What Makes a Great Mobile Banking Application

In many ways, there is no difference between what makes a great mobile banking application and what makes a great non-banking mobile application. The key components are:

- Simplicity: Does the app replace a non-mobile process that is done often? Does it make a customer’s daily life easier? Is it easy to use? In the non-banking world, the KeyRing application achieves this because it stores multiple loyalty cards in one place on a mobile phone, eliminating the need to carry plastic cards. The app also links to digital offers that can be redeemed without cutting coupons.

- Engagement: Does the application stimulate positive interaction, and build a better application from this engagement? The Marriott mobile application does a great job with engagement. Beyond providing the standard ability to make reservations and check loyalty balances, it also allows a customer to check in early, receive notifications when a room is ready and informs about special offers through multiple channels.

- Contextual: One of the benefits of a mobile application vs. an online tool is the ability to provide value based on where a customer is located. A favorite app from a contextual perspective is OpenTable. Using locational functionality, OpenTable provides suggestions of restaurants based on current location and previous dining experiences. Reward points are provided for using the app and the app will also allow payment for a meal using a phone and the OpenTable application.

So, which mobile banking applications meet one or more of the above criteria and could become part of a consumer’s digital banking nirvana? As could be expected, this list is fluid, since new innovations are being introduced every week, replacing previous applications that were once best-in-class.

Mobile Banking ‘Basics’

For an active mobile banking user, there is some functionality that must be the foundation for a best-in-class mobile banking relationship. First of all, as covered in a recent blog post entitled, Banking Innovation for the Fat-Fingered, leveraging mobile imaging technology and a smartphone’s photo capability simplifies mobile banking by removing keystrokes and improving accuracy. Therefore, the most active mobile banking customers will expect their future mobile bank to provide the following:

- Mobile photo account opening using just a drivers license

- Mobile photo bill pay

- Mobile deposits

- Mobile photo balance transfer

In addition to leveraging the photo capabilities of a phone to simplify banking, consumers would prefer to eliminate many of the password and authentication steps, while not having to worry about security issues. One potential solution is to integrate Capital One’s new SureSwipe login feature into a new mobile banking relationship. With SureSwipe, all a customer needs to do is remember a pattern as opposed to passwords, making login easier.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

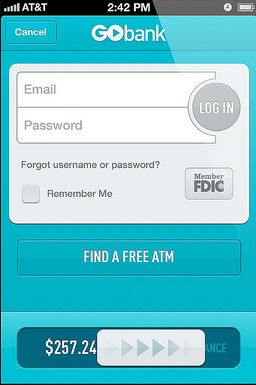

Digital consumers also do not want to go through a series of authentication steps just to see the balance in their account. In the U.S., GoBank provides the opportunity to see balances with a simple swipe of the finger. GoBank is still one of the few banks in the U.S. to provide this instant balance feature, even though Mapa Research found close to 20% of major banks worldwide offing this functionality.

Banks overseas offering a similar capability included Commonwealth Bank’s Kaching, Swedbank’s ‘balance shake’ and Bank of New Zealand’s mobile app that allows you to see your entire relationship without a full login.

Other benefits of GoBank that should be included as part of a digital banking nirvana include having a wide range of customized alerts, a negotiable monthly fee, and their ‘fortune teller’ that informs a customer when they might be spending money they will need later.

Going a step further, it would preferable not to type any information at all into a phone for basic mobile banking. With USAA’s Virtual Assistant powered by Nuance, that would be possible since members are able to use voice commands to perform basic banking tasks. Nuance is also testing a similar solution at U.S. Bank.

Mobile Payment Applications

Beyond the basics, no other functionality of mobile banking is as important as payments. Despite high industry attractiveness and relatively low consumer acceptance (in the US at least), mobile payments is the Holy Grail of mobile banking and is the potential tipping point in the battle between bank and non-bank providers. From making payments to tracking payments, the diversity of payment applications globally is exciting.

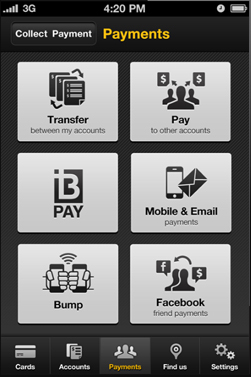

One of the most comprehensive mobile payment applications is from Commonwealth Bank in Australia. The CommBank Kaching application provides the ability to make P2P payments by bumping phones with another person, using a mobile phone number or email address, or even through Facebook. For bill or merchant payments, QR codes can be used and NFC payments are supported with internal Android functionality and with a CommBank Paytag on iOS devices.

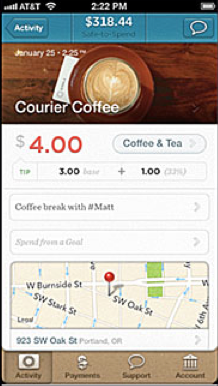

Once payments are made, some of the best mobile receipt capabilities have come from the new banking competition in the U.S. Moven digital receipt capability provides real-time feedback on PayPass or debit card purchases as well as contextual transaction insights (the application also has spend tracking to compare spending to previous periods and the ability to pay friends by email, mobile or via Facebook).

It would also be nice to include the ability to add pictures to receipts as offered by Simple in addition to having real-time adjustments to safe-to-spend and budgeting insight. Simple also provides a very comprehensive search capability that can assist the tracking of spending using ‘Google-like’ queries or hashtags for spending categorization. Poland’s mBank also provides transaction search capability using Google-like queries supported by the excellent Meniga PFM platform.

Simplified Budgeting

A mobile phone is probably not the best platform for enhanced budgeting, but it is still nice to be able to track how you are doing each month using a mobile device as an adjunct to the online banking capability on the desktop. This requires striking a very careful balance between form and functionality.

Both Moven and Simple do an excellent job with their tracking and budgeting capabilities. Both allow a customer to see their financial position compared to previous periods and utilize a mobile-first design. The visualization of spending behavior is excellent with the use of easy to understand graphs on both the online and mobile platforms.

One of the best personal financial management (PFM) tools has been developed by MoneyDesktop. Using some of the most advanced user interface design capabilities in the industry, the MoneyMobile solution takes some of the best functionality from their online application and creates an excellent visual interface for mobile devices.

Channel Integration

In looking for the ultimate mobile banking experience, it’s clear that mobile may not be the best channel for all interactions with a bank. In those instances when a customer wants to use online banking tools, talk to a customer service representative or visit a branch, it is important to still use the same criteria of simplicity, positive engagement and contextual functionality.

When a customer travels between online, mobile and a tablet, they don’t want to relearn how to conduct a banking transaction. While they may want added functionality that takes advantage of the tactile and interactive benefits of the tablet or the expanded canvas of the desktop computer, they want the ‘feel’ of the experience to be similar.

Westpac New Zealand recently introduced an excellent device agnostic solution that provides a similar look and feel across devices. In addition to using a responsive design (making the look conform to the device and how the device is held), the use of a ‘central platform’ will simplify changes in the future.

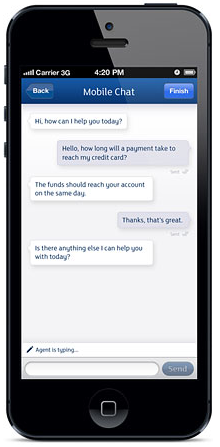

When a customer has a problem with their account, the last thing they want to do is search for the appropriate phone number for customer service or wait until they get home. Therefore, the ability to have an integrated customer service capability within a mobile banking application is a must.

NatWest and RBS were the first two banks in the U.K. to offer in-app, real-time customer service whereby a customer can initiate a conversation with a dedicated Mobile Chat advisor. In addition, ING has a mobile application that allows for direct appointment setting with a specific agent in a few easy steps.

Going one step further, Turkey-based Akbank became the first bank to offer video chat. Customers can make a one-click video call from within the bank’s online banking site to one of the bank’s video enabled service agents. No additional software is needed and the application will soon work on Android and iOS devices as well.

Finally, for those potential instances a customer may want to use a branch, the traditional branch just doesn’t meet a digital consumer’s needs. Thye want to be in and out as quickly as possible and most likely won’t need to see a teller. Banks globally are trying to address this change in customer behavior by scaling back traditional transaction-centric branches and replacing them with either advisory-centric units or technology-enabled branches that leverage video and advanced transaction capabilities.

National Australia Bank (NAB) recently opened their first ‘Smart Store’ where traditional tellers have been replaced by full service machines. These new branches take less space, will potentially have longer hours and are geared to the lifestyles and digital-savvy nature of Customer 3.0. (This new branch format was covered by The Financial Brand here)

Expanded Mobile Functionality

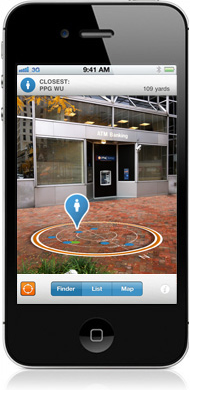

As with any avid mobile banking user, a digital native wants even more from their mobile banking experience than just basic transactions, payments and basic money management. For instance, they would enjoy PNC Bank’s ATM/Branch Finder, that uses augmented reality to allow a phone to search and find facilities through the screen on a phone. Interestingly, while a customer may find the app useful, they would be intrigued as to why the app isn’t integrated into the normal mobile banking application (PNC Finder is a separate app).

With the demise of most points programs associated with debit card usage, more elaborate (and potentially more lucrative) merchant-funded rewards programs have taken their place. Unfortunately, the vast majority of these programs require a proactive opt-in on an offer level basis and are connected with the online banking relationship as opposed to mobile banking. This makes taking advantage of any rewards cumbersome at best and downright maddening most of the time.

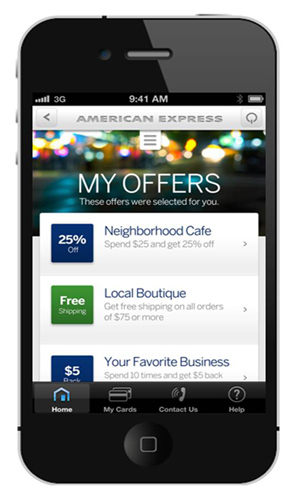

To address this problem and to provide locational rewards using a phone’s GPS capability, Cardlytics is enhancing their merchant-funded reward program to include a much more user-friendly rewards program that will provide offers based on where the customer is located. This functionality is already available from American Express with their My Offers program that leverages both transaction history (what you do) with locational information (where you are).

Support of Wearable Technology

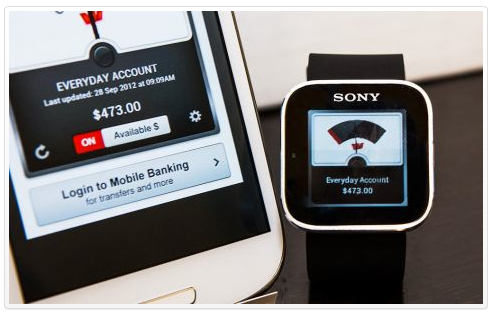

In the effort to develop a digital banking nirvana, we should look a bit further into the future and make sure the mobile banking relationship can be supported by wearable technology. While definitely not for budgeting or more difficult mobile banking transactions, both Google Glass and SmartWatches can potentially be effective for mobile alerts, balances, simple transfers/payments and augmented reality ATM/Branch finding capabilities.

Two banks are setting the pace globally for wearable technology integration. Banco Sabadell has already used an open app development forum to create mobile banking using Google Glass. As covered by The Financial Brand, the first iteration of ‘banking by glass‘ includes balance inquiry, the ability to get alerts and find branches and eventually deposit a check by looking at it.

In addition, Westpac New Zealand has created the first SmartWatch banking app that leverages the bank’s Cash Tank application. Initially only providing balances without formal login, the application is expected to also include the ability to get alerts and do transfers in the future.

One Last Word on Mobile Banking Innovation from Australia

It is clear that the development of innovative mobile banking applications is an ongoing process with new applications and capabilities being introduced almost every day. Therefore, it is important for those searching for digital banking nirvana to not only keep up with industry trends globally (much of the innovation is being done in the Asia Pacific region as mentioned in my recent blog post on innovation), but to also partner with those banks that have innovation ingrained in their culture.

It is clear that many banks at Next Bank Sydney obviously do more than just talk the talk on innovation . . . they walk the walk. It was apparent that each institution put a high premium on future thought and were encouraged to think out of the box and not be afraid to fail. The energy level of people from these banks was high and there was an amazing willingness to share from each other as well as leaders globally.

Beyond Australia, banks like CaixaBank and HanaBank, as well as USAA, Moven and Simple in the U.S. are ones to follow. BBVA is also doing testing, with their Innovation Center that is both robust and very public. In addition to a public Innovation Center web site, there is also a LinkedIn and SlideShare page, sharing ideas that have been developed and discussing the innovation process at BBVA.

It is clear that a digital banking nirvana will be a moving aspirational target. But, by combining what is available globally today into a single mobile banking app, it would provide the foundation for a killer mobile banking relationship with a bank.