What sets Moven apart from not only traditional banking organizations, but also the less traditional financial intermediaries that are entering the banking battlefield?

First of all, Moven is not a bank. Similar to Simple, while not having a banking charter, Moven provides a unique customer experience interface with a traditional banking organization working in the background (with banking licenses, FDIC insurance, etc.). The focus of Moven from the beginning of development has been to ‘help customers spend, save and live smarter’ using mobile technology.

According to Brett King, “With Moven, we’re not talking about downsizing an Internet banking portal onto a mobile screen or downloading a debit card onto a mobile wallet. Instead, we are creating an entirely new way of thinking about a bank account, giving the customer mobile insight and control every time they make a decision that could impact their financial health.”

Not Mobile Banking… Mobile Money Management

Moven PayPass Sticker

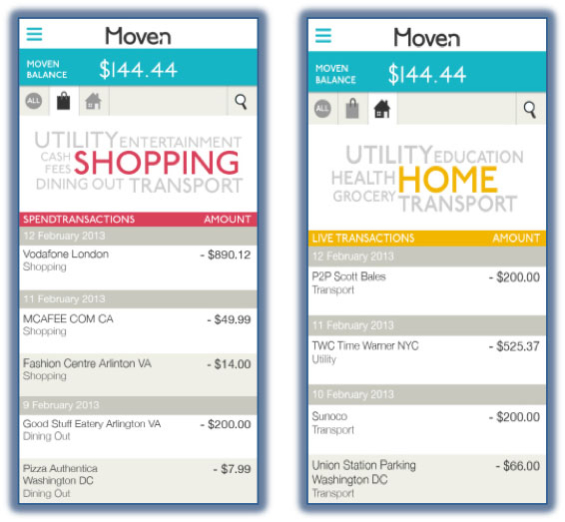

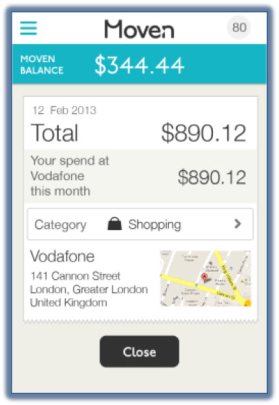

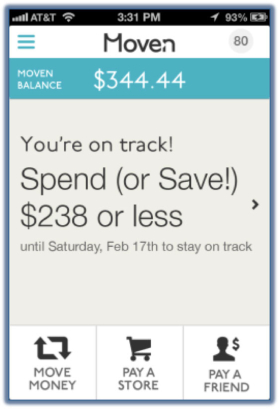

It is the goal of Moven to leverage the power of the smartphone as the primary payment device and to provide immediate feedback with every spending decision. As a customer pays at the cash register using their contactless MasterCard PayPass sticker on the back of their phone, they will get real-time feedback on how the purchase impacts their financial health right on their phone’s screen.

According to King, while initial customers will have the option to receive a plastic card with a magnetic stripe for times when the tap-to-pay option is not available and for ATM withdrawals, the ultimate goal of Moven is to have a cardless, branchless experience.

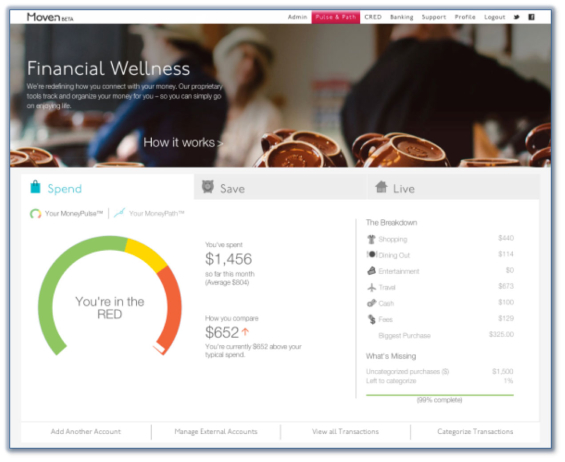

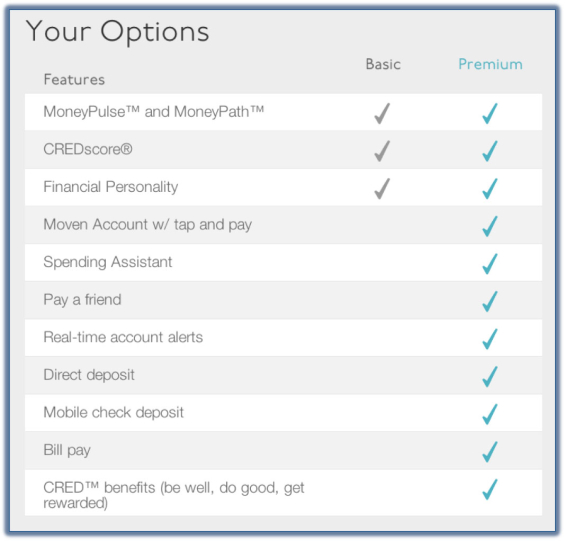

One of the tools that is being used to assist customers is Moven’s personal financial management (PFM) interface called MoneyPulse™ which will analyze spending behavior and provide visual cues (green, yellow and red indicators) to let customers know how they are doing compared to past behaviors.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

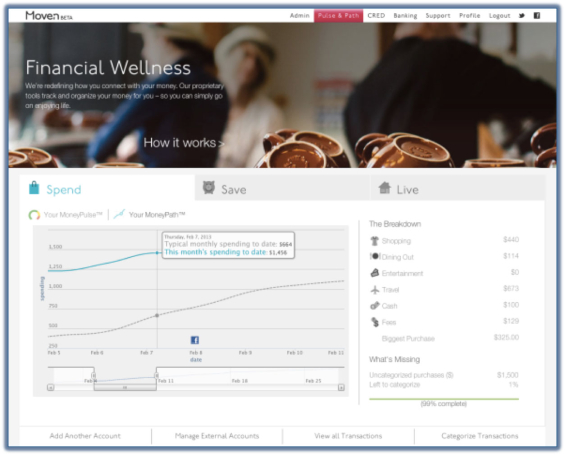

While MoneyPulse looks at how a customer is doing from an individual transaction perspective, MoneyPath™ charts a customer’s spending over a month’s time to allow the customer to understand spending patterns. According to King, “Moven will allow customers to see how much they’ve spent at a certain location over a specific period. For instance, one scenario would let the customer know that they’ve spent say $230 at Starbucks during the month, allowing them to identify an unconscious habit that’s hurting their savings patterns. The power of mobile allows us to provide scalable, real-time personal financial management.”

A unique feature from Moven integrates the MoneyPath financial timeline with a customer’s Facebook social timeline allowing a customer to see the impact their social life has on their spending habits . . . essentially linking a purchase or spending decision with a check-in or status update.

In addition, there will be real time categorization and gamification around spending behavior. According to King, “The ‘cool factor’ is the ability to create immediate financial awareness (“Crap, I didn’t know I spent that much in local bars or on coffee!”) and then gamifying behavior to encourage saving and other positive behaviors”.

So how do all of these capabilities work together from a customer perspective? Moven just released a 3 minute video to show how MoneyPulse, MoneyPath and some of the other features work. What can be seen from the video is how much emphasis Moven places on immediate feedback to financial decisions. It is clear that this form of feedback would not be possible in either a check or card environment.

Engaging Without Being Intrusive

Moven’s mission is to leverage mobile technology to continually encourage customers to be more aware and responsible with their financial behavior without being too judgmental or intrusive. The Moven team has a psychologist, behavior specialist, user experience specialist, designers and experienced banking industry professionals on staff. This combination is behind the unique skill set that Moven believes is needed to develop tools and provide ongoing insight into better personal money management.

Financial education is extended beyond the mobile applications, with helpful hints provided regularly on the Moven blog. Beyond announcements around the future introduction of Moven, there are musings regarding savings, retirement, budgeting, credit use, etc. which all reinforce the Moven brand.

One of Moven’s most unique engagement tools is their CREDscore®. Taking into account an individual’s traditional credit score in addition to a customer’s use of digital payment channels, social connectivity and money management beliefs, CRED assesses risk as well as a customer’s financial potential. Unlike a credit score, CRED is designed to be a sort of financial health or wellness score, like a calorie counter on your phone – a score that goes up when a customer gets better at saving or managing their money.

“CRED goes beyond just a credit rating to include a view of social and financial management credibility,” says King. “The key will be to provide customers a valid value trade-off, where they will be willing to share social data to participate in building a better financial solution”.

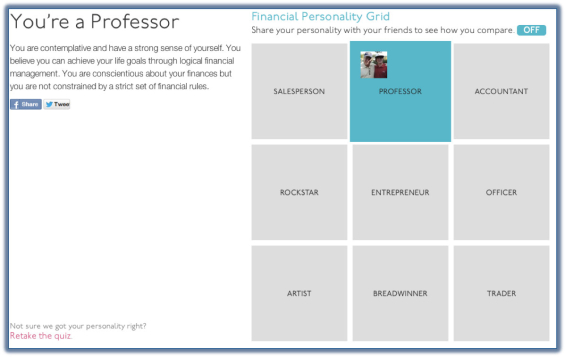

Another engagement tool is the Financial Personality, that uses an interactive survey to determine where a customer may fall in comparison to others. As with all other elements of Moven, this tool can change over time and allows for social channel engagement, since sharing and comparing of Financial Personalities is encouraged. The real purpose of the Financial Personality tool to further customize the real-time feedback and messaging according to the personal ‘money style’ of each customer.

Removing Friction From Banking

Chris Skinner, who writes the Financial Services Club Blog did a post entitled, “The Bank That Removes The Friction Will Win” where he discusses the benefits provided organizations that have removed friction from commerce using digital data such as Amazon, Apple, Google, Facebook, Paypal, etc. His belief is that banks that leverage the available customer data and make banking as easy and intuitive as Apple makes entertainment and Amazon makes shopping will be both disruptive and successful.

While Moven will be introduced later this month with only a portion of the eventual functionality, what do we know today about how Moven wants to disrupt the traditional banking model initially and in the future?

Account Opening. The unique user experience begins at account opening. There are no extensive new account forms to sign and no involved opening process. Simply deposit funds, receive a MasterCard PayPass sticker and start using the account. When I opened my relationship, the process also asks for information on accounts I hold elsewhere and allows me to build my Financial Personality and my CRED score. Similar to Mint, Moven wants to be at the center of a customer’s money management process.

Platform Support. Moven already has an online and mobile introductory site and plans on launching their beta platform on both iPhone and Android platforms out of the gate (unlike most other new players). In fact, they already have an Android app for CRED available on the store. Moven also has Facebook apps available for customers and prospects today, such as the Financial Personality profiling tool.

Card vs. No Card. As mentioned above, customers during the first 90 days will be provided the option of receiving a card for cash withdrawals at ATMs and for transactions not supported by PayPass. That said, it is the intention of Moven to quickly move to a cardless engagement due to Moven’s belief that there are significant limitations to a card-based strategy.

This positioning was reinforced at Finovate Europe, where King drew the line in the sand by stating, “Any bank that still issues a plastic card to their customers in the future doesn’t understand where mobile fits in the emerging banking experience.”

Product Line Expansion. When viewing an application or business like Moven, it is normal to try to view the offering within the normal product-focused perspective of traditional banking. Is it a mobile banking app? Is it a mobile wallet? Is it PFM?

This would be a mistake, since the strategy at Moven does not focus on the underlying products, but on the utility of banking and the utility of a consumer’s money. That’s why Moven will not offer checks and is forthright in their criticism of cards.

Moven will focus entirely on retail banking services is not looking to expand into the small business space at this time (Many of the current complaints around the Simple offering deal with their lack of business accounts as discussed in The Financial Brand blog post reviewing Simple).

According to King, later this year, there will be unique savings functionality added that will provide impulse saving incentives and a credit/overdraft capability will be added that will not work in the same way traditional banks handle credit.

Not Everyone is Sold on Moven… Yet

While Moven is bringing a new perspective to the way people can bank in the future, there are industry followers who wonder about the potential of Moven to move market share.

For instance, in a blog recap of the Finovate Europe conference, Forrester’s Benjamin Ensor stated he was impressed with the innovation done by the Moven team, but believes the solution could be overhyped because of the difficulty in launching a brand new bank. According to Ensor, “Moven’s biggest impact may be in encouraging traditional banks to raise their game, rather than the customers it takes from them”. He did add that he would welcome being wrong.

Similarly, Daoud Fakhri from Datamonitor Financial wrote a blog entitled, ‘Market Not Yet Ready for Moven’, where he expresses concern that consumers may not be ready to embrace the concept of a virtual bank that only exists in the digital realm. Fakhri references Datamonitor’s 2012 Financial Services Consumer Insight Survey that found that 90% of US consumers regard a conveniently located branch as an essential feature, and that only 26% would even consider switch to a bank with no branches.

Fakhri summarized, “Moven looks impressive on paper, but consumers are just not ready to embrace virtual banks right now. The move is a brave gamble, but one that is likely to prove too far ahead of its time.”

JJ Hornblass from Bank Innovation, while not necessarily being skeptical of Moven or any other recent new player, believes that many may be missing the potential risk of new channels and new business models. As stated in his post entitled, ‘Amid the Innovation Hubbub, Are We Forgetting Risk Management?,’ Hornblass says, “How can an enterprise fully understand the entire gamut of risks of something that is entirely new”? While he doesn’t suggest these risks are insurmountable, he just believes managing risk should be part of the equation.

Counter to these cynics, Ron Shevlin believes we are entering a new phase of competition where the importance of location is replaced with the expectation of being able to monitor personal financial performance in real time as discussed in his Snarketing 2.0 blog.

In Shevlin’s blog entitled, ‘NeoChecking Accounts,’ he also discusses many of the benefits of the new mobile offerings, stating that the likely early adopters may be those consumers who are less entrenched in their current financial relationships – Gen Yers. When asked whether this would be a drawback, Shevlin believes that affluence is not what will drive the profitability of Moven. “Profitability will most likely be driven by potential fees (people will pay for value), interchange, and the potential to generate revenue from third parties who would benefit from Moven’s customer insight”.

Brett King’s response to the skeptics is even more straightforward. “We’re carefully timing our launch to match emerging smartphone behaviors and launching a bunch of unique innovations, but at our core we’re just trying to make a consumer’s money and banking experience work better, minus the friction and inefficiencies of a typical bank. In that way, I think we are already becoming the benchmark of what a banking experience will become. However, in reality, many are probably hoping we will fail because I think they realize when we succeed we will render current distribution methods largely obsolete.”