As we look back on 2020, financial institutions should be proud of the way the industry responded to a crisis that wasn’t on any organization’s radar. Faced with immediate branch closures, and the need to create digital capabilities ranging from end-to-end digital account opening and lending capabilities, to PPP small business loans, many firms did things that once seemed impossible – sometimes in a matter of days.

The ability to conduct business depended on how quickly banks and credit unions could respond to consumer needs, using technology to enable legacy systems and workforces to adapt to a new normal. The acceleration of digital transformation occurred across the entire banking ecosystem.

But the transformation was not fast enough and is far from complete. Research from the Digital Banking Report found that financial institutions ranked themselves lower in digital transformation maturity this year than they did in 2019, reflecting consumer expectations that are increasing at a pace faster than our collective ability to deliver. The report also found that innovation and data/analytics maturity in the banking industry also fell in 2020 for the same reason.

Despite the pandemic being an everyday reality for every person and business, organizations can not use this as an excuse to not push forward even further. New initiatives must be prioritized that can leverage data and analytics to improve the customer experience. Digital engagement must be improved, focusing on simplicity and speed far beyond what is currently provided. And, financial institutions must optimize the use of technology that is already in place.

Every bank and credit union must embrace the digital banking transformation trends that are forthcoming in 2021, doubling down on the commitment to improving digital customer experiences as well as the internal processes, infrastructure, products and personnel that will provide the foundation for future competitiveness.

Read More:

- 7 Essentials of Digital Banking Transformation Success

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

1. Focus on Digital Banking Experiences

Financial institutions will come under greater pressure to provide digital functionality that is both simple and fast. As opposed to new account opening or loan application processes that can be completed in 5-10 minutes (or longer), organizations will focus on internal processes, procedures and flow of data to enable completion in less than a minute to meet rising customer demands set by big tech organizations.

In some cases, financial institutions may separate their external presentation layer from their back-office data layer to create enhanced digital consumer experiences. An example of this shift is the Google Plex partnership with several financial institutions. Beyond enhanced account opening and the combination of checking and savings, the new service provides simple, seamless and personalized digital engagement.

The risk of not providing this level of customer experience will be the potential shift of new and existing business to organizations that have succeeded in rethinking legacy processes for a new digital reality. It’s more than simplified account opening – it’s an enhanced user experience (UX) across the entire customer journey.

According to Forrester, “Organizations will work to determine what really matters to their customers, identify projects to improve important experiences, prioritize the efforts with the biggest potential upside for customers and the business, and then train their employees (and give them new tools) so that they can deliver the right experiences consistently.”

2. Use of Data and AI for Predictive Personalization

Financial marketers were thrust into the spotlight with the COVID crisis, needing to respond to unforeseen circumstances in an instant. Instead of selling services, marketers were being asked to customize communication to help customers deal with the financial impact of the pandemic. Blanket communication around branch closures quickly needed to transform to personalized messages around loan payment deferrals and how to use unfamiliar digital tools.

The coming year will bring the next evolution of financial marketing, leveraging data and advanced analytics to provide predictive personalization. This use of AI and machine learning will result in tailored websites, real-time financial recommendations, and a level of test and learn capabilities far beyond what was imagined just a few years ago.

For the vast majority of financial institutions, this level of personalization is playing a game of catch up in meeting consumer expectations. Accenture found that nearly half (48%) of consumers abandoned a purchase process when the website did not personalize the experience, with nearly all consumers (91%) saying they are more likely to do business with brands that know them, look out for them and reward them.

Unfortunately, research by the Digital Banking Report found that 75% of financial institutions considered themselves ‘not adept’ and using data and analytics to determine a next best action. Despite this performance gap, the accelerated growth in predictive personalization will be a key digital transformation trend for success in 2021.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Rethinking Financial Services with Artificial Intelligence Tools

3. Movement to Cloud Computing

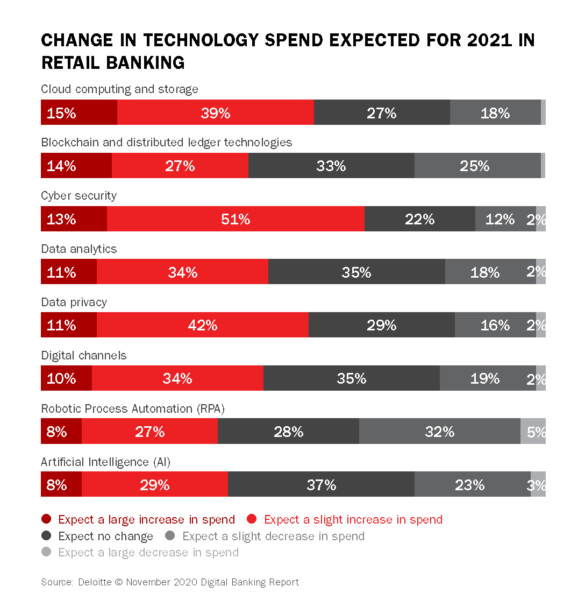

The movement to cloud computing has been slower than anticipated in the banking industry, mainly because of concerns around security and perceived accessibility for smaller institutions. With the importance of processing increasing amounts of data as quickly as possible, and the desire to provide increased accessibility to insights across organizations, the use of hybrid cloud infrastructures will escalate significantly in 2021.

This embracing of cloud computing will be considered by financial institutions of all sizes in the coming year because of increased investment in scalable and industry-specific capabilities by IBM and other providers. These solutions standardize many of the cloud capabilities, eliminating much of the up-front investment previously required. These solutions also address issues like privacy, security and compliance.

According to Daniel Newman, contributor to Forbes, “The widespread, sudden disruptions caused by the coronavirus have highlighted the value of having as agile and adaptable a cloud infrastructure as you can — especially as we are seeing companies around the world expedite investments in cloud to enable faster change in moments of uncertainty and disruption like we faced in 2020.”

4. Automation Becomes a Financial Imperative

At a time when most financial institutions are concerned about the prospects of loan losses and the shrinking of revenues in a post-pandemic economy, the focus on automation and robotics seems natural. Robotic Process Automation (RPA) can increase efficiency by providing a cost-effective substitute to human resources both in-house and outsourced.

While still in its infancy, RPA provides the benefits of cost reduction. increased efficiency, enhanced accuracy, improved customer experiences, and seamless flexibility. Similar to the movement to cloud computing, this trend is gaining momentum because of the influx of external providers who have leveraged lessons learned over time to provide scalable solutions at a reasonable cost to small and large organizations.

“Global robotic process automation (RPA) software revenue is projected to reach $1.89 billion in 2021, an increase of 19.5% from 2020”, according to the latest forecast from Gartner, Inc. “Despite economic pressures caused by the COVID-19 pandemic, the RPA market is still expected to grow at double-digit rates through 2024.”

Read More:

- Financial Institutions Aren’t Prepared for the Digital Revolution

- Becoming a “Digital Bank” Requires More Than Technology

5. Investment in Privacy and Security Escalates

While virtually all financial institutions state that improving the customer experience is the top corporate priority, the same organizations are increasing investment in privacy and security solutions more than any other technology. The reason for this investment is clear. Not only are the risks of breaches increasing, but consumers are becoming much less tolerant of organizational mistakes.

Cybersecurity and data privacy will become a unique selling proposition (USP) for many financial institutions and big tech organizations. In an interview with the Banking Transformed podcast, David Birch believes consumers will be the ultimate owner of their identity, but that financial institutions will be the place the identities are maintained.

In this scenario, consumers will manage access to their data residing on applications, web and other digital channels, with the burden of complying with increasingly stringent regulations being the responsibility of banks. While the EU has built regulations around privacy and security with the General Data Protection Regulation (GDPR), this is only the beginning.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

6. Redefined Future of Work

Across the entire banking ecosystem, financial institutions are rethinking the way work is done, where it is done, and the skills that will be required to do work going forward. What initially was remote collaboration necessitated by a global crisis, became more normalized as the pandemic extended from weeks, to months and longer.

More than ever, organizations realized the importance of flexibility, adaptability, self-sufficiency and teamwork during the pandemic. Without the benefit of in-person engagement, financial institutions still needed to create, innovate and collaborate at a pace never before imagined. For the most part, there was a surprisingly high level of success.

While upskilling was a priority for most financial institutions before the pandemic, it became a business imperative as organizations recognized the significant skills gap caused by the explosive shift of consumer engagement to digital channels. According to an excellent report by Udemy for Business, 38% of workforces have already been upskilled in 2020, compared to only 14% in 2019.

Beyond reskilling, most observers do not foresee a return to traditional corporate office spaces in the near future. Not only has the pandemic failed to subside, but many organizations see remote work as part of the future as they try to find ways to reduce costs to better compete with digital organizations.

7. Open Banking as a Revenue Opportunity

Most financial institutions see open banking as a technology that allows consumers to access data from multiple organizations, opening the door to innovative services through open APIs. According to Juniper Research, the number of open banking users is expected to double in size from 18 million in 2019 to more than 40 million users by 2021.

Beyond the traditional view of open banking, there is the potential for exciting new services with revenue opportunities. New banking solutions – with seamless customer experience at the front end and multiple interconnected providers in the background – will become the norm in the near future. Some organizations are already having success with these new models. Both imagin from CaixaBank and Liv from Emirates NBD are examples.

According to Gartner, “The API economy is an enabler for turning a business or organization into a platform. Platforms multiply value creation because they enable business ecosystems inside and outside of the enterprise to consummate matches among users and facilitate the creation and/or exchange of goods, services and social currency so that all participants are able to capture value.”

Key Takeaways for Banking Organizations

For digital banking transformation to be successful, there must be an alignment between all areas of an organization, starting at the top. Without a commitment of C-suite executives to the process of digital banking transformation, investments in technology will be wasted and customer experiences will suffer.

The foundation of an organization’s digital transformation journey must be around data, analytics and technology, but the human element can’t be ignored. An alignment between the CMO and CIO or CTO is imperative, but the entire organization must become comfortable with using the insights that are generated from AI and machine learning initiatives. This will require an upskilling of legacy skillsets and a change in legacy culture.