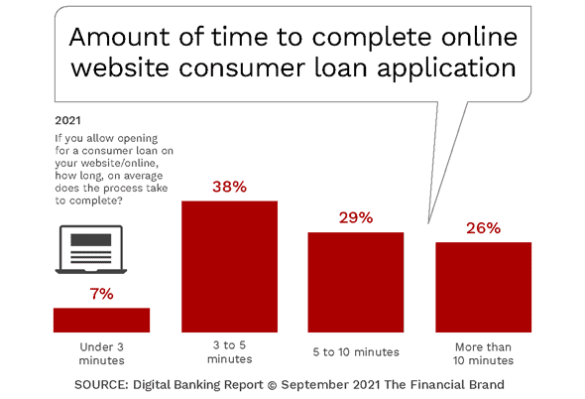

For website/online applications, 44% of the applications took consumers less than five minutes to complete. This is a vast improvement from 2020, when only 15% of organizations claimed to provide consumers this level of efficiency. In addition, only 26% of organizations stated that their online application process took over ten minutes, compared to 38% in 2020 and 42% in 2019.

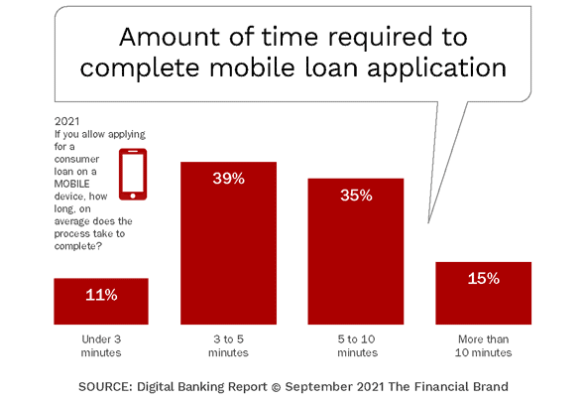

In 2020, when we asked financial institutions about the speed of their mobile application process, we saw the average speed of application get worse from 2019 to 2020. This was explained by the significant increase in mobile functionality offered by traditional banks and credit unions without the requisite focus on speed as the pandemic took hold.

This year, we saw an amazing jump in speed of mobile applications across all sizes of financial institutions, with 50% of organizations stating that consumers could complete a mobile application in less than five minutes. This is vastly better than was evident in 2020, when only 20% of financial institutions offered this level of speed. On the other end of the spectrum, only 15% of organizations admitted that their mobile application took more than ten minutes (compared to 34% in 2020).

Focus on Mobile Consumer:

Half of financial institutions provide a mobile application process that can be completed in 5 minutes or less, compared to only 20% of organizations in 2020.

This trend must continue if traditional financial institutions want to remain competitive with alternative lenders that still exceed these time parameters. As we saw in previous studies, there are still many organizations that said they ‘did not know’ how long a mobile or online application takes at their organization. This illustrates that the time to complete digital applications may not be top of mind at some legacy institutions even now.

Still a Need to Avoid Branch Visits

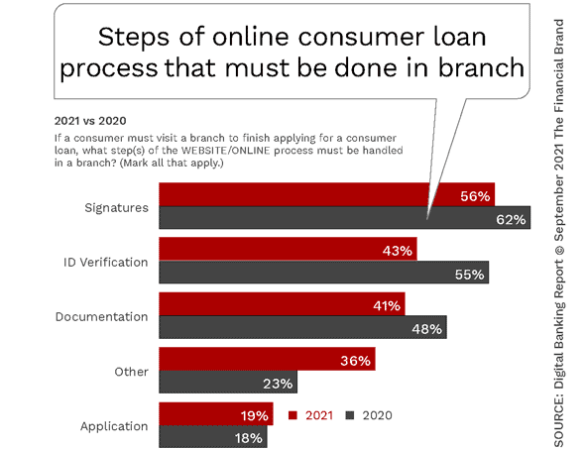

While significantly more traditional financial institutions no longer require a visit to a branch as part of a digital loan process, some still have steps that must be completed in person. The good news is that there are many third-party options in the marketplace that can move these steps to a digital alternative.

As in the past, the top reasons given for requiring a branch visit include signatures on documents (56%), ID verification (43%) and loan documentation (41%). While all of these numbers continued to decrease measurably as they did from 2019 to 2020, the numbers are still too high. As we have stated before, for an increasing percentage of consumers, the requirement to come into a branch for any step of a loan application is both inconvenient and hard to rationalize given the many digital solutions available.

‘Save and Resume’ Functionality Becoming Table Stakes

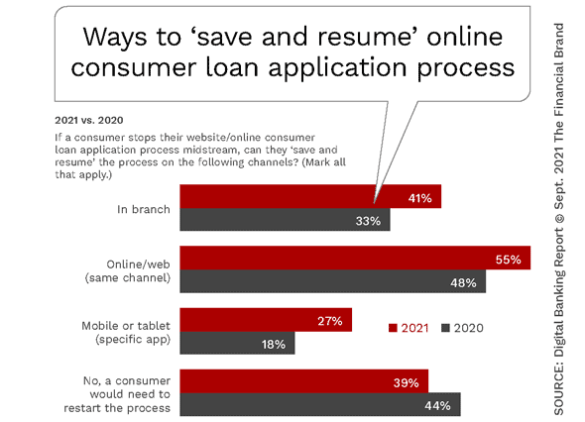

Consumers may want to apply for a loan, but do not have all the information available to complete the process. If they start the process on any channel, they don’t want to restart if more information is needed. Just as importantly, if they begin the process online, they may want to complete the journey on their mobile device — or visa versa. They want the option to ‘save and resume’ the loan application process on the channel of choice.

In the past, we found that many organizations were not able to support the ability for a consumer to stop and restart a loan application… even on the same channel. The ability to ‘save and resume’ was a major performance gap for most financial institutions.

The good news is that, for the first time, more than half of the institutions surveyed (55%) now allow a person to restart an online application on the same channel. While not optimal, we also saw a significant jump in the ability to restart a loan application process in a branch compared to 2020, and even on a mobile device. While this improvement is encouraging, there are still far too many organizations (39%) that make a consumer restart an entire loan application from the beginning if they did not have the needed documentation before they began the process.

While we found that that this functionality was better for loans initiated on a mobile device, this impacted fewer consumers since fewer organizations provided mobile application capability.

Consumers are Demanding Digital Loan Options

The latest “Expectations & Experiences” consumer trends survey from Fiserv, Inc., states that almost two thirds of people who have applied for loans in the past two years now do so either partially or fully online, representing a significant increase from the past. A major portion of this growth is due to increasing usage of smartphones and tablets. According to another study, the digital lending market was valued at $311.06 billion in 2020 and is expected to reach $587.27 billion by 2026, registering a CAGR of approximately 11.9% during the forecast period (2021 – 2026).

Major factors driving the growth of the digital lending is the changing consumer expectation and behavior due to the pandemic and the multiple benefits offered by the digitization of all banking and financial services. The desire for digital loans ranges across all forms of credit, from personal loans to SME finance and home loans according to our research.

Digital Applications Understated:

Despite a continued increase in digital applications reported, these numbers are under-reported due to abandoned digital application processes.

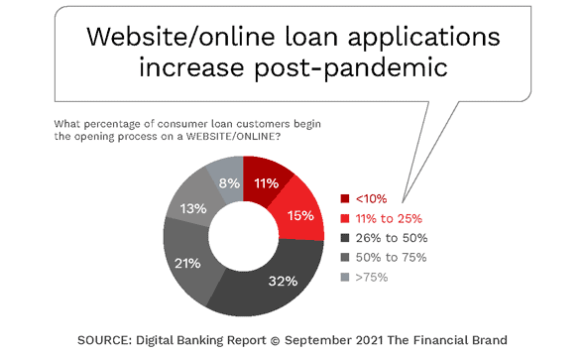

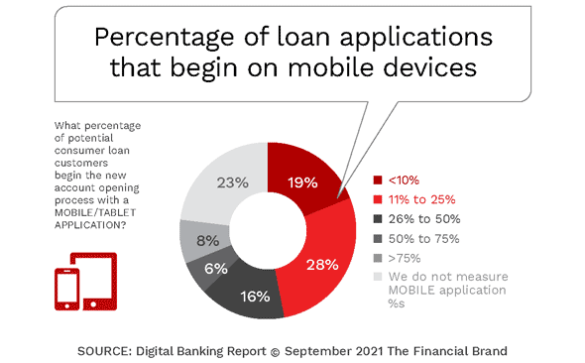

While financial institutions in the past reported that ‘demand is low’ for digital account opening and loan application functionality, the pandemic shined a light on the reality of consumer demand. In 2020, we found that 46% of organizations indicated that less than 25% of applications were started on a website/online app and less than 48% on a mobile app. These numbers dropped to 26% and 47% respectively in 2021. We believe that these numbers continue to be impacted by both a lack of tracking and false reporting from branches that convert digitally initiated applications to branch-based apps.

In other words, last touch attribution results in false reporting. (If the applicant must come into the branch to complete the digital process, the branch takes credit for the loan without any partial digital attribution.) To resolve this issue and get a better reporting of loan initiation, organizations should monitor all applications that begin on a digital channel and match these back to the loans completed in the branch. In other words, what initially appears to be a lack of demand for digital loans is actually a ‘mirage’ caused by the financial institution itself.

According to Research and Markets, the adoption of several technological advancements, such as the proliferation of adoption of smartphones, combined with the impact of the pandemic, has led to an increase in the adoption of digital banking across several end-user verticals. Also, technologies like artificial intelligence, machine learning, and cloud computing have benefited the banks and fintech firms as they can process huge amounts of information about customers. This data and information allow organizations to obtain results about suitable services/solutions that customers want, which has aided, essentially, in developing improved customer experiences.