Bank and credit union executives are on a full-blown Amazon watch, anxiously waiting to see if/when the ecommerce company will close in for the kill by launching its own bank or checking account (or partner with a megabank to accomplish the same goal).

Skeptics might wonder if a bit of the stage magician’s “misdirection” is at play here — keep people focused on one thing, while the real action takes place elsewhere. In reality, Amazon has long been adding financial services to its shopping cart and will continue doing so, but perhaps not in ways traditional players see coming.

At an industry conference, Patrick Gauthier, VP/GM at Amazon Pay, was grilled about any new financial innovations Amazon may have in the works. On one hand, Gauthier suggested Amazon had no plans to take banking on directly On the other hand, he reflected on developments underscoring how financial services augment and enhance Amazon’s other interests.

For instance, attendees at the conference were curious if Amazon would roll out its own cryptocurrency, following in Facebook’s footsteps with Libra and its related Calibra digital wallet. But Gauthier, who is a payments industry veteran of several major brands including PayPal and Visa, quickly iced any Amazon crypto rumors.

“Libra is fresh and speculative,” said Gauthier. “At Amazon, we deal not really in the speculative, but in the ‘now’.”

While Gauthier did not exactly say that Libra was unnecessary, he doesn’t believe there’s a case for anything similar at Amazon. “At Amazon, we deal with data a lot, so I’d be happy to have that conversation two to three years from now. Right now we deal with the types of customer needs that we can solve.”

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

“The fact that we can build something does not mean that we should.”

— Patrick Gauthier, VP/GM Amazon Pay

In light of the issues Facebook has faced concerning its use of data, Gauthier said that Amazon considers the trust of its customers “the most important asset that we have” — something he said the company monitors every day.

“Part of maintaining the trust of those customers is that we always start from- and identify needs that we really understand — that we have the capabilities to solve,” Gauthier explained. “The fact that we can build something does not mean that we should.”

Amazon truly believes that consumers want to leverage voice services like Alexa to order things and conduct their financial business. As Gauthier put it, people want the ability to ask, “Where’s my stuff?”, so that’s where the e-commerce company’s priorities are… at least at the moment.

“Amazon,” said Gauthier, “is a very pragmatic company. We start with the customer problem and determine what is the best way to solve that problem. What do we have to build, what do we have to partner. And then we measure success. And rinse and repeat.”

What About Amazon Checking Accounts?

When pressed as to whether Amazon will introduce an Amazon Prime checking account, Gauthier gets a bit coy. Gauthier says any Amazon customer can already use Amazon Pay, which is accepted for payments at participating stores and online merchants outside the Amazon platform, suggesting that there really isn’t a need for Amazon to offer a checking account.

But that doesn’t mean that Amazon isn’t interested in basic banking services.

“We’re constantly asking ourselves, will we — with a well-identified need — create a solution that will actually solve a customer problem today and that can scale,” says Gauthier. “That’s how we approach product development and how we’ve built Amazon Pay. People trust Amazon, therefore we can help merchants and customers connect across the wide world.”

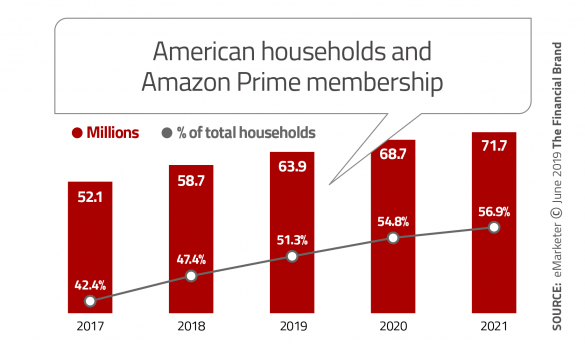

What troubles most traditional banking execs is that at any point, Amazon might just decide to help those “merchants and customers around the world” by offering some sort of quasi-checking product. After all, the portion of Americans who belong to Amazon Prime — roughly half the entire adult population — is astounding. That is a huge potential consumer base for any kind of financial service, should Amazon decide to offer it.

“It would be absolutely natural for us to partner with financial institutions, because we believe in the power of choice,” Gauthier said. He said Amazon partners with financial institutions “all the time,” citing Synchrony Financial as an example. Amazon has partnered with Synchrony on its store card for over a decade.

Read More: Amazon Secured Card Move Throws Spotlight on Controversial Niche

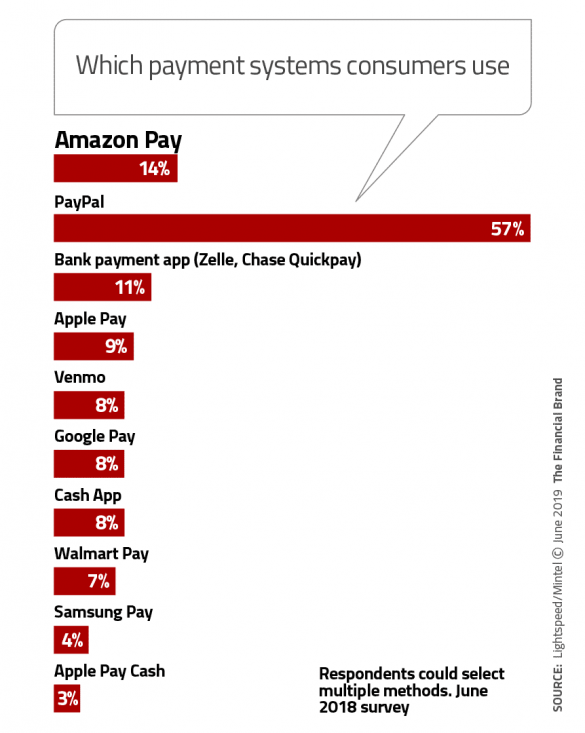

Gauthier said that 300 million Amazon customers around the world use Amazon Pay to shop at other merchants and make donations. Amazon Pay taps information in a consumer’s account to complete transactions. The company says that Amazon Pay is accepted at tens of thousands of sites, and can be used to pay by voice using Alexa, Amazon’s voice assistant. Amazon Pay can also be set up for use in-store and for social media shopping. Use of Amazon Pay avoids the need to enter payment information at participating sellers, and reduced cart abandonment is one of the benefits that Amazon promotes. Eligible purchases made using Amazon Pay are covered by the company’s A-to-Z satisfaction guarantee.

Amazon’s has steadily added additional elements to its quiver of payments partnerships. In March 2019, Worldpay agreed to integrate Amazon Pay into the options offered to consumers. It’s a significant move. Worldpay is a leading international payments acquirer, processing over 40 billion transactions annually. Its agreement with Amazon eliminates the need for individual merchants to build Amazon Pay into their payment options.

Even cash comes into Amazon’s planning. In early 2019, Amazon introduced Amazon Paycode, which gives consumers four days in which to pay for a purchase using cash or a debit card at Western Union locations. After payment is made the items are shipped.

Amazon Seen as Top Competitive Threat to Banking

Beyond Synchrony, other large financial services players partnering with Amazon in the U.S. include JPMorgan Chase, which issues Amazon Rewards cards. And in late 2018, another partnership was used to launch the Amazon Business American Express Card. The card, for U.S. small businesses, features no annual fee, rewards, and a selection of financing options. For example, cardholders can choose rewards or instead opt for payment terms that can help their small firm’s cashflow. The cards offer superior benefits for Amazon Prime and Business Prime members.

For these and other partner financial institutions, there are benefits as Amazon broadens its activities in banking services. But what about the vast majority of the banks and credit unions that aren’t Amazon allies and have little to no likelihood of ever becoming such?

Tearsheet Research polled a small sample of digital finance executives about the relative potential competitive impact of Google, Apple, Facebook, and Amazon (GAFA). The executives gave their readings in two categories: consumer banking and business banking, and over two time frames, over the next one-three years and the next three-ten years.

In both banking categories, Amazon came in as the greatest threat overall, sometimes in a tie for the near-term time frame. The trend was strongest in business banking.

“The industry is clearly concerned about [Jeff] Bezos and team eating into consumer banking, regardless of whether or not Amazon launches a full-fledged banking product,” Tearsheet observes, referencing the Amazon CEO.

On the other hand, the publication continues, of GAFA, only Amazon was seen as a major threat for business banking.

“Financial professionals are keeping a close eye on Amazon’s intentions and activities when it comes to encroaching on commercial banking,” says Tearsheet. “The global ecommerce company ranked highest among our survey respondents in its competitiveness to commercial banking now and in the future, far outstripping any of the other options.”

Read More:

- Three Customer Experience Lessons From Amazon

- Banking Needs An ‘Amazon Prime’ Marketing Strategy

- How Banking Providers Can Achieve Hyper-Relevance in the Amazon Age

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Taking a Closer Look at Amazon’s Business Lending

Amazon made over $1 billion in small business loans in 2018, but Amazon as a business lender isn’t quite like anything else out there — not like a traditional bank business loan relationship and not like a fintech business loan from Kabbage or one of the other online players. In fact, a business can’t even apply for a business loan from Amazon unless Amazon invites it to.

Amazon lends only to third-party sellers that use its site, but that’s a tremendous “only.”

In 2018, third-party sellers accounted for 52% of Amazon’s total sales — coming to $160 billion in physical merchandise sold by these third parties in 2018. This piece of Amazon sales has experienced a 52% compound annual growth rate from 1999-2018. So business lending to U.S. Amazon sellers represents less than 1% of total sales, giving an indication of the tremendous upside this business has.

Qualifying Amazon sellers can borrow from $1,000 to $750,000 for as long as a year. Amazon has the advantage, in evaluating applicants, of knowing precisely what their sales and customer metrics are on the company’s platform.

The program began in 2011. In an in-depth research project on the program, Finder.com illustrates a program with built-in lender protections. Repayments come out of borrowers’ Amazon accounts monthly, automatically, and any losses are handled by seizing inventory in the company’s warehouses or from sales proceeds made into the sellers’ Amazon accounts. Finder.com notes that some borrowers report almost instant turnaround, and others report approval taking almost two weeks.

Interestingly, CB Insights points out that Amazon considers its lending program to be a selling tool it provides to its merchants.

“Giving out loans to Amazon merchants in this growing space makes sense for Amazon,” according to a CB Insights report. “If the company can give its third-party merchants loans that go back into selling products on Amazon, it’s a win for both sides. Amazon gets the increased business, plus the interest from the loans; the merchant gets the capital they need to grow.”

The report points out that Amazon lending doesn’t take the documentation usually required by bank business lending. Amazon doesn’t have bank examiners to worry about.

On the other hand, Amazon apparently has a bank standing behind its lending program. In early 2018 CNBC reported that insiders said that Amazon had partnered with Bank of America. The partnership was reportedly considered confidential. However, in Amazon’s 2018 annual report the company confirms that it had a revolving credit facility of $620 million secured by seller receivables. The facility was first opened in 2016. The annual report indicated that most of the facility had been drawn down as of yearend.

The CB Insights report also notes that Amazon is known to be interested in getting into the mortgage business.

“Amazon wouldn’t be the first company to try to disrupt the $1.6 trillion residential mortgage industry, nor would it be the first to use its distribution advantage to out-compete the incumbents,” CB Insights states. “It might, however — owing to it massive customer base and pervasive brand — be one of the best positioned. … If Amazon is serious, the best path may be partnering with an existing lender on the distribution side rather than trying to boil the ocean itself.”