As shelter-in-place orders have either shuttered or severely limited access to financial institutions, people have had almost no choice but to engage with banks and credit unions on digital channels.

To understand how consumers and businesses are interacting with financial institutions in these unique times, we looked at search trends data provided by major search engines such as Google. We also dove deeper into the data on bank and credit union websites looking at web analytics data from sources such as Google Analytics and Adobe Analytics as well as data on web traffic to online banking platforms.

What America’s Googling About During COVID-19 Period

The second week of April, traffic to the public websites and online resources of many banks and credit unions reached all-time highs. This spike in visitation piled onto the already significant increases in online banking logins and usage of functions such as bill pay.

Of course, much of this increased digital engagement is being driven by people being in quarantine, tracking interest rate changes and looking into government loan programs. Additionally, many consumers are in the unfortunate position of having lost their jobs, and are wondering if they can miss payments, if there is information about student loan forbearance, or if they can obtain a consolidation loan.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

However, the growth in visitors performing bill pay, transfers, and other account activities is driven by customers that would normally have performed these activities on other channels, primarily at branches.

The primary question on everyone’s mind is if the people who performed these functions through branches and call centers will ever return to those previous methods. If a large portion of these visitors bank digitally after the quarantine is lifted, how will this impact branch strategies for banks and credit unions across the country?

What Can Web Analytics Predict About the Future?

In order to answer these questions, we looked into the web analytics data of banks and credit unions across the country. We analyzed over 80 million digital visits at community, regional, and national financial institutions across the U.S. over the previous six months.

Here are some of the insights we uncovered:

1. For all but one institution, March was the busiest month and the trend lines are showing that April will be even higher, when analysis is complete, with the week of April 12th being the highest volume week for most institutions.

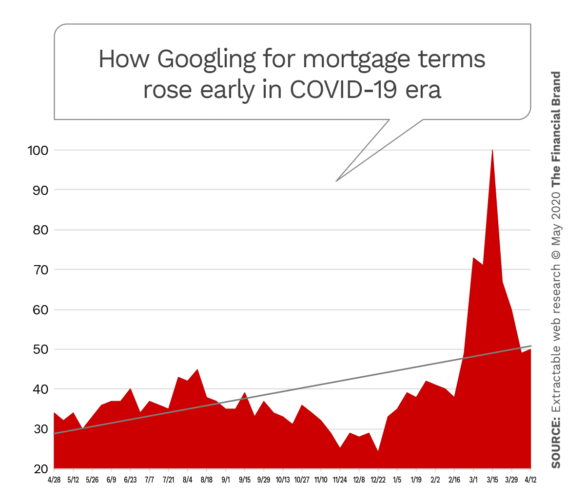

2. Google reported a near 100% increase in search volume for “loan” related phrases in March and April, compared to prior months. “Mortgage”-related phrases saw an increase of over 300% in the same time period. “Deposit”-related phrases also saw increases, but not nearly as high.

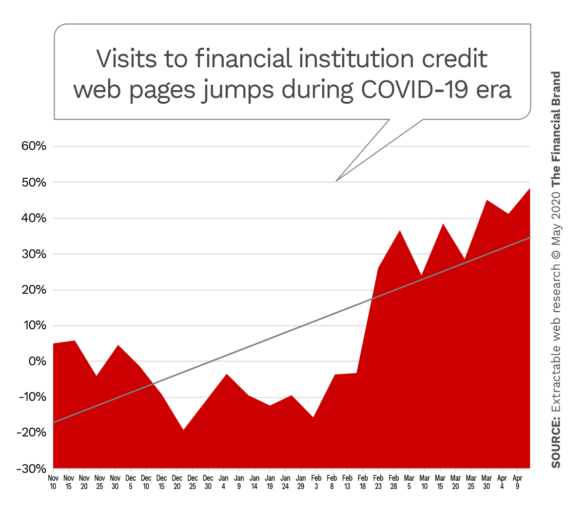

3. Most institutions saw a steady increase in visitation to loan and credit product pages starting in early February. Most institutions saw a 40%-150% increase in views of these products compared to the same period in the previous year.

4. Institutions that focus exclusively on high-net worth and commercial clients saw the lowest level of growth in visitations and product views.

5. The increase in visits to checking and savings pages was relatively low until the week of April 12, when most institutions saw their highest volumes in the last six months.

6. Financial institutions saw a 10%-30% increase in monthly logins in March and April compared to prior months.

7. In the financial institutions we viewed, some saw a small increase of approximately 7% in visitation to advanced online banking functions, such as bill pay and transfers. But some financial institutions saw an increase in these functions of around 24%.

Read More: Tectonic Shifts in Consumers’ Life Views Financial Marketers Must Grasp

What These Trends Suggest for Preparing for the Near Future

These data points beg some important questions. If a bank or credit union sees a 20% increase in digital online banking engagement during the crisis, it’s likely that much of this growth came from customers who hesitated to perform these actions on the digital channel previously. During the pandemic, these “digitally reluctant” customers learned how to perform these actions online and may prefer to do so post-COVID-19.

If just half of these new digitally advanced customers never go back to the branches, that could result in a 10% decrease in branch traffic after the quarantine is lifted. For most banks and credit unions, this would be the largest annual decrease in branch traffic over the last ten years.

Such a shift could result in financial institutions radically shifting their focus, budgets and support from the offline channel to the online channel.

It is paramount that banks and credit unions completely re-examine their digital strategies and determine what changes they need to make in their business plans. They should be asking:

- Are we tracking the appropriate data to understand what behaviors are changing?

- Do we have forums to talk to consumers and businesses to understand changing needs and behaviors?

- Do we have the right technology, partnerships, methodologies and resources to make changes quickly?

It is imperative that banks and credit unions respond to the current need in digital with a long-term strategic vision that can guide them towards a more resilient future.