Some people within banking may object to a direct comparison between a large regulated financial institution and challenger bank. They may feel that it’s not an apples to apples comparison. But none of that matters in the eyes of the end user.

Consumers nowadays, especially the younger generations, don’t factor in longevity when choosing a banking provider. What really matters to them is that you offer them what they need in the most convenient way — and that you do it efficiently and at the lowest possible cost. Therefore, a direct comparison makes perfect sense, because that’s exactly what consumers do.

So let’s put ourselves in the shoes of consumers and compare what is offered in digital banking in the U.S.

Comparison Based on What?

When attempting a head to head comparison of mobile banking, one should keep an important parameter in mind: It is not just about how many functionalities you offer, but also about how well you offer them. Your institution might have the budget to offer almost everything digitally, but if at the end of the day it takes the end user too much time and effort to use, in their mind it is as if you do not offer a function at all.

A word about our method. Our digital banking research platform, FinTech Insights, is a research tool that analyzes every feature of real bank accounts. This analysis is taken a step further by calculating the user experience (UX) of each feature for the institution. The platform has more than 30,000 user journeys documented so far.

With the aid of this platform, we analyzed selected features of PNC, SoFi and Revolut.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Why These Three Particular Institutions?

Choosing which banks to compare was difficult, but we ultimately decided on the following three, each for their unique standing in the market.

PNC is one of the biggest legacy banks in the U.S., founded in 1983 as a result of a merger, but with roots going back to 1845. They are a good example of a large traditional bank.

SoFi, founded only nine years ago as a student loan refinancing app, has managed to implement many digital banking features within their mobile apps and acquire more than 7.5 million registered users.

Revolut, one of the most successful challenger banks in Europe, offers the most functionalities of any challenger bank we have analyzed (929 functionalities across all digital channels). They officially launched in the U.S. in 2020 bringing those functionalities to American consumers.

Note: Neither PNC, SoFi or Revolut are clients of or in any way affiliated with Scientia and FinTech Insights. The analysis presented below is solely based on data acquired through the Fintech Insights platform. All the scores, metrics and numbers presented in this analysis were measured for the iOS (iPhone) application of PNC, SoFi and Revolut respectively.

How the Three Institutions Compare to the Wider Market

Before diving into specific aspects of each of the three banks’ mobile banking, let’s take a look at their performance against some of their competitors.

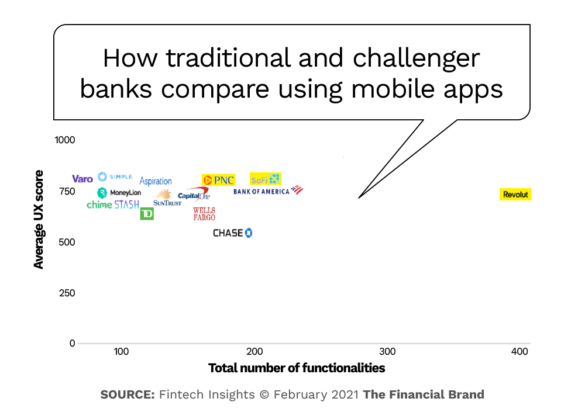

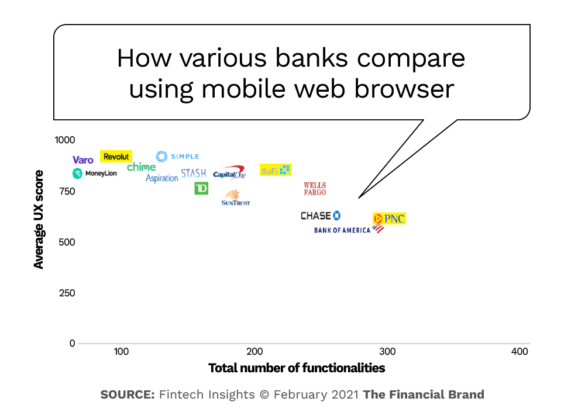

The various positions in the following two charts are determined by their total number of mobile functionalities offered for an institution’s iOS application together with their UX performance, based on our analysis. (A bank’s UX score is calculated based on a number of variables including the number and complexity of steps along with the technical savviness of the customer.)

Both charts relate to mobile banking, one as conducted through the mobile web browser and the second as conducted through the institution’s mobile app. As you can see, there are significant differences.

The charts show that traditional banks have yet to implement as many functionalities in their mobile apps (above) as they offer through the mobile web browser channel (below), but in general they offer a good user experience for both channels, with some exceptions.

Some challenger banks in the U.S. have managed to have strong UX scores even if they offer very few browser-based functionalities (e.g. Varo, MoneyLion and Simple). Revolut, as mentioned earlier, has a great number of mobile app functionalities (top chart), following an all-in-one approach when it comes to how customers can manage their money. They have fewer functions available through a mobile web browser (lower chart), yet they offer strong user experience.

Read More: Data Reveals a Surprise Driver of CX Satisfaction in Banking

Scenario 1: Comparing Sending Money to a Friend

Now let’s jump into some hard facts that differentiate the three banks from one another. We will go through a very specific scenario, and see how it gets completed by each bank while also examining the obstacles in each journey.

The first scenario is: I wish to send money to a friend, who has an account at Bank of America. To complete this user journey you would have to send money via a person-to-person (P2P) transfer. Each of the three banks has different constraints regarding this.

PNC — In the iOS application of PNC you are able to send money via Zelle, which resides within the bank’s mobile app and allows for transfers using your mobile phone or email. The obstacle here is that the friend needs to have either their phone or email registered in Bank of America, where Zelle is also used.

SoFi — The quickest way to send the money using SoFi would be using a payment link. As soon as your friend gets this payment link they can follow two possible routes: 1. They can either choose to become a customer of SoFi themselves and go through the KYC process, in which case the money will be credited to their new SoFi bank account; or 2. They can input their bank account details, and wait two to three business days on average for the money to be credited to their Bank of America account.

Revolut — Revolut does not have a P2P option for transferring funds to another U.S. bank, so in order to complete this transaction a user will need to input all the Bank of America account information. It should be noted that at the final screen of the transaction in Revolut the user is presented with the message, “Payment has been sent.” However, the payment will only be visible in the BofA account after four to five business days.

Scenario 2: Comparing Opening an Account by Mobile

Everyone should understand that the customer experience begins when someone decides to be your customer — usually by opening a transaction account. If this very first step of becoming a customer is complicated, people will inevitably choose another bank that makes it easier for them.

In the descriptions below, the steps we refer to can be active or passive. Examples of active steps include tapping, typing and swiping, while passive steps include reading, omitting information, etc. Typing in particular is usually considered a point of conflict for users.

PNC — For PNC a customer has to go through 93 distinct steps in order to open a bank account. Some of these steps involve providing employment information and typing an assortment of personal information.

SoFi — To do the same at SoFi, a consumer needs only 34 steps. Out of these, only four require the user to type in information. The rest of the steps involve tapping options and verifying information, which require much less effort.

Revolut — To open an account at Revolut requires 48 steps. Apart from typing your full name, address and Social Security Number, all other personal information can be scanned automatically from a document.

Read More: 6 CX Developments Banks & Credit Unions Can’t Ignore

Scenario 3: How the Three Banks Handle Investment Options

Challenger banks, since they follow the all-in-one-place approach, often integrate investment capabilities into their main banking application. Furthermore, they try to make investments, which can be a complicated, simple and easy to manage, and thus accessible to people of all ages and financial backgrounds.

SoFi and Revolut are examples of this approach. Their customers can manage their portfolio of investments right from their phone, while also receiving help on what they need to do every step of the way.

PNC provides investment accounts, but does so in a completely separate mobile app. So a customer of PNC has to manage two different apps in order to be in charge of all their money at any one time.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Rapid-Fire Scenarios

In this section we have prepared three additional scenarios on how some important customer needs are supported, or not, on mobile devices, by each of the three banks.

Somebody stole your wallet. You need to block your debit card and order a replacement.

If you are a PNC or Revolut customer you will need 16 steps to take care of this, and 17 if you are a SoFi customer. All banks offer great user experience for this scenario.

You are switching phones and need to download your banking app again. How easily will the app pair to the new device?

In order to re-pair to a new device as a PNC user, you would have to go through a relatively short authentication process (just 11 steps), which involves answering some security questions. This can become a conflict for the customer because they need to remember those answers, or go through the process of resetting them.

SoFi requires a few more steps (13 in all), but makes it easier and safer for the customer, because in order to pair to your new device, you are sent an OTP (one-time password) code to your registered phone number.

Revolut makes it even more secure, yet not necessarily easier or more effortless for the customer. They are required to enter not only an OTP from their registered phone number, but also a selfie to cross check that it is really they who are accessing their phone.

You are having lunch with friends and want to split the bill. Nobody has cash on them so they have to send you the money. Can your app handle this?

PNC allows their users to split the bill with their friends, as long as the user has enabled Zelle. SoFi does not have this specific functionality. And Revolut offers P2P transactions, provided that every friend has a Revolut account.

Clearly no single player “won” every round in this UX faceoff. But the above comparisons serve to reinforce a vital lesson to every banking provider: Understanding what a consumer needs and how easily they need that process completed should be at the core of every banking digitalization strategy plan.