Even as digital wallets increase in popularity, the appeal of smartphones as payment platforms is growing in general, thanks to the digital devices’ utility in moving money.

Wallets typically take a bank or credit union’s payments products, such as credit or debit cards, and push it through a mechanism most typically owned by big tech — Apple Pay, Google Wallet and so forth. But major banks’ consumer mobile apps are becoming home to mobile payment control centers — where customers can not only tackle basics like Zelle payments and check capture but also more sophisticated tasks, according to Keynova Group research. (Dig Deeper: Consumers Have Embraced Digital Wallets. But They Also Want Them to Be Better)

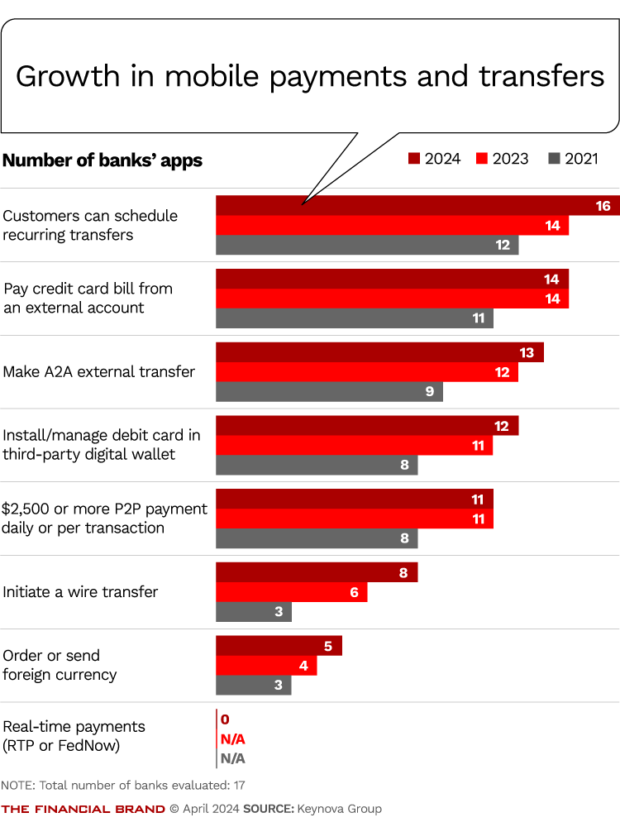

Options have been expanding over the last few years to include functions like scheduling recurring transfers, paying credit card bills from external accounts, using account-to-account functions to easily transfer funds to the customer’s accounts at other banks and, increasingly, initiating wire transfers and ordering or sending foreign currencies.

“The evolution of mobile payment options is a response to a wider range of consumer needs and expectations, including alternatives for various types of payees and recipients, transaction types and faster delivery.”

— Susan Foulds, Keynova

It’s yet another example of the “mobilization” of banking. Foulds, managing director at Keynova, says customers increasingly want the ability to access a wide range of payments services while being mobile and independent of their institutions. While it’s typical for such products and services to become commodities over time, right now they still offer of differentiation.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Large Banks’ Mobile Apps Grow Broader and Deeper on Payments

This trend is most pronounced at the top of the banking pecking order, where institutions with large tech staffs can support innovation. Many regional and community banking institutions will not be able to offer such a sophisticated range of payment options for some time, says Foulds.

Growing payment depth is a key trend identified by the Keynova Mobile Banking Scoreboard for the first half of 2024. Keynova Group studies mobile banking and finance apps by opening and using actual accounts and keeping a running comparison of features and functionalities. Currently there are 17 major banks in the company’s evaluation universe.

Even so, a notable missing function is real-time payments via either FedNow or The Clearing House’s Real-Time Payments program. None of the 17 institutions tracked offer it to consumers on mobile devices at present, according to Foulds. Citibank offers RTP through its online banking service, but not yet on smartphones. Chase offers RTP to small businesses through both online banking and smartphones, but not to consumers at present.

While adoption and inclusion of faster payments in mobile payment offerings is likely in the cards, Foulds suggests that for many consumers, services like Zelle and other options will do the job. When something faster is needed — such as a mortgage payment that’s running late —institutions might offer that “express service” for a fee.

All this said, Foulds believes several of the banks the firm studies are in the midst of preparation for implementation of faster payments via consumer mobile apps.

Read more: How Bank of America Unified Five Apps Into One Experience

Apps Have to Up Their Game on Customer Alerts

An area of further improvement that Foulds identifies is advanced alerts. As payment services broaden and deepen, customers would appreciate reminders of what’s going on. For example, in those institutions where mobile app users can set up recurring payments, a useful alert would be a nudge after a given period.

Basically, the app would say, “You’ve been making this payment automatically for a year. Do you still want this to be happening?”

A related function is subscription monitoring. It’s easy to forget about streaming services, databases and more that quietly keep grabbing their monthly fees.

Such alerts and interactions beyond alerts could be enhanced by use of GenAI in time, but Foulds says her impression is that most of the institutions Keynova studies are proceeding cautiously. More tailored suggestions, such as “Do you know you can get getting 4.5% on that money in our new savings account?” will come before direct interaction between mobile users and GenAI.

Read more from our payments :

- Shocker: Amex, Chase and Citi Top BNPL Satisfaction Rankings

- Lifetime Value vs. Share of Wallet: Which is the Right Metric for Customer Retention?

- PayPal’s Dan Schulman on the Future of Banking: Digital, Seamless and Consolidated

Improved Payments Navigation Takes Two Paths

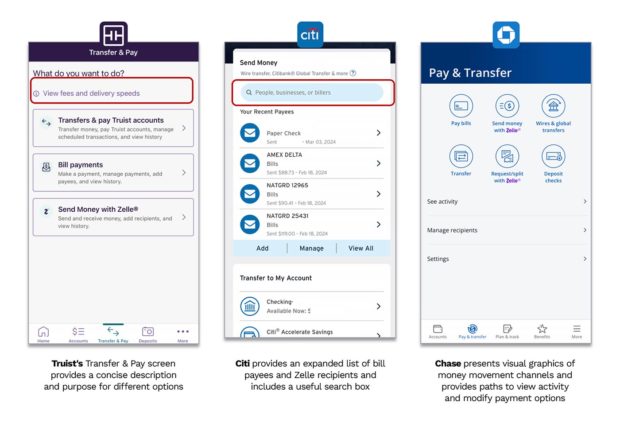

Over the last couple of years, the majors have created smoother navigation through payment functions, which Foulds applauds. She says more attention is being paid to showing consumers what their options are and explaining the various payment channels available.

“That’s important. The banks knew that they had to be clearer on using Zelle versus account-to-account versus billpay, for example,” says Foulds.

A parallel trend is the growing adoption of virtual assistants, which Foulds says can serve as guides to payment services, providing invisible navigation by bringing users directly to functions they need to complete transactions. A small but growing number of the banks with virtual assistants help customers set up Zelle payments, for example. Bank of America’s Erica can detect recurring payments the user is doing manually and offer to help set them up as automated recurring payments.

About three out of four of the company’s study group now have virtual assistants or chatbots that can provide at least some guidance in the payments area.

While the virtual assistants grow more helpful, some gaps still need to be filled. The study found that BofA’s Erica is the only assistant that warns users when they are at risk for potential overdraft or insufficient funds — an omission institutions could remedy as legislative and regulatory attention to overdrafts intensifies.