If the term “Web 3.0” has crossed your radar, and you are wondering what it is and whether it’s worth starting another ulcer over, we have four words for you: Eco, Valora, Compound and TrueFi.

Eco, which promotes the fact that it is not a bank and not FDIC insured, offers accounts held in stablecoins that function as both spending and savings accounts, but with higher returns.

Valora is an app available through the App Store and Google Play that uses the blockchain to deliver a version of P2P services out of a mobile crypto wallet.

Compound describes itself as “an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications.” Among the services using it is Compound Treasury, which promises a 4% annualized return with dollar deposits turned into stablecoins as well.

TrueFi is a marketplace lender offering unsecured loans for borrowers and an opportunity for people with funds to invest in loans to earn a higher return. TrueFi is a form of decentralized finance — “DeFi” — using stablecoins.

Numerous tech and crypto investors back these fledgling companies, all of which are doing business through some aspect of “Web 3.0,” also called “Web3.” One investor in common is Andreessen Horowitz.

The venture capital firm is investing heavily in crypto through a hedge fund. In late 2021 it launched a lobbying campaign in support of its idea of how the World Wide Web should evolve, and, along with it, many of the businesses and activities that tie into it — including financial services. This push so far includes issuing ten Web 3.0 principles for world leaders shaping the future of the web and publishing a major Web 3.0 white paper, “How to Win the Future: An Agenda for the Third Generation of the Internet.”

Regarding financial services, that paper states: “Our financial system needs to be revamped for fast payments. It also needs to be more inclusive; for instance, by improving access to credit through better credit scoring that incorporates more data sources. Web3 has demonstrated the potential of alternatives to the current system. Decentralized finance, or DeFi, is also supplying a wave of new infrastructure to support more sophisticated financial products…”

There’s more in the paper, but it’s far from the only voice in Washington promoting Web 3.0. Anti-bank rhetoric is part of it.

In congressional testimony on Web 3.0, Brian Brooks, former Acting Comptroller of the Currency, who liberalized treatment of crypto activities by national banks, said in part: “Do we believe a user-controlled decentralized internet is better than an internet largely controlled by five big companies? … Do we trust big banks more, or open-source software more, as a tool for maintaining ledgers of account and allocating credit and capital?” Brooks is now CEO of Bitfury Group, a supplier to the cryptocurrency business.

Clearly, both traditional financial institutions as well as neobanks and fintechs have to understand what Web 3.0 is and how it could develop. The following Q&A presents the basics of what is already becoming a very complicated new field.

Disruption Déjà Vu:

The temptation to dismiss Web 3.0 financial services as fringe efforts should be tempered by realization that many in banking missed the potential of PayPal and Chime until they became huge competitive threats.

Web 3.0 also includes the metaverse, but goes far beyond that.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

What is Web 3.0? (The Technical Answer)

There are two ways to look at Web 3.0. One is to understand the guts of what is making its beginning stages work. The other is to consider what its backers say it would accomplish and in what ways.

Let’s take the first.

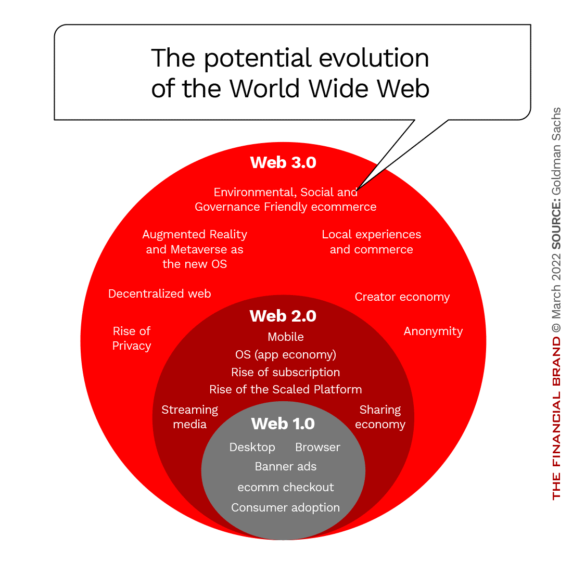

Web 3.0’s backers say it is the next step in the evolution of the World Wide Web. The graphic below shows how the widespread Web 2.0 we have today, with the heavily linked webpages with audio, video and much more that we take for granted, grew out of the now primitive Web 1.0.

Web 3.0 is based on blockchain technology. As such, a key element of how it is intended to run is that it will be decentralized. Blockchains are intended to run independent of central authorities like governments and even major internet powers like Google. Indeed, as Investopedia suggests, Web 3.0 “would break down the massive databases currently held by internet giants like Facebook (now Meta) and Google, and hand greater control to users.” Web 3.0 is intended to operate based on open source software that any developer can tap and is “trustless.” That, according to Investopedia, means “anyone can participate without authorization from a governing body.”

Digital Birds of a Feather:

Much of the transacting that is going on in Web 3.0 involves cryptocurrencies. There's a strong overlap between crypto believers and Web 3.0 fans.

For most purposes the value that changes hands does so as “tokens,” synonymous with cryptocurrency. The Ether cryptocurrency is one of the key cryptos used.

In some ways, aspects of Web 3.0 are like what a science fiction fan would call an “alternative reality.” For example, in the current web world we have “apps.” In Web 3.0 there are “dapps,” which stands for decentralized apps. In theory, those are to be built and owned by users, though some doubt that it won’t be done by companies like the present web and app world.

Although the idea is that there is no centralization, governance does exist in a sense, in the form of “DAOs.” This stands for Decentralized Autonomous Organization. A major role of these bodies is developing and maintaining the digital protocols that govern each blockchain.

As multiple commentators have pointed out, for the typical person on the internet street, the likelihood that they will participate in Web 3.0 without some third-party providing easy access is doubtful. And, as the financial services examples opening this article underscore, there’s money to be made.

Read More: Surging Use of Crypto Cards Warns Banks of a New Payments Disruption

What is Web 3.0? (The Philosophical Answer)

The first answer gets at the nuts and bolts of Web 3.0 at a high level, but doesn’t get much at the “why.” Over roughly two decades we have gradually come to accept life built around websites and mobile devices, with connectivity never dreamt of before.

NPR describes Web 3.0 as “an umbrella term for disparate ideas all pointing in the direction of eliminating the big middlemen on the internet. In this new era, navigating the web no longer means logging onto the likes of Facebook, Google or Twitter. … Web3 is about grabbing some of the power back.”

Maybe. The truth is, the tech titans are already battling over what Web 3.0 will look like as its ingredients congeal more. In late 2021 some of this came to a head as Bitcoin advocate Jack Dorsey, the founder of Twitter and of Square (now Block, from blockchain), began criticizing how Web 3.0 is coming together.

For all the talk about decentralization and even “democratization of the web,” Dorsey expressed, via Twitter, his belief that it was already game over for those goals.

“You don’t own ‘web3.’ The VCs [venture capitalists] and their LPs [limited partners] do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into…”

— Jack Dorsey, Block and Twitter

Pro-Web 3.0 forces, including Andreessen Horowitz, counter-attacked, and the debate continues, in social media and elsewhere. In the meantime, consumers will have more questions as time goes on. For example, if information we worried about being exposed on the present web goes on a blockchain, will that make it easier for our personal data to be leaked to the world?

Read More about the Metaverse: Should Your Bank Follow Chase Into the Metaverse?

What Is Proponents’ Vision for Web 3.0?

A cynic would say that when venture capitalists back something, it’s because they think they will make money at it. Then there’s the school that holds that you can “do well by doing good.”

The Andreessen Horowitz paper presents Web 3.0 as an opportunity to have a reset from where the web evolved to date.

“Web 2.0 has transformed our economic and social interactions in ways that have profoundly benefited society. At the same time, few would debate that Web 2.0 social media and today’s large tech platforms — took a wrong turn along the way.”

— Andreessen Horowitz report

More specifically, the paper argues that in the Web 2.0 world neither the public nor private sector has been able to solve issues like data breaches, outright lies distributed through the web, monopolistic practices and algorithms with biases that skew results.

“Meanwhile, authoritarian governments have never had more data with which to surveil, censor and manipulate their citizens and those of other nations,” the firm adds.

Andreessen Horowitz favors seeing coexisting dollar-denominated stablecoins and central bank digital currencies coming to the front as Web 3.0 solidifies. While banks have recently entered the stablecoin business, CBDCs have been targeted by the Bank Policy Institute as undermining the traditional banking system.

Rather than arguing for a laissez faire approach, the firm’s paper argues for extensive government involvement in Web 3.0’s evolution and suggests fresh approaches to regulation.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

A Web 3.0 Naysayer’s View

Lurking behind talk of all the good that could come from the next iteration of the web is the belief that the real motivation is “How do we monetize it?”

Blogger Scott Galloway, NYU Stern marketing professor, brands Web 3.0 as “a hazy/vague term describing a crypto-powered internet, and a font of yogababble.”

He observes in the same blog, regarding the leadership developing in Web 3.0: “The new guard also looks older and more, well, guardian than the old guard. Specifically, dudes from Stanford/Harvard who conflate luck with talent and serve under the delusion of a mandate to save us while accidentally making billions.”

Regarding the promoted benefits of decentralization, Galloway notes that “centralization” sounds stifling and corrupt. But he points out that history has a lesson for us.

“The Wild West was decentralized. And we soon discovered that towns need sheriffs and central protocols (i.e., laws). Theft runs rampant on Web3. Losses from crypto scams and thefts totaled $14 billion in 2021.”

— Scott Galloway, NYU Stern

Galloway is far from the only Web 3.0 skeptic. There have been questions, for example, over whether Web 3.0, as it exists, is really even decentralized.

What Could Come Out of Washington That Would Affect Banking?

Plenty of legislation around crypto and more has been introduced in Congress, but may or may not move further. One factor that may influence things is a pending unreleased presidential executive order dealing with cryptocurrency, CBDCs and related issues. The overall impression left by leaks about the document is that the Biden administration may want CBDC development to move somewhat faster than the Federal Reserve has done. On the other hand, the administration has shown a desire for increased control of financial services, which goes counter to much of what Web 3.0 backers favor.