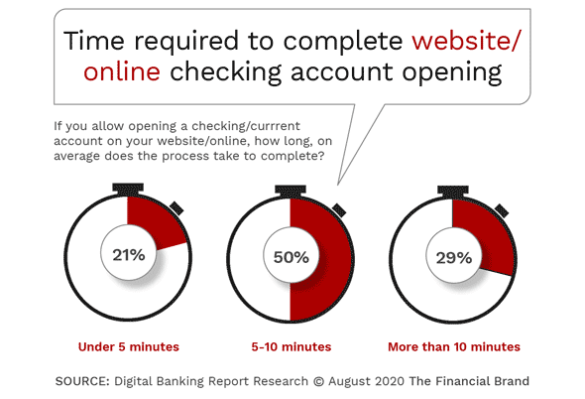

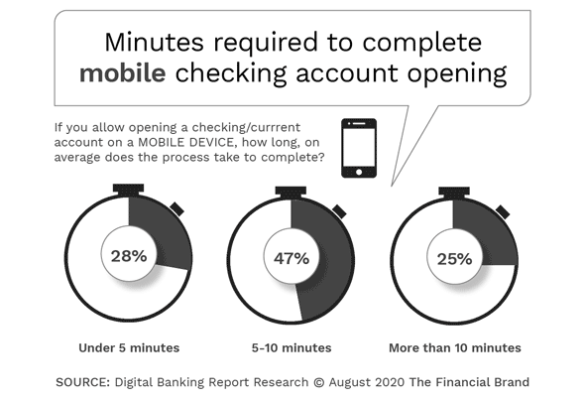

The COVID pandemic completely altered the global economy and the banking industry, forcing banks and credit unions into a crisis mode to replace physical engagement with digital functionalities. Some financial institutions accelerated digital transformation efforts that were already in process, while many others created digital capabilities in an ’emergency mode’, often without a well thought-out focus on the user experience. While digital account opening and digital loan application capabilities increased significantly, many processes took between 5-10 minutes – or longer – resulting in lost business opportunities.

The consumer will not be retracing their footsteps … returning to the way they did banking in the past. Many financial institutions globally have closed branches or adjusted hours of service reflecting the need to reduce person-to-person engagement. As a result, financial institutions need to remain focused on providing the highest level of user experience within their digital banking apps, with the same speed, simplicity, intelligence and technological integration that consumers receive from organizations in other industries. To accomplish this, banks and credit unions must improve their data and analytic maturity to support real-time, personalized engagement across all channels.

The Digital Banking Report has found a direct correlation between a financial institution’s digital transformation maturity and their ability to use data and analytics for an improved customer experience, the support of an innovation mindset, the successful deployment of advanced technology, and most importantly, financial performance. Digital banking ‘champions’ are not always fintech or challenger banks. In fact, Deloitte found that 81% of digital banking champions were incumbent banks. This is because capabilities without scale often create issues around trust and customer care, while only supporting digital channels.

While starting with a digital business proposition helps, legacy financial institutions can also become digital banking champions. One of the keys to success is a leadership team that embraces the opportunity of becoming a digital bank, and creates a culture that reinforces the use of data, analytics and technology to deliver an exceptional digital customer experience. The result is an organization that outperforms peers in market value, revenue growth, efficiency (cost ratios), customer satisfaction and even the ability to find and keep talent.

Read More:

- 7 Essentials of Digital Transformation Success

- Now is the Time for Intelligent Digital Banking Experiences

- Digital Banking Strategies Hampered By AI Talent Gap

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Importance of Data and Analytics

Research from the Digital Banking Report found that digital banking champions use data to improve customer experiences while still increasing both financial and non-financial revenues. This is because the most digitally and data adept organizations provide value-added services that improve efficiency from the consumer and banking perspective, embed solutions within traditional services, allow for proactive personalized recommendations and create engagement opportunities that increase loyalty and expansion of relationships.

In other words, data and analytics provides the platform for real-time solutions that are seamless and intuitive, creating a unique user experience that puts the incumbent financial institution at a competitive advantage. The key is to have the internal talent and organizational support to deploy insights so customers realize that you know them, understand them and will reward them.

Digital Banking Champions are Strong From the Outset

The Digital Banking Report found that while many incumbent financial institutions added both online and mobile account opening and digital loan application capabilities soon after COVID shut down branches, the processes were far from easy or fast. For instance, more than 75% of online/website account openings took longer than five minutes, with close to 30% taking longer than ten minutes. Surprisingly, the time to open a new account online has changed very little since 2017.

For mobile new account openings, the time to complete a new account opening was only slightly better, with 28% indicating a process of less than five minutes, but 25% taking longer than ten minutes (compared to 20% in 2019).

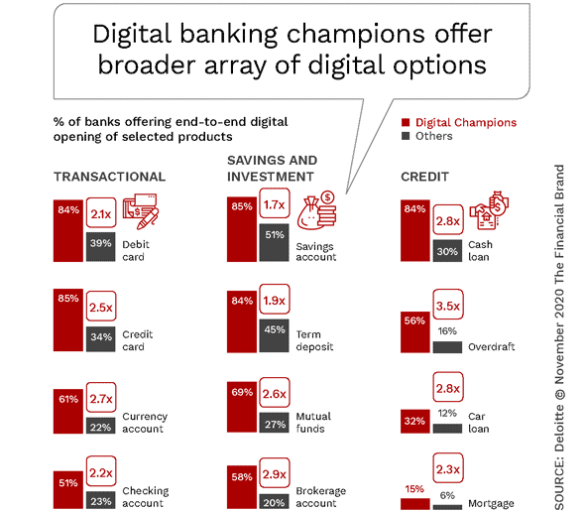

Deloitte found that a greater percentage of digital banking champions provide end-to-end online and mobile account opening functionality, while also enhancing the experience with several time-saving capabilities and user experience enhancements. From simple data entering, to progress trackers and ‘stop and resume’ functionality, the processes at digital banking champions put the customer in control, with speed and ease of use being the differentiator.

Digital banking champions also allowed customers to open a much broader array of services digitally, improving cross-sell and up-sell success. Digital champions make it easier for a customer to open virtually any service, end-to-end, without the need of physical interaction.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Already Drowning in Data, Financial Marketers Ask for More

- Rethinking Financial Services with Artificial Intelligence Tools

Digital Champions Go Beyond Traditional Banking

While there is a lot of discussion in the banking industry about embedded functionalities and added digital services for an improved digital customer experience, few organizations actually have expanded beyond the ordinary, often having separate silos for checking/current accounts, savings accounts, credit products and ancillary services. According to Deloitte, these silos do not exist at digital banking champions, allowing leaders to enhance relationships with expanded capabilities during the entire customer journey.

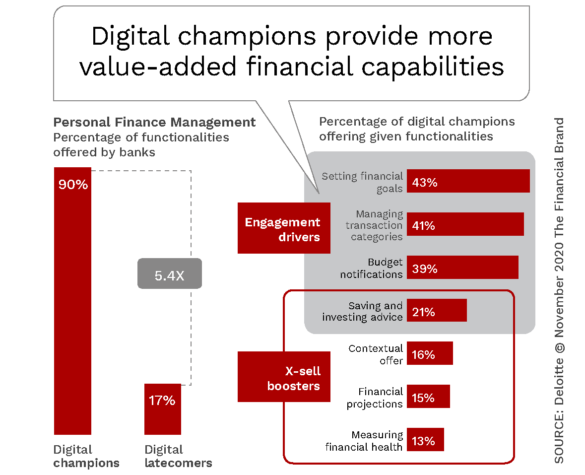

One of the more dramatic differences between digital champions and the rest of the industry is the focus on using data and customer insights to improve personal financial management (PFM) functionality. From setting financial goals and managing different categories of the financial relationship, to offering contextual offers and projections, digital champions serve as a financial management ‘concierge’ to their customers, according to Deloitte.

Beyond traditional financial services and integrated PFM functionality, the most progressive digital banking organizations have found ways to move ‘beyond banking’, including services ranging from transit passes and retail discounts to credit reports and privacy insurance. These types of enhancements are engagement and loyalty tools that help make using the mobile banking app on the phone or online a daily occurrence.

Use Data to Enhance the Customer Journey

The change in consumer and competitive behavior surrounding banking relationships illustrates that there is more to being a digital banking champion than just having data and analytics maturity or to be able to open an account digitally. It requires a seamless and integrated experience across the entire customer journey, from the shopping process, to account opening, to relationship expansion and loyalty, and even including the ability to close and transfer accounts with ease.

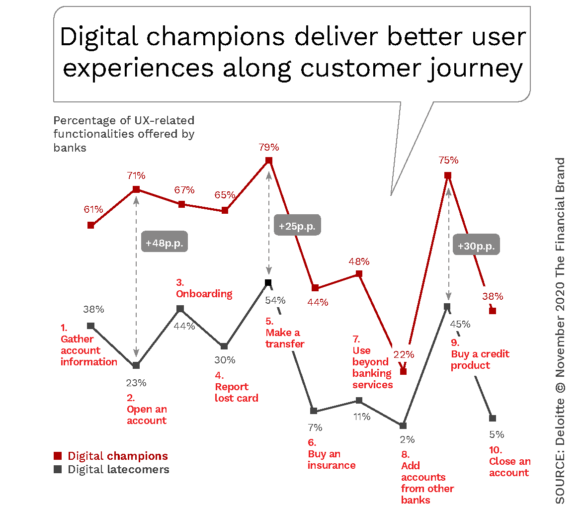

With digital technologies continuously improving and consumers becoming more adept (and demanding) around digital functionality, the bar for user experience excellence continues to rise. Without a digital culture, reinforced on an ongoing basis by leadership that is focused on becoming a digital bank, the ability to keep a customer satisfied over time is made more difficult. As illustrated by the chart below, digital champions in banking overperform at every step of the customer journey.

Change will continue to occur in banking and other digital industries. It is important for financial institutions to provide the highest level of user experience, supported by data, advanced analytics and a overarching institutional focus on building solutions from the inside-out, with the customer being at the center of the development process.