With competition increasing from both traditional and non-traditional financial organizations, the importance of an improved consumer experience and resultant satisfaction and loyalty has never been greater. Not only does an improved experience impact growth of a relationship and retention metrics, it can improve referrals and even the economics of serving customers and members.

The challenge, at a time when tactical and strategic priorities are multiplying, is determining where to focus efforts to get the greatest impact. Should websites and digital banking apps be upgraded? Should branches be redesigned and reconfigured? Should back office systems be upgraded and front-line staffs retrained for a more digital banking existence? What individual and/or combination of initiatives should be pursued in the quest of ‘delighting the consumer?

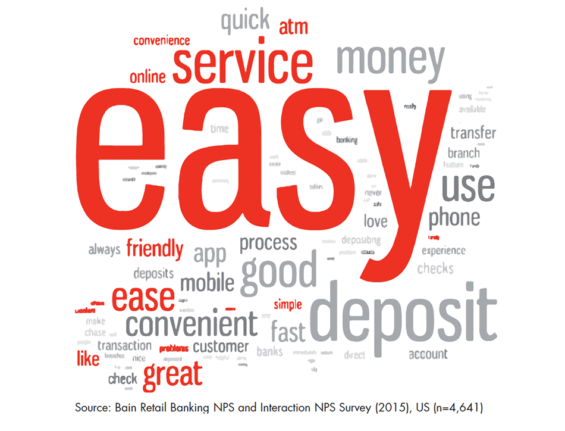

When Bain & Company asked consumers the question, “What is the primary reason [this interaction] increased your likelihood to recommend your bank?,” the overwhelming verbatim response was that the interaction was ‘easy’.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Simplifying Routine Transactions

Bain & Company surveyed 14,812 retail banking customers in Australia, Canada, the UK and the US, asking the participants to assign a Net Promoter Score (NPS) to their recent experiences with a dozen common banking interactions, from everyday transactions to more complex sales and service experiences. As could be expected, those who were delighted with their recent experiences gave their financial institution a higher score.

Interestingly, while improving any single interaction improved the overall NPS at a given organization, some interaction had a bigger impact on overall consumer satisfaction than others. According to Bain, on average, routine interactions contribute more to the score than do sales and service interactions (even though sales and service interactions have a greater individual influence).

For example, a significant percentage of consumers who have a good experience opening a credit card, applying for a mortgage loan or even opening a new checking account would likely recommend their bank or credit union. The likelihood of a consumer recommending their financial institution based on a positive everyday transaction would be 20-30% lower. This makes sense since consumers put a higher value on the more complex interactions.

The difference is frequency. With frequency factored in, routine interactions have a greater cumulative effect: According to Bain, these interactions contribute three to four times more than sales or service to the lift in a bank’s loyalty score since they occur so much more frequently.

So how can financial institutions improve routine transactions? One way would be to eliminate steps in the most frequently performed tasks (such as checking balances or making payments). Allowing customers to check account balances without needing to log in, or use a phone’s contact list to enable direct P2P payments are two examples of simplifying everyday transactions.

Moving Customers to Digital Channels

Bain research has determined that, for most banks, “60% to 70% of teller transactions are bad (because of errors or rework) or avoidable (because they would be quicker, easier and cheaper through digital channels).” This is why Bain strongly recommends that transactions be migrated to digital channels for improved satisfaction.

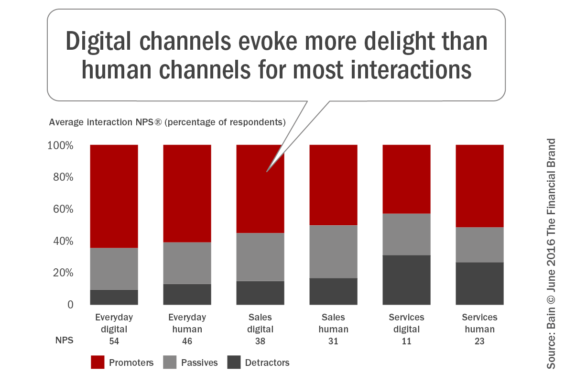

Beyond the lower cost of digital transactions, digital (especially mobile) interactions consistently create more ‘customer delight’ for routine transactions than do traditional channels. This of course assumes that the mobile app is well-designed, reliable and easy to use.

“Migration hinges on banks having a thoughtful process for changing behaviors of customers who are technology laggards. In the branch, for instance, employees can ask customers whether they would like to skip the line, then pull them aside to help them set up an online account and show them how to transact. The second or third visit might require further guidance, until the customer is comfortable with the technology,” states the Bain analysis.

Simplifying Sales and Service

Despite the lower frequency, simplifying sales and service transactions still impact overall customer satisfaction and the NPS score and therefore can’t be ignored. Because of the bar set by non-financial firms like Amazon and the experiences created by new fintech start-ups and large technology companies, a seamless digital sales and service experience is expected. The impact of simplifying digital experiences is amplified since almost one-third of sales or service interactions in the past quarter occurred via mobile, Bain’s global consumer survey found.

While the branch is still used by many consumers for complex sales, service and advice, an increasing number of these interactions are supplemented and/or complemented by digital technology such as mobile chat or video. Digital technology is also used to reduce paperwork and simplify back-office supported branch functions.

Focusing on the Overall Experience

Consumer satisfaction and loyalty is built over time, through a series of daily interactions combined with sales and service experiences. As a result, financial institutions need to simplify the digital and physical processes from the beginning to the end of the customer journey.

This requires the collaboration across departments that are used to working in silos. The priority of investment in improving the customer experience should be based on where an organization falls short and where the greatest impact can be realized. For most organizations, the investment should begin with simplifying the routine and improving the episodic sales and service interactions over time.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

‘Simplification’ Means ‘Removing Steps’

Legacy bankers are used to adding components to the customer journey to ‘improve’ customer satisfaction. ‘More is better’ used to be the mantra banking and other industries lived by. In a digital world, the opposite is true. Consumers are looking for clean design, simplified processes and the minimal number of taps to get the job done.

In many instances, the goal should be to remove steps, touches and entries required to perform a transaction or complete a sales or service process. Some ways this has been done include:

- Pre-login balance availability

- More customizable alerts and notifications

- Leveraging the tools of the modern digital device (biometric login, address book access, camera use for deposits and account opening)

- One touch access to customer support

- Digital account opening

- Streamlined websites with reduced pages

- Comparison tools and modular financial management calculators

- Visual representation for money management

Organizations should have a goal of simplifying processes as an ongoing mission. Use firms like Moven, Simple and other mobile-first organizations as examples. Set an objective of removing steps from customer-facing interactions regularly.

Consumers are evaluating all of their digital partners regularly to determine how they can make their daily life easier. Those financial and non-financial firms that can simplify the design and engagement of mobile applications will be the winners in the long run.