There is no doubt that the discussion of mobile payments is front and center in both trade press and mainstream media. The coverage has been fueled by a number of developments that could reshape the mobile payments landscape, including:

- Apple Pay: The introduction of Apple Pay is thought by many to signal the tipping point for mobile near field communication (NFC) acceptance by financial organizations, merchants and consumers because of their devoted fan base and the unique ability to change consumer behavior on a large scale. The new payments alternative allows iPhone 6 and 6 Plus users to make payments at over 200,000 retail locations in the US. One of the major advantages to Apple Pay is that it includes new security features that speak directly to consumers’ top mobile payments concerns.

- MCX: Not to be outdone by Apple (and presenting a potential point of confusion for consumers), Merchant Customer Exchange (MCX) has built a consortium of over 70 of the largest retailers in the US including Target and Wal-Mart and announced an alternative mobile wallet solution, CurrentC. The participating merchants control one in five retail dollars spent in US stores, and have said they won’t accept Apple Pay.

- ISIS: While significantly smaller than either Apple Pay or CurrentC, the Isis mobile wallet app is backed by three of the largest U.S. wireless carriers. It changed its name to Softcard after a violent military group of the same name began to dominate headlines.

- In-App Alternative: There are alternative apps that bypass payment terminals altogether by allowing users to make in-store purchases entirely within their phone. This option changes the way consumers pay in restaurants and bars and potentially other locations, making mobile payments a software-only process.

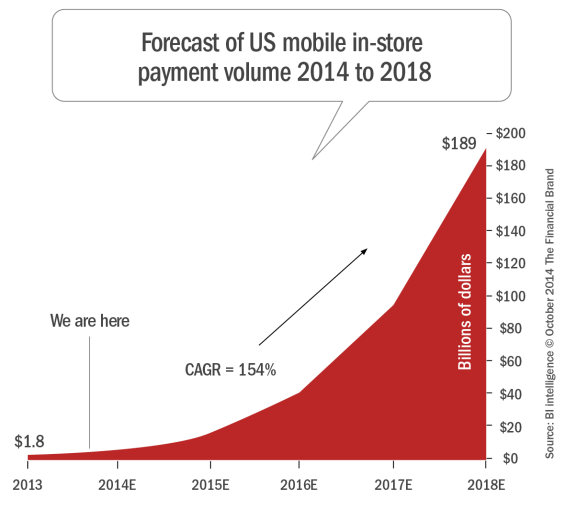

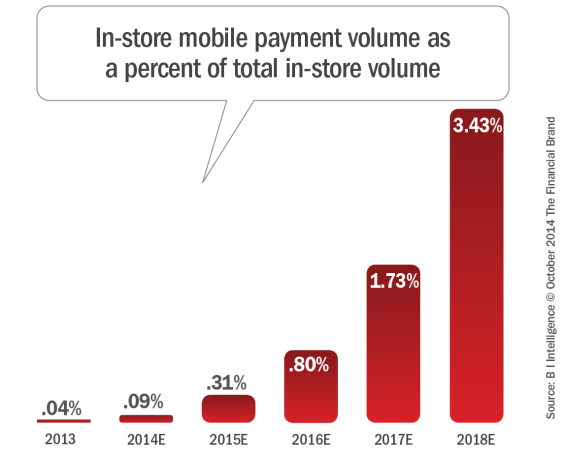

The question that needs to be asked is whether these developments are enough to be the catalyst for people to finally start paying with their phones? In a report from BI Intelligence, it was projected that while mobile payment volume will grow rapidly over the next five years, it will still only represent less than 5% of in-store retail sales in 2018.

Read More: It’s Time To Get Serious About Mobile Payments

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Mobile Payments ‘Explosion’?

Words like ‘explosion,’ ‘exponential,’ and ‘unprecedented’ continue to be used in conjunction with the growth of mobile payments. Are these exaggerations or simply a case of selective statistical analysis?

One of the challenges is that reporting of the growth of mobile payments often uses different ways to calculate mobile payment acceptance. Even the definition of ‘mobile payments’ gets convoluted due to the different types of mobile payments used in calculations:

- Mobile Wallet: Possibly the most hyped form of mobile payment, this method uses “tap and go” or a smartphone’s built-in NFC wireless technology at the POS terminal. This in-store payment is the area where Apple Pay, Softcard (previously known as ISIS) and CurrentC (MCX) are competing.

- Digital Wallet: This form of payment lets consumers make payments to merchants or to other people (P2P) using a mobile device without direct contact with a POS terminal. This is usually an online transaction done on a phone with a credit or debit card entered for payment but could also include email, SMS or even social-based payments.

- Merchant-Based Mobile: This type of mobile payment actually uses a consumer credit or debit card to process a payment using a merchant’s mobile device. This type of payment is usually associated with card reading devices from Square, PayPay and others.

- Closed Loop Mobile: Think Starbucks, TabbedOut, OpenTable or any one of a number of merchants that are building payment functionality into their mobile app. Done right, it simplifies the payment process for frequent customers.

With any and all combinations of the above options, in addition to mobile bill payments, being used by government and trade organizations to measure ‘mobile payments’, no wonder there is confusion on growth estimates. For most industry watchers, the most important measure of mobile payment acceptance is the growth of in-store mobile wallet payments.

In a case of the ‘law of small numbers,’ the growth rate of POS mobile payments is expected to ‘explode’ at a five-year compound annual growth rate (CAGR) of 154%, to $189 billion in 2018. While seemingly impressive, in-store mobile payments will still only account for less than 4% of brick-and-mortar transaction value according to BI Intelligence.

Read More: How Will Banks Respond if Apple Becomes Mobile Payments Player

Foundation for Growth

There are a number of reasons mobile payments have not been widely adopted in the United States. Some of the barriers are on the supply side – for example, the difficulty of getting industry participants to agree on technological standards and the lack of compelling business models for participants.

Barriers to acceptance and usage also exist on the demand side, not the least of which are the lack of a well defined value proposition or the continued concern around privacy and security. Many believe Apply Pay may have addressed some of the convenience and security concerns.

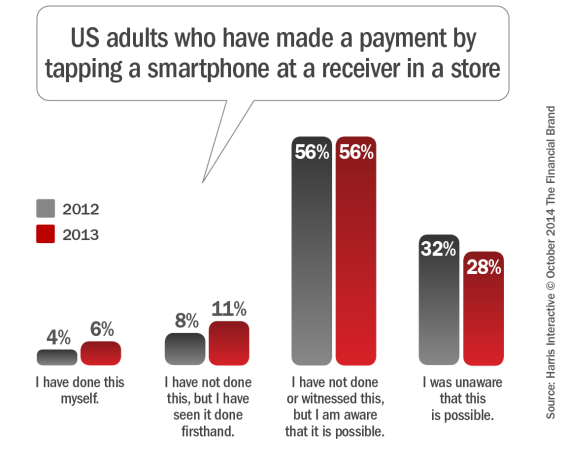

According to Harris Interactive, as of 2013, while awareness of the ability to make mobile POS payments is relatively high, just 6% of US adults said they had made a payment in a store with their smartphone by tapping it at a payment terminal. BI Intelligence believes that over the past year, that number has most likely grown to about 8%, following the existing growth trend.

Future growth is expected to be positively impacted by the introduction of Apple Pay, since going forward, 90 percent of future smartphone shipments will be able to make NFC payments.

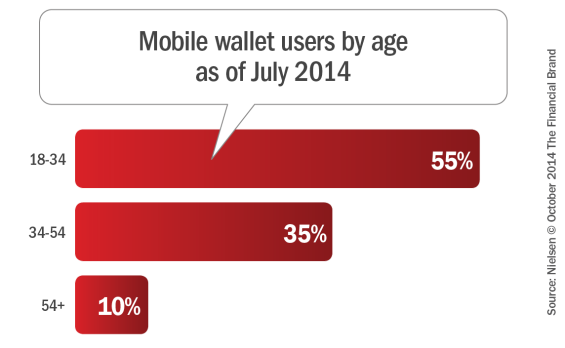

Not surprisingly, the primary demographic group that is leading the charge to greater in-store purchasing acceptance are the millennials. In fact, fifty-five percent of people who say they use mobile wallets are millennials (ages 18 to 34). Mobile natives in the millennial and other demographic groups are expected to continue to drive mobile wallet adoption.

From a mobile platform perspective, Android users outpace iPhone users in making proximity payments, which most likely reflects both the demographic make-up of the platforms as well as the fact that most Android phones now have integrated NFC capabilities.

With the 2015 EMV migration deadline set by the card networks and with new Apple phones having NFC compatibility, most merchants will be upgrading to NFC-compatible terminals in the next 12-18 months. So, instead of consumers having to search out NFC compatible terminals (or merchants disengaging the functionality), consumers will have more places to make in-store mobile payments.

Read More: 300 Mobile Payment and Digital Banking Trends

Overcoming Mobile Adoption Barriers

BI Intelligence believes that the most promising benefits of Apple Pay, in the context of mobile payment acceptance overall, is that the new Apple offering solves two of the biggest hurdles mobile payments adoption among consumers – lack of interest and security concerns.

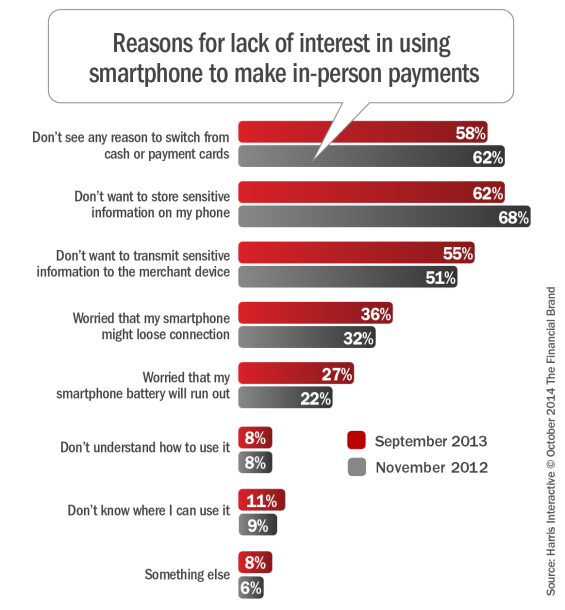

According to a Harris Interactive 2013 survey:

- 58% of people who were not interested in mobile payments said it was because they did not see any reason to switch from cash and payment cards

- 62% said they didn’t want to store sensitive information on their phones

- 55% said they didn’t want to transmit sensitive information to a merchant device (an increase from 2012 most likely attributable to security breaches at Target and other retailers)

The ability of Apple to change consumer behavior in the mobile payment space can’t be overestimated. Much like they have changed the music industry, they are a driving force that could make mobile payments “cool” and have 900,000 users who can make a measurable market impact.

BI Intelligence believes this impact will be increased by the ability to integrate offers and loyalty programs within the Apple Passbook application. They also believe the built-in security features of the iPhone 6 and Apple Pay will help alleviate some security concerns of consumers:

- Sensitive payment-card data will not be stored on a user’s phone or by Apple but will be encrypted, rendering it useless to hackers

- Payments will be authenticated using Apple’s fingerprint scanner Touch ID

- All transactions will be done using a single use tokenization process as opposed to using debit or credit card numbers

- Apple also says it will not harvest purchase data from consumers for use by third-party advertisers (that is not to say they won’t integrate iBeacon technology to drive merchant offers)

Financial Institution Response

It has been well publicized that the majority of larger financial organizations have already indicated that they will become part of the Apple Pay network. This should not be a surprise given the size of the Apple consumer user base and the fact that MCX is trying to bypass banks with their solution and the modest size of the Softcard initiative.

But how should the rest of the banking and credit union industry react to the recent changes in the mobile payments marketplace? Given the relatively small penetration of in-store mobile payments now and in the near future, there may be other more pressing digital banking priorities that need attention first, like simplifying the overall mobile banking experience, providing a seamless mobile banking account opening process, developing a tablet-specific mobile banking application, etc.

This is not to say that providing mobile payment functionality isn’t important for financial organizations of all sizes. It simply means that reacting to over-hyped mobile payments statistics (that may be positioned to amaze rather than inform) may divert attention from more important strategic priorities.

The introduction of new mobile payment alternatives that address consumer concerns is exciting and will lead to growth in the percentage of payments made by a smartphone on premises. Once the POS mobile payment value proposition is increased and more consumers accept this new form of payment, all organizations will need to provide this functionality.

Until then, financial institutions should continue to closely monitor mobile payment trends and be ready to react quickly when customer and member demand reaches each organization’s respective tipping point.