Nailing the subject line ranks as the most important task in email marketing. A subject line of lead won’t sell an email body of gold. Unopened marketing emails might as well have never been sent at all.

Banking institutions fire off millions of marketing emails annually, some of which work well, and many of which go … thud.

Anjali Ambani, Senior Research Analyst at Mintel Comperemedia, sees more of both than the typical financial marketer does, given the company’s vast network that pulls in email, direct mail, and other marketing efforts across the financial services business.

Ambani spoke with The Financial Brand shortly after issuing her 2018 Banking Annual Marketing Review. Something not covered in the report but of deep interest to every financial marketer desperate to improve open rates is the subject line.

Banking players have been tinkering with many aspects of their email efforts, including new twists on subject lines. The text of the subject lines themselves is evolving. Ambani ticks off some of what she’s been seeing among the largest email senders:

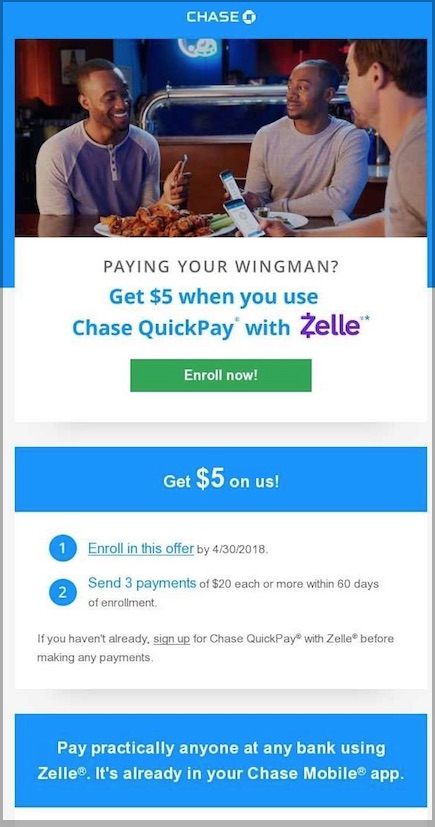

JPMorgan Chase – Emphasizing dollar values of incentive offers.

Bank of America – Using recipients’ first names in subject lines. In addition, the company has been stressing specific actions in the lines, such as signing up for billpay, scheduling appointments, and trying Zelle.

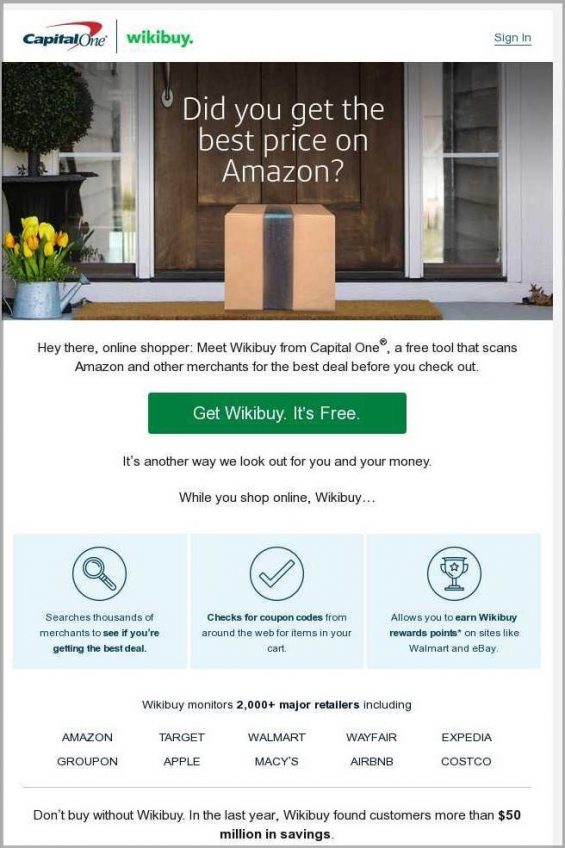

Capital One – Using a friendly tone. “Capital One has had the highest open rate among banking firms over the last few years and it’s mostly been because of the tone it takes in the subject lines,” Ambani explains. One example: “Hi, we saw you just spent $57.10 on Amazon.” (Used in a promotion for a free Capital One service that verifies you are getting the best price.)

Capital One also uses words like “Thank you” and “Loyalty” and generally the recipient’s first name in subject lines, Ambani notes. “That is how it garners those high open rates.”

But there’s a newer twist in subject lines that Ambani’s been seeing that would defy any spell checker: emojis.

Read More:

- 6 Strategic Trends Reshaping the Future of Email Marketing in Banking

- 10 Essential Email Marketing Insights for Banks & Credit Unions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Will Emojis Bring Smiles to Financial Marketers’ Rates?

The original physical smiley buttons and stickers were a product of the 1970s, followed by typographical approximations of smileys and other variations that begat the huge family of graphic emojis now available on smartphones and other devices. Since mid-2016, both Google desktop and mobile enable searches including emoji characters.

Ambani says BofA and Capital One have been trying out emojis in subject lines. Ally Bank, near-bank Varo Money, and investment app Stash use emojis in subject lines with regularity.

The analyst says this is a natural reaction to the younger consumer bases that these companies increasingly wish to serve. “Most of the younger Millennials and Gen Z like to communicate via emojis,” she says. Not only are these symbols appearing in subject lines, but even in email texts. And, for that matter, in direct mail pieces from financial companies.

“We have examples in our database that show financial mailers using a lot of these icons in direct mail, which, while it is kind of funny, may be driven by their wish to show how the bank is able to relate to the younger generations’ thinking, and their preferences for how they like to read their messages and communicate.”

Emojis increasingly are becoming a cross-generational language, the way texting has replaced many phone calls. And social media has grown rife with the symbols — so it’s all of a piece that banks and credit unions would add them to their messaging.

This should be tried carefully, experts suggest. One risk is how different browsers will display the emoji and authorities recommend testing. Another recommendation is A/B testing to see how typical consumers who already know your institution react to emojis.

Some bloggers insist that emojis always increase open rates, but a study by Clever Tap of push notifications using emoji found that acceptance varied by industry. The three industries most likely to see increases in clickthrough from implementing emojis are business and finance, utilities and services, and retail. At the bottom: entertainment and events, travel and hospitality, and health and fitness.

For financial institutions looking for differentiation, ReturnPath.com suggests six tips for testing before diving in:

- Test on a small sample.

- Don’t overdo it — there’s such a thing as too much candy.

- Make sure they make sense in context and for the industry.

- Make sure they render properly everywhere.

- During testing, keep track of where emoji subject lines are landing and being opened.

- Watch how competitors are using them.

And be sure you are using the right emoji. The meaning of these symbols can be looked up on Google — what you might think is a wry emoji may carry a very different innuendo.

You can always ask a Millennial or Gen Zer.

Read More: Banking Communications That Drive Consumers Up The Wall

Why Financial Marketers Keep Buying Stamps

During The Financial Brand Forum for 2019, marketing guru and keynote speaker Gary Vaynerchuk hammered the point that spending one dime on direct mail in the age of texting and emails was absurd. Beyond being a dated medium that he believes no one examines seriously, he feels that the dollars can be spent more efficiently on newer channels, such as paid Facebook ads.

Even so, in conversations with The Financial Brand editorial team, many bank and credit union marketers affirmed continuing faith in direct mail for appropriate missions. The large institutions that tend to show up in Mintel’s marketing surveillance network apparently feel likewise, because Ambani says volumes remained high through the end of 2018 and into 2019.

There’s a seasonality to direct mail that isn’t always appreciated. Ambani says top brands tend to use direct mail at least in the first half of the year. “That’s when consumers are most actively working towards their financial goals for the year,” she explains.

Likewise, direct mail can be more straightforward for approaching prospects, versus online marketing that’s subject to anti-spam laws. Even Ally, an online-only bank, uses direct mail for some promotions, according to Ambani.

Different players, with varying strategies, led different promotion categories in 2018. For example, a major portion of the increase in direct mail for promoting checking accounts — up 79% over 2017 — was led by Chase. CD promotion, steady year over year, was dominated by Discover. Money market account direct mail was led by Capital One. American Express led savings direct mail.

Overall, institutions tend to use direct mail to promote “orthodox messages,” according to Ambani. Cash bonuses for opening new accounts represent one such purpose. 38% of tracked direct mail messages were devoted to persuading consumers to switch financial institutions. Citibank dangled the highest such bonus seen by Mintel in 2018 — $700 to open a Citigold premium account. Chase followed with a $600 offer for opening both a checking and a savings account.

This play can be a bit of a dice roll, according to Ambani’s report, as Mintel consumer research indicates that 58% of consumers would consider changing providers to save on fees. By contrast, only 28% say they are moved by cash incentives.

An interesting angle — especially given the roiling debate over the future of the branch and its role — are messages promoting physical proximity to consumers. A promotion from Regions offered $300 to switchers with the news that “Regions just opened a new branch near you!”

Read More: Think Direct Mail Marketing Is Dead? Not For Millennials

Email Is Both a Strategic and Generational Choice

Increasingly, email represents a cross-selling mechanism for financial marketers, according to Ambani. Lucrative consumer segments represent a target of choice, in the attempt to bring more of their relationships into the institution with special offers. One such offer came from Barclays, which urged its cardmembers to open online savings accounts that would earn them 5,000 bonus JetBlue points.

At the same time, the content of email messages continues to diverge more and more from the look and feel of what’s going out by direct mail.

“Email creative is becoming more contemporary,” says Ambani. “Sometimes we are seeing them being targeted more toward younger generations. And that’s why we will see them use modern lifestyle images, which are in line with the younger generations’ daily activities. This may help get them to apply.”

Ambani says the tone of the text of banking emails has been changing. The language is friendlier and terms like “you” and “your” speak directly to the consumer, rather than more anonymous language.

Another wrinkle — and it’s not limited solely to email — is a movement away from using stock photos depicting “standard American person.” There’s less one-type-fits-all and more variety.

“I have noticed that images are being used differently,” says Ambani. Lifestyle pitches that promote services like Zelle may feature younger people, because that’s who they most appeal to. But Ambani says, more generally, that major institutions, such as U.S. Bank, Capital One, and Bank of America, have been using “images of different ethnicities and of people at different points of time in their lives.”

Email that Doesn’t Exactly ‘Sell,’ by Design

Much of both direct mail and email marketing seeks to produce readily identifiable return on investment. How many accounts resulted from last month’s wave? How many new cards were issued?

Between explicit sales-oriented marketing and true brand advertising a middle-ground has been emerging. These emails position the institution as assisting the recipient to achieve financial well-being.

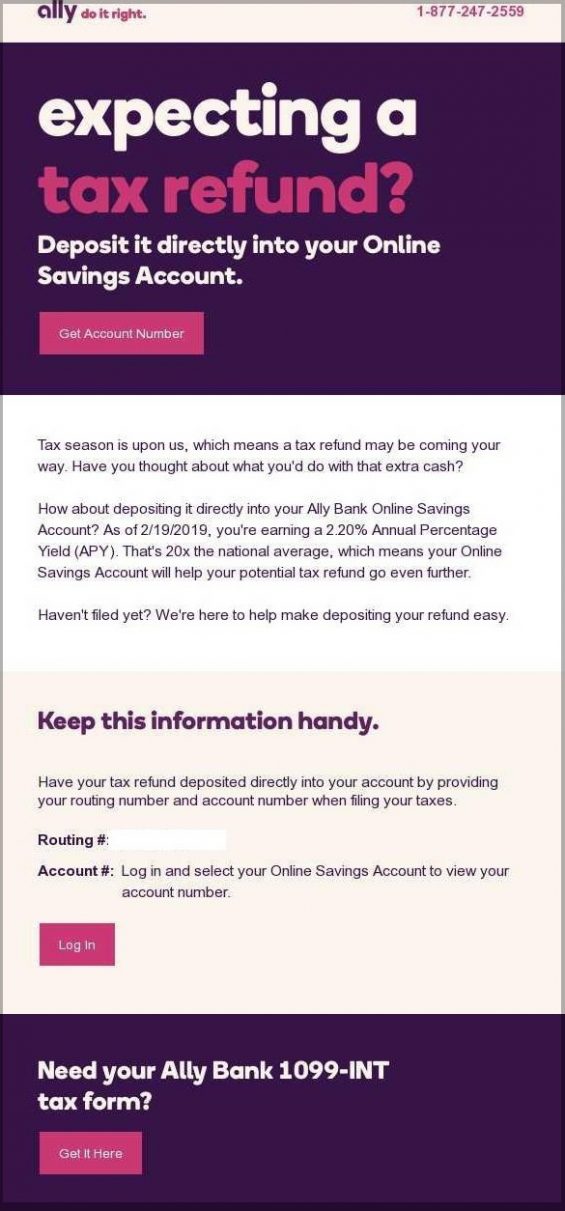

“This approach has evolved tremendously in the last year or so,” says Ambani. In some cases the message is general, in some cases the intent is to promote financial tools that the financial institution provides. Tax time this year was an opportunity some marketers pounced on, tying achievement of savings goals to the huge refund checks that some Americans received, courtesy of tax reform.

Two examples cited in Ambani’s report are BofA’s “Family Life Banking,” designed to connect consumers with life-appropriate tools and expertise, and Huntington’s “Heads Up,” which offers budgeting and related tools plus monthly progress reports.

“We expect that banks will continue to help consumer with an increasing focus on financial wellness,” says Ambani. “And we are also seeing credit unions increasingly adopting this technique, to enhance member relationships.”