Optimistic? Pessimistic? Research shows consumers are very conflicted in how they feel about the economy, so much so that it is hard to reduce their outlook to one simple sentiment.

Some of the mixed feelings may be skewed by the fact that Millennials and Generation Z dominate the workforce. And some of it may be the result of an economic environment that younger adults have never experienced before.

A consumer pulse study by TransUnion, fielded from April 25 to May 9, found that three out of four consumers — 75% of the 3,000 adults surveyed — believe that the U.S. will be in a recession by yearend. And 44% of the sample believe that the economy is already in a recession or will be before the end of June.

In spite of these pessimistic expectations, three out of five consumers — 57% — are optimistic about their own household’s finances for the next 12 months. That’s the highest level of such optimism seen in TransUnion’s quarterly pulse study since the last quarter of 2021.

Nearly a third of consumers say they intend to seek additional credit in the year ahead.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

What’s Muddying Consumers’ Economic Views? Inflation, For One

Inflation is partly to blame for the conflicting feelings, according to TransUnion. Nearly half of the respondents — 46% — said that inflation is eroding their purchasing power from the gas pump to the grocery store.

While the inflation rate has been easing, historically high inflation continues to be a factor. (In mid-June, the Federal Reserve held rates steady but made it clear the hikes would resume if inflation failed to cool further.)

“We are living in unchartered territory from a consumer credit perspective. The combination of rising interest rates and elevated inflation, while not uncommon from a historical perspective, is an unfamiliar experience for many consumers, especially those in the Gen Z and Millennial generations,” says Charlie Wise, a senior vice president and head of global research and consulting at TransUnion.

Some consumers have a sense of being in a “personal recession,” which influences their view of the economy as a whole, he says.

At the same time, low unemployment buoys optimism on the personal front, especially for the younger generations. While 57% of the survey respondents overall are optimistic about their own finances, there is a big divide between younger and older consumers. Among Gen Z, 73% are optimistic and, for Millennials, it’s 69%. On the other hand, just half of Gen Xers (51%) and even fewer Baby Boomers (41%) are optimistic.

Wise says different employment and salary situations account for much of the disparity.

“The job market’s been quite strong,” he says, “but a lot of the strength has been skewed to lower-income jobs, the lower end of the pay scale. Many younger consumers have seen a lot more of that positive job mobility and opportunity over the past couple of years.” Many also expect that they will be making more as employers bid up market wages to attract employees, he adds.

In contrast to the pessimism seen after the financial crisis, “you have almost the opposite now, with consumers coming out of school with multiple job offers. If they don’t like the job they have, they can walk across the street and get a raise. And they’re becoming accustomed to getting raises every year, even every sixth months,” Wise says.

Optimism Hinges on Expectation of Pay Hikes:

Among the generations, 68% of Millennials and 66% of Gen Zers expect their incomes to rise over the next year. By contrast, 46% of Gen Xers expect their incomes to rise and 27% of Boomers expect theirs to increase.

Even the economic dislocation of the pandemic was over relatively quickly, especially given government relief efforts. Wise thinks this has left younger consumers with the impression of permanent resilience — that the economy will always bounce back quickly.

Demand for Consumer Loans, Credit Cards and BNPL to Rise

Consumer spending, absent government support and stimulus, relies on a “three-legged stool.” One leg is income, which many perceive as shrinking because of inflation, absent getting a raise. Another leg is savings. Wise says the incremental savings of the pandemic period suggests there’s still $600 billion “floating around out there,” but adds that it seems to be in the hands of people wealthy enough to keep it socked away.

“A lot of the struggling households have long since burned through their excess savings,” he says.

This leaves the final leg of the stool, consumer credit. “Many consumers have been turning to credit to help them make ends meet in this more difficult, inflationary time,” says Wise.

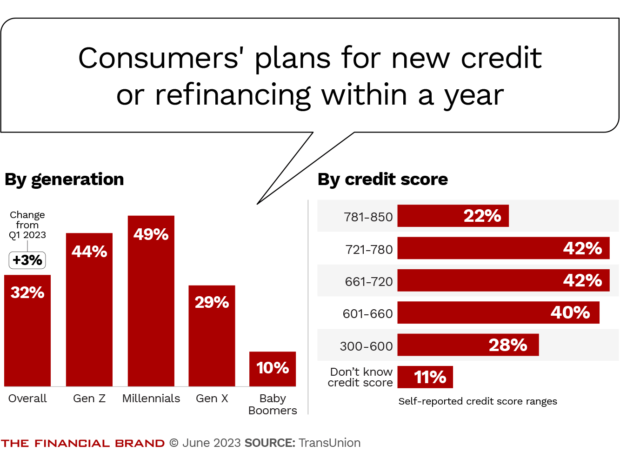

The pulse study found that almost a third — 32% — of the survey respondents plan to apply for new credit or to refinance existing credit. This is three percentage points higher than seen in TransUnion’s first quarter 2023 study and six percentage points higher than in the final quarter of 2022.

The appetite for additional credit is strongest in the most optimistic groups, Millennials and Gen Z, as illustrated in the chart above.

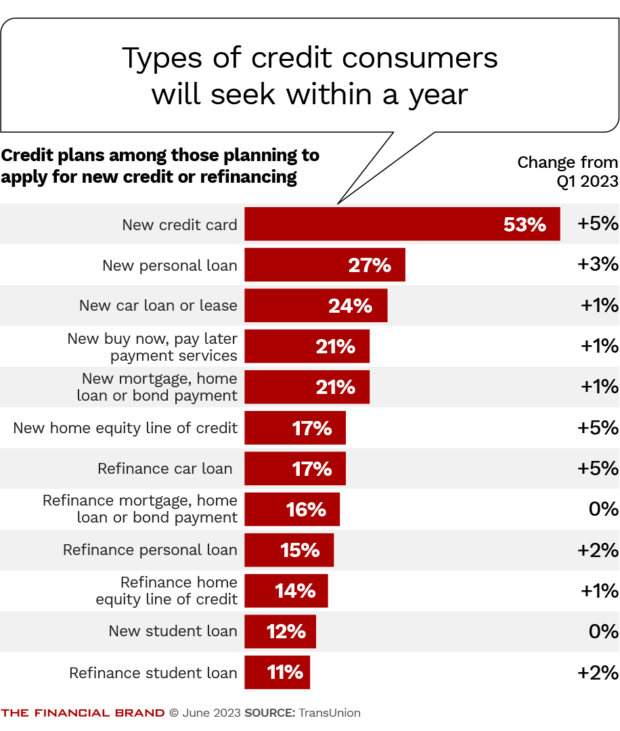

The greatest demand is for credit cards, followed by personal loans, as shown in the chart below. Interestingly, buy now, pay later plans also are in demand.

A point to watch: 31% of respondents say they expect to be unable to pay a current bill or loan in full. This doesn’t mean they are going to default, Wise emphasizes, but that they will likely need to use a form of credit to cover at least part of the payment. And that’s partly what credit is for, he says.

Read more: 4 Tips for Building a Strong Personal Loan Program

Economic Outlook Similar for Small Business Owners

TransUnion’s findings align with a separate survey that the National Federation of Independent Businesses conducted in mid-April. In that survey of 669 small business owners across many industries, including retail, professional services and construction, 78% said they believe that the U.S. is either already in a recession or will be by yearend.

But like consumers in the TransUnion survey, the small business owners have conflicting feelings. They are largely upbeat about the financial state of their business and the local economy, in sharp contrast to their view of the national economy.

Most said they view their local economy as “okay” (48%) or “good” (33%). Only 13% said it is “bad,” and 5% consider theirs to be “excellent.”

The majority also had a rosy assessment of how well their business is doing: 44% said it is “good,” 30% “excellent,” and 22% “okay.” A mere 4% said “bad.”

The small business survey did not ask about plans for future borrowing, but did assess current borrowing, as detailed in “How Small Business Owners Size Up Their Banking Relationships and the Economy.”