About 27 million consumers will experience payment “shock” with the end of student loan forbearance.

But will that shock create widespread delinquencies and credit issues across consumer lending?

Data suggests ripples will run the gamut in ways that create pockets of high credit risk for lenders. Pressure on certain Baby Boomers from returning payments outpaces most Millennials, student loan borrowers who also utilize buy now, pay later (BNPL) could be increased credit risks flying under the radar, all while those who are delinquent on federal student loans go unreported to credit bureaus, according to analysis by The Financial Brand.

It’s a precarious place for the banking industry to be.

More than 36 million U.S. consumers — and about 89% of all student loan borrowers — have federal student loans. In contrast, only 1% of student loan borrowers have private loans. That means most student loan debtors (and about 10.6% of the U.S. population) have enjoyed payment forbearance since March 2020, when then-President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) into law.

Where The Cards Lie:

The number of Americans who have had student loans in forbearance since 2020:10.6%

With subsequent expansions and extensions, borrowers have not had to worry about interest, late fees, collections or default either.

As of October 2023, all that has changed. About 50% of borrowers already have an invoice for $200 or more in their mailbox, according to data from TransUnion. A considerable and concerning number now face invoices in the range of $500 to $1,500, and some are for even more than that.

What should concern lenders is student loan debtors’ new borrowing since forbearance began, their use of new credit instruments like BNPL and the rules still in place preventing student loan delinquencies from being reported to credit bureaus.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

More Borrowing and Higher Balances

Borrowers received their first federal student loan bill as early as September, according to the U.S. Department of Education, with a due date just 21 days after that.

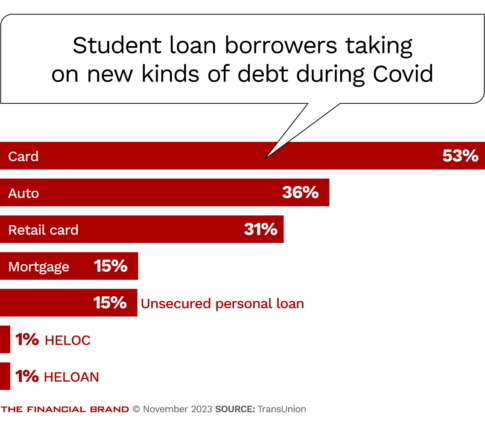

The scary part is that they have more non-student debt now than they did in 2020, when the federal student loan pause went into effect: Nearly 53% opened a new credit card, 36% took out an auto loan and 31% opened a retail card. About 15% obtained a new mortgage. (All data reported in this article is as of May 2023.)

“During this payment pause, we saw student borrowers seeking out new credit, notably credit card and retail card, as well as auto loans,” says Jessica Harmon, senior director, for TransUnion. Balances and payments “are higher now than they were pre-pandemic.”

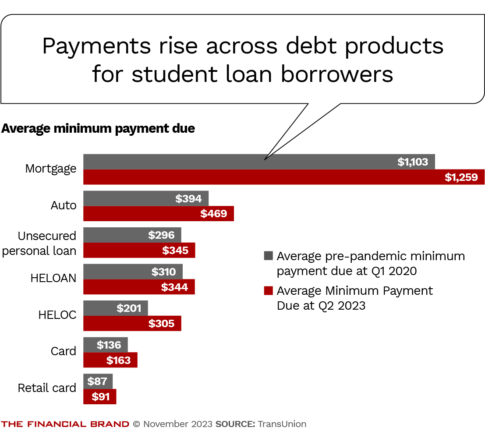

Balances grew across every lending category from first quarter 2020 to first quarter 2023. Across installment loans, balances are up by an average of 19%. They are up 25% for unsecured loans, 21% for auto loans and 11% for mortgages. The only loan type with declining balances among student loan debtors is home equity loans, which are down 15%.

They added to revolving credit types as well, though not to the same degree. Balances in cards, retail cards (those issued by retail stores) and home equity lines of credit are up by an average of 5%.

The short of it: Student loan debtors now owe higher payments in every credit category than they did three years ago.

The return of payments paused by policy could spark a new and negative financial reality in homes throughout the country. But could it be more than that? TransUnion data suggests there’s significantly more risk in certain pockets of consumer credit.

End of Forbearance: Unexpected Effects

Student debt is commonly thought of as a young person’s burden. And while it’s true that younger consumers are more likely to have student loans, the amount borrowed and corresponding payment size may in fact strain people in older generations more.

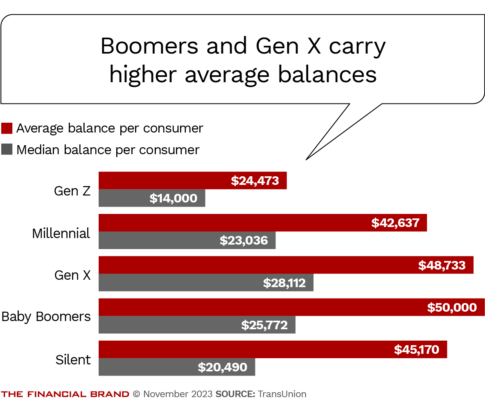

Let’s take a look at the numbers. Millennials comprise nearly half (43%) of student loan borrowers. Gen Z makes up about 28%. Generation X and the Baby Boomers have a healthy 21% together. Even the Silent Generation make up 7% of the student debtor population.

When older generations have student debt, they have a lot of it. The average Baby Boomer balance is more than twice that of Gen Z, and 16% more than Millennials.

“Why do we see higher payments or higher balances for some of the older generations? One reason could be graduate school debt, as well as additional undergraduate debt,” Harmon says. “They also could be helping out a child who is in college by taking on a Parent Plus Loan.”

The Silent Generation and Baby Boomers are also more likely to have payments in the range of $500 to $1,500 or more. Gen X is not far behind. Again, when older generations have the debt, they are the most likely to owe high amounts in balances or payments. In contrast, just 20% of Millennials and 5% of Gen Z are returning to $500 or more in payments.

The conclusion here is not that older generations will have financial struggles. The data published by TransUnion looks largely at student debt, which older borrowers are typically better prepared to handle. That said, there are older borrowers who will now be on the hook for payments akin in size to a second mortgage. If they also borrowed more, prepared poorly for retirement or have only a small savings cushion, financial strain may be near at hand.

Read more:

- Topsy-Turvy Student Loan Battle Means Lenders Need to Re-Educate Themselves

- Zillennials: The Millennial & Gen Z Mash-Up with Unique Financial Needs

End of Forbearance: Risks Under the Radar

About 37% of BNPL users are Gen Z and 32% are Millennials. And, those polled who used BNPL did so during the past 12 months, according to a TransUnion report in August. That means about 71% of student loan borrowers are Millennials or Gen Zers, who 69% of are also BNPL users.

What’s more, a third of BNPL users have a credit score of less than 620, a below-prime credit score that indicate high propensity (33%) for delinquency. And, that was before forbearance ended.

Dig Deeper: BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

What’s scary about that?

In addition to the rising debt load of Millennials and Gen Z, it’s the fact that credit reporting is still catching up with tracking BNPL in consumer credit score that should give lenders pause. BNPL is not baked into credit scores. (Lenders can see BNPL data on a consumer’s credit report if they do that level of credit analysis.) Millennial and Gen Z borrowers may appear to be significantly better credits when in fact they are risky bets flying under the radar.

End of Forbearance: Navigating Unreported Delinquency

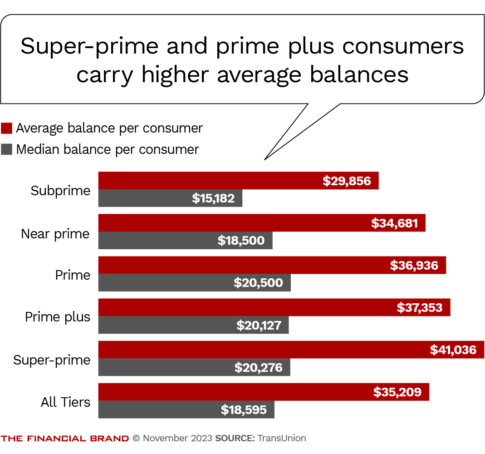

Even strong borrowers from a credit score perspective have some heavy payments coming this month. In fact, stronger credit correlates to both higher student debt balances and payments. Super-prime borrowers, for example, carry balances exceeding $41,000, which means some payments might as well be for a house.

A fifth of super-prime borrowers (and near-prime borrowers as well) now face a student loan payment in the range of $500 to $1,500. Prime plus borrowers are not far behind with 18% shouldering the same high monthly payments.

People afforded these payments before, especially those with greater financial strength. But incomes change all the time, especially during economic downturns when they might lose a job or close a business. Even when tragedy doesn’t strike, student loan borrowers have not needed to make their payments for three years. Are they ready to pay them again now? And if not, how will it impact their repayment behavior for the debt they’ve accumulated?

The Biden administration has put safeguards in place to help borrowers adjust, including a 12-month payment “on-ramp” grace period, for the end of forbearance. From October 2023 through September 2024, people who miss monthly payments will not be considered delinquent, reported to credit bureaus, placed in default or referred to debt collection agencies.

Lenders must now ask: When a borrower goes delinquent on student loan payments, how will we know? Here again, lenders will face credit decisions for borrowers who may be weaker financially than they appear.

Learn more:

- Preparing to Survive the Storm of Delinquent Accounts [Webinar]

- Credit Card Trends Have Bank Issuers on Alert

Reacting to Clouds on the Horizon

Is a thunderstorm brewing in consumer credit? There are certainly some favorable conditions for lighting to touchdown.

A kind of credit kaleidoscope now pushes more risk into consumer lending. New consumer borrowing, product innovation, credit information, public policy and generational dynamics are creating a unique environment for 2024 and beyond. But we also know deposit volumes in the banking system are still historically high. People still have equity in homes and vehicles. We haven’t seen big jumps in unemployment. There’s both risk and strength facing the industry right now.

With forbearance gone, banking executive should consider some forbearance of their own, not carte blanche, but through deeper looks at consumers’ financial circumstances to make the best credit decision.