Unexpected life events can throw families and small businesses some difficult financial curveballs. Whether it is a late payment from customers, a vehicle towed, or a child who needs a cast on a broken arm, people can need money today. But even with a check in-hand, not all the funds would be available today.

With advanced payments technology, the wait may not be necessary.

Most small businesses too struggle to make ends meet. About four out of five report challenges related to rising costs, according to the Federal Reserves’ survey of 8,000 small businesses. Close to half of all small businesses reported difficulties paying operating expenses or navigating uneven cash flows.

As interest rates and inflation push day-to-day expenses higher, Americans report they have less cash, and it’s affecting their savings. About 74% of U.S. adults say they are saving less right now due to economic factors, according to a June Bankrate poll. In January, Bankrate reported 57% of Americans have less than $1,000 in savings.

Where the Struggles Lie:

For small businesses, rising costs is a growing financial challenge. Nearly half of the small businesses surveyed by the Federal Reserve struggled to balance their operating expenses.

With businesses or families more at risk of not having funds for surprise expenses, faster fund availability could be the difference that saves them from additional interest or overdraft fees. It might even help prevent debt spirals where borrowing causes more borrowing and more fees that hinder financial success even more. Financial institutions can’t solve income shortages for businesses or consumers, but they can reduce delays in the process of getting paid by check. Here’s how new technology might open the door.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

But Are Checks Still Viable?

Paying by check is still in vogue for small businesses. Small companies write eight times as many checks than retail account holders, according to Forbes. In fact, they’re writing just about a check every day; small- to medium-size businesses average 406 checks per year, according to a study published by Biz2Credit.

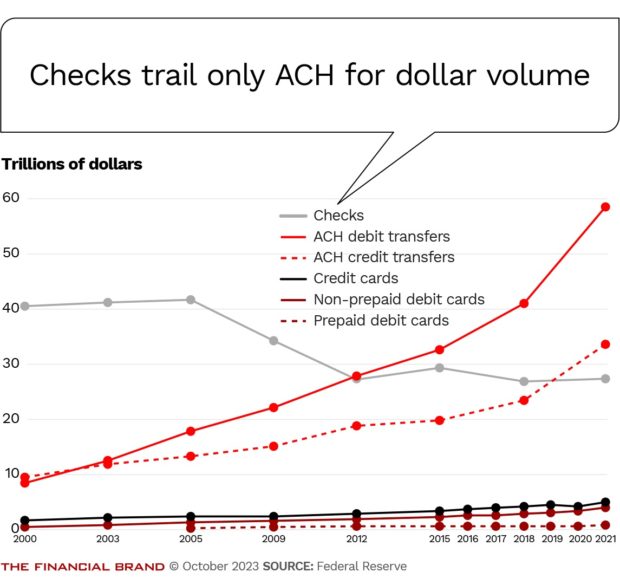

The digital banking boom during the pandemic admittedly did slow down the use of cash and check to make payments, but not by much. Consumers and businesses together paid $27 trillion via check in 2021, which is about 21% of all noncash payments, according to the latest report from The Federal Reserve. That compares to only about $9 trillion worth of debit and credit card payments.

Only ACH moves more money than checks in terms of dollars paid.

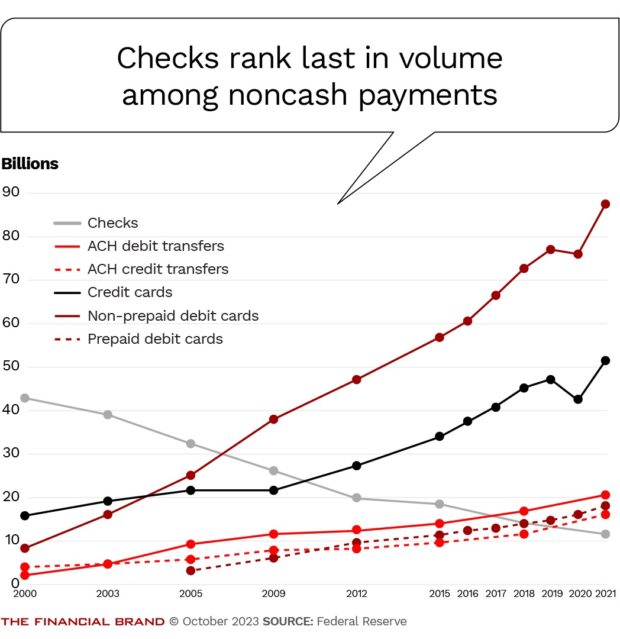

It’s important to note, however, that when it comes to number of payments, checks rank last. Cards accounted for approximately 77% of all noncash payments by volume. The Federal Reserve noted that noncash payments grew by a larger amount from 2018 to 2021 than in any previous measurement period since 2000. And, the number of card payments accounted for more than 84%of the growth in the number of noncash payments.

The increasing size of checks also means institutions have more risk in cashing them, particularly from fraud. Doesn’t that create a barrier for institutions in reducing the wait time for check funds to become fully available?

Friction Caused by Fraud and Legacy Systems

Since The Check Clearing for the 21st Century Act (Check 21) passed in 2003 – which made images of checks the legal equivalent of a paper check – institutions have added channel after channel for check cashing: such as remote deposit capture, mobile deposit capture and capture at an ATM. They’ve also added technology to technology.

The tech stacks for banking to operate and maintain these banking features is massive, and much of it out of date. Some of the software can be more than several decades old. “The industry has developed some 14 channels many of which are serviced by siloed, independent technology which institutions have to integrate,” Jason Schwabline, chief strategy officer at Alogent, a technology company that helps institutions streamline check and payment processing, tells The Financial Brand.

“Fraudsters have loved to play against that siloed system over the years,” Schwabline says. “They would cash a check from their car, for example, and then go into a branch and deposit the same check at a teller station, and then pocket the money. They knew those two pieces of technology didn’t talk for two days.”

Over the years, institutions developed best practices to overcome those siloed elements of their tech stack: Delayed fund availability to allows systems to sync in defense against fraudsters.

“The industry has developed some 14 channels many of which are serviced by siloed, independent technology which institutions have to integrate.”

— Jason Schwabline, Alogent

Most financial institutions’ policy on fund availability is to make funds from deposited checks available on the first business day after they are received, according to the FAQ page of one of the nation’s largest banks. But data can trigger a deposit hold on these funds and delay availability for up to 7 business days when an account shows frequent overdrafts, when a deposit exceeds the total available balance in the account, or when the customer has no longstanding relationship with the institution.

Think of it this way: If an account holder had a long-standing relationship, made no overdrafts, and checks deposited followed a consistent pattern, could data be used to go the other way? To make funds more available and faster?

Just getting everything on one platform could make that possible while managing delays needed to prevent fraud.

“Right now, institutions have to manage different fraud risks in different channels, and it can be different for one provider compared to another, and the systems together can have weaknesses,” Schwabline says. “If institutions took all those technology pieces throughout their aging check infrastructure and brought them into a single source, you no longer have all these disparate systems and the risks they create.”

Read more:

- Are You Fighting Yesterday’s Checking Account War Instead of Today’s?

- Zelle’s Growing Popularity with P2P Users Benefits Banks

- Will FedNow and BNPL Dent Credit Card Use?

Democratizing Check Processing

Banks and credit unions no longer need to guide account holders to channels based on the idiosyncrasies of the software for that channel. They can now democratize their options. When a business needs funds quickly from a check, they can choose a channel that works with their needs and not just “the fastest option.”

Where does the problem lie? If businesses are charged a fee for the value of quick fund availability (especially when the only reason the fee needs to exist is because of an old tech stack), they won’t consider that a great experience.

“We had a bank customer that until recently was charging people for mobile deposit capture,” Schwabline says. “They were guiding activity to the branch with a fee.” What if the options institutions provided were based on value instead of outdated technology?

Staff know account holders personally when they have interacted with them before. “But they don’t know what their trends have been for depositing through mobile, or how many deposits have ever been bad from [the depositor],” Ashish Bhatia, vice president of product management for Payments at Alogent, tells The Financial Brand. “When the data is in place, you can have a customer score that looks back 90 days at what checks they have made and if there were ever any issues.”

“Consider going beyond the pretty pieces on the front that people see and beyond adding a new consolidator with a bunch of old systems plugged into it.”

— Ashish Bhatia, Alogent

The question for institutions to consider, Bhatia suggests, is: “Do you look at the transaction or the depositor right now? Most check processes follow rules that treat every transaction the same. What if a depositor needs an amount today from a check they’ve cashed many times? What if it’s from the same entity, for a similar amount, and there’s no history of a problem? What could we do for that customer if we knew their past performance when they needed faster fund availability?”

Building a Successful Check Process for the Future

To deliver a noticeable change for businesses and consumers, check operations must become much more efficient for institutions as well.

“There’s room to explore differentiation through the check experience because of how much waste happens in all the technology,” Schwabline says. “The cost savings available from eliminating operating drag, software cost and maintenance, and resources spent on fraud prevention are substantial.”

But to achieve the operational shift needed to democratize deposit choices for businesses and consumers, executives need to look deeper than just how things look, Bhatia says.

“When it comes to modernizing check processing, leaders often think in terms of ‘the front’ or ‘the back,’ rather than optimizing the entire chain of custody from start to end,” he says. “Consider going beyond the pretty pieces on the front that people see and beyond adding a new consolidator with a bunch of old systems plugged into it.”

Reskinning or back-end-only approaches leave staff with the same system they had before. And customers and member continue to receive the same experience they had before. If institutions want new ways to differentiate in retail banking, they have to go looking for value no one else has: With technology available today, relationship and behavior-based fund availability could be that differentiator.