Over 40% of Americans are living paycheck to paycheck, according to a report from Springleaf Financial, a consumer finance company. The findings apply to people across all education and salary levels. The study discovered that 24% of consumers have less than $250 in their bank accounts on any given payday leaving them without reserves to handle unexpected costs.

Surprisingly, of those who make more than $200,000 per year, 20% said they save rarely, inconsistently, or not at all. One in four consumers with a graduate degree actually couldn’t miss a single month of paychecks without having to borrow or sell assets. One in five say they would rather go to the dentist than spend half an hour learning money management skills.

It’s even worse for the Millennial segment. According to CNNMoney, which cites a report from Moody’s Analytics, the savings rate for people under 35 has dipped to negative 2%, meaning that they’re spending more than they have. They’re the only age group that has a negative savings rate.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

A Contextual Savings App

Today’s Personal Financial Management (PFM) apps provide a vast array of interactive budgeting and money management tools. But they take a rather significant personal commitment to yield the basic benefit most people desire … more savings. Digit is a free savings application that uses spending history and habits to help save money without the user even noticing.

By monitoring a linked checking account’s spending patterns, Digit uses contextual analytics to determine when and how much to pull out of the linked bank account into a FDIC-insured Digit custodial account held at two of its partner banks, Wells Fargo and BofI Federal Bank.

According to Digit’s 29 year old founder, Ethan Bloch, the app looks at the linked bank account balance every few days and considers a series of factors, including:

- Is this a high or low balance based on how this person makes and spends money?

- Do they have any bills coming due in the next several days?

- Will they have any income in the next several days?

- How much money did they spend yesterday?

- How much did they spend over the previous several days?

- How much have they saved so far this month?

“After answering questions like these, Digit tries to arrive at a small amount of money it knows the user won’t need, but more importantly, might not feel is missing based on recent spending and income,” states Bloch. Digit also has a ‘no overdraft’ guarantee, meaning if they accidentally overdraw the linked account, they’ll pay for any fees.

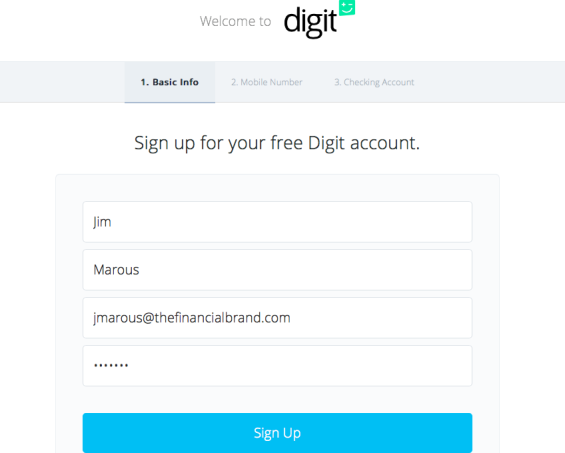

Setting up a digital savings account could not be easier. In just a few easy steps, the user provides the following personal identification and banking information within the extraordinarily austere Digit online application:

- Basic personal Information (name, email address, desired Digit password)

- Mobile phone number (used for SMS transfer notification)

- Linked financial account (select from more than 2,500 eligible organizations and provide online banking account password)

Once set up, money will be automatically transferred from the checking account to the Digit savings (usually in increments of $5 to $50) every two or three days. The user can use Digit to transfer money back to their checking account at any time by texting ‘Withdraw’ to Digit. The funds are transferred the next business day, with no fees or limits on how much or how often withdrawals can be made.

Mobile SMS Engagement

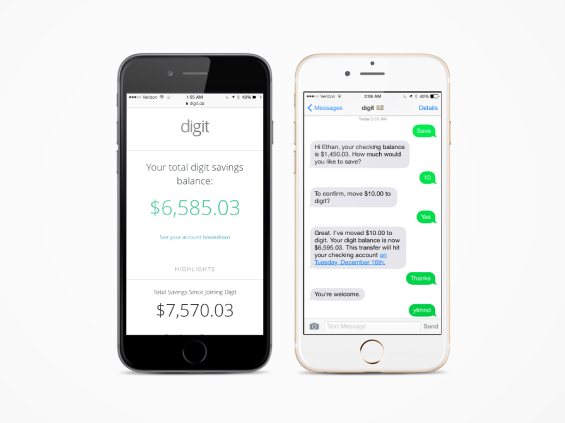

Somewhat surprisingly, the service does not have a mobile app or web site with colorful visualization of spending habits or budgeting tools. Instead, Digit can only be opened through an online web portal. Once the Digital savings program is set up, however, the user can access their account through a smartphone.

The online or mobile view of the account provides how much money is currently in the account, how much has been saved over time, what the average transfer amount is, and how often a withdrawal happens. The site also has a detailed list of each transfer over time that can be scrolled through.

Digit’s primary mode of communication with users is via SMS. It sends users daily updates via text each day. Most of the time, Digit provides a notification of the balance in the user’s savings account, but it occasionally also updates the user on how much they’ve saved with Digit over the course of a week or a month.

Digit mobile screenshot

Users can request more information using a series of simple SMS commands. For example, the user can type ‘Recent’ and Digit will text back the last three transactions to be recorded by your checking account. By texting ‘savings,’ users can see the amount saved so far, ‘balance’ allows the user to check their checking balance, ‘pause’ stops the automatic savings, and ‘bills’ allows the user to see upcoming bills Digit knows are about to be paid (through billpay).

Digit doesn’t charge users for its service, with operating costs covered by the interest Digit earns by consolidating funds at partner banks. Eventually, the intention is to share some of the interest earned with its users.

“Our goal is to share some of the interest with our customers as we grow our deposits, as long as we know we can cover our costs,” Bloch mentioned in an interview. With $1M per month being saved for members before official launch, that may happen soon.

Safety and Security

As for safety, Digit uses bank level security to keep user information encrypted and protected. According to the website, they don’t store bank login or passwords, and while they do store bank account numbers, they use asymmetric cryptography to keep bank information safe.

Will Digit Succeed?

There is no doubt there are ways that a consumer can save money and earn more on their money (they could earn the same under a mattress). For instance, Acorns is an alternative that helps users save by rounding up purchases to the nearest dollar and automatically invests that difference into a diversified stock portfolio (resembling the Bank of America ‘Keep the Change’ savings program).

While there is the potential for greater earnings on savings with Acorns, it takes much longer to build a meaningful balance. There is also a monthly fee of $1.00 with Acorns.

Acorns mobile app

The beauty with Digit is its simplicity. Digit exists for the majority of consumers who aren’t good at saving money and haven’t been able to do so on their own. Digital puts money aside automatically and seamlessly, with minimal effort from the user.

During the initial pilot, users were able to see their savings grow significantly. Potentially more impressive is the overwhelmingly positive reviews and impressions shared online. In a search of this service, the number of positive impressions on almost all personal finance sites bodes well for the future of Digit.

More than anything else, the reason Digit will most likely succeed is because Americans are terrible at saving. “There’s plenty of academic research that says we’re bad at making decisions about money.” Bloch says. “Digit’s goal is to help people maximize their money, while driving the amount of time it takes to as close to zero minutes per year as possible.”

Here’s a short video describing Digit.

What Traditional Banks Can Learn From Digit

Traditional banks can learn a lot from Digit. First and foremost … that simplicity rules the day. It doesn’t matter whether you are talking about a digital savings account, an online retailing app, a taxi service or a travel app, digital consumers gravitate to easy-to-use apps. Banks and credit unions should try to make all of their online and mobile applications more seamless, requiring fewer touches and keystrokes.

Second, there is no reason your customers and members should be withdrawing funds from your organization and moving them to a third party’s custodial account at another bank. Most institutions already have an automatic savings transfer option, where set amounts can be moved automatically into a savings plan. The difference is that set transfers don’t adjust for the ebbs and flows of a customer’s checking balance.

The customer analytics process being used by Digit (while significantly more involved than a set transfer amount) can be built by traditional banks. Moreover, the data used to build the model would be more robust since banks and credit unions already have demographic, transactional and relationship insight.

Finally, traditional banks need to do a better job responding to historic consumer needs, such as the inability to save. This is far from a new phenomena. Trust and loyalty is built by showing customers and members that you know them, will look out for them and that you’ll reward them. There may be no better way to do so than with an intuitive and uncommonly simple savings app.