The global financial services landscape continues to be disrupted, as consumers expect greater use of digital technologies and the contextual experiences possible with the combination of big data, advanced analytics and mobile devices. These expectations have fueled the growth of fintech start-ups, from a niche competitor to a subset of the banking industry where one-third of digitally active consumers now use two or more fintech services.

While there are definitely hurdles in the path of fintech firms hoping to gain market recognition and scale, it is clear that the solutions provided by many of the new financial services start-ups are meeting the needs of an increasingly digital consumer. Remaining independent or partnering with legacy banking organizations or large tech companies, there is the foundation for a new phase of growth with the emergence of open Application Programming Interfaces (APIs), Artificial Intelligence (AI), the Internet of Things (IoT), etc.

Findings from the EY Fintech Adoption Index 2017, published by EY, indicate that fintech firms are approaching mass adoption among digitally active consumers. Leveraging digital technology, combined with personalized solutions, fintech firms are differentiating the customer banking experience. Simplicity, clean design, personalization, real-time insights and transparency are the defining components of these new solutions.

The four key themes that emerged from the 2017 EY Fintech Adoption Index were:

- Fintech services have reached mass adoption in most global markets

- New services and players are driving increased adoption

- Fintech users prefer digital channels and technologies

- Fintech adoption will continue to gain momentum

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fintech Goes Mainstream

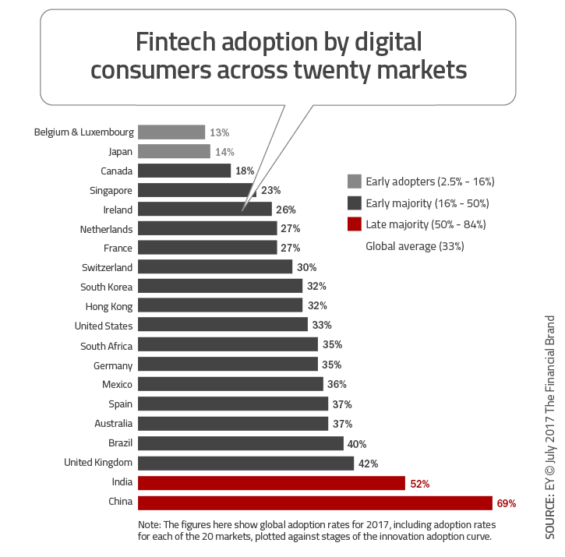

Over the past two years, there has been a significant increase in both awareness and adoption of fintech services, according to the EY research. In fact, the average percentage of digitally active consumers using fintech services in 2017 reached 33% across the markets evaluated. At the same time awareness of fintech services reached 84% in 2017, compared to only 62% in 2015.

As can be seen in the chart below, much of this growth is driven by countries like China, India, Brazil, Mexico and South Africa, where adoption averaged 46%. In China and India the growth is attributed to those consumers who are tech literate but financially underserved.

According to the EY report, some of the primary strategies used by fintech firms to gain traction include:

- Offering a service for free or at a much lower cost that traditionally had a cost associated

- Solve a problem an existing customer base

- Provide an entirely new service

- Create word-of-mouth advocates

- Build a strong brand identity

- Leverage highly targeted marketing

The impact of fintech firms gaining mainstream acceptance is that these firms can begin to define industry standards and customer expectations. Much like how Google has defined expectations around search, and Amazon has defined how digital consumers shop, fintech firms are defining what consumers will expect in the future of finance.

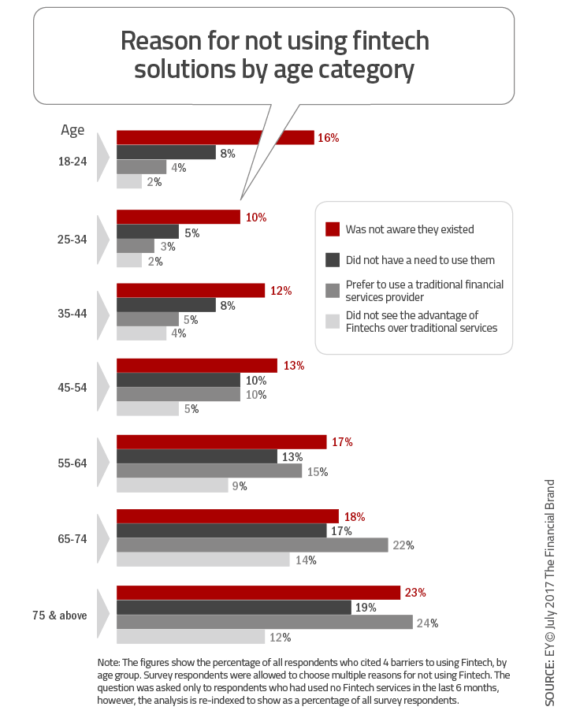

When EY evaluated adoption rate movement since 2015, they found that increases in adoption followed increases in awareness (which makes sense). For instance, Hong Kong had the highest adoption rate for fintech services as well as the highest level of awareness. While once the number one reason for not using fintech firms, awareness has been supplanted by the desire to bank with traditional organizations.

Read More: The Challenger Bank Battlefield

New Services and Players Drive Adoption

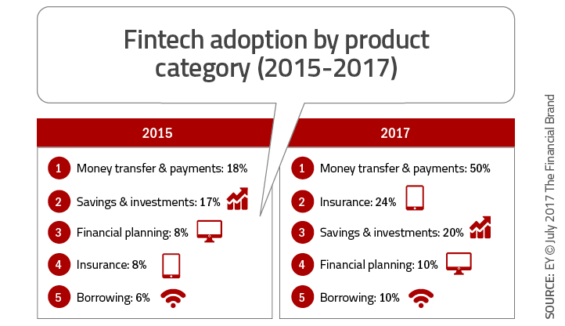

When EY evaluated the most important services that drove adoption of fintech globally, money transfer and payment services continued to be the most dominant solutions. Of digitally active consumers, 50% used these services in the previous 6 months compared to only 18% in 2015. Insurance services moved into second place in adoption, with 24% usage. Much of this use could be attributed to premium comparison services, according to EY.

While there is some regional difference in the adoption of fintech services, much of this variance can be attributed to differences in regulation. The ability to combine multiple financial services within singular platforms provides China a significant platform for fintech growth, which was apparent in the research.

Fintech Users are Digital Consumers

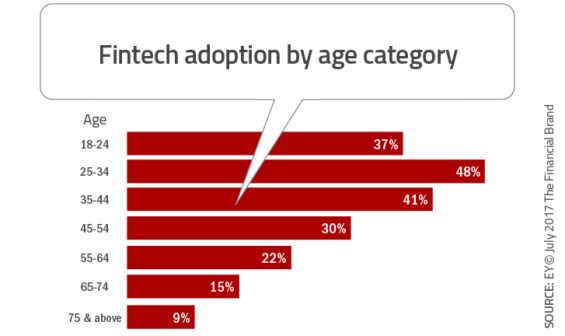

In trying to determine the difference between fintech users and non-users, EY found almost no surprises. The age categories that were the most likely to be attracted to fintech solutions are correlated with those most likely to use digital devices. These consumers are younger (aged 25-44).

This is also the demographic category of heavier financial product users, homeowners and more educated consumers. Fortunate for fintech providers, these consumers are also the most likely to try a new provider. Consumers in older age groups are more settled in their financial habits and more loyal to their current provider (less likely to switch).

The most dramatic variance between fintech users and non-users is the ways consumers prefer to manage their lives. According to EY, “64% of FinTech users prefer managing their lives through digital channels, compared to 38% of non-FinTech users. FinTech users are also more likely to be users of non-fintech digital platforms, such as on-demand services (digital taxis, online food, etc.) and the sharing economy (bike and housing rentals).”

Fintech Growth Will Continue

The EY study found that there is significant positive sentiment among consumers around fintech solutions, with estimated adoption expected to exceed 50% globally. This sentiment indicates that fintech providers are not only meeting expectations, but exceeding the expectations that consumers have around traditional banking solutions. These estimates do not reflect the impact of fintech solutions that go beyond what is found today.

Beyond converting non-users, the study found that a category of ‘super users’ will emerge who will use over 5 fintech services. For these consumers, the ease of setting up a new account digitally becomes very important.

Fintech firms will continue to be the hotbed for technology change within the industry, setting the standard for the experience digital consumers will come to expect and for traditional banks to aspire to. While incumbent banks will continue to have strategic advantages related to capital access, customer base and ability to respond to regulatory changes, fintech firms will have the advantage of nimble processes and newer digital capabilities.

According to EY, “Fintech and non-financial services firms represent a threat to incumbent firms’ market shares, revenues and strategic models. However, they also create opportunities for incumbent firms to differentiate themselves and become more competitive. In addition to potential joint ventures, acquisitions and investments into fintech firms, incumbent financial services firms can learn from or acquire the services of fintech firms to enhance existing offerings,”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Challenger Bank Battlefield

The Digital Banking Report, The Challenger Bank Battlefield , provides insight into more than 30 fintech challenger banking organization globally. Beyond a review of the strategies and products offered, this report includes an analysis of the competitive positioning of the organizations reviewed.

, provides insight into more than 30 fintech challenger banking organization globally. Beyond a review of the strategies and products offered, this report includes an analysis of the competitive positioning of the organizations reviewed.

The report also includes interviews with challenger banking organization founders and financial services industry leaders. The report has 82 pages of analysis and 15 charts/graphs. Finally, the report includes secondary research into the competitive marketplace and guest articles from organizations who are close to those organizations involved.