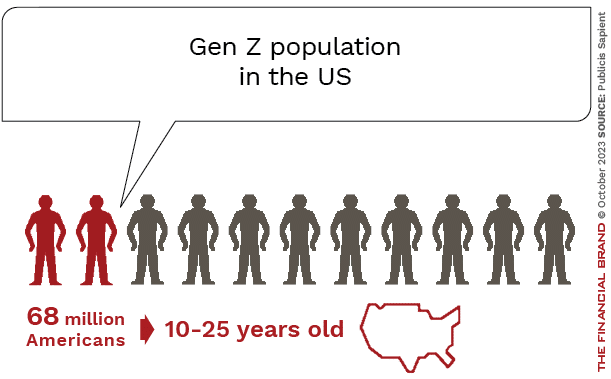

The banking industry is facing a pivotal generational shift. Gen Z, born between 1997 and 2012, now makes up a sizable portion of the U.S. population. With their unique behaviors, values and tech fluency, this cohort is set to reshape financial services.

Insider Intelligence reports the projection that at least 4 million Gen Z consumers will open accounts annually through 2026. By 2023, there will be 33.7 million Gen Z mobile banking users in the U.S. Their economic clout is undisputed, with $360 billion in disposable income in 2021 alone.

To capture this demographic, banks and credit unions must adapt their products, branding, marketing and value alignment accordingly. “You have to have a test-and-learn mindset,” Brendan Coughlin, a vice chairman at Citizens Bank, said in a recent interview on the Banking Transformed podcast. “You’ve got to be agile, and you’ve got to be fast moving.”

Gen Z exhibits financial behavior that is distinct from previous generations. The average Gen Zer saves $857 per month – far surpassing millennials’ $294 in monthly savings, according to Publicis Sapient research.

Coughlin said that many Gen Zers feel anxious about their finances. Banks should leverage digital tools to increase transparency, advice and money management capabilities. “They give us tons of data and information. How do we then translate that back to them in a way that makes them live their life in a significantly different way?” he asked.

Read more: BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

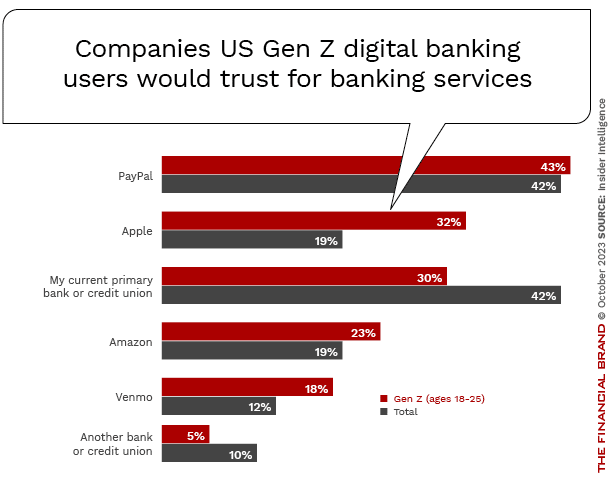

Competing with Big Tech and Fintechs

Gen Zers have grown up with the convenience and personalization of Big Tech. Their high trust in Apple as a financial services provider hints at a competitive threat, according to Insider Intelligence. Major payment apps like PayPal and Cash App are also encroaching on traditional banking territory with debit cards, savings and investing features. Even Amazon and Venmo provide threats to traditional financial institutions.

Neobanks also have inherent appeal for Gen Z, with sleek digital experiences and teen banking options. Insider Intelligence predicts neobanks will gain 10 million Gen Z customers from 2023 to 2026. Gaming and cryptocurrency present additional inroads.

Banks and credit unions can outcompete by combining digital excellence with a holistic product suite. As Coughlin said, “If you’re a diversified financial institution, and your mission in life is the sum of the parts, that’s where retentive behavior can really come to life.”

Read more: What Gen Z and Millennials Want From Banks: 5 Key Insights

Serving Gen Z’s Financial Education Needs

Per Bank of America, as Gen Z establishes their financial footing in an inflationary environment, they are facing difficult decisions in order to achieve their financial milestones. Approximately two-thirds are actively saving for financial goals, yet 85% said they have financial barriers to success. The top three reported by respondents include the high cost of living, insufficient income to achieve financial goals and the economy.

Banks have an opportunity to fill knowledge gaps with personalized digital advice and financial literacy content. Coughlin emphasized that banks must move beyond mere functionality to provide “advice, help and value day in and day out.” For instance, AI-powered wealth management platforms could provide personalized insights and recommendations tailored to Gen Z’s evolving needs and life milestones. Gamification can also make financial education interactive and engaging.

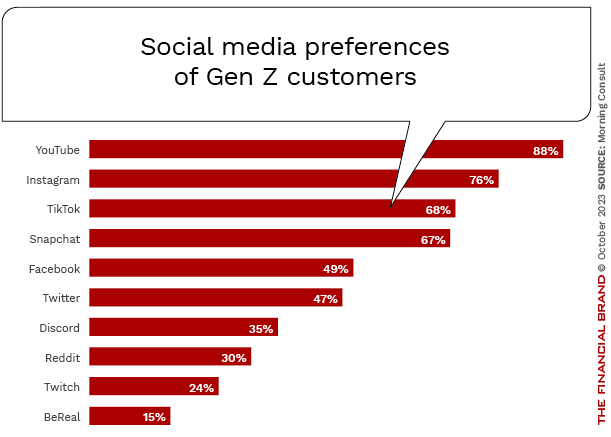

Social media platforms are potential financial wellness content distribution options as Instagram, TikTok and YouTube are being used for bite-sized financial tips from influencers. #PersonalFinance content has exploded in popularity, allowing banks and credit unions to meet Gen Z consumers where they are digitally shopping for expertise.

Banking institutions also have a role to play in bolstering financial confidence. Tools like spend tracking, projections and automated alerts help Gen Z consumers gain control of their finances and avoid overdrafts. Ultimately, financial institutions must become partners in Gen Z’s financial journey – not just transactional providers.

Ongoing education, advice and digital money management are the pillars of this relationship. Leaning into this advocacy role is key to earning long-term loyalty with Gen Z and building greater engagement.

See all of our most recent coverage about Gen Z.

Evolving Credit Products for Gen Z

Gen Z is fueling exponential growth in buy now, pay later (BNPL) services, with Insider Intelligence predicting 35.1 million BNPL users in this cohort by 2026. Though more fiscally conservative overall, Gen Z still has a need for responsible credit building. Banks have an opportunity to cater to Gen Z’s preference for incremental payments by partnering with BNPL providers. Offering flexible point-of-sale financing helps capture Gen Z spend while minimizing risk of overspending.

Gen Zers have an average credit card debt of $2,589 according to Credit Karma. While lower than other generations, it demonstrates openness to responsible revolving credit. Banks should structure products accordingly, with transparent terms, spending notifications and tools to avoid ballooning balances. Longer-term loans for housing and vehicles also remain out of reach for many Gen Zers. Banks and credit unions can guide them on managing tradeoffs between lifestyle costs, building emergency savings, and preparing for major purchases.

Citizens Bank has expanded credit access through advanced underwriting algorithms – enabling higher approval rates while minimizing risk. As Coughlin explained, the key is using “machine learning and AI models” to evaluate diverse financial data beyond traditional credit scores.

Ultimately, Gen Z needs partners along the credit journey – not old-line banking players who will punish them for missteps. Proactive education and appropriately structured lending set this generation up for lifelong financial health.

Read more: Gen Z Payment Trends: How They Use Cash, P2P and BNPL

Walking the Walk on Brand Values

Purpose matters to Gen Z consumers. However, Publicis Sapient research reveals a perception gap between banks’ social commitment and reality. While brands believe they excel in diversity, racial equity and sustainability, progress remains uneven. “ESG is very important to the Gen Z cohort and to us as an organization,” said Coughlin. “Banks must showcase commitment to diversity, sustainability and community impact to earn Gen Z’s business and trust.”

“Just do the right thing,” advised Coughlin. “Banks must ensure diversity within their own walls, invest in local communities and facilitate environmentally conscious products.”

Gen Z is the most disruptive and demanding generational cohort banks have yet faced. But their expectations also present an opportunity to improve products, advice and brand experiences for consumers overall.

As Coughlin summarized, “You’ve got to have that innovation mindset. And the second you don’t have a good answer to that is the second they’re going to get distracted and move some of their relationship to another spot.”

Ultimately, the financial institutions that will thrive are those that embrace Gen Z as change agents pushing the entire industry forward. Prioritizing mobile excellence, financial empowerment and purpose is the key to making this generation part of the future – not just the present – of banking. But lasting change requires moving beyond superficial commitments. As Coughlin reflected, “If you win Gen Z, you win the future. If you ignore Gen Z, they’ll never forget.”