Economists at Wells Fargo and JPMorgan say the U.S. economy can avoid recession in 2024, but they’re not ready to call it definitively either way.

“Cracks are beginning to appear” that may cause a slower-moving economy next year that’s more susceptible to “any kind of shock,” they say.

But then again, data on Americans’ wealth suggests the country has economic resiliency that can sustain it during monetary tightening. More Americans than ever before are mortgage-free – leaving them large amounts of disposable income – and still more are “equity rich.” To top it off, Baby Boomers and the Silent Generation will pass on trillions in wealth each year until 2045.

With consumer consumption driving nearly 70% of U.S. gross domestic product, financially secure Americans is good news for economics in 2024. Let’s look at the four charts that suggest that economic strength.

Mortgage-Free Homeownership

For single-family, condos, and townhomes, 61% are mortgaged. The other 39% are owned free and clear of a mortgage, according to analysis by The Financial Brand of December 2023 data published by ATTOM — a residential real estate data aggregator. And, according to reporting from Bloomberg, the current ratio of mortgage-less homes is a record.

Monetary tightening has removed cash from consumers’ balance sheets, yet Americans continue to pay for homes in full. In fact, they’ve added more mortgage-free homes every quarter since rates began rising last year.

It may feel like distant history now, but all-cash home purchases made up 36.1% of home sales in 2022 — a 10-year record at the time. We don’t have the annualized ratio of all-cash sales for 2023 yet, but they made up 36.6% of home sales this past quarter. And the ratio is still growing year over year.

The ratio of all-cash home buyers grew in 2023

| Q3 2022 | Q2 2023 | Q3 2023 | |

| Ratio of Cash Sales | 35.2% | 36.4% | 36.6% |

| Increase YoY | 4% |

But are those all-cash buyers American consumers, or are they institutional investors? The latter purchased nearly 6% of homes sold in third quarter, according to ATTOM, down 22% year over year. Investors also make up just 2% of the overall single-family rental market, according to the National Rental Home Council, which adds that single-family rental home companies own approximately 0.19% of the residential real estate in the United States.

Institutional investor sales share

| Q3 2022 | Q2 2023 | Q3 2023 | |

| Institutional Investor Share of Home Sales | 7.6% | 6.2% | 5.9% |

| Increase YoY | -22% |

Owning a home free and clear provides a lot of wealth, but it also provides a lot of expendable income. You don’t need to make a mortgage payment. A job loss — while a setback — would likely not risk their homeownership. Suppose a mortgage-free homeowner loses a job and is of retirement age. In that case, they may continue spending as much as before because they have Social Security, pension payments, or investment income.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Equity-Rich Homeowners

Over 47.4% of homeowners who used a mortgage to finance their home are now “equity-rich,” according to ATTOM, meaning they have 50% or more equity in their homes relative to their mortgage balance.

And that’s not all. Another 23% of mortgage borrowers have 50% or less equity, according to analysis by The Financial Brand.

Read more:

- Proposed Capital Rules Could Crimp Credit Card & Mortgage Lending

- Timely Advice Beats a Rate-Only Mortgage Lending Strategy

Homeowners possess substantial equity in their homes, but it has softened some. The ratio of equity-rich homes was down in third quarter, but home price declines don’t explain the drop in equity, ATTOM says. Prices were down early in the year but rebounded as the months progressed in 2023.

Rob Barber, chief executive officer for ATTOM, suggested the decline in equity was caused by homeowners borrowing against their rising wealth “as millions of households kept benefitting from the nation’s extended runup in home values.”

Home equity down slightly

| Q3 2022 | Q2 2023 | Q3 2023 | |

| Ratio of Equity Rich | 48.5% | 49.2% | 47.4% |

| Increase YoY | -2.2% |

Wealth Transfer Underway

Baby Boomers and the Silent Generation will pass on some $84 trillion in wealth by 2045, according to a report from Cerulli. Of that, $72.6 trillion (85.7%) will be transferred to heirs, “with trillions of dollars set to be in motion on an annual basis,” says Asher Cheses, a director at Cerulli.

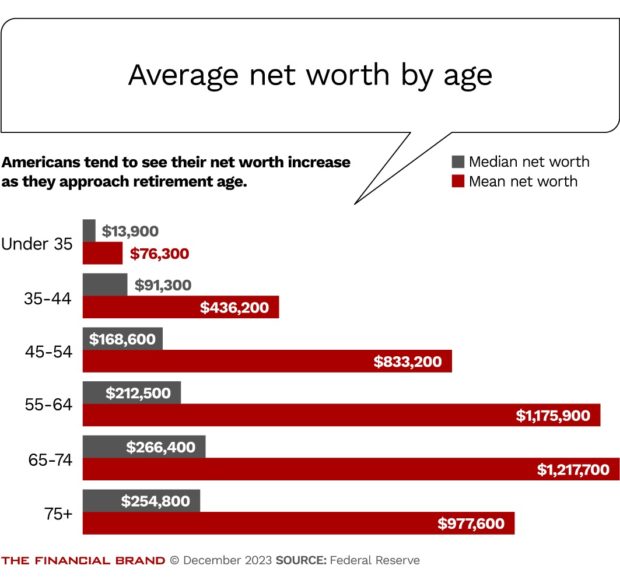

The oldest members of the Baby Boomers are now in their mid-70s. The youngest members are near their retirement years. Their average wealth is between $970,000 and $1.2 million, according to the Federal Reserve’s Survey of Consumer Finances.

Data on mortgage-free borrowers among Millennials suggests that a wealth transfer has already begun. Nearly 16% of Millennials are already free of a mortgage payment, according to a recent report from Forbes.

But where did the cash come from to pay off the house early? Most Millennials — who are between 27 and 42 years old as of 2023 – need more time before they can clear a 30-year mortgage. Most have student loan debt — typically a more expensive rate than a mortgage — which borrowers often target first for early repayment.

Learn more about how student loans will impact banking.

While Fed policy pulls liquidity out of the economy, many Americans have no mortgage, others aren’t even close to upside down on their home, and they could sell – taking equity out in the transaction while also repaying their lender. Parents and grandparents also have massive wealth to transfer to children and grandchildren.

The point here is not that the wealth of Americans will derail the Fed’s plans, but that it may buoy the economy even while higher rates cause tightening. Americans’ wealth and the current demographic landscape may make right now a fortuitous time to fight inflation.