More than one banking analyst has labelled regional banks an endangered species. Too big to be nimble and local, too small to compete with the giant banks. In particular regional banks often find it challenging to invest in the technology needed for digital banking transformation. As with all financial institutions, regional banks need to rethink existing business models and support a challenger mindset. Finally, to be successful, regional banks need to develop innovative ideas and approaches to reduce expenses, create new products and services, serve unique market segments and leverage technology for future growth.

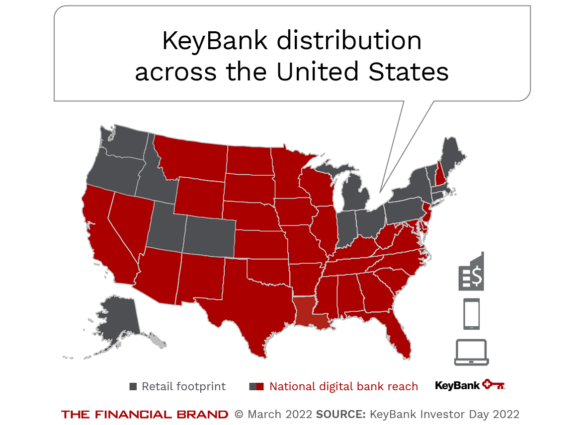

One organization that has emerged as a regional banking success story is KeyBank. Headquartered in Cleveland, Ohio, KeyBank is a top 20 bank serving 15 states with over 1,000 branches and 1,500 ATMs.

CEO Chris Gorman has been with KeyBank for over two decades, becoming chairman, chief executive officer, and president of KeyCorp in May 2020, succeeding Beth Mooney, the first female CEO of a top 20 U.S. bank. The timing of Gorman’s ascension occurred just as the pandemic gripped much of the world, and the banking industry in particular.

According to Gorman, his primary focus was to help his employees and customers deal with the impact of Covid-19. At the same time, he wanted KeyBank to continue to improve their digital banking capabilities as customers increasingly changed their daily banking habits. This was achieved through investment in internal capabilities combined with partnering with, and acquiring, third-party digital solutions.

Below are highlights of the interview. You can listen to the entire interview in the Banking Transformed podcast.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How is the digital transformation process going at KeyBank?

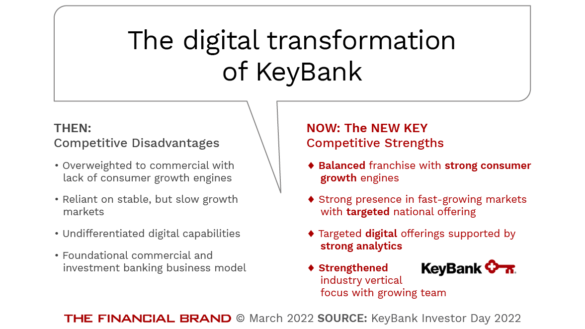

Gorman: I see Key as a digitally progressive bank, not just a regional bank. One of the reasons we’re so able to do that is because we’re focused on just certain sectors.

Gorman: I see Key as a digitally progressive bank, not just a regional bank. One of the reasons we’re so able to do that is because we’re focused on just certain sectors.

Our strategy is what we call ‘targeted scale’. We’re not trying to be everything to everyone, but for those clients we are focused on, we’re trying to be really important to them, and to be digitally out in front. We redid the entire front-end of our digital offerings, and we’re to a point where we have end-to-end digital processing for 90% of our products.

We’ve also bought a lot of fintech companies. For instance, we bought a company called Laurel Road in the second quarter of 2019. When we bought them, they had 32 full stack engineers. Today, that number’s above 50. In the first quarter of 2021, we turned this acquisition into a digital affinity bank serving doctors and dentists globally.

In addition, I always say you can’t be a great digital bank unless you have great analytics. Last year we bought a business called AQN. We put them in charge of our analytics. One of our four strategic pillars is to digitize the entire enterprise. It’s great to have great front end, but you have to have a smooth middle and back office as well. We’ve made huge progress here as well.

How has Key automated and digitized the back office?

Gorman: We started from scratch, and instead of trying to cobble it all together, we built the back and middle office on a very flexible platform that enables us to iterate very, very quickly. We basically built a new chassis from the beginning as opposed to working with the systems and processes we already had.

Can you discuss the concept of ‘targeted scale’ at KeyBank?

Gorman: The secret is to figure out who you want to be relevant to, where you win, how you win, and why you win. We said we’re going to make a pivot and we’re going to be focused on certain industry sectors by definition.

For instance, we are a leading healthcare bank. Several years ago, we bought a leading boutique that advised large healthcare organizations. On the commercial level, we helped provide capital and handled payments. On a consumer side, we helped doctors and nurses refinance student loans, buy houses, and manage their money. We ended up offering all employees of healthcare organizations specialized financial planning and financial wellness tools.

We used the same strategy for the technology sector, buying a boutique shop and creating specialized solutions. We’re also focused on some great niche plays. For instance, we are the number two financier of renewable energy in the country. We’re also the number three player in the exploding area of affordable housing.

How important is the combination of physical and digital?

Gorman: The nice thing about digital is that it removes the constraints of geography. Right now, a full 25% of our new customers are under 30. I think that really speaks to the combination of digital and physical, because people that are under 30 are digital natives and they know what they want – and they know what good technology is. We think we provide a leading digital banking solution.

The other thing that helps us grow is that we are [physically] in some really fast-growing markets. With either physical or digital delivery, the way you get engagement is to push out real information that matters to the customer and having a connectivity with them.

How does Key invest to keep up with much larger financial organizations?

Gorman: It starts with targeted scale. We’re not investing in everything. We’re trying to figure out where we can be relevant. We spend about $800 million a year in tech and ops with $200 million or so of that in front-end capabilities. We’ve done a lot of the heavy lifting around core systems, so we have a lot of money that we can spend. We also buy other companies that wouldn’t be included in those numbers – where we get technology, we get people, we get capabilities.

Read More: 9 Digital Transformation Hurdles Facing Financial Institutions

What challenges does your bank face?

“You can’t be a great digital bank without great analytics. We need to find the data which is actionable so we can be out ahead helping our clients. A great digital bank also has to fight complacency.”

— Chris Gorman, KeyBank

Gorman: The biggest challenge we face is that we’ve got competition from every direction. Large banks that have significant budget, fintech firms that focus on certain things that matter to certain groups of people, and smaller banks that are consolidating and getting bigger. We must make sure that we’re out in front of our targeted customers and that we’re really relevant and differentiated.

The next challenge is you can’t be a great digital bank without great analytics. We have $5 trillion worth of transactions that run through Key on an annual basis. What we need to be able to do is find that which is actionable. Finally, one thing that we all have to fight is complacency. What worked in 2021 won’t work in 2022, and what works in 2022 won’t work in 2023. We always have to be looking ahead 18 or 24 months.

Read More: Tech Is Only One Piece of The Digital Transformation Puzzle in Banking

What is your perspective on M&A going forward?

Gorman: In terms of buying another traditional bank, I don’t think scale just for scale’s sake makes a ton of sense. It would have to have a very high bar strategically, and it would also have to make sense from a financial perspective.

We bought First Niagara in 2016, took out 42% of the costs, and kept the people and the clients. That was a successful business model. But our strategy right now is to focus on serving our targeted clients. The largest bank in the United States has $3.7 trillion in assets. We’re a very large bank at $180 billion … so I would ask the rhetorical question, what is scale?

How do you build a ‘digital culture’ that accepts change?

Gorman: One of the things that we reward and talk about throughout our company is the notion of being intellectually curious. And then the notion that we need to iterate quickly. When we look for people, we want those with great subject matter expertise – but we’re also looking for people who are just business people, who just enjoy being in the game and trying to figure it out.

What is the biggest opportunity in the future?

Gorman: I’m a big believer that we need to continue to invest heavily. We need to invest in our people. We need to invest in digital. We need to invest in analytics. Those will drive growth and growth will create opportunities for our shareholders and also for our teammates.