While the potential benefits of digital technologies are well documented and accepted by a majority of bank and credit union leaders, the deployment of digital banking transformation does not appear to be keeping pace, according to the Innovation in Retail Banking 2019 report, published by the Digital Banking Report, and sponsored by Infosys Finacle in cooperation with Efma,. This is concerning given that the pervasiveness of required digital transformation is moving beyond the IT area of banking to include virtually all areas of the organization.

Financial institution executives surveyed indicate that budgets are increasing for almost all digital technologies and that the technologies being impacted are expanding. At the same time, the ownership of both digital transformation and innovation are moving up the organizational hierarchy, with cross-functional teams being leveraged to break down legacy silo perspectives.

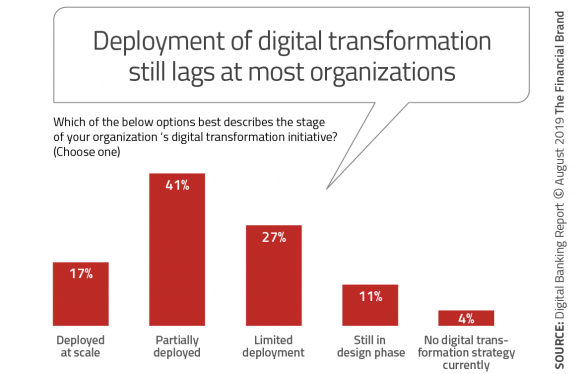

When asked about the progress of digital transformation efforts, only 17% of organizations surveyed indicated that the transformation was ‘deployed at scale’, with 41% stating that digital transformation was ‘partially deployed’. An additional 38% indicated that their efforts were either in the design phase (11%) or had ‘limited deployment’.

There are strong indications that leadership lacks experience in implementing such massive transformations. This has resulted in a prioritization of technology being purchased that may only scratch the surface of needed transformation. For instance, purchasing a new mobile banking platform is only as good as the underlying processes that also must be changed to improve the overall digital banking customer experience.

It also appears that the current financial strength of the industry is resulting in complacency around making large, overarching changes to what has long been the operating norm in banking. But the challenges don’t end there. On the not-too-distant horizon, banks and credit unions will need to address a digital skills shortage and the internal culture shift requisite to facilitate needed innovation and transformation.

Read More:

- Financial Institutions Aren’t Prepared for the Digital Revolution

- How Bank of America and Chase Get Mobile Account Opening Right

- Becoming a ‘Digital Bank’ Requires More Than Technology

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Digital Transformation Not Meeting Business Objectives

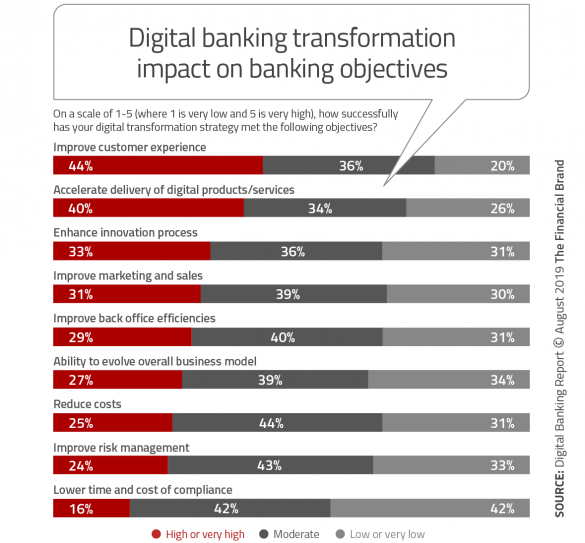

When financial institutions were asked about the objectives of their digital transformation efforts, the top objectives included improving the customer experience, accelerating the delivery of digital products and services, remaining competitive in the current marketplace, implementing more efficient business models, reducing costs and increasing revenue.

When financial institutions were asked about the objectives of their digital transformation efforts, the top objectives included improving the customer experience, accelerating the delivery of digital products and services, remaining competitive in the current marketplace, implementing more efficient business models, reducing costs and increasing revenue.

When the same organizations were asked about the success of their digital transformation strategy in meeting these objectives, results were inconsistent at best. Digital transformation seems to be having the greatest impact in the areas of customer experience and the delivery of digital solutions, with most other objectives not being impacted nearly as much.

Seeing that one of the most important elements of a successful digital banking transformation is the ability to change existing business models, it is concerning that only 27% of organizations believed that digital transformation impacted this objective significantly.

Digging deeper into the data reveals a correlation between the size of an organization and the progress of digital transformation. The Digital Banking Report research found that larger organizations had greater digital transformation maturity and greater success in meeting organizational objectives. Credit unions also performed better than their community and regional bank counterparts.

Read More:

- Digital Future of Banking Requires New Leadership Model

- What Makes A Great Digital Banking Transformation Leader?

Digital Readiness Not Aligned With Potential Impact of Technologies

As mentioned, many financial institutions are attempting to execute digital transformation on a piecemeal basis, investing in individual technologies. While important, the investment in these technologies, by themselves, doesn’t guarantee that digital transformation will be fully integrated or seamless from either an internal or external basis.

The organizations with the greatest digital transformation maturity tend to be upgrading the most number of digital technologies. In most cases, the prioritization is determined by a mix of business requirements, cost, ease (or difficulty) of transformation, and skills available either internally or through partners.

Organizations with the highest digital transformation maturity have also made progress on implementing the more sophisticated technologies. These include artificial intelligence (AI), robotic process automation (RPA), cloud computing, the Internet of Things (IoT), and blockchain solutions.

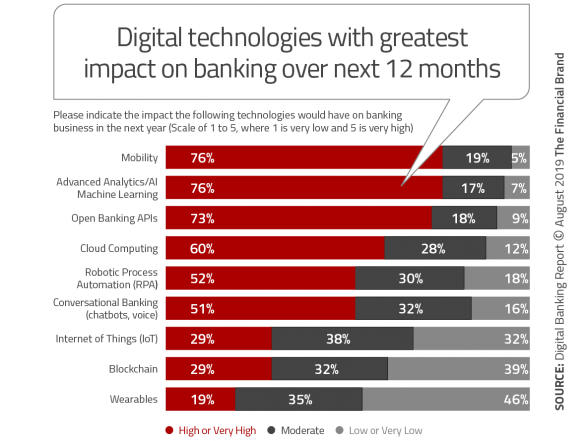

When asked which digital technologies would have the greatest impact on banking in the near future, respondents to the Digital Banking Report survey put mobile technologies at the top, followed by advanced analytics and open banking APIs. At the lowest end of the spectrum were the Internet of Things, blockchain and wearables.

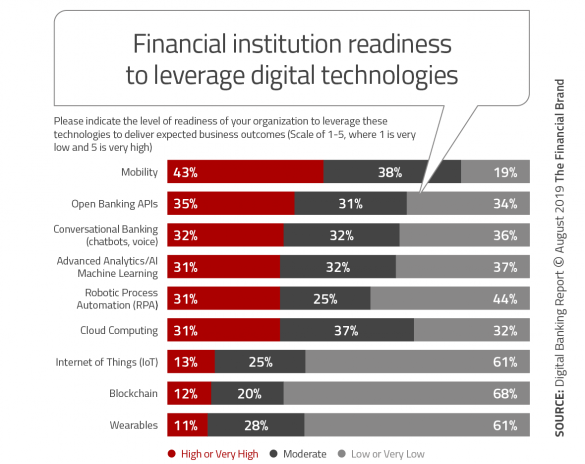

Probing further into financial institution’s digital readiness to deploy the same list of technologies, we found that most financial institutions did not consider themselves prepared for the future, with less than half of them believing they were significantly advanced with any technology. It also appeared that organizations believed they were less prepared for advanced analytics/AI/machine learning than what the marketplace may dictate (76% high impact rating – first chart, compared with 31% high degree of readiness – second chart).

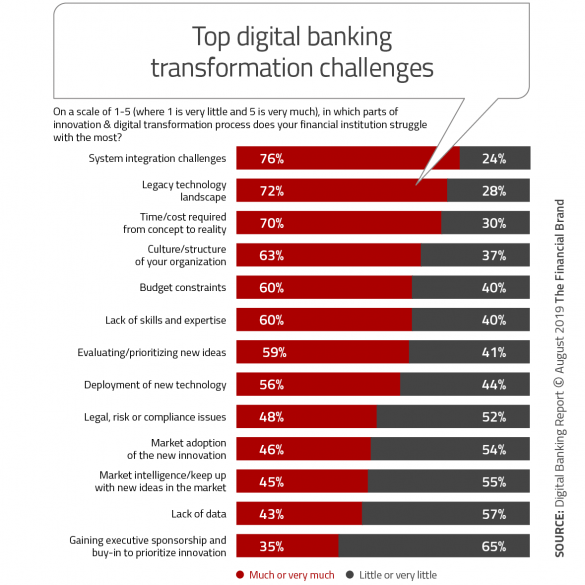

Top Digital Banking Transformation Challenges

The two most difficult challenges banks and credit unions face in their digital banking transformation journeys are not surprising: legacy technology (72%) and systems integration challenges (76%). These overarching issues are intertwined with the challenge of time and cost required for implementation (70%).

The fourth most-cited challenge was the culture and structure of the organization, with 63% of organizations saying that they struggle with this either much or very much. The financial services industry is steeped in tradition, with many of the processes, organizational structures and deliverables created decades ago, when the industry was comparably much simpler. It is clear that legacy cultures must undergo a significant evolution to facilitate the digital transformation underway.

The research indicates that, while budgets are growing, the funding of digital transformation efforts may not be keeping pace with needs. This is illustrated by the fact that budget constraints were mentioned by six out of ten organizations.

The survey results also confirm that developing talent and skills throughout the organization is considered one of the major challenges to digital transformation. This relates not just to specific capabilities, but also to the need for leaders who better understand how to integrate new digital methods and processes into existing ways of working. It is expected that this challenge will only get greater in the future due to the lack of experience in the marketplace.

As organizations take stock in the challenges faced with digital transformation, this list can provide guidance as to where emphasis should be placed.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How to Increase Chances for Digital Transformation Success

While survey respondents indicate that many digital banking transformation efforts are underway, most efforts are still in the early stages of implementation. Lessons can still be learned from financial institutions as well as non-financial organizations who have gone further in the journey. Some of the keys to success during a digital transformation include:

- Create an innovation and digital transformation culture: More important than the investment in new people or technologies, organizations must support an innovation and digital culture – using leadership and culture to accelerate all underlying investments.

- Rethink the workplace: Banks and credit unions will need to invest in people and skill sets that are radically different than what has been needed in the past. Some of this may be solved through retraining, but much will be driven through cross-functional teams, external partnerships and new employment models.

- Build from the inside-out: Buying new digital technologies will not create optimal results unless underlying processes are completely revamped for a digital future. Steps must be eliminated and design must reflect the desires of the digital consumer.

- Provide universal accessibility to insight: In the past, data and consumer insights were held within product-driven silos. For digital transformation to be successful, data, insights and digital tools must be accessible across the organization.

- Encourage risk-taking: People across the organization must be encouraged to challenge legacy ways of thinking and provided the opportunity to generate new ideas that may involve modest risk taking.

- Foster sense of urgency: Banks and credit unions have traditionally progressed slowly with change. Digital transformation requires an agile mindset with incremental changes being ongoing and rapid.