For six straight years, PwC has surveyed consumers about banking channels and activities. From these surveys, several trends are taking shape which provide a glimpse into the future preferences of the increasingly mobile consumer as well as their branch-based counterpart. In 2018 Digital Banking Consumer Survey, there were five key themes:

- Think mobile-first

- Consumers choose banks for more than just convenience

- Many consumers are becoming less ‘engaged’

- Most consumers are goal oriented financially, but need help reaching goals

- Branches aren’t going away

Think Mobile-First

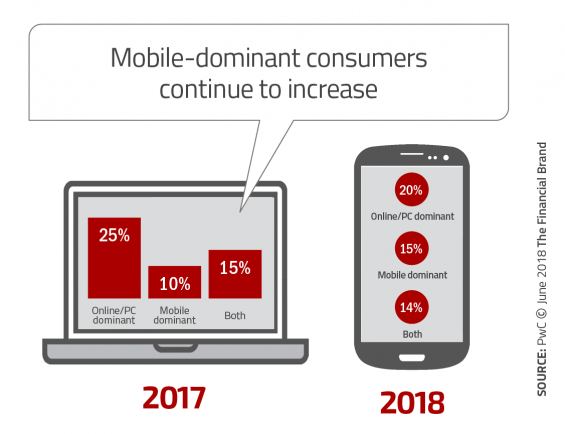

As with other research covered by The Financial Brand, the PwC research found that consumers who were once online-dominant are now becoming mobile-dominant consumers. That is not the only shift that was seen. For instance, while there was a rise of ‘omni-digital’ consumers in the 2017 PwC research (digital consumers without a preference for using a laptop, a tablet, or a smartphone), these consumers are quickly developing a preference for mobile banking.

According to PwC, 15% of customers are now mobile dominant, up sharply from 10% just one year ago. The majority of this shift came from consumers who previously banked online through a browser. But the shift is deeper than that. More consumers than ever view basic banking engagement via a smartphone as indispensable. This would include checking balances, transferring funds between accounts and making P2P payments.

This shift in platform preference means that most financial organizations should build for the mobile experience first. Then these firms should adjust online and in-branch engagement to add synergy for the mobile consumer.

This is far more than just adding new functionality or changing a mobile screen. The mobile experience has to be built from the ground up at most organizations. According to the PwC report, “It’s clear that many just don’t have the right resources to handle this kind of flexibility across the technology stack. And not surprisingly, their workforce often isn’t up to it, either. It’s not just that the technology is different; the user experience has to be different, too.”

Read More:

- New Study Shatters Myth That Digital Channels Are Killing Branches

- The Rise of the Digital-Only Banking Customer

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Consumers Choose a Banking Organization

There are a lot of different factors that go into the choice of a financial institution. Consumers surveyed take into account convenience, referrals from family or friends and previous experiences. In excess of 60% of consumers surveyed said that it’s important to have branches that are ‘convenient’ (a majority of consumers defined ‘convenient’ as ‘within five miles’).

For the millennial segment, digital capabilities and brand familiarity were also very important. As we have seen in other research, younger consumers are more likely to select one of the ‘big 5’ banks for both of these reasons. These organizations have also made it easier to open new accounts without the need of branch support.

Because of the growing impact of mobile banking, convenience (as traditionally defined by distance) is losing strength as the primary determining criteria for banking engagement. More consumers are considering direct banks, mono-line product providers, and other challenger organizations for financial services. In these cases, ‘rates’ and ‘costs’ become preferred criteria for selection. This should be a warning to financial organizations that have far higher operating costs than their fintech competition.

Because of the growing impact of mobile banking, convenience (as traditionally defined by distance) is losing strength as the primary determining criteria for banking engagement. More consumers are considering direct banks, mono-line product providers, and other challenger organizations for financial services. In these cases, ‘rates’ and ‘costs’ become preferred criteria for selection. This should be a warning to financial organizations that have far higher operating costs than their fintech competition.

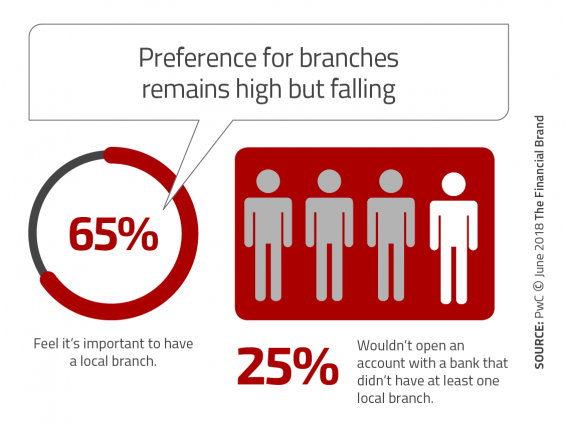

Branch Usage Continues

There continue to be select transactions where consumers prefer branch engagement as opposed to using a mobile device, computer or a call center. These would include applying for a loan (59%), opening a new checking or savings account (58%), establishing a new investment account (43%) or using advisory services (37%).

The question continues to be whether branch preference is artificially inflated by the inability for many financial institutions to provide the digital account opening capabilities consumers may prefer. Do consumers really prefer to use a branch or are they forced to do so by antiquated new account processes? And if the consumer has questions to address about the opening process, have financial institutions provided simple digital tools that can help eliminate costly in-person engagement?

Unfortunately, the tracking of the customer journey is difficult since most organizations only monitor the ‘last touch’. For instance, if a consumer starts online or on a mobile device, and completes the transaction in a branch, the branch gets the entire credit for the account opening. For an improved consumer experience, not only should hand-offs between channels be seamless, but tracking metrics should monitor all channels used.

Unfortunately, the tracking of the customer journey is difficult since most organizations only monitor the ‘last touch’. For instance, if a consumer starts online or on a mobile device, and completes the transaction in a branch, the branch gets the entire credit for the account opening. For an improved consumer experience, not only should hand-offs between channels be seamless, but tracking metrics should monitor all channels used.

Banking Engagement Falling (Maybe)

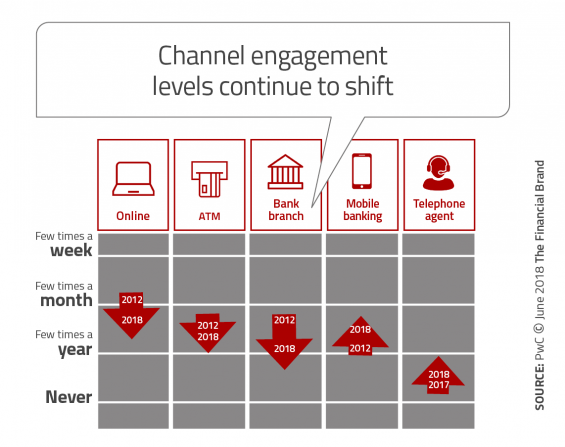

To measure engagement, PwC monitors more than 20 types of financial activities across all channels used by consumers, including online, ATM, branch, mobile and telephone agent. Obviously, not all channels support all activities, but measuring engagement over time can provide insights into usage trends.

What was found by the PwC research is that engagement on my channels is falling, but that other channels may be more than compensating for these decreases. What may need to be measured is how ‘important’ each engagement is to the loyalty and value of the consumer relationship. In other words, if a consumer is using the branch less frequently, but looks at their balance on their phone once a day, has engagement increased in a way that could impact loyalty … or is the primary bank more vulnerable to attrition?

Measuring both the level of engagement and the consumer journey is important if your financial institution wants to understand consumer behavior better, as well as to be able to find opportunities and threats to the overall relationship. Is declining engagement a threat or is the consumer being served better with less ‘touches’ required?

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Consumers Want Help Reaching Financial Goals

Across all age categories, consumers want help with their finances, usually to help save for retirement and to pay down debt. While relatively straightforward objectives, reaching these goals is far from easy. This is where digital tools can excel. Not only is it possible to provide many forms of financial education digitally, but there are many digital tools available to increase savings and decrease reliance on credit.

The key is to proactively target the right consumers for the right solutions. This goes much farther than simple budgeting tools or visualizations of opportunities. With digital engagement, proactive recommendations can be provided that can make money management close to effortless. Bottom line, there’s a tremendous opportunity for firms that can emphasize overall financial wellness, while reducing the complexity of money management.

Positioning for the Future

The largest financial services organizations are building digital tools that combine support for basic transaction services as well as advanced digital engagement. More than just a well designed mobile app, the largest organizations are expanding their digital capabilities to help consumers take advantage of new digital technologies to improve financial wellness. This is also being done by fintech firms and big tech companies, combining the power of consumer insight, advanced analytics and digital applications.

The speed at which these changes are occurring is unprecedented. To keep pace, smaller regional and local organizations will need to determine how they address expanding consumer expectations. The result may be a significant investment in mobile channels or a retrenchment strategy to serve specific markets better. Either way, doing nothing is not an option.