The use of the term “Zillennial” has been gaining momentum as a relatively new generational identifier. Zillennials are considered a micro-demographic group that straddles Millennials and Generation Z, pulling from both of those groups.

Zillennials are those born approximately between the early 1990s (younger Millennials) and the early 2000s (older Gen Zers), a cohort that sociologists estimate at about 30 million people. The label, a combination of “Millennials” and “Gen Z,” came about because of the shared traits and unique experiences that span these two generations.

Marketers in general are eager to understand this group better, especially given that more than half of Zillennials are working full time (a PYMNTS.com study puts the figure at 54%).

For Logica’s study on the future of money, we surveyed 1,000 U.S. adults in April 2023. We augmented this with 200 older Gen Zers ages 16 through 25, most of whom fit into the Zillennial segment.

The study offers valuable insights for banks, credit unions and other financial institutions, both to help with better serving the financial needs of Zillennial customers and to inform efforts to attract and retain Zillennial employees.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

What Zillennials Expect at Work

As with any examination of a generational approach to finances, it is important to look at how this cohort works and earns their money. Zillennials are unique in what they are looking for from their jobs.

They share Gen Z sentiments toward work in some ways. For example, they prefer and expect remote or hybrid work; value an ethnically and racially diverse workforce with a company that puts a high priority on diversity, equity and inclusion, or DEI, efforts; seek a workplace that supports their mental health; and look for employers with social consciousness.

But even though they are broadly aligned with Gen Z on these preferences, Zillennials also have perspectives of their own. They are notoriously frugal, as they watched their parents struggle through the Great Recession in the wake of the banking crisis that hit in 2007. They were also deeply affected by the pandemic, according to a MetLife study.

These experiences diminished their employer loyalty, compared with their Millennial and Gen Z counterparts. Zillennials are not only constantly looking for a work environment that fits their personal ethos, but they are also looking for the best financial package. Our study found that 56% of Zillennials say they are open to switching jobs, with higher income and better financial benefits as their top motivators.

So how do banks, credit unions and other employers meet these demands and optimize employee satisfaction and retention? By understanding and embracing the unique qualities of Zillennials.

Employers should not only take action on environmental, ethical and DEI issues, they should be more proactive about providing financial education to appeal to this generation. In our study, 87% of Zillennials said they consider employer-provided programs important in helping to manage their finances.

See: How to Define the Generations: The Ultimate Guide for Marketers

Zillennials Crave Money Management Help More So Than Others Do

So what help are Zillennial consumers looking for in terms of money management?

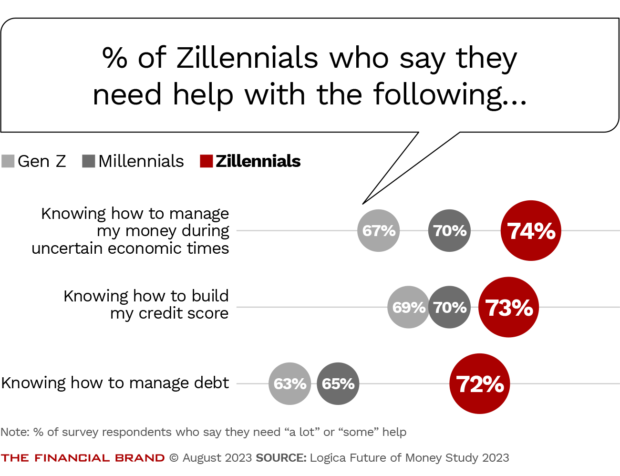

Our study suggests they require more assistance than either the Millennials or Gen Zers. The Zillennials say the need support in areas such as navigating financial challenges during uncertain economic periods (74%), building a strong credit score (73%), and effectively managing debt (72%).

As shown in the chart below, a smaller share of the other generational groups indicate that they need such support.

Zillennials will seek guidance from diverse sources to handle their finances. Consequently, financial institutions should be prepared to engage with them on their preferred platforms and channels — including digital.

The fact that Zillennials are still learning how to effectively manage their finances has implications both for meeting their needs as customers and for attracting and retaining them as employees.

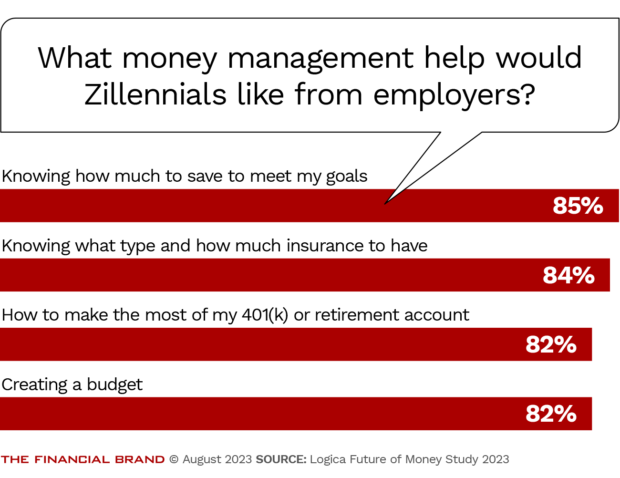

Be ready to help Zillennials with their top priorities of “knowing how much to save to meet goals” (85%) and “knowing what type and how much insurance to have” (84%). This generation is already interested in retirement as well, with 82% looking to learn more about how to make the most of their 401(k) or other retirement accounts.

All of these topics align well with the services financial institutions already provide, but be sure to consider outreach to employees rather than just consumers in general.

Read more:

- Reality Check: Is the Average Consumer’s Debt Actually Shrinking?

- Gen Z: The Answer to the Struggle of Acquiring New Accountholders

Zillennials Have a ‘Savings Mindset,’ and Privacy and Security Matters

Both the Great Recession of 2008 and the coronavirus pandemic have left enduring imprints on Millennials, and the same is true of Zillennials. These events contributed to a “savings mindset” — which one Zillennial respondent in our study says comes from her parents.

“Growing up, my parents instilled in me, ‘Make sure you have that [savings] account that you kind of don’t touch, let it build interest. … We need our rainy-day fund, because you never know when we are going to need this.’ So that’s always been important to me, make sure we have that savings account.”

— Zillennial respondent in the Logica Future of Money study

The study found that 50% of Zillennials say they are saving more right now due to market volatility and 57% plan to save more in the next 12 months. It also found that 32% say they are taking on less debt and 47% plan to take on less debt in the next 12 months.

On this front, Zillennials present a significant opportunity for financial institutions to offer savings guidance, especially by relating it to overall financial health and security. They tend to want tailored advice in this area.

Financial institutions also should prioritize offering attractive, easy-to-understand savings products to this market segment.

Zillennials are beginning to focus on account security as well. Two of their top priorities when it comes to choosing banking accounts are “information and money are protected against fraud” and “data never shared with outside parties.”

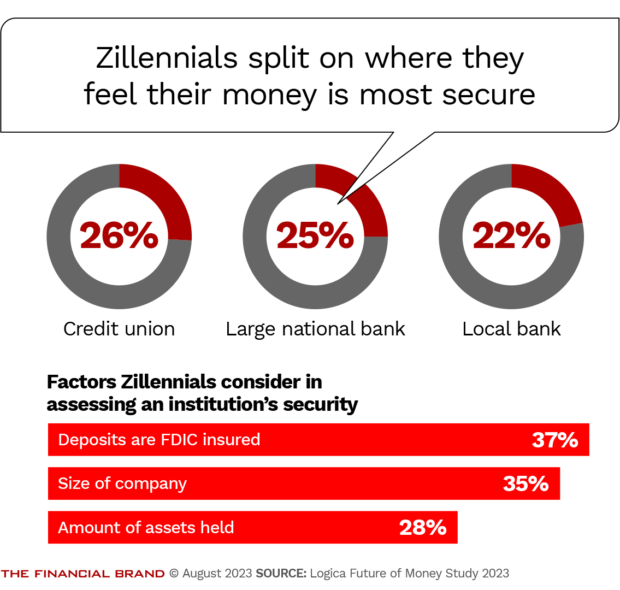

Logica’s study found this cohort to be split on where they feel their money is most secure: 26% said credit unions; 25%, large national banks; and 22%, local banks. Asked about the factors contributing to their perception of security, they most often cited the following three things: deposits being covered by insurance from the Federal Deposit Insurance Corp., the size of the company and the amount of assets held by the company.

Logica’s study found this cohort to be split on where they feel their money is most secure: 26% said credit unions; 25%, large national banks; and 22%, local banks. Asked about the factors contributing to their perception of security, they most often cited the following three things: deposits being covered by insurance from the Federal Deposit Insurance Corp., the size of the company and the amount of assets held by the company.

See all of our latest coverage of Gen Z trends in banking.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Use of Tech for Managing Finances, Including ChatGPT and Other AI

Technology usage serves as a defining characteristic for identifying different generations, and Zillennials came of age in a society profoundly shaped by tech advances, social media and digital interconnectedness. They “straddle the generations of Millennials, who are considered digital pioneers, and Gen Z, who are considered digital natives who never knew life before screens,” says a CNN article describing this micro-generation.

Zillennials are commonly recognized as adaptable and at ease with using digital platforms and devices. This has a major impact on how they manage their money.

Our study found that most Zillennials feel comfortable using generative artificial intelligence platforms like ChatGPT to get recommendations on managing their finances. In fact, 64% of Zillennials expressed their willingness to use or consider using an AI-based tool for receiving financial advice. And they are starting to use it for making decisions.

“I said [to ChatGPT] ‘show me some good stocks to invest in now.’ And it gives you a list within seconds. It’s amazing. You can even search ‘show me the best financial institutions to invest in or enroll in.'”

— Zillennial respondent in the Logica Future of Money study

The Zillennial survey respondents say they expect technology to consider their complete financial situation to offer recommendations on products and services like retirement savings, homeownership, funding their children’s education and insurance options. They are seeking personalized solutions tailored to their specific needs.

Financial institutions must adapt to this changing landscape by harnessing the power of new technologies for content optimization. Given that Zillennials are accustomed to relying on search engines for all their queries, banking executives need to understand how to utilize emerging technologies, like ChatGPT, as a potential replacement for traditional search methods. This adaptation will enable financial institutions to better cater to the preferences of the Zillennial generation.

Read more:

- Ally Taking ChatGPT Slow, But Could Be Using It By Yearend

- Gen Z Takes Money Seriously and Will Leave Banks That Don’t Deliver

Talking with Zillennials About Money Requires a Digital Strategy

Zillennials primarily look to family and friends for financial advice, according to our study, and this also includes those in their online social networks. They might look to professional advisors and financial institutions for advice as well, but to a smaller degree. So leveraging their social networks and channels will be key.

“As a Zillennial, one of the ways I am most similar to Gen Z is my preference for short-form content … TikTok, YouTube shorts, Instagram reels. The key benefit is that it is quick. … It can be really useful for financial education. If financial companies were trying to reach Zillennials like me … stick to digital platforms with short-form content.”

— Zillennial comment during a Logica Money Conversations webinar

Zillennials want communication about financial products and services to come to them digitally and, in many cases, specifically through social media. Financial institutions using digital options for providing educational resources regarding the basics of savings and investment would be valued.

Understanding what forces have shaped Zillennials, and the motivations behind their behavior, will be key to finding success in collaborating with them on their financial lives.

About the author:

Lilah Raynor is the founder and chief executive officer of Logica Research.