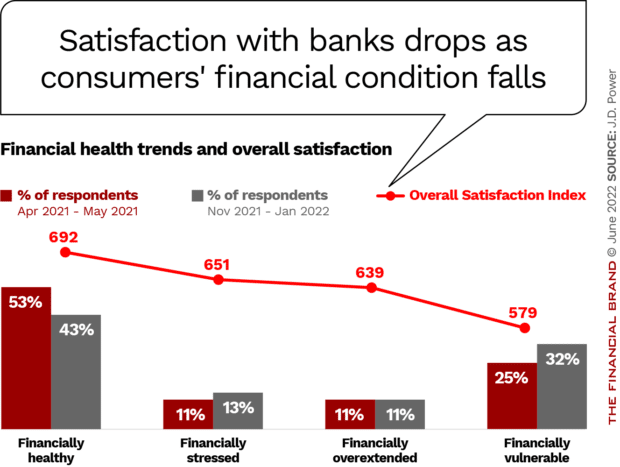

Many Americans’ financial health is slipping and that is beginning to be reflected in their overall view of the major retail banks that serve them. It is also lowering their opinion of the customer experience they have with the banks’ apps and websites, according to J.D. Power research.

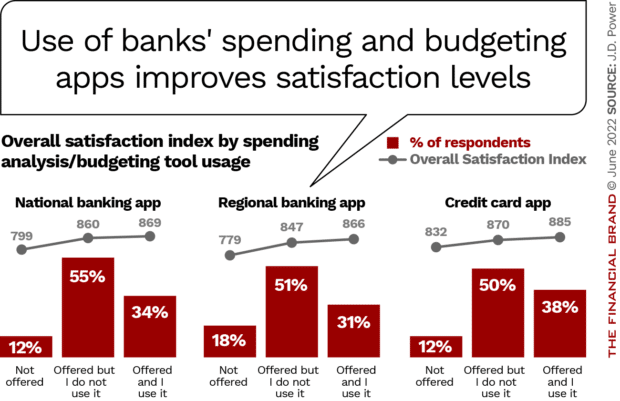

The good news: When consumers use the banks’ digital tools related to financial health, such as apps that assist in budgeting and tracking spending, their satisfaction levels rise.

The bad news: Many consumers don’t use these potentially helpful digital tools and thus display lower levels of satisfaction with their banks.

Digital Experience is Critical:

1 in 7 customers moved their money to a different bank because the new institution offered better digital tools, according to J.D. Power.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

Navigating Credit Card Issuing in an Uncertain Economic Environment

These insights and others in this article come from a cross-analysis by J.D. Power of a collection of their retail banking and credit card satisfaction studies.

Before the pandemic, many banks tended to treat financial health issues as a niche strategy. In the wake of the pandemic lockdowns and mini-recession, and now the return of significant inflation and the possibility of “stagflation,” how well an institution addresses this shift in financial health, both in general and through its digital channels, will make a difference.

With the level of consumers who are financially healthy falling ten percentage points in less than a year, as shown in the chart, the need to address this problem before the economy worsens must be considered. Note that most of those people joined financially vulnerable consumers, the group with the greatest difficulties.

Customers who are not financially healthy want both long-term advice on how to save for key needs like retirement and more immediate advice on near-term tactics, which is where digital tools can often be of immediate help, according to Jennifer White, Senior Consultant for Banking and Payment Intelligence at J.D. Power.

“The banks that figure out how to blend those together are the ones that are earning people’s trust the quickest,” says White, in an interview with The Financial Brand.

Read More: Why Bank of America Believes Financial Health is the Future of Banking

Good Tools (If Used) Drive Greater Satisfaction

White says that digital budgeting and spending tools are becoming a key functionality that deserves more attention from financial institutions both because consumers are clamoring for such tools and because some of the most competitive fintechs frequently lean on them as part of their offerings.

“People want this support and the banks that make it a priority are all likely to earn the hearts and minds of banking customers now,” says White.

However, usability is a critical factor, according to White. Many retail banks recognize that making digital financial health tools available has become a must, she says, but often banks’ offerings fail to provide the full utility and attractive customer experience that fintechs’ tools provide.

Visual appeal is important but so is the customer’s ability to access information and content quickly and easily. Navigation is important, as is speed.

Institutions that not only put a strong tool on the table, but work to keep it current and fresh, will enjoy greater success than those that don’t, says White. This is especially so with consumers who are under 40, who will ditch a confusing or boring tool quickly.

The chart above shows usage of financial health apps among national banks, regional banks and credit card providers. (A parallel analysis of use of website tools showed similar correlation.)

Read More:

- The New Role Financial Wellness Plays in Banks’ CX Strategies

- Should Banks Add ‘Financial Therapists’ to Their Wellness Programs?

- 4 Segmentation Strategies to Improve People’s Financial Health

How to Drive Greater Satisfaction by Encouraging More Use of Tools

The fact that many consumers don’t take advantage of the tools their banks offer, begs the question, “Why not?”

“It is a really interesting puzzle,” says White. “On one hand consumers are telling us that what they need most is assistance with budgeting. They want to be able to spend within their means and want help to prioritize their debt payments so they can strengthen their everyday financial health. On the other hand, their actual usage is low.”

While the quality of the tools may be a factor, White thinks communication shortfalls are also at play. The same body of research indicates that branches remain important to many consumers. White says it may be necessary for contact staff to talk up the bank’s digital financial health tools so people with difficulties will try them. On the digital front, messaging to encourage usage that is tailored to the consumer’s circumstances could help drive more interest.

“Too much of the messaging now is not personalized, and may not be relevant to the consumer’s immediate needs,” says White. “That may be impacting their awareness of these services.”

A Tip to Marketers:

Banks need to appreciate that budgeting means different things to consumers in differing circumstances.

Knowing that a tool is right on their desktop screen or on their phone means one thing to a financially healthy consumer whose ambition is saving for a great vacation versus the consumer who is juggling way too much debt.

“Budgeting tools can likely help both of them,” says White, “but understanding what someone’s really looking for out of a budget tool is critical in crafting a message that will get their attention.” Using the four segments that J.D. Power uses for dividing up its study samples in the charts above would be a beginning.

White suggests that while Gen Z and Millennials are known to like such digital tools, that may be distracting banks from another segment: Generation X.

“We tend to overlook Gen X, but our data indicates that they are raising their hands to say that they want support from tools like these,” says White. Gen X can be a “lost generation” in some quarters, coming between Boomers and Millennials, and institutions that devise solutions to help them may prosper.