Growth-hungry bank and credit unions are scratching and clawing for loan demand to put the cash on their balance sheets to work. One possible source of new credit may be right under their roofs: people who have already borrowed from them who have exited from the various hardship programs set up in 2020.

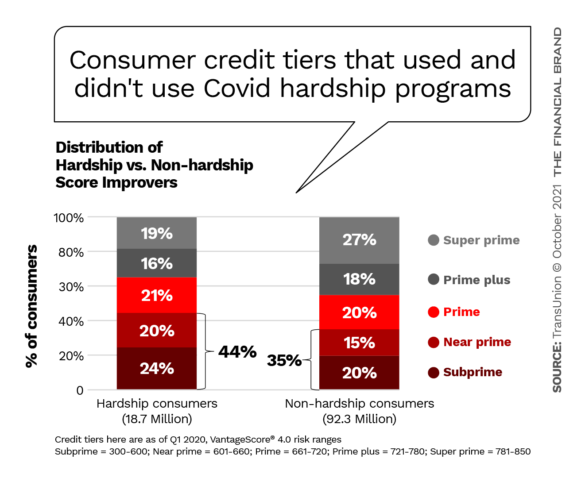

Preliminary research by TransUnion of credit patterns during 2020 indicates that 58% of the 18.7 million U.S. consumers who entered a financial hardship program in 2020 saw an improvement in their credit scores. (This excludes the student loan relief program.) That percentage exceeds what TransUnion saw in the same period for consumer borrowers who did not enter hardship programs. 54% of those people saw their credit scores rise.

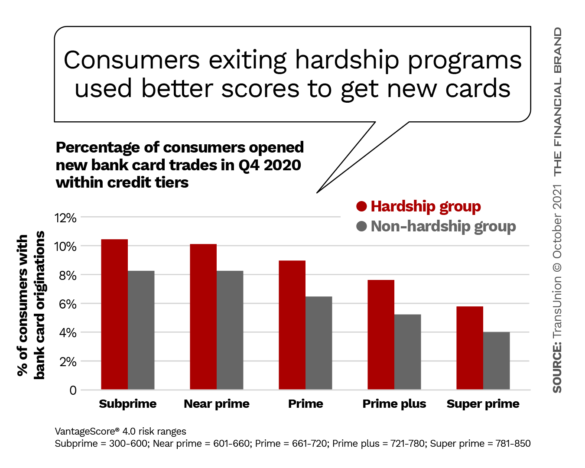

Further, the research indicates that in the latter part of 2020 those consumers who experienced improvement in their scores while in hardship programs were more likely to seek and receive new bank cards. This was seen in all credit risk tiers, from subprime to super prime.

Overall in 2020, despite all the shutdowns and job losses, “15% more consumers received increases in their scores than decreases,” compared to 2019, according to Paul Siegfried, Senior Vice President and Card and Banking Business Lead.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Understanding the 2020 Consumer Credit Picture

Siegfried, a bank consumer credit executive for about 24 years prior to joining the credit bureau, says 2020 will likely have an asterisk next to it in the record books, much as happens in sports in certain abnormal years.

2020 saw the intersection of many unusual factors. For example, says Siegfried, hardship programs gave borrowers heading for potential credit trouble a respite and gave others an insurance policy when they didn’t have trouble. During the height of the 2020 Covid troubles, credit card balances fell dramatically.

“During that time of low mobility people were worried about toilet paper and food,” says Siegfried. “They were not worried about spending on travel or other non-essential things.”

On top of those factors, unprecedented financial relief was provided in the form of multiple stimulus payments and expanded unemployment benefits. Siegfried says lack of spending and high household liquidity contributed to score increases. In addition, some consumers who entered the programs took advantage of liquidity and paid down debt.

In the wake of this period, ending in September 2020, many consumers applied for and received additional credit cards.]

“What we found was that those who exited hardship status are actually more credit active than those who remained in hardship. What we mean by credit active is that they are more likely to have one additional form of credit after exiting.”

— Paul Siegfried, TransUnion

The company’s research found that those who exited the programs who were not prime borrowers had a lower delinquency rate than those non-prime borrowers who remained in hardship status.

What Should Lenders Do with Hardship Status Applicants?

Siegfried says the lesson for lenders in this highly unusual period is to analyze consumers’ behavior carefully to see how they behaved while in hardship status and what happened to their scores and their performance after they exited the program.

The only period Siegfried knows of in recent times where consumer credit behavior was influenced so much by larger events not including economic crises like the Great Recession was during the aftermath of Hurricane Katrina in New Orleans and environs in 2005.

“Katrina was different from other hurricanes because you had entire areas of land that were vacated for very long periods of time,” says Siegfried. “Some people relocated for months, even years. I was a lender at the time and we didn’t know how to get statements to many of our customers. We didn’t know if they were there or not.”

Siegfried thinks the hardship programs, impacting multiple types of credit nationwide, left lenders with key lessons.

“I think the industry figured out through these adverse events that when you and the consumer work together proactively, you can produce a different result,” says Siegfried.

Siegfried believes it is too early to say if 2020 efforts to ease the crisis for borrowers should be an industry blueprint going forward. But he says that by late 2022 things should be clearer, and it’s already apparent that the response helped avoid the tripling of charge-offs that could have been seen.