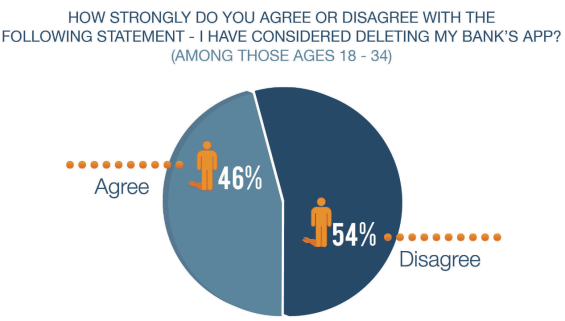

A just released report available from Varolii Corporation entitled, ‘Can You Bank on Your Banking App?’ illustrates that banks have a ways to go before they are creating the customer experience desired by the active mobile user. In fact, while 52 percent of smartphone and tablet users have downloaded their bank’s mobile application, roughly 40 percent say they have thought about deleting the app. And the dissatisfaction is even higher among the important 18-34 year old segment as shown below. Obviously, expectations are not being met.

Providing account balances and SMS text alerts is no longer enough. Mobile banking customers are expecting more advanced functionality such as mobile check deposits, real-time updates on account activity and balances and alerts that can help them avoid surprises. “Consumers are looking to their banks for help with financial management”, said Brian Moore, financial market manager for Varolii. “However, our study shows that most banks are failing to deliver on consumer expectations with first or second generation mobile applications.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Developing New Mobile Banking Applications Is Only Half The Battle

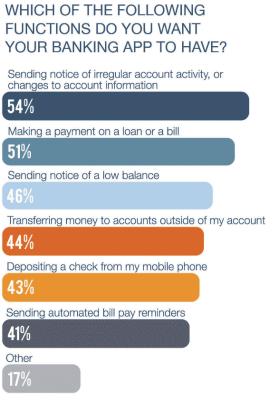

According to the Varolii research, there are a wide variety of functions mobile banking users prefer beyond just account balances and the ability to transfer money between their accounts at the bank, including the ability to make payments on loans and bills, transferring money to others and depositing checks using their mobile device. In addition, users want notifications about irregular activity on their account, low balance notifications and reminders about upcoming bill payments.

Push notification alerts, which are delivered within the mobile banking app as opposed to being delivered via email or SMS text is the preferred method of delivery for those using downloadable apps. These notifications can be customized at the account holder level and can be delivered in close to real time.

While some of the larger banks such as Bank of America, Chase, Wells Fargo and others already support many of these functions, Varolii found that communication of these capabilities must be lacking, since almost half of mobile users believe their bank only offers basic functions. Maybe not surprisingly, those users over the age of 55 were 36 percent more likely to believe their mobile app only handled basic functions.

“Banks need to take special care to educate their high value segments as they introduce new capabilities,” says Brian Moore from Varolii. “Interactive tools that promote and demonstrate how to use the new features should be available as new applications are launched.” He added, “Banks should take a lesson from Apple and train ‘mobile banking geniuses’ for each branch who can show customers in line how they may be able to accomplish what they came to do faster with their mobile app.”

Even when using apps, however, more than 70 percent of mobile customers indicated being frustrated with an app while trying to complete a task according to research conducted by the Adcom Group. These customers want to solve these issues quickly so they can complete their intended task.

In these cases, it is important to have a communication option that alleviates any negative brand perceptions or decreases app utilization. It was found that embedding a click-to-callback solution that allows a customer to directly contact customer service within the app can be an excellent solution.

The Importance of Alerts

The Varolii research found that nearly two-thirds of mobile users believe it is the bank’s responsibility to immediately alert them when balances are low or an overdraft is about to occur. And this belief is strongest among the younger demographic groups, where a financial problem is potentially more likely.

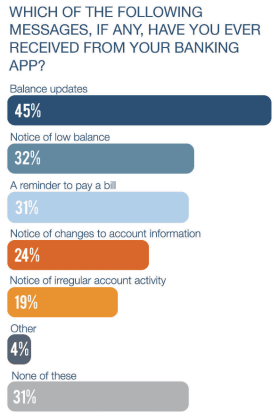

Interestingly, nearly 70 percent of households surveyed believe a banking alert could have helped them avoid a financial problem, while 80 percent of those under 35 believed an alert could have helped. Unfortunately, the vast majority of mobile banking customers surveyed said they have never received this type of notice.

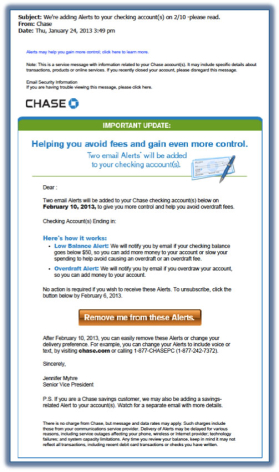

While the research shows that most mobile banking customers do not believe their banks are meeting the need for proactive notifications, there is evidence that some banks such as Chase, Capital One are proactively opting eligible customers into automated and email alerts as shown below (courtesy of Competiscan). The notification below even indicates that the customer can opt-out, change their delivery preference or even include a voice alert.

Channel Preference

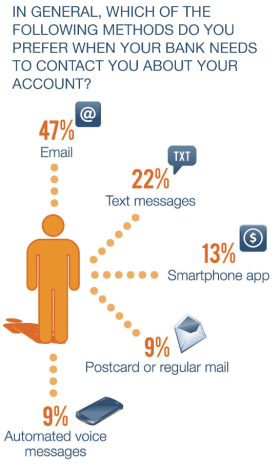

Unfortunately, just because a customer has downloaded a mobile banking app doesn’t mean they want to receive alerts within the mobile app. In fact, Varolii found that email is still the preferred channel for most mobile banking customers followed by text alerts. These preferences may be based on more on mobile phone behavior than on how customers manage their banking relationship (some people always check email and text as opposed to viewing apps).

Bottom line, banks will be challenged to find economical and effective ways to integrate communication options on a personalized basis. According to Brian Moore, “Banks need a platform that can acquire and apply customer’s explicit (e.g. ‘I only speak Spanish’ and ‘I prefer text messages’) and implicit (e.g. $200 should be considered a ‘low’ balance or ‘I prefer to pay rent on the 10th of the month’) preferences to a set of business rules.”

Next Steps

The evolution of mobile banking, payments, digital wallets and even financial institutions will continue at a dizzying pace for the foreseeable future as will the advancement of mobile and digital technology. The expectations for real-time insight into a customer’s financial situation will be table stakes in a battle for providing more enhanced capabilities and access to better, and more intuitive financial management tools.

Unfortunately, most banks are not meeting customer’s expectations and the ability to keep pace is becoming more difficult. This is evidenced by the Varolii finding that nearly half of mobile banking customers are using their mobile banking app less than when they first downloaded it.

Banks, therefore, are faced with both a challenge and an opportunity. The challenge is to determine whether adequate investments can be made to keep pace with customer expectations. The opportunity is that mobile banking functionality is becoming a powerful differentiator in the battle for acquiring and retaining customers. Banks that can provide the ‘best’ tools will be in a position to win the mobile banking war.

As Varolii’s Moore states, “The modern digital customer sees value in banking apps. Banks have an opportunity to create ‘third generation’ mobile applications that will enable them to have a more proactive role in their customers’ finances”.