Banking leaders know that the worst time to woo a depositor is after funds have left their account. The challenge for banks and credit unions has been learning who to engage before a competitor whisks them away.

Data has long offered great promise to improve institutions’ understanding of depositor satisfaction or the lack thereof. Banking has even made great headway at engaging depositors who show activity – such as a new mortgage or a termed-out deposit certificate — casually tied to attrition.

But what about those who don’t have clear indicators of departure?

With the data and technology now available, institutions like Monona, Wis.-based Lake Ridge Bank are using data to model attrition, even in the absence of clear causal precursors. As a result, the $2.9 billion bank’s average depositor lifespan has reached eight years. And that’s relative to a horizon of less than two years to recoup the cost of acquiring that depositor.

“If our timeframe was much shorter, I think we’d be more stressed out about our client acquisition,” Ben Udell, senior vice president of client experience at Lake Ridge, tells The Financial Brand. Instead, “we have six years of runway after those first two years to earn our investment back because we have a full eight years with them to provide them even more value.

“The average person buys a new home or refinances their mortgage during the course of eight years,” he continued. “And they may also change jobs, so we get a chance at their 401(k) rollover. They’ll probably pick up another credit card during that time as well. The opportunities provided by relationship tenure makes us more comfortable being more aggressive up front in acquisition.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Using Data to Turn Attrition Risk into Loyalty

Lake Ridge Bank takes all its data — such as balances, account transactions, debit and credit card transactions, and payoffs — and models attrition risk. It also derives the best ways to engage depositor segments based on that data.

With the help of Alkami, a digital banking platform, the marketing segments available to Lake Ridge Bank have become increasingly well-developed. “We know that they shop at Home Depot, enjoy eating at Culver’s, go bowling, and drink beer,” he says. “We’re not going to do hyper-targeted marketing to the standard Wisconsin guy doing all that. But we could.”

During 2022, homeowners across the country bought new homes or refinanced their mortgages in droves. Bank mortgage lenders incentivized borrowers with lower mortgage rates when they opened and funded a new bank deposit account.

The risk to Lake Ridge comes from consumers who paid off their mortgage with the bank last year, and now have exposure to a new bank. Will they switch their banking relationship too?

Data provides Lake Ridge with a double strategy to counteract that risk. “That is the key,” says Udell. “How do we get ahead of them? And how do we create marketing that’s much more tailored and targeted? Loyalty comes from connecting with clients with greater relevance.”

“Loyalty comes from connecting with clients with greater relevance.”

— Ben Udell, Lake Ridge Bank

First, relevant messages for its segments have made it better at expanding account holders’ product usage. Depositors with equity and Home Depot transactions are great candidates for home equity loan information.

“Think of that classic home equity campaign; it focused on taking a dream vacation, remodeling, or consolidating debt. Those are all good uses, but now we can split each audience up,” says Udell. “And home equity loans are a high-value product for us as a bank.”

Second, because Lake Ridge has built strong customer retention, it can go on the offensive for deposits instead of becoming defensive when mortgage borrowers move elsewhere. Again, customers will likely stay well past the two-year horizon needed to recoup acquisition costs.

“If we’re not offering a special, somebody else is. So, we’ve tried to take a step back and focus on getting their direct deposit [out of marketing campaigns],” Udell says. “Instead of having bankers sell all these other products, let’s just sell direct deposit. If we get that, they figure out how to use online and mobile banking, use their debit card, and order checks. Then, when rates go back down, we’re the preferred financial institution and get a good shot at their mortgage refinance.”

Learn more: Proposed Capital Rules To Crimp Credit Card & Mortgage Lending

Identifying Deposit Account Attrition Risk

The core accounting system’s transaction data tells an entire story about the customer, from their income level to their spending habits. But the core itself isn’t good at surfacing that data. Institutions can dig into attrition data, such as the number of accounts lost and the associated average balances, but these insights fall far short of being actionable.

Transfers between external accounts reveal the customer’s relationship with other institutions. Changes in income or large deposits can indicate major life events. An increase in spending, such as purchases at Home Depot, may be an opportunity for additional financial products, such as a home equity line of credit.

Mark Leher, director of product management at Alkami, calls this type of transaction data “key lifestyle indicators” (KLIs). “Key lifestyle indicators are insights or metadata derived from core trends,” Leher tells The Financial Brand. “Where you spend your money reflects what your true priorities are. And we think that gives a lot of great insights for a financial institution into what an account holder is actually doing with their financial lives.” Alkami also provides AI-driven, predictive modeling for departing deposits.

“Where you spend your money reflects what your true priorities are. And we think that gives a lot of great insights for a financial institution into what an account holder is actually doing with their financial lives.”

— Mark Leher, Alkami

Leher points out that large deposits, for example, should be an inflection point: institutions should reach out and try to lock up the funds in a CD before the funds leave the institutions. “You should have campaigns to fight for those deposits,” Leher advises.

From an engagement perspective, reaching out shows that the institution cares about its customers. “Their competitive differentiator is their service,” Leher points out. “These are all insights that can help deliver that service. It’s all there, in the data.”

In the reverse, Alkami has one client that runs a daily report of accounts with large balance decreases. The institution looks to see where the money is going. Though, inevitably, not all accounts are worth saving. Every institution should consider the account’s profitability before spending time trying to save the account. If the account costs too much money, it becomes a graceful exit.

Read more about deposit growth:

- How One Community Bank Drove $135 Million in Deposits in 90 Days

- Faster Access to Funds Could Reshape the Battle for Deposits

The Rising Role of Predictive Modeling

A mortgage payoff is a pretty clear sign of possible deposit attrition.

What about accounts that don’t have events like that? Often, depositors don’t close accounts, even when they’ve moved on.

Alkami’s AI-driven modeling is “trained by an institution’s population of closed accounts,” says Leher. “We’re looking back six months for the KLIs leading up to that event to find KLIs with the greatest predictive power for attrition.”

Predictive modeling provides an institution a head start on engaging customers by scoring them — based on their account activities or KLIs — for attrition risk. Institutions using that can potentially engage depositors months before attrition may actually occur.

“People with low engagement scores can have 20- or 30-times greater chance of leaving the institution than the highly engaged, but that doesn’t mean they will,” Leher says. “We’re modeling the ingredients of attrition for that particular institution… and for target events. Those events could be closed accounts, but it also could be accounts that declined to a low balance, even though they remained open.”

Competing Amid Rising Cost of Acquisition

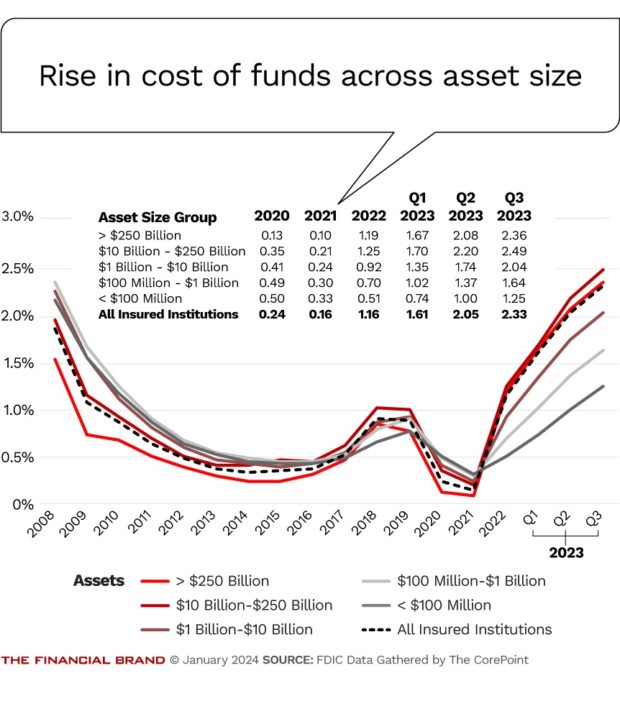

Bank and credit union costs of funds have risen to levels unheard of since before 2008.

According to data published by The CorePoint, banks already had skyrocketing interest expense in the first quarter of 2023. Since then, depending on a bank’s asset size, their cost of funds has risen by another 1%. Compared to 2022, it’s up by 2%, depending on asset size.

Marketing costs add another layer of expense. According to Datatrac, the average new account costs a bank or credit union between $350 and $422, and that doesn’t include staff or backroom costs to get from application to an open and funded account.

For Lake Ridge Bank, when it must compete with the specials of other institutions, it can avoid marketing expenses through more efficient management of its marketing channels. And that, again, is possible because of its data.

“We’ve been able to start piecing together strategic decisions about how we spend money on things like direct mail,” Udell says. “For junior savings accounts, for example, it’s hard to go to a CFO and say we’re doing direct mail to plant seeds that won’t pay off until ten years from now. We can go on the digital side, and our entry cost is really small.”

For products like home equity loans, on the other hand, Lake Ridge can save costs by only mailing promotions to high-propensity account holders. “Instead of mailing 1000 clients, now we’re going to mail to 500 who are more likely to convert because they have the transaction types, the equity, and the credit score that make home equity borrowers a fit.”

With the kind of digital understanding Lake Ridge has of its customers, using data to defend against attrition means it can welcome depositors in the door when other institutions are worried about how they keep funds from walking out the door.