Much has been made of how during the coronavirus pandemic senior citizens have been trying out digital banking and getting used to this leap from traditional branch banking transactions.

Figures cited to back this up vary from study to study. There’s also a fair amount of anecdotal evidence cited, such as a community banker’s story of how his own nearly-80-year-old mother tried mobile banking after COVID-19 hit. He told The Financial Brand that she says she may stick with digital channels.

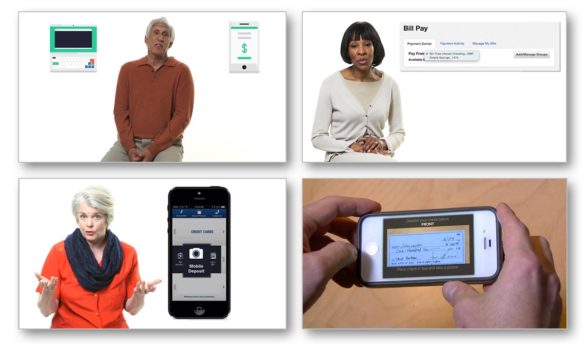

“The pandemic is forcing seniors and other vulnerable populations to need to be online all of a sudden,” Tom Kamber, Founder and Executive Director of Older Adults Technology Services, says in a blog interview for Capital One. Kamber’s group developed a set of free videos called “Ready, Set, Bank” for Capital One several years ago to train senior citizens in many aspects of mobile and online banking channels. The 44 nonbranded videos feature senior citizens speaking with friendly confidence about each transaction type.

The conclusion many draw is that a beneficial side effect of the unhappy COVID-19 period is an acceleration by years of consumer behavioral change. One can argue that this has indeed happened or that people are succumbing to fears about touching money or ever going into a branch again. Or one can play the skeptic, and ask how much of this “evolution” is merely because seniors’ alternative was waiting hours in drive-through lanes or finding workarounds like having kids or even grandkids do their banking.

Whatever the motivation for the change in behavior, banks and credit unions should focus on how can they maintain and increase that momentum as some new normal arrives.

The Financial Health Network, working with AARP Foundation, Chase and Dalberg Design, has produced a study on meeting the financial needs of low-to-moderate income people over 50. The report sets out tips that financial institutions could use to keep moving seniors’ adoption of digital channels forward. (In the research “fintech” is defined broadly, including nearly any banking, borrowing or financial service available digitally.)

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Understanding Seniors’ Financial Mindset Helps Frame Services

While for some seniors availability of mobile or internet service can be an issue, typically their historical lack of participation in digital channels hasn’t been because they don’t own tablets, smartphones, computers or even smartwatches and smart speakers. They can tweet, watch amusing dog videos and binge on streaming with the rest of us. And when they learn about interesting apps, likely they did so on an online review site or watching someone’s online video tutorial.

Here’s the rub for them: Trusting their money to their devices has until recently been an issue — and many seniors worry about digital fraud. Often, pre-COVID, if they took the digital plunge it was with the attitude that they ought to try it while the choice was still a voluntary one, the FHN study explains.

Fundamentally, according to the research, seniors, especially those in low- and moderate-income groups, fear losing control of their finances.

They keep a tight hold on often-slim resources and fear anything that could harm their financial condition. Often they rely on paper because they crave the assurance that a printed receipt gives them. Paper is solid, it won’t crash.

In 2019 research, the report notes, two-thirds of smartphone users over 50 reported generally not using their device for banking or other financial purposes.

“Seniors don’t want digital financial products specifically created ‘for seniors.’ But having the ability to customize a mainstream product pleases them.”

They can’t afford to lose a dime, and so trust has been a hurdle. FHN research classifies only 17% of low- to moderate-income Americans over 50 as financially healthy. Indeed, the research, conducted before COVID-19 arrived in the U.S., found that these seniors often feel like many technological choices are being foisted on their generation. Often the presentation and formats of digital channels fail to include approaches and options that would make them comfortable with online and mobile services. And many fear setting up automated payments and the like because they worry about potentially incurring fees that they can’t afford.

However, the research found an interesting wrinkle. While these seniors have concerns and needs, they don’t want digital financial products specifically created “for seniors.” But having the ability to customize a mainstream product, such as being able to change type style and size to improve readability, does please them.

“They seek fintech products that will make them feel included, financially competent and tech-savvy,” the report states. “… By creating a small ‘win’ that gives users a sense of autonomy and pride, personalization (of background design, dashboard content, etc.) signals that older users can make a product work for them.”

Marketing Angle: Here’s an opportunity for banks and credit unions that saw significant adoption of digital banking among seniors during the COVID-19 lockdowns. The report suggests engaging seniors who are comfortable with online and mobile banking to be digital advocates or ambassadors. Financial institutions have just grown a crop of potential digital boosters.

Who says an “influencer” can only be a 20-something fashionista?

Read More:

- Mobile Banking: Financial Institutions Must Clean Up Their Apps

- Pandemic Gives Traditional Banks a Rare Chance to Catch Up Digitally

- What Reopening Plans Reveal About Retail Banking’s Future

10 Tips to Keep Adoption Momentum Going

The report has an extensive set of recommendations. Among them:

1. Choose imagery that’s inclusive. “Use marketing that showcases different ethnicities and backgrounds, and that frames aging in a positive light,” the report advises. No one likes being portrayed as dumb, helpless or past it.

2. Emphasize reliability. Remember, seniors shop around, and if your app has lots of downtime, they’ll learn about it from reviews and nasty comments left online. But if you have a great record, this is the crowd to brag to.

3. Offer online demos that don’t require commitment. Any type of tryout that doesn’t require immediately surrendering personal information builds confidence in the product.

4. Customize, customize, customize. Do you have trouble reading small type? Type that’s gray instead of sharp black? So do many seniors. “Customization — within reasonable parameters — is an empowering experience, and signals that a product or service was designed with ‘users like them’ in mind,” the report states. Make it easy to find the controls enabling users to customize or you’ll defeat the purpose of building them in.

But in addition, “strike a balance between providing options for a range of potential customization uses and maintaining simplicity so that users are not overwhelmed.”

5. Don’t forget the human element. Make it easy to switch into voice mode with a real human for times of confusion. If chatbots are part of the service, don’t fail to enable users to switch to a person.

6. Test with senior citizens. Why guess at what will and won’t serve seniors’ needs? When testing new features, include seniors in pilot groups. And, as pointed out earlier, there’s a self-selected group of seniors who have just been using your existing digital services. Chances are they would love to share some thoughts about what they loved about your service now — and what they didn’t.

7. Invest in “wayfinding.” Not just seniors will thank you if you make it easy for users to get back to where the were before on your app or website and make it clear when a task has been completed successfully or at least that the user is still going down the right path.

8. Keep tutorials available — and keep them fresh. No one is going to sit down and watch every tutorial you offer any more than people read instructions on tech products all the way through. Make it possible to view tutorials again, and if there are updates to the service, make sure the tutorials remain in step.

9. Make it easy to pause automated services. Ever experience the frustration of trying to cancel or amend an ecommerce subscription? As described earlier, trusting automated charges and more is a big step for seniors on a budget. So make it easy to control these features and make it easy to find the controls.

10. Provide a Plan B. Forgetting passwords can be frustrating, and may even lead to abandonment of a relationship. This feeds into seniors’ fear of losing access to critical financial information. Make it easy to reset passwords, or even consider biometric authentication.