Compared to the Coin solution that quickly captured the hearts, millions of YouTube watchers and the fintech world, Loop has been amazingly under the payments ‘next shiny object’ radar during its funding process. There was a wave of fintech buzz initially, including several articles and a presentation at Money2020, but not much since.

In an exclusive interview with Will Graylin, CEO of LoopPay, Inc, he said, “Loop has been focused on product development and our soft launch. We did a small PR effort at the time of our Kickstarter campaign, but we did not want to blow a lot of hot air before we had our product ready for market and had happy users.” He continued, “Many have overhyped their solution and have failed. We are more interested in the long run and are building solid a foundation for our future with solid partners.”

Given that Loop is delivering a solution that automatically transforms virtually every existing POS terminal mag stripe reader into a contactless payment receiver, Loop may not be in the shadows much longer.

That’s right, unlike other solutions that require merchant terminal conversion or a programmable card with limited security, memory, card or battery capacity, Loop integrates the highest level of Payment Card Industry (PCI) security and can store hundreds of payment, gift, loyalty, reward or ID cards into a smartphone.

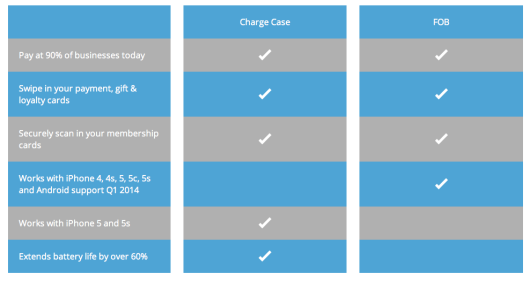

To ‘trick’ the mag stripe reader into thinking a physical card is being swiped, the consumer will need one of several add on devices available from Loop to emulate the card swipe including a Fob, smartphone charging cases (available for iPhone 5 and 5s initially and other devices shortly thereafter) and eventually wearable devices.

Once cards are ‘swiped’ into the LoopWallet app using the Square like device, the user can select the card they want to use at payments. While the process initially will use additional consumer hardware, ultimately, Loop would prefer that their Magnetic Secure Transmission (MST) technology be directly embedded into the mobile device itself, eliminating the need to carry any additional hardware.

Watch the video below and see if you agree with me that this is an ingenious new mobile payments innovation.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What is Loop?

Loop co-founders Will Graylin and George Wallner think they have the killer mobile wallet solution. Their invention, which they’ve dubbed Loop, allows consumers to use their iPhone or Android phone to buy virtually anything anywhere they’d normally use a debit/credit card.

The best part? It works with the existing mag stripe swipe terminals that nearly all merchants use today, so merchants don’t need to make any changes to accept Loop payments . This is a major milestone in the mobile payments race! The loop app can also provide timely insight (gift card balance, reward points, available balance) and can serve offers from merchants and card issuers.

Oversubscribed in initial Kickstarter fund raising efforts, Loop collected $10 million in Series A funding, setting the stage for Series B funding in 2014 to will fuel future growth.

In an exclusive interview, Graylin said, “We see Loop as the only contactless solution that has ubiquitous acceptance on day one.” He continued, “Given that all other technologies require changes in the POS to have contactless mobile transactions, or require infrastructure or system changes by merchants, that puts Loop in a very good position to lead the way as the first wallet solution that works across merchants.”

This is a major distinction to other mobile wallet solutions. Beyond mag stripe POS system readers, the only new POS interface to have achieved more than 10% acceptance across merchants is EMV, and that took 2 decades to reach 50% worldwide acceptance and is still not here in the U.S. And while EMV will come eventually, it will most likely continue to co-exist with magstripe readers for decades.

Since the mag stripe will continue to be used by most debit card, gift card and loyalty card holders, Loop could be either a ‘bridge’ to a full mobile solution or ‘an end solution’. According to Cherian Abraham, mobile commerce and payments lead at Experian Global Consulting, “As far as acceptance, Loop has fair winds. No longer is there a need to search for merchants who accept your choice of payment. And guessing by the state of EMV – even when it’s been called a ‘bridge solution’ – Loop can expect a very long bridge.”

How Does Loop Work?

Unlike most other mobile wallet solutions, Loop doesn’t require a special dedicated transaction network. Instead, it mimics the magnetic transmission frequency usually held on a card’s mag stripe, allowing it to be received by a traditional POS card reader. When the Fob device or MST enabled ChargeCase is held close to the reader (about 4 inches), the transaction occurs exactly the same when a card is swiped.

Initially, Loop will only work with a $34 Fob device that comes in a variety of colors (shown above). The Fob can be replaced in 2014 with an MST enabled charging case for owners of an iPhone 5 or 5s.

The Fob is a small audio jack device with a card reader to scan a consumer’s cards. This Fob is compatible with both iOS and Android devices (app available in 2014). Since the Fob also holds your payment information, it doesn’t need to be connected to your phone to make payments. It pays using whatever card you selected as your default payment card. If you want to change the card, you can reconnect the Fob to the phone and select the alternative card you want to use.

When a consumer receives their introductory kit, they follow these simple steps:

- Download the LoopWallet App

- Simply swipe debit, credit, loyalty, IDs, membership and gift cards using the swiping Fob device provided (similar to a Square device)

- Use the LoopWallet app to select the card you want to use

- Place the Fob (or ChargeCase) near the POS card reader and hit ‘transmit’ on the screen or device to make purchases

Loop gives the consumer control over what to include in their LoopWallet. Load what cards you want and the LoopWallet app allows a consumer to organize and manage the cards as desired. A consumer can even store passwords within the application and take photos of the cards (unlockable with a pin).

The Loop ChargeCase is a protective case that serves as both a transmission device as well as providing 60% more battery power similar to a Mophie battery case. A swiping device is included with the ChargeCase solution.

Loop Security

From initial LoopWallet set-up, to ordering the Fob or ChargingCase to initiation of a transaction, it is clear that security has been a top priority for LoopPay designers.

When ordering the device itself, security measures are in place to ensure that the person ordering the device can be authenticated. When purchasing the Loop FOB or ChargeCase, Loop provides security questions ranging from the last four digits of a social security number to previous address validation. This ensures that if someone stole a Fob, they would still need to have access to the name and password associated with the LoopWallet.

In addition, when the transaction is taking place, the device must be less than 4 inches away from the mag stripe reader and the encrypted information only gets transmitted for a few seconds. No sensitive data is stored in Loop’s servers and all card information is secured by a 4-digit pin (beyond what you need to access your phone).

In an exclusive interview with Damien Balsan, COO of LoppPay, Inc., he provide a list of security measures their team has put into place for enhanced security:

- We are preventing cards from being used by anyone other than the owner himself/herself. The user has to register to LOOP Wallet thru a KYC Process and our server is authorizing any card loaded in the wallet. You could only enter cards with the users name.

- Our server is a Level 1PCI certified server. It does not store Track Data. The card information is stored in a Global Platform Secure Element.

- The LOOP experience is quite intuitive for a consumer: he/she loads all his cards one time whether payment cards or ID/Loyalty cards and he can chose the level of security he desires.

Potential Drawbacks

The two most likely drawbacks of Loop would probably be the cost ($34 for a Loop Fob and $99 for the ChargeCase) and the desire for more simplicity. There is also the issue of ‘the other 10 percent’ of places where Loop won’t work.

Cost

Requiring consumers to invest in specialized hardware could be a significant obstacle to acceptance. While Coin may have been able to get people to invest in their card technology at $50 (early bird offer), there is no history on the potential mass appeal of a mobile payment device at any cost and certainly not at a cost of $99.

In response to this issue, Loop’s Graylin said, “Today, consumers pay $99 for a Mophie charge case. For the same price, we give them a mobile wallet that can be used at almost every store.” He added, “Obviously, being able to claim 90%+ acceptance at current retail locations is a big plus, but it remains to be seen if consumers believe the cost offsets the current convenience afforded by carrying plastic.”

He also added, “Just consider the benefit of being able to pay at a store the few times that you have forgotten your wallet. Many of our pilot users and testers remind us this all the time.”

Simplicity

“In the payments space, Coin has almost an Apple-like simplicity to it, stated Deva Annamalai, SVP of marketing technology and data insights at Salt Lake City based Zions Bancorporation. “On the other hand, the Fob is a form factor that is almost a step back in time.”

For any payments solution to stand the test of time with today’s digital consumer, it will need to be easy to understand and simple to use on a daily basis. The iPhone 5 ChargeCase with integrated Loop technology is definitely a step in the right direction, but will need to be offered for other Android and Apple devices quickly for the solution to be embraced.

The ‘Other 10%’

The fact that Loop works on approximately 92% of the POS systems in the country, there are the ‘other 10%’ of locations that users need to be aware of. For instance, Loop will not work on most gas station devices or at ATMs or on machines that that use ‘two-sided’ readers (older technology). For this reason, Loop recommends that users bring along a ‘go to’ card for those places that Loop may not work. That said, initial tests have shown that Loop will work in most locations.

The Future of Loop

In addition to the shipping of an MST enabled ChargeCase ($99, 1200 mAh battery) for the iPhone 5 and 5s in 2014, a potential thinner and more powerful ChargeCase may follow. In addition, Graylin has hinted on several occasions that other form factors (possibly wearable technology) are in development.

There have also been discussions of a Bluetooth LE-enabled plastic card (sounds like Coin) and a mobile wallet product aimed at students who prefer not to carry college IDs, payment cards, loyalty cards, etc.

Potentially more important to the industry, Loop has been having discussions with handset makers to see if Loop could be integrated into future phones. As mentioned by Cherian Abraham from Experian, “Loop’s ultimate goal will be to be aggressive with its future form factors so that it no longer draws attention to itself and disappears – into phones or its accessories. Aesthetically it’s dongle has to be like Square, and that’s tough when you are not Square.”

When the team at Loop was asked about the future, they said the main question that they get over and over is how will their solution work after EMV becomes more prevalent in the US. Their response was that the Loop solution will still be able to work. They referred to the fact that they will continue to co-exist with magstripe readers for decades to come and are confident that their dynamic data solutions will be appealing for many issuers.

While Loop is definitely an ingenious solution for an industry looking for a go to mobile wallet solution, the road ahead is not all smooth sailing. Not only does Loop need to convince Customer 3.0 that a mobile wallet solution with a physical Fob or ChargeCase is a value added solution worth the cost, but they also need to persuade skeptical consumers who continue to worry about security and privacy issues around mobile payments.