No solution in financial services generates more discrepancy between what a consumer says they want and what they are willing to put effort towards than the management of money. A part of every consumer’s New Year’s resolutions, the desire to budget, save, invest and spend more wisely has always been easier said than done.

“PFM vendors and banks will only succeed if the focus moves to creating context-sensitive insight and functionality that helps consumers make good financial decisions.” — Frank Bria, Principal and CEO, Bria Analytics Group

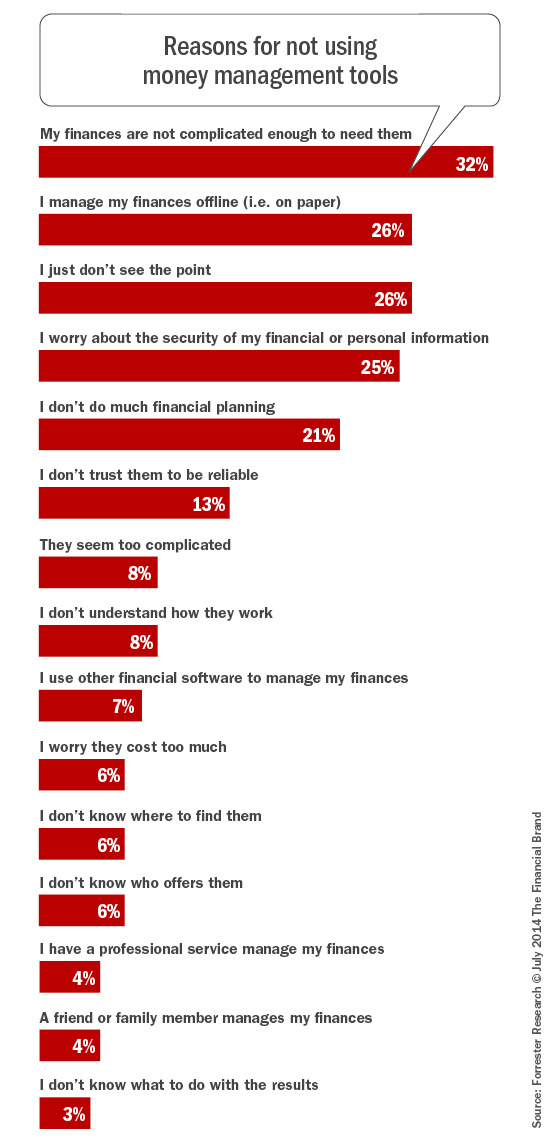

So it should have come as no surprise to personal financial management (PFM) solution providers that, while the ‘demand’ by both consumers and financial institutions for their solutions over the past 24-36 months was strong, the actual adoption rates of the varied tools at banks and credit unions has been less than anticipated. From viewing aggregated account balances, to receiving financial alerts to earning rewards, the consumer wants it all. The problem is, they don’t want to expend much energy to receive these benefits.

In a Forrester Research report entitled Best Practices In Digital Money Management, the following recommendations were provided to solution providers to make PFM solutions more viable:

- Take a systematic approach to understanding consumers’ needs

- Make it easy for consumers to achieve their money management goals

- Use marketing and education to drive customer adoption

- Provide useful advice that is easy and fun to use

In other words, understand the consumer (using both internal and external data), make the process as seamless as possible, promote ongoing engagement, and offer tangible and intangible incentives. Unfortunately, early iterations of PFM made the consumer do much of the heavy lifting, providing ‘bolt on’ solutions that were not integrated into the daily customer experience. And while the visual deliverables were fantastic, the process was far from fun.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

As Frank Bria says, the “F” in PFM Should Stand for “Fail,” and in his book, Seven Billion Banks: How a Personalized Banking Experience Will Save the Industry, “PFM vendors and banks will only succeed if the focus moves to creating context-sensitive insight and functionality that helps consumers make good financial decisions.”

In an exclusive interview with The Financial Brand, Melanie Flanigan, senior director of marketing at Yodlee said, “The financial management ‘enthusiasts’ (who keep track of every detail of every financial account) love PFM and continue to actively use it and receive substantial value. But the mass population, while needing financial tracking & controls, don’t aspire to be as in-the-weeds as many PFM users today are.”

“For those less engaged, it’s more of a contextual thing – getting advice ‘in the moment’, with automatic account triggers that only engage you when required, apps for both short-term and long-term use cases (e.g., save for vacation vs. retirement planning), automated advice, financial planning help, ‘people like me’ social benchmarks, etc.,” continued Flanigan. “The trick is to surface what a user wants, and only what that user wants, and let them go as deep as they choose to go, on whatever device and in whatever fashion he/she chooses.”

Moving to Contextual Money Management

The Mapa Research PFM Insight Series report entitled, Will Big Data Projects Help Put PFM Center Stage, provides in-depth insight into how digital PFM has evolved over the last 12 months, along with an account of the top developments from providers across the globe. One of the most significant trends seen was a shift from just visualising and presenting historical data to providing more forward looking insight such as financial calendars, cash flow projections and real-time alerts.

“PFM is not a product silo, it is a platform, for the consumer and business.” — Bryan Clagett, Chief Marketing Officer, Geezeo

In addition, the majority of PFM solution providers are working on a wide variation of big data projects, with the goal to provide more intelligent insight and marketing messages to the consumer. As discussed in an interview with Yodlee Interactive by Forbes, the benefits of these projects include more targeted solutions and increased sales and loyalty. Looking ahead, solution providers anticipate that using ‘big data’ will become even more important. This could even include collaborations between financial institutions and merchants which will result in consumers receiving intelligent offers based on PFM data.

Most importantly, PFM is becoming more embedded into the overall digital experience according to Mapa. “The early generations of big chunky implementations seem to be disappearing, with increasing development of mobile-first solutions that work behind the scenes as opposed to being bolted on solutions.”

“Moving towards ‘PFM as a platform’ is a huge opportunity for banks and credit unions, says Bryan Clagett, chief marketing officer at Geezeo. “PFM will evolve from a simple product silo to something much more robust and in fact will drive the digital banking experience, rather than be an ‘add on’.”

Different providers and organizations are taking different approaches including:

- Internet, mobile as well as tablet banking only

- Mobile and tablet banking

- Cross channel solutions

- Responsive web design implementation

According to Clagett, one of the biggest changes in the past 12 months is that clients are wanting a deeper PFM integration with online banking and mobile. “Many of our current clients and partners are using our API to bring elements of PFM into online and mobile banking. I believe payments integration is the next natural step in the evolution of PFM.”

In the Mapa research of PFM implementations globally, they found that many of the features are fairly similar across the new initiatives coming to market. While there were a small number of standout examples, it is the methods used by the providers to facilitate integration and increase both intuition and engagement that was the most distinctive.

Next Gen PFM As A Selling Tool

According to Matt West, SVP at MoneyDesktop, Financial institutions increasingly want the ability to leverage big data for cross-selling purposes. They recognize that their data is severely limited by the fact that they can only see their users’ internal accounts, and they recognize that PFM solves this problem by providing views outside the bank or credit union’s walls. “Once a financial institution can see each user’s internal and external accounts, they immediately gain a better understanding of their user base. This allows them to market more effectively by leveraging the aggregated data to create contextual ads and offers,” said West.

West continued, “Users no longer see irrelevant advertisements. Instead, the experience is more like Amazon’s ‘recommended for you’ concept, which users appreciate. This is possible with the successful categorization and account aggregation PFM can provide.”

Duena Blomstrom, vice president of brand strategy at Meniga said in an interview with The Financial Brand, “PFM becomes a set of visualisation tools of one’s transactional information … the de facto “back-end of the front-end” essentially acting as a data enhancement platform enriching transactions by aggregating all transactions from all internal and external sources.” As banks and credit unions categorize them and perform other operations like merchant mapping, this allows organizations to get even more engagement with quicker to deliver better advice and offers.”

Notable Global PFM Examples

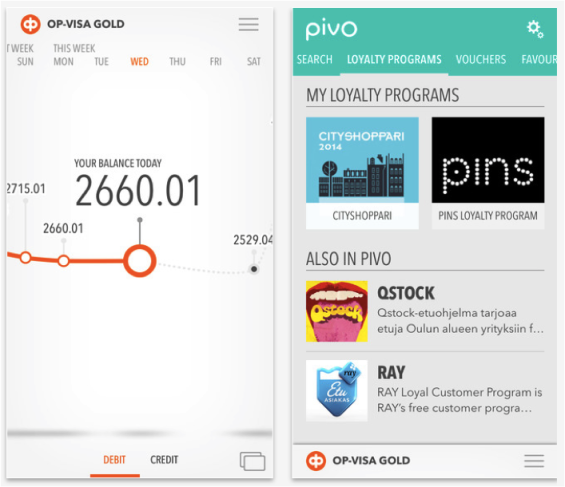

In October 2013, OP-Pohjola in Finland launched a free mobile wallet solution to its customer base. It will soon be available to all Finns regardless of who they bank with. The Pivo app (separate to the regular mobile banking app) stores account, payment and loyalty cards, favorite shops and their special offers. Most importantly, enables the consumer to see what has happened and what likely will happen in the future.

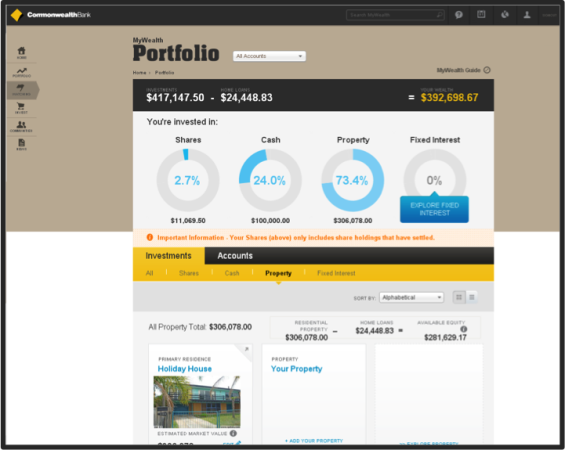

MyWealth from Commonwealth Bank in Australia is a consumer’s online investment hub. The services sits separate from the regular internet banking platform and provides a summary of cash, shares, property holdings: aiming to make investing easy. The service provides visual summaries, health check tools and access to expert views that can be interacted with, making it an appealing and an engaging experience.

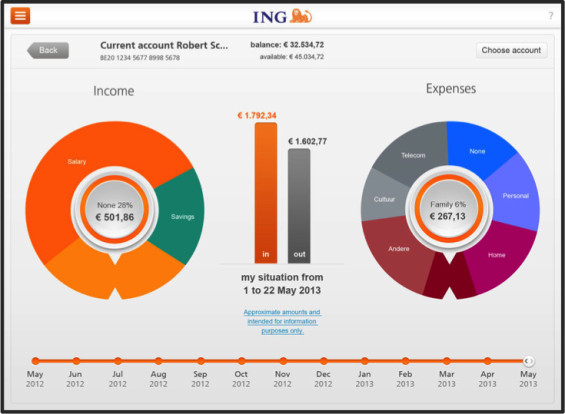

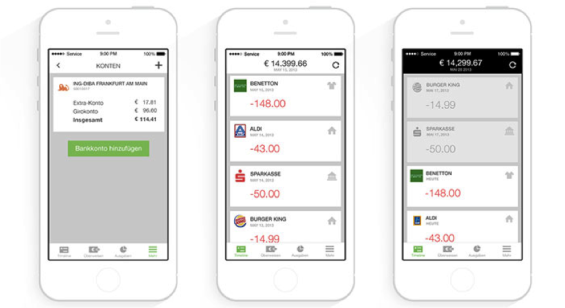

‘Smart Banking’ from ING consists of one clear and intuitive overview page. Users can set the preferred time period at the bottom. By pressing and turning the wheel users can choose to highlight categories of interest. When tapping ’View details’ users can see a breakdown of spend in that particular category. ING has prioritised developing PFM features for iPad users only.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

A number of providers have used the Facebook feed feature as inspiration for PFM related developments as a way to present features more intuitively and engaging. Numbrs (One App, Every Bank) is a mobile banking application that allows users to conduct transactions, track spending, pay bills, and predict future income and expenses. The application supports all major banks and is compatible with iOS iPhone. The app has seen + 200,000 downloads to date.

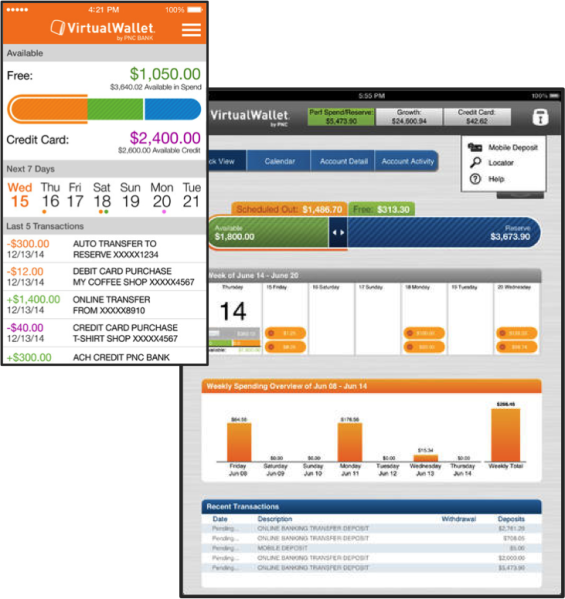

While not a new digital money management solution, Virtual Wallet from PNC continues to be upgraded and is viewed by many to be the standard to measure customer engagement. With appealing and easy to understand graphics as well as tools to manage spending, saving and credit, this application that was once geared exclusively to the Gen Y segment, goes far beyond most to meet the needs of any digital consumer.

Tink is a Swedish start-up that has taken inspiration from the likes of Mint. Covered extensively in the Mapa research report, Tink is targeting the mass market as being an easy way to consolidate and manage all of a consumer’s finances. Once a consumer enters their banking, credit card and other financial information, Tink automatically retrieves new data as soon as a change occurs, thus ensuring that the analysis is always completely up-to-date, no matter how many banks the consumer uses.

The Future of Digital Money Management

It is clear that the ‘early movers’ in the PFM space, while benefitting from the learnings that laggards will not have, also suffered both in time and money supporting bolt on solutions that weren’t embraced by the consumer. And while the economic justification for integrated money management remains, the delivery and execution of the solution is vastly different than even 12 months ago.

Today’s digital money management solution works behind the scenes to provide contextual benefits that don’t require nearly as much consumer involvement. This results in an entirely different PFM experience, enabling it to become much more mainstream. Interestingly, the solutions being developed today are built for the digital consumer, who is more likely to use a mobile device (smartphones and tablets) to understand their finances as opposed to an online tool.

As we move forward, PFM, as a stand alone solution will probably disappear. Instead, there will be an assortment of visualization and transactional analytical tools that a bank or credit union will be able to select from that will become integrated within future digital banking experiences. “The most critical change will consist of tearing down the walls between digital banking and PFM. No more product silos. No more of the fractured digital experience. Third-party providers will work in tandem better than ever for the benefit of the end user, and in turn financial institutions will understand why PFM is so critical,” stated Matt West from MoneyDesktop.

“The ‘ergonomics’ of digital banking is evolving to better answer consumer needs for ease, convenience and empowerment, said Clagett. “PFM is not a product silo, it is a platform, for the consumer and business.” Blomstrom may have put it best when she said, “PFM doesn’t need to be visible … it needs to be the foundation of all interactions we have with the with the consumer as we deliver sticky, relevant and contextual experiences … hence engagement.”

The Mapa PFM Insight Series

Mapa Research has followed the growth and changes in the PFM marketplace for the last few years. Besides providing a 76 page view and analysis of the overall marketplace, a Mapa PFM report also includes insight from four leading PFM vendors, highlighting what they have been busy working on and where they see the market going.

Findings from the report included:

- PFM was not top of mind delivery wise during 2013. Generally speaking, PFM in its pure sense, was not a key area of development among traditional banks during the last 12 months. Mapa believes, however, things were being worked on behind the scenes as part of developing self-servicing features for mobile and tablet environments.

- PFM is moving into the overall digital experience. Mapa highlights many new initiatives in their report that are naturally integrated as part of service offerings.

- Non-traditional players are raising the bar. New players outside traditional banking are setting new standards for what it is feasible and how to present data. As a result, pressure is being added to deliver similar experiences.

A 13-page summary of the more expansive report is available.