Citigroup CEO Jane Fraser announced on January 12 that the bank planned to cut 20,000 jobs over the next two years. The move is expected to boost returns after the bank posted a $1.8 billion loss in the fourth quarter of 2023.

“The fourth quarter was very clearly disappointing,” Fraser told analysts. “We know that 2024 is critical.”

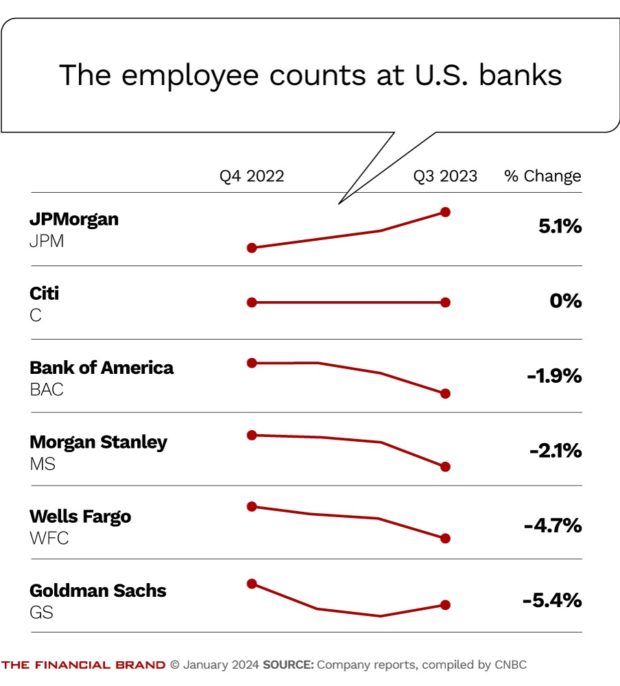

The Citigroup announcement is a stark example of a trend among Wall Street banks over the past year. With the exception of JPMorgan, the next five largest U.S. banks cut a combined 20,000 positions as of October 2023, according to data analyzed by CNBC.

With thousands of employees on the hunt for new roles, layoffs can be a time of opportunity for smaller institutions seeking top talent — especially for community banks and credit unions who are looking to fill roles right now.

There’s a misconception that when companies do layoffs they are cutting just their low performers, says Kyle Samuels, chief executive of Creative Talent Endeavors, an executive search agency and HR consultancy. Often, big layoffs simply mean companies are eliminating entire divisions, Samuels says.

“It just means that their job went away,” he says. “That is a great time to find amazing talent.”

If you’re looking to scoop up a few solid hires from the lengthening list of laid off workers, here are a few steps you should take and key mistakes to avoid.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Market Your Role to the Right Candidates

As with any new role, it’s important to first think about the reasons why you’re looking to hire, says Thad Price, chief executive at Talroo, a job advertising platform. Companies generally hire for two reasons: to fill a specific role or to recruit a specific person. A layoff at a competitor, he says, can be a good time to make either of these types of hires.

The hiring manager should have a good idea of the type of candidate they are looking for, Price says. Different roles require different skills and experiences.

“That all starts with the persona conversation,” Price says.”The conversation around what requirements you’re attracting for the role. It can be various experiences, it can be skills. Things that can help your organization drive quality of hire.”

Then, craft a job description based on that persona. It’s important to put time and effort into crafting a description that will attract the right candidates, Price says. This is especially true for smaller organizations that may not immediately be on job seeker’s radars.

“Recruiting is marketing,” Price says. “You’re trying to attract talent to your business.”

Read more:

- The Winding Road to Leadership: A Case Study from ClearBank

- Why Banks Must Rethink Employee Comp and Benefits

Focus on Recruiting

Once a job is posted online, hiring managers should focus their efforts on recruiting. Hiring managers should target specific candidates on social media like LinkedIn and other job networks. When you’re reaching out to candidates, make sure your message is specific and tailored to that candidate’s interests as possible, Samuels says.

“At scale, you can’t make every single email super specific, but make sure that it’s at least tailored to the right person,” he says.

There is a good chance you’ll be able to find a good quality candidate by recruiting. Indeed, 45% of laid off workers who found work after being let go were recruited for their roles, according to a ZipRecruiter study.

Don’t forget about referrals, Price says. Sometimes the best candidates can come from your employees, who already know the culture and the business. For community banks and credit unions who are recruiting from a specific locale, make sure your company is visible in the community.

“Ensure that you have a presence,” Price says. “Get involved. Many local newspapers have best places to work [lists]. It’s a way for you to potentially submit [your business] and gain some recognition.”

Offer Competitive Compensation Packages

Don’t offer salaries that are below market value to potential workers just because you know many are desperate for jobs, Samuels says. If you want to retain talent long-term, you’ll need to offer packages that are commensurate with their experience and skills.

It’s also important to keep tabs on the competition, Price says. If you can pay a little more money or offer slightly better benefits than your competitors, you have a better shot of attracting top-quality candidates in your market. One big perk right now is flexibility, which is typically an easy benefit to provide. Even if you can’t let employees work from home every day, you can still offer them more flexibility than your competitors.

“Flexibility is almost as important as pay,” Price says. “When you think about the tradeoffs people are making in their life, especially many folks who lost loved ones during the pandemic, I think it was a reset of what’s important for a lot of families.”

Dig deeper: Higher Pay Isn’t Enough to Stem Bank Employee Turnover

Be Mindful of Non-Compete Clauses

Depending on the type of job and level you’re hiring for, some prospective employees may have signed a non-compete clause when they were hired or laid off from their prior jobs. Separation agreements — which employees often sign to receive severance pay — may include non-compete clauses in some states.

For some roles, like sales positions, they may have also signed an agreement not to bring over clients for a certain period of time, Samuels says.

“Anyone who is responsible for bringing over clients, there’s going to be at least a year where they can’t bring people over,” he says.

Anything that may impact the terms or conditions of a person’s employment should be disclosed upfront, Price says. Hiring managers should encourage prospective candidates to be candid about any contracts or obligations that may impact their ability to be hired for a new role.

“Transparency is important,” Price says. “Those are conversations you should have, it should be part of the process.”

Workers Who Still Have Jobs May Want to Leave, Too

Layoffs create uncertainty for the future at an employer. Workers often worry that their job will be cut next. Downsizing, in general, can also increase stress for remaining workers by adding more work to their plates. If you want to poach a specific worker from a competitor, right after a layoff might be a good time to do it, Samuels says.

“There’s always a ripple effect,” he says. “It starts to make people feel like ‘I wasn’t looking or even open but let’s talk.'”

Learn more: 6 Strategies to Position Banks for Growth Post-Recession

Make sure you’re being intentional, Samuels says. Focus on hiring workers who have similar values. Sometimes the candidates who may not be your first choice on paper can turn into rockstars.

“You don’t hire a school or degree,” Samuels says. “You hire an individual.”

Regardless of how you choose to recruit, be mindful that layoffs can be a stressful time for employees – whether they were impacted or not. Be sensitive to candidates’ individual situations and lead with empathy.

Caroline Hroncich is a freelance business journalist based in New York. She writes about workplace trends, HR, personal finance, banking, and more. Her work has appeared in MarketWatch, Business Insider, Employee Benefit News, the Society for Human Resource Management, and Cannabis Wire.