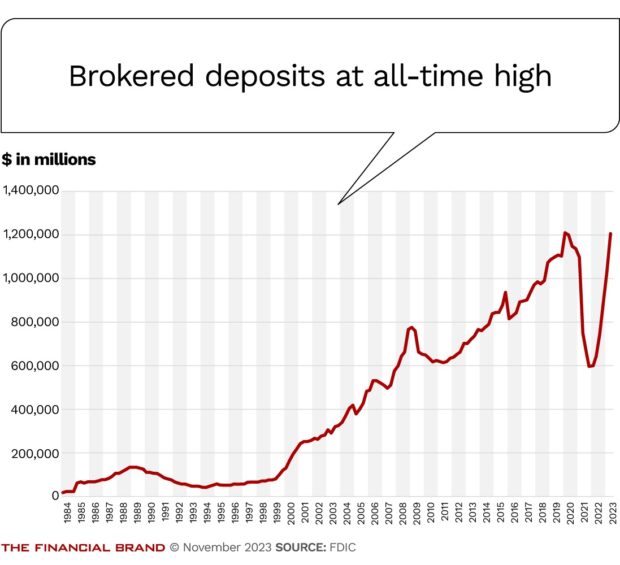

Banking executives have never wanted their institution’s services to become commoditized. The irony right now is that they’re choosing not to raise deposits from their communities. And instead, have run up their tab of brokered funding to the highest levels the Federal Deposit Insurance Corp. has reported in 28 years (with one small exception).

Brokered and wholesale funding sources come with no relationships, and they represent no unique value provided from institution to community; by definition, using these sources commoditizes the bank. Yet, banks have nearly doubled their use of brokered deposits during the past year.

Why is the industry running in that direction? Yes, banks need funding, and rates have increased competition. But why turn to that source in such dramatic volume?

It comes from a green-eye-shade mindset narrowly focused on the marginal cost of gathering deposits. The idea is that outsourcing bank funding makes mathematical sense; it’s necessary to protect profits. The danger comes when bankers take it too far and forget what’s shuttered commodity businesses throughout history.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Math of Marginal Cost

First, why does commoditizing the bank’s funding book make mathematical sense?

Consider a bank with $100 million in deposits: $30 million in demand accounts at 0% (known as DDAs), $40 million in savings accounts at 1%, and $30 million in certificates at 3%. The total interest expense on the funding book is $1.3 million.

Let’s say the bank wants to raise a net $10 million in deposits and it expects low-rate accounts like DDAs and savings to shrink. Depositors clamor for the high rates they hear about in the news and banks will ask for a commitment in return, which has caused most new funding to come from CDs during the past year.

We can assume those 0% DDAs decline to $25 million and those 1% savings accounts to $35 million. But the CD portfolio expands to $50 million — having grown by $20 million at 5% — with the original $30 million in CDs still hovering around 3%. In that case, the total interest expense to obtain net new funding of $10 million in CDs is $950,000, a marginal cost of 9.5%.

Wouldn’t the bank have been better off buying $10 million in brokered or wholesale funding at 5% — a marginal cost of $500,000 or 5%? Spending the 9.5% for $10 million is worse than 5%, or so the math says.

But something is missing here, and no small detail. Gathering deposits from local markets is inherent to the franchise value. Abandoning it today, with all the innovation and access tech companies have created to move money, is a risk to a financial institution’s inherent advantages, not to mention its reason for being.

Read all of our latest coverage about deposits.

How Good Management Can Lead to Disruption

The allure of the math done above comes from similarities between banking and true commodity businesses. Like a manufacturer, banks take the raw material of local deposits and use them to make loans. What should keep bank executives up at night is the history of disruption for incumbents in commodity businesses.

It turns out that when incumbents abandon lower-margin business lines, especially to new-entrant competitors, they inadvertently sowed the seeds of their demise. The disruptors toppled them even though the math — similar to that shown above — pointed correctly to more profits.

Incumbents across a diverse array of industries have been unseated by a kind of “good management,” says Rory McDonald, co-chair of a disruptive innovation program at Harvard Business School. “Using principles studied in business school… executives have led their firms into the ground.”

How could that possibly be? McDonald gives an example from the history of U.S. steel companies. For a time, companies could only fabricate steel products in large integrated steel mills, which cost $10 billion to construct. Then came an innovation, the mini mills, which produce products at 20% lower cost than incumbents’ integrated mills, though at a lower quality.

“Now put yourself in the shoes of a CEO of an integrated steel company,” McDonald says. “They looked at the rebar market where they made a 7% margin and said we make so much more upmarket in angle iron or structural steel, we’re in a commodity business that’s super competitive, why would we ever defend a low margin market like rebar?”

The incumbent mills got out of rebar, and their per unit profitability improved. Then, when the mini mills pushed the last incumbent out of rebar, they challenged incumbents in angle iron. Executives again yielded a market, and their profitability increased.

“Only one integrated steel mill had avoided going bankrupt [as of 2014],” McDonald says. “I can tell the entire story of U.S. steel without saying ‘stupid manager’ one time because there is no stupidity involved. Every time incumbents pulled out; they were more profitable. The pursuit of [margin] caused the process of disruptive innovation.”

Read more:

- Deposit Competition Is On, But Should CDs Still Be the Go-To?

- What Bankers Should Know About the Alarm Over Brokered Deposits

Banks Need Courageous Leadership

There is no intrinsically “good” or “bad” deposit tactic. But banks can go very wrong when a tactic like brokered or wholesale funding becomes a silver bullet. Understandably, executives are concerned about marginal cost increases for their funding. But they are making huge assumptions if they believe brokered funding will save them from disruption.

Similar to mini mills in steel, banking has a host of technological innovations that allow new entrants to serve customers cheaper than incumbents. And entrants are hungry for depositors who now can move money to another financial provider in less than five minutes — some account opening platforms have the time down to under three minutes — and they can do the same with DDAs, savings accounts, and even a CD. Depositors can change where their direct deposit goes in 30 seconds.

Yes, banking is “a commodity business that’s super competitive,” just like steel, and bankers can be assured the segments they abandon will be happily gobbled up by low-operating-expense competitors who don’t need branches to reach customers. Why would banks assume their inactivity will cause DDA and savings account holders to sleep through their obvious, easy, and sizeable monetary advantage in changing banking providers?

Then there’s the perspective of regulators and acquirers. What a bank saves in marginal cost may be lost entirely to the regulator’s critical perspective and oversight pressure on brokered funding. Shareholders and any future acquirers alike will not pay a premium for a funding book dependent on brokered markets.

After so many years of not needing to use deposit-gathering muscles, brokered funding can feel like both an easy and smart way to respond. But it’s a dangerous game of chicken when it results in dissolved relationships with local depositors.

The average account holder is not a hard-bargaining rate shark looking for basis points. They’re largely people looking for options who are as concerned about making a wrong decision as bank executives are about cost of funds. Depositors will give banks the basis points they need to operate when they receive tools and options from bank staff, especially when they see the staff taking care of them. But staff needs the training and tools from their leaders to make that happen.

As the industry works through rate volatility, executives should explore new ways to serve depositors and the staff, which was inherent to leading a bank before 2008, rather than abandon the local deposit relationships at the heart of banking. Those relationships stand between banks and disruption from a narrow pursuit of profit via low marginal cost.

About the author:

Neil Stanley is the founder and chief executive of The CorePoint.