Banks and credit unions — particularly those in the U.S. — still have some work ahead of them before mobile banking plays the central role that it could and should. As a report by Entersekt states, “On mobile, we’re not quite there yet.”

“The convenience of self-service banking and digital payments has enticed tens of millions of Americans to change how they bank and pay for goods and services,” states Entersekt in its report on mobile banking usage trends. “But many Americans don’t have banking apps or do not identify as regular users.” Even among mobile banking users, researchers find that many still use their banking apps for only the most basic functions.

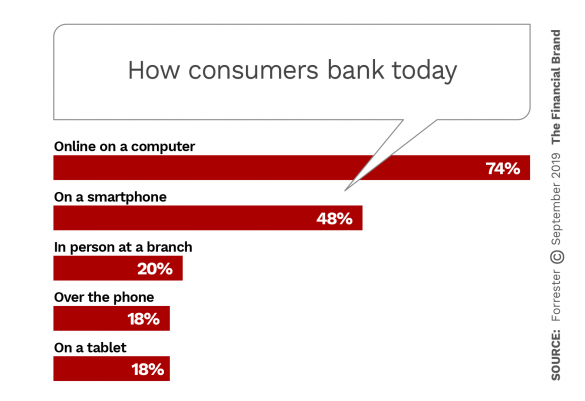

Presently, according to research by Forrester among a large sample of Americans, online banking still outpaces banking on mobile devices by a wide margin.

Of all U.S. adults surveyed, 92.9% own mobile devices. However, only 70.6% describe themselves as regular users of mobile banking apps. All told, the study found that one in four American adults with mobile devices have never used a mobile banking app, with a handful whose institutions still don’t offer one.

“Many non-users do not believe that banking apps provide anything they don’t already have on the desktop,” Entersekt’s report states. “Even regular users may not be as engaged on the channel as they could be.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

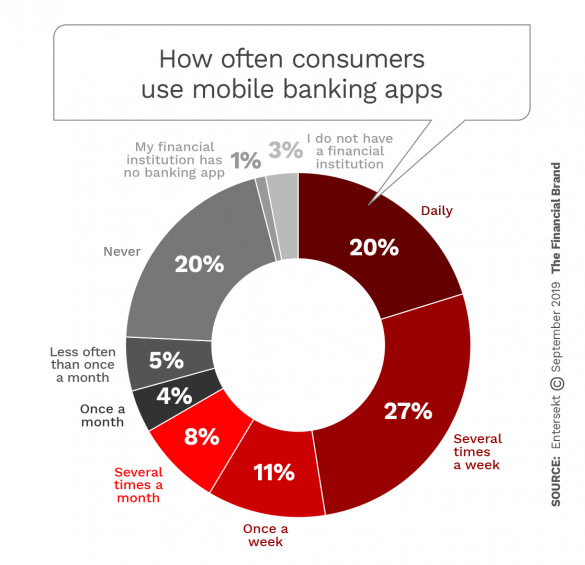

As shown in the chart below, the numbers, relative to the whole, indicate both cause for optimism and cause for thinking about how to draw more users into the active fold.

Entersekt also found that apps for mobile payments are used less often in the U.S. than are mobile banking apps, and substantially less than in other regions. Only 33% of the survey sample use the payment apps weekly or more often. While 20% of the sample use mobile banking apps daily, only 7% use payment apps as often.

Read More:

- Great Mobile Banking UX Demands More Than a Flood of Features

- The Mobile Experience Now More Important Than In-Person Banking

What Should Institutions be Offering in Mobile Banking?

“Mobile banking is widely used in the U.S., but financial institutions can still increase usage significantly through customer-centric, channel-appropriate digital product development,” states Entersekt in its report.

Part of the solution lies in marketing — showing consumers what they have to gain by going mobile.

Financial institutions looking to increase usage of their mobile apps need to consider who their target consumer is, and will be.

For example, for younger generations, a white paper from the International Center for Monetary and Banking Studies, makes it clear that they want it all:

“The functionality, design and experience of a mobile banking application can be the deciding factor for a mobile native customer …. Firms that are able to master a strong mobile-first or mobile-only experience can significantly decrease onboarding times, lower conversion costs and decrease long-term customer acquisition costs if they can market to the customer inside a highly targeted mobile environment.”

Clarity of use is something that transcends generational lines, and it may not actually take much research to tell if people are connecting with the app that a bank or credit union offers.

“If a bank branch has customers coming in regularly to ask how to use certain features of the app, then it’s clearly due to poor banking app design and bad usability,” writes user-interface designer Joseph Downs in a blog discussing tips for mobile banking look, feel and navigation.

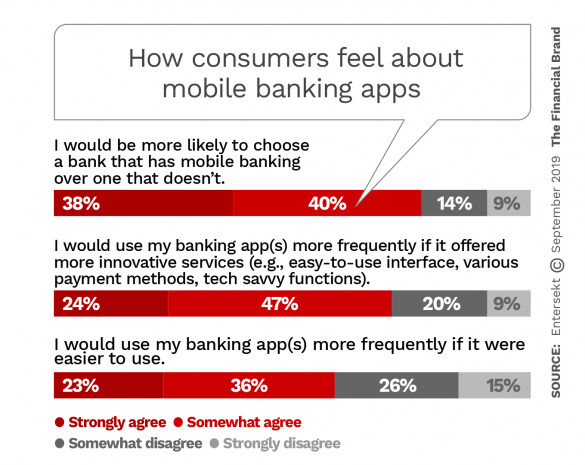

More specifically, Entersekt’s research found that greater ease of use and more innovation in design would improve how many consumers feel about the mobile apps that their financial institutions provide.

“Almost all traditional retail banking functionality can now be accessed at any time, from anywhere, all in the palm of the hand,” Entersekt observes. “Still, few consumers would point to financial services as the exemplar of on-demand convenience.”

One thing that consumers surveyed by Entersekt say they would like is apps that give them greater control. One way that applies is more information that can be acted on in the moment, rather than having an app that’s a rear-view mirror.

For example, the company found that four consumers out of five would like to be told before they make a mobile purchase if going through with it will impact their credit score.

Read More: Will Live Mobile Video Banking Become the Branch of the Future?

All Things to All Consumers? Or a Single Simple Channel?

It’s not unusual for consumers to have so many apps on their phones that the organized ones organize them into folders and subfolders. Research has shown that of all that code crammed into the phone, consumers typically make the most use of just a handful.

Entersekt specifically looked at this trend in regard to mobile banking and payments apps. Among mobile device users, while 48% had only one app, and 24% none, 18% had two banking apps on their phones and 11% had three or more banking apps. Among device owners, 43% had one payments app and 29% had none, but 18% had two, and 9% had three or more.

That’s just a third in both cases that have more than one app for the purpose.

“Juggling so many apps,” the Entersekt report states, “it’s not a surprise that a majority of regular banking app users find the idea of an all-in-one banking and payments app attractive.” The research found that 68% would prefer to handle their finances through a single banking and payment app, and 67% say that they would be less likely to use cash or physical credit cards to make purchases if they had a single, unified app.

“The lure of an all-in-one combination app is stronger among younger adults (18 to 44 years) who regularly use banking apps,” the study also found, indicating potential welcome for the type of central role for a digital, new-model banking institution as envisioned by Anne Boden. “Just over three-quarters (76%) want one, compared to only half of those aged 55 and over.”

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Don’t Underestimate Impact of Design

The look and feel of mobile banking apps can’t be overemphasized. The hard launch of T-Mobile Money, the T-Mobile venture with Customers Bank’s BankMobile in 2019 and the Apple-Goldman Sachs partnership with the Apple Card are seen as examples of how much design will matter.

“Both Apple and T-Mobile have strong, well-known brands and they have large customer bases, and customers have strong connections to their brands,” says Alyson Clarke, Principal Analyst, Forrester, in a video blog. “That’s the key reason bankers should be concerned. Banks usually don’t have a strong emotional connection to their customers.”

In addition, Clarke says that financial institutions must “lift their game. Both Apple and T-Mobile are changing product design.”

In his blog, Joseph Downs provides several tips that financial marketers can see as a starting place:

- Identify your main users and design to their preferences.

- Use progressive disclosures to avoid overwhelming consumers. This means applying compliance disclosures in the moment, as consumers need to know things.

- Pay attention to color in the design. Color should agree with the brand, but it should also be used to make important points stand out. For example, Downs writes, “Revolut uses various colors and color shades to differentiate currencies, accounts and options, along with loud pink color for call to actions. It also uses various shades of greyscale to distinguish important text and explanatory paragraphs.”

- Make hard facts easy to find — items like pending payments and balances.

- Listen to consumer feedback.

That last point, of course, means the bank or credit union must make it possible to reach somebody. Actually, as admired as the likes of Amazon are, it’s a safe bet that anyone who needs to reach a real person at a bank or credit union stands a better chance of finding one than with an ecommerce company.