While financial services and technology behemoths overall set the pace for digital maturity in banking, some far smaller players demonstrate equal or greater digital prowess. These “David” disruptors consistently punch above their weight class through visionary leadership, scrappy cultures, innovative mindset and nimble operations.

At the other end of the spectrum, many well-resourced banking “Goliaths” appear stuck in a former era. Despite ample budgets and much larger customer bases, they trail smaller peers in deploying capabilities to meet escalating digital age expectations.

These were some of the surprise findings of research done by Emerald Research Group in conjunction with the Digital Banking Report, sponsored by Alkami Technology.

The research takes a deep dive into the varying levels of digital maturity across banks, credit unions and fintech firms, revealing a landscape that is both diverse and dynamic. The research was completed in December 2023, painting a picture of the spectrum of maturity by categorizing banks and credit unions into distinct segments based on their readiness and implementation of digital strategies.

The research illustrates what separates those still digitally emerging from those who are on the forward edge of the digital and data spectrum. Here’s a sample of insights the research unpacks:

- The most digitally advanced institutions reported twice as much revenue growth in 2022 as the least digitally advanced in our study.

- Top performers embrace the maxim “Digital transformation starts when legacy leadership embraces change,” cultivating innovation and change-readiness into their organizational DNA to continually expand digital capabilities.

- Data-driven decisions fuel the breakaway of banks and credit unions who have democratized analytics across their institutions, leveraging data to inform most decisions.

As with most industries, digital mastery increasingly mirrors business dominance. The organizations realizing this today will increasingly bank the customers of tomorrow. Their visionary efforts form the foundation for impending industry leadership.

Yet, economic advantage provides only one motivation for prioritizing digital maturity. With customers conducting 60% of their financial interactions via digital channels today – a figure growing annually — digital experience has become a key brand component for banking organizations.

Download the Report: Digital Sales and Service Maturity Model

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Spectrum of Digital Maturity in Banking

Our analysis revealed common patterns that distinguish financial institutions on a digital development spectrum. The four evolutionary stages of digital maturity in banking include “Patiently Exploring,” “Innovation-Ready,” “Digital-Forward,” and “Data-First.” Each segment possesses unique strengths and weaknesses reflecting their digital priorities and willingness to challenge conventional views.

The report described the four segments as follows:.

- Patiently Exploring (14%) — Primarily smaller institutions which place emphasis on interaction rather than technology, heavily relying on third-party digital providers. Their customer-first, relationship-driven mindset often sets them apart and they strongly value high-touch, in-person experiences. This segment is slower in adopting advanced capabilities.

- Innovation-Ready (39%) — Mostly mid-sized organizations beginning to put significant investments into technology, prioritizing user experience over advanced functionality. Most of them strive to have great platform user interface and usually deliver on it. Their next focus is typically the new or non-customer experience, adding more ways to shop for products and speeding up their account set-up experience.

- Digital-Forward (38%) — Heavily invested in digital technology and are above average in their digital maturity. Have understood the value of technology for an extended period and have automated many back-end processes. Account set-up experience among the best in the business for customers and non-customers. Striving to be a truly data-driven organization leveraging modern technologies.

- Data-First (9%) — Fully embrace a data-driven mindset, laser-focused on results and using data for nearly every decision. Consider technology a major advantage and push vendors forward if not already building things in-house. This segment tends to be larger, full-service institutions, looking beyond banking to hire the best talent. Differentiates on access to data and ability to get the most out of it.

Not surprisingly, achieving maturity goes beyond technology investment and implementation. Companies must foster a culture that prioritizes iterative and continuous innovation. Being resistant to change hinders digital maturity progress even for technology-equipped organizations.

Nearly half of FIs with underwhelming performance admit to being cautious in adopting new technologies. Most rely entirely on third-party platforms. In contrast, their higher-growth counterparts often collaborate with third-party platforms, developing some aspects of digital solutions internally. They also recruit technologists from outside the financial services industry.

Mindset Over Matter

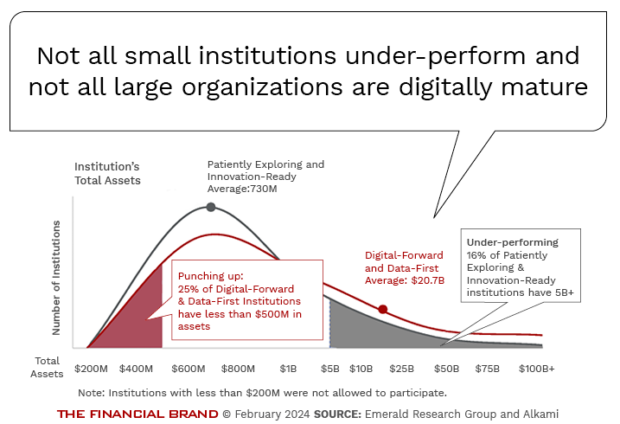

At first glance, the research findings confirm long-held assumptions. The most digitally mature segment, “Data First” adopters average near $5 billion in assets, handily outperforms general market capabilities and benchmarks. Conversely, smallest “Patiently Exploring” institutions seem overwhelmed by the exponential pace of technological change. With limited investments spread thinly across priorities, a follower’s adoption mindset tends to cripple competitiveness.

However, a cohort of remarkable overachievers punctures assumptions by thriving at a fraction of their mature peers’ resource scale. Displaying key future success markers — like customer-centric digital account opening on mobile devices, future-ready back-office automation, and data modernity — these “David” disruptors embody how culture and philosophy outweigh budget.

Meanwhile, 16 percent of those in the less mature segments are represented by institutions with at least $5 billion in assets. Though similarly resourced as elite peers, change-resistant mindsets yielding risk and data deficiencies keep them firmly grounded in a fading past.

Read more: Lack of Digital Maturity Threatens Survival of Banks Worldwide

Over-Performing Underdogs

Separating industry leaders from Patiently Exploring (regardless of size), the analysis distills distinguishing attributes that position faster movers for future success.

- Openness to change – With technology continuously redefining engagement models, they view business reinvention as the path to sustained distinction and embrace calculated risk-taking.

- Data and tool obsession – Rigorous analysis guides strategy shaped by market truths rather than internal assumptions or past experiences.

- Customer co-dependence – They fixate on removing friction through journey mapping empathy rather than pivoting solely around organizational constraints.

- Test-and-learn cycles – From partnerships to emerging capabilities, they pilot new solutions and quickly assimilate successes through agile methods.

By focusing on mindset, a modernized platform, the ability to embrace change and leveraging third-party solution providers, smaller firms aggressively tackle friction-filled processes, integrating automated solutions for instant account opening, modern payments and servicing bolstered by analytics. Consumers reward their frictionless experiences with expanded share of wallet and/or reduced attrition.

Having implanted data-informed, customer-centric cultures ahead of peers, they are already reaping multiplier effects from compounding knowledge and capability advantages that position them to lead markets for the next decade.

Some examples of smaller financial institutions that the FIsionaries Podcast found during interviews to continuously outperform their peers include, Alliant Credit Union, MSU Federal Credit Union, Coastal Community Bank. and Star One Credit Union. Each of these organizations have leadership that paves the way for a strong blend of technology prowess, digital engagement, a customer-centric focus and an innovative culture.

Download the Report: Digital Sales and Service Maturity Model

Goliaths Stuck in Yesteryear

In contrast, far too many larger institutions seem trapped by profitable, yet fading, business models that inhibit reinvention urgency. These under-performers primarily rely on vendors versus building customized solutions in-house or with partners. Constrained by data gaps and change-averse cultures, they are rarely first movers on emerging capabilities.

Consequently, lucrative segments like Millennial shoppers exit after forming negative experiences while zealous upstart tech brands, smaller agile banks and credit unions, and larger peers build acquisition and recommendation engines that display channel alignment and journey focus.

Without fundamental changes that upgrade talent, modernize technology, and realign on distinctive value, these asset leaders risk being both out-innovated on digital capabilities and outworked through nimble delivery. The threats of client erosion and talent exodus grow more urgent by the quarter.

Read more: Digital Banking Transformation Trends for 2023

Death by Lack of Digital Distinction

Increasingly, consumers first engage financial brands digitally, across prospective and existing relationships. Patiently Exploring user experiences or outdated interfaces cripple reputation and bottom lines regardless of branch density or community longevity claims. As a result, “silent attrition” occurs when digital experience needs remain unfulfilled, with customers and members retaining dwindling account balances and embarking on diversified relationships with multiple alternative providers.

Customer or member satisfaction metrics from the Digital Banking Report reveal sharp drops over recent periods for banks and credit unions lacking mature digital capabilities. Complaints concentrate around avoidable frustration from channel misalignment and un-targeted offers.

Mirroring times past, when most relationships were personal and engaging, many smaller yet highly sophisticated providers earn acclaim through customer empathy, self-service simplicity and frictionless processes that have replaced the benefits of human interaction. Streamlined account opening and simplified account funding capabilities headline capabilities, drawing consumers through seamless experiences.

These dynamics debunk long-held precepts. Competency now outweighs legacy as disappointed customers increasingly choose among commodity-like services, searching for the best fit.

The Bottom Line

By correlating size and revenue with digital maturity markers, new analysis indicates long-held truisms don’t always apply.

Those clinging to conventional relationships find poles reversing as consumer behavior evolves exponentially. To win market relevance and wallet share moving forward requires adopting long-term, results-obsessed approaches of today’s overlooked overachievers.

Institutions aiming to enhance their digital maturity should:

- Prioritize customer-facing digital channels over legacy physical infrastructure.

- Shift culture from intuition-led to data-driven decision making.

- Collaborate with third-party partners to pilot emerging technologies.

Rather than resign themselves to diminishing competitiveness, large and small incumbents alike must reassess assumptions of their advantages – and manifest the agility to take calculated risks in transforming to meet escalating digital age demands.