The concept of digital lending does not simply mean that a consumer can apply for a credit product online or on a mobile device. To be a digital lender requires being able to complete the entire application process digitally, proceeding along the entire borrowing journey – through the disbursement process – without visiting a physical facility. If a potential borrower can’t request credit and receive funds quickly, on the platform they desire, a provider is simply ‘faking digital’.

In this year’s Digital Banking Report research on Digital Lending and Account Opening, sponsored by MeridianLink, we found that 85% of financial institutions allowed consumers to apply for a loan online, with only 44% providing the ability to do the same on a mobile device. The good news is that both of these numbers increased significantly since 2019. The bad news is that only 66% allowed the entire process to be completed online, with only 46% allowing end-to-end completion on a mobile device.

This digital capability lags what is now possible for digital checking account openings. In this year’s research, we found that 72% of organizations now allow consumers to open a checking account end-to-end on a website (up from 61% in 2019) while 46% provide this capability on a mobile device (up from 36% in 2019). While encouraging, these numbers are still insufficient for a person who has now become accustomed to ordering groceries, selecting movies, communicating with dozens of people at once or buying anything imaginable (even a car) with a simple click of a button.

Leading the pack are the large number of digital fintech and big tech providers who have built capabilities from the inside out as opposed to simply replacing paper and legacy processes with digital functionality. Most traditional financial institution digital lending solutions still lack both functionality and speed beyond the basics.

Read More: Digital Lending Requires Speed and Simplicity to Win Battle With Fintechs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Marketplace Changes Drive Demand for Digital Lending

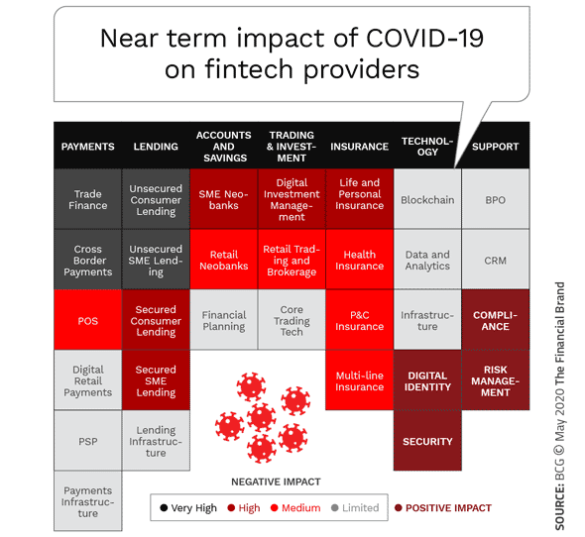

According to Boston Consulting Group, there are four marketplace changes that are driving the move to digital lending. First and foremost, consumer behaviors have changed, mainly due to the experiences offered by big tech firms. This change in behavior has increased exponentially due to COVID-19. There have also been rapid technological changes, from the increased reliance on mobile devices to the ability to conduct entire know your customer (KYC) processes without meeting a person face-to-face.

Thirdly, changes in regulations and compliance around digital engagement have allowed both digital lending and digital account opening processes to be modernized for the benefit of the consumer. Finally, the innovations and simplification of the operating models of fintech providers have driven the entire industry to improve.

When a mortgage can be applied for and closed without a visit to a physical facility or a new deposit account can be opened in less than three minutes on a mobile device, the entire industry takes notice. Evidence of this significant progression of digital engagement is seen throughout this year’s Digital Lending and Account Opening Digital Banking Report.

It should be noted that the introduction of the small business PPP loan program forced many organizations of all sizes to find ways to provide customers with digital lending solutions in a matter of days. This innovation in a crisis mode, while not optimal, served as a lesson that prioritization and focus on the desired result can create solutions that would have taken years without the pressure of crisis.

Digital Lending Expands Marketplace Potential

When consumer data and advanced analytics are combined with revised back-office processes, product innovation, the potential for speed, and significantly lower costs, digital lending can be much more inclusive in nature. Instead of only serving the most credit worthy of consumers or small businesses with a limited number of traditional credit solutions, digital lending can now include segments with less credit history (students, lower income households, gig workers and start-ups) as well as open doors for new credit solutions altogether (POS credit, payday advances, etc.).

From the approval of credit to the monitoring of credit behaviors over the duration of the relationship, data, AI, advanced analytics and digital engagement through chatbots allows for an ongoing assessment of both the ability and willingness to repay credit obligations. This can allow digital lending solutions to be financially viable to a wider audience than ever possible with traditional lending.

Ultimately, the goal is to have the entire consumer journey (both with loans and deposit services) – from application, KYC, decisioning disbursement, collection, reporting, archiving and compliance – fully digitized at scale and at a speed comparable to involved digital engagement in other industries.

Why Pursue Digital Lending?

Beyond the expanded marketplace available with digital lending, there are a number of additional advantages for digital lenders. According to Kaylin Kugler from Capco, “Digital lending gives financial institutions additional data points, such as browser cookies to conduct targeted marketing and direct outreach, enhanced controls of information outflow compared to human interactions, as well as a simpler way of testing to monitor performance and remediate challenges, including A/B testing.” Obviously, these capabilities positively impact the customer experience.

As mentioned earlier, done correctly (changing internal lending processes to reflect digital functionality), digital lending is faster, cheaper, more transparent and ultimately more aligned with engagement from other industries. These impacts are not just for the young, digital generation, but because of the impact of COVID, these solutions are accepted by consumers of all ages.

Even for those consumers who still desire a face-to-face interaction, the processes put in place to facilitate digital lending and account opening will streamline and improve branch-based engagement. In other words, the move to digital functionality can positively impact consumers regardless of the channel desired.

COVID-19 has illustrated that consumers do not need to have branches to open new deposit accounts or apply for loans. As consumers continue to move to digital engagement, the ability to support the initiation of digital relationships is no longer optional. It’s imperative.

Becoming a Digital Lender

Moving from a traditional financial institution to a digital bank is no easy task. Often there may be resistance to change, an inability to accept risks, and the lack of top leadership desire to disrupt traditional norms. It becomes a cultural decision that is tough to make even in times of crisis.

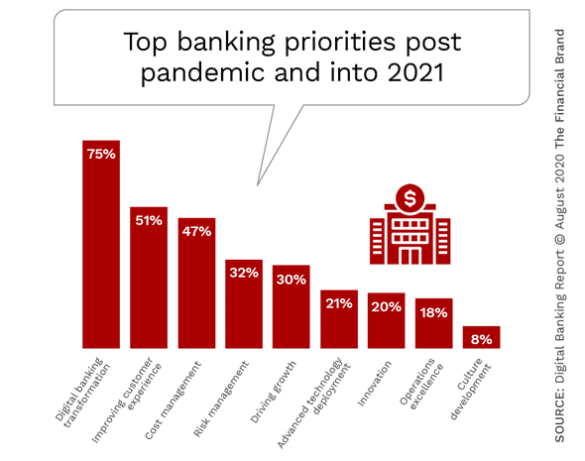

A digital banking transformation must have a strategic foundation that is supported across all levels of the organization. Leaders must align the strategic priorities at a top management level and determine the implications on existing processes and technology – designing the optimal operating model while developing an enhanced customer and operational experience to achieve desired benefits.

Most organizations cite ‘future survival’ as the rationale to make the necessary changes. If they do not adopt digital transformation, opportunities will be lost to fintech startups.

As a lender, you’ll want to make sure consumers have an exceptional digital experience. The potential for process abandonment is higher when a consumer begins a digital process. Digital consumers are inherently impatient and will not tolerate slow processes. Here’s what PwC recommends you do:

- Provide clear guidance on approval criteria. Many firms can see a significant uptick in loan applications and new account opening requests when a digital option is provided. Provide clear guidance as to what is needed to complete the process and how to be successful in the process.

- Be transparent with clear communications. Let customers know the steps you’re taking to make sure that their applications are being handled as quickly as possible. Provide process updates and communicate about missing pieces if needed.

- Don’t be saddled by tradition. Develop new processes, training materials and communications about how new policies will be handled consistently for all customers. Becoming digital is not replicating old processes online or on a phone. Rebuild for digital engagement.

- Offer alternative channel options. Don’t require consumers to go into branches unless there is not another option. In addition, allow consumers to restart processes on a channel different than where they started without needing to start the process over.

- Be prepared to handle surprises. Develop policies to address these unforeseen situations and then stick with it.

Customer Experience Drives Differentiation

To differentiate in the future, financial institutions will need to differentiate their digital lending and account opening capabilities by providing an improved customer experience. The key will be to reduce the time it takes to complete a process, give the consumer power to choose the channel(s) they want to use and to design the application for the best user experience.

Rate will become less and less of a differentiator if institutions can leverage data and analytics to customize solutions for each consumer at the time of need (or before). This will require the ability to proactively advise consumers of times when using credit is the best financial decision.

The focus will move from a selling mentality after the consumer asks for credit to offering credit alternatives that fit a need the consumer may not even realize they have. By doing so, trust is built as well as loyalty.

COVID-19 resulted in the introduction of newer, faster, and easy-to-use digital tools and products to the marketplace. Almost immediately, consumers changed the way they transacted, engaged, communicated and made purchases. This resulted in expectations that increased as comfort levels went up.

With bank and credit union branches closed, the bar for digital services and products rose to a level much higher than it was just a few short months ago. Going forward, only those organizations that can provide credit quickly and easily will be able to grow portfolios efficiently.